Key Notes

- Ethereum value breaks above $4,600 for the primary time in two weeks regardless of insider sell-off by Ethereum Basis.

- Derivatives market exhibits new speculative lengthy positions constructing as open curiosity rises 1.7% amid flat weekend buying and selling quantity.

- Institutional inflows stay sturdy, with ETH ETF logging 5 consecutive days of internet positive aspects and Bitmine’s treasury holdings crossing 2.65 million ETH.

Ethereum value rose 1.4% on Sunday, October 5, breaking above $4,600 for the primary time in two weeks. Derivatives market information exhibits ETH attracting recent lengthy bets, even after the Ethereum Basis confirmed a 1,000 ETH sell-off on Friday.

In line with CoinMarketCap, Ethereum traded as excessive as $4,619 intraday, defying lean spot buying and selling volumes by means of the weekend. Extra so, the rally got here within the wake of a Basis announcement stating it could convert 1,000 ETH to stablecoins to fund analysis, grants, and donations.

1/ At this time, The Ethereum Basis will convert 1000 ETH to stablecoins by way of 🐮 @CoWSwap‘s TWAP function, as a part of our ongoing work to fund R&D, grants and donations, and to spotlight the facility of DeFi.

— Ethereum Basis (@ethereumfndn) October 3, 2025

Traditionally, Ethereum Foundation sell-offs have imposed downward strain on ETH value motion. Nonetheless, ETH derivative markets exercise over the weekend might invalidate this pattern.

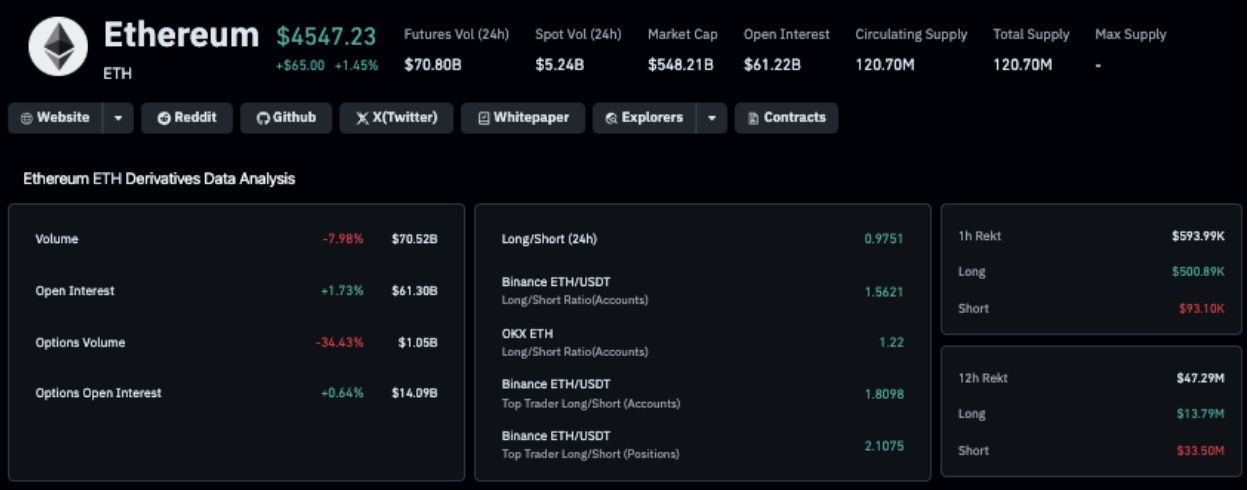

Ethereum Derivatives Market Evaluation | Supply: Coinglass

The newest information from Coinglass exhibits that ETH open curiosity climbed 1.7% up to now 24 hours, to hit $41.3 billion regardless of a 7.9% drop in buying and selling quantity. This divergence means that Ethereum Basis’s sell-off has not nullified bullish conviction amongst ETH speculative merchants.

Bulls Cost Ahead Regardless of Ethereum Basis Promote-Off

Whereas insider transactions sometimes spark fear-driven sell-offs, Ethereum’s value has staged a breakout above the $4,600 stage and attracted internet inflows of $700 million in new futures contracts positions on Sunday.

Valued at roughly $4.6 million at present costs, markets seem unfazed by the Ethereum Basis’s 1,000 ETH sell-off, with institutional demand and ETF inflows offering sturdy counterweights.

Ethereum ETFs report 1.3 billion internet inflows between Sept 29 to Oct 3 | Supply: FarsideInvestors

FarsideInvestors data exhibits the Ethereum ETF scooped $1.3 billion in 5 consecutive days of internet inflows final week.

ETHtreasury reserve inflows additionally stay energetic, with market-leader Bitmine (BMNR) has increased its Ethereum holdings to 2.6 million ETH.

Mixed, these inflows have supplied ETH with the liquidity to defend the $4,600 resistance zone. Ought to open curiosity proceed rising together with ETF inflows, ETH value may probably take a look at $4,750 within the week forward.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed info however shouldn’t be taken as monetary or funding recommendation. Since market situations can change quickly, we encourage you to confirm info by yourself and seek the advice of with an expert earlier than making any choices based mostly on this content material.

Ibrahim Ajibade is a seasoned analysis analyst with a background in supporting varied Web3 startups and monetary organizations. He earned his undergraduate diploma in Economics and is at present learning for a Grasp’s in Blockchain and Distributed Ledger Applied sciences on the College of Malta.