- Ethereum merchants trapped in longs as market declines.

- Ethereum reveals energy in income and TVL dominance.

Ethereum [ETH] continues to play a significant position within the cryptocurrency market, and as we enter the final quarter of the yr, a number of key elements are anticipated to affect its value motion.

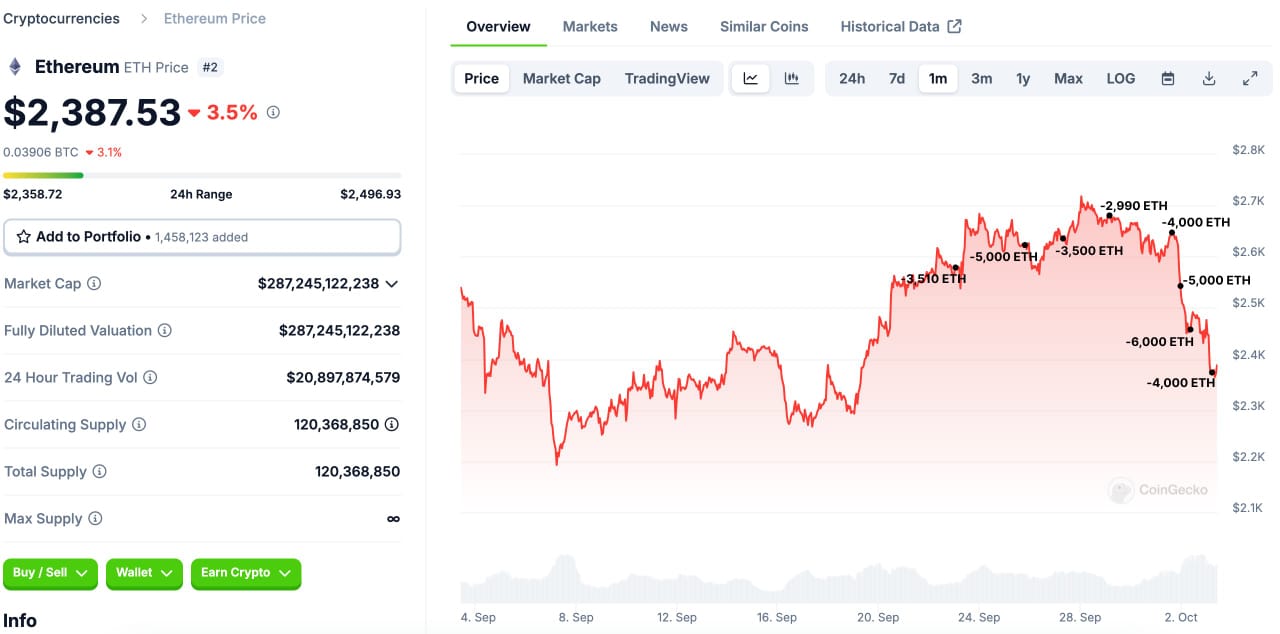

Towards the tip of September, retail merchants elevated their publicity to Ethereum, attempting to capitalize on value dips. Nevertheless, this led to many being trapped in shedding positions as ETH continued to say no.

With comparable patterns reappearing, merchants are cautious about whether or not ETH will proceed to fall within the ultimate months of the yr.

ETH value motion alerts bearishness

Ethereum’s latest value motion, it appears possible that the ETH/USD pair might proceed to say no. On the day by day chart, ETH is buying and selling beneath the 150, 50, and 20 exponential shifting averages (EMAs), signaling a bearish development.

That is additional confirmed by the S&P 500 (SPX) index, which has additionally flipped beneath the 150 EMA, including extra weight to the damaging outlook.

Moreover, quantity bars present that sellers stay in management, reinforcing the concept ETH might disappoint merchants by persevering with to drop.

Impression of ICOs and Grayscale on ETH

On-chain information provides to the bearish sentiment, notably regarding preliminary coin choices (ICOs) and Grayscale’s exercise. A major Ethereum ICO participant lately bought 19,000 ETH, value round $47.54 million.

This participant initially acquired 150,000 ETH in the course of the ICO, with a purchase order value of $46,500, now valued at $358 million.

The truth that early Ethereum whales are promoting off their holdings contributes to the downward strain, particularly since ETH was bearish throughout the complete fourth quarter after a inexperienced September in previous years.

As well as, two dormant Grayscale ETF wallets have deposited 5837 ETH, value $14.17 million, into Coinbase in accordance with Onchain Lens.

These wallets had beforehand held 23026 ETH, bought at a median value of $1,593 a yr in the past.

The motion of those funds, coupled with the wallets nonetheless holding 17,189 ETH, additional signifies that giant buyers are making strikes that might impression ETH’s value.

Sentiment amongst merchants

Each retail merchants and bigger buyers appear to share a bearish sentiment concerning Ethereum’s value. This shift occurred after latest geopolitical occasions induced a downturn within the broader crypto market.

Consequently, ETH is predicted to face extra promoting strain, which might result in additional value declines within the fourth quarter.

Ethereum’s income energy and TVL dominance

Regardless of the bearish outlook, Ethereum has proven resilience in different areas. The platform has generated over $140 million in gross income throughout 9 completely different chains over the previous 12 months.

As a federated community of economies with ETH as its foreign money, Ethereum stays a “land of alternative,” which might finally reverse the damaging development.

Furthermore, Ethereum continues to dominate in complete worth locked (TVL) in comparison with different Layer 1 blockchains. Its market cap of $48.7 billion far exceeds opponents like Solana ($5.4 billion) and Sui ($984 million).

This energy in TVL dominance reveals that ETH remains to be main the market, regardless of the bearish alerts and challenges posed by newer blockchains.

Learn Ethereum’s [ETH] Price Prediction 2024–2025

Whereas Ethereum faces bearish sentiment within the brief time period, its robust fundamentals and market place could enable it to bounce again in the long term.

Nevertheless, merchants ought to stay cautious as market dynamics proceed to evolve.