Key Notes

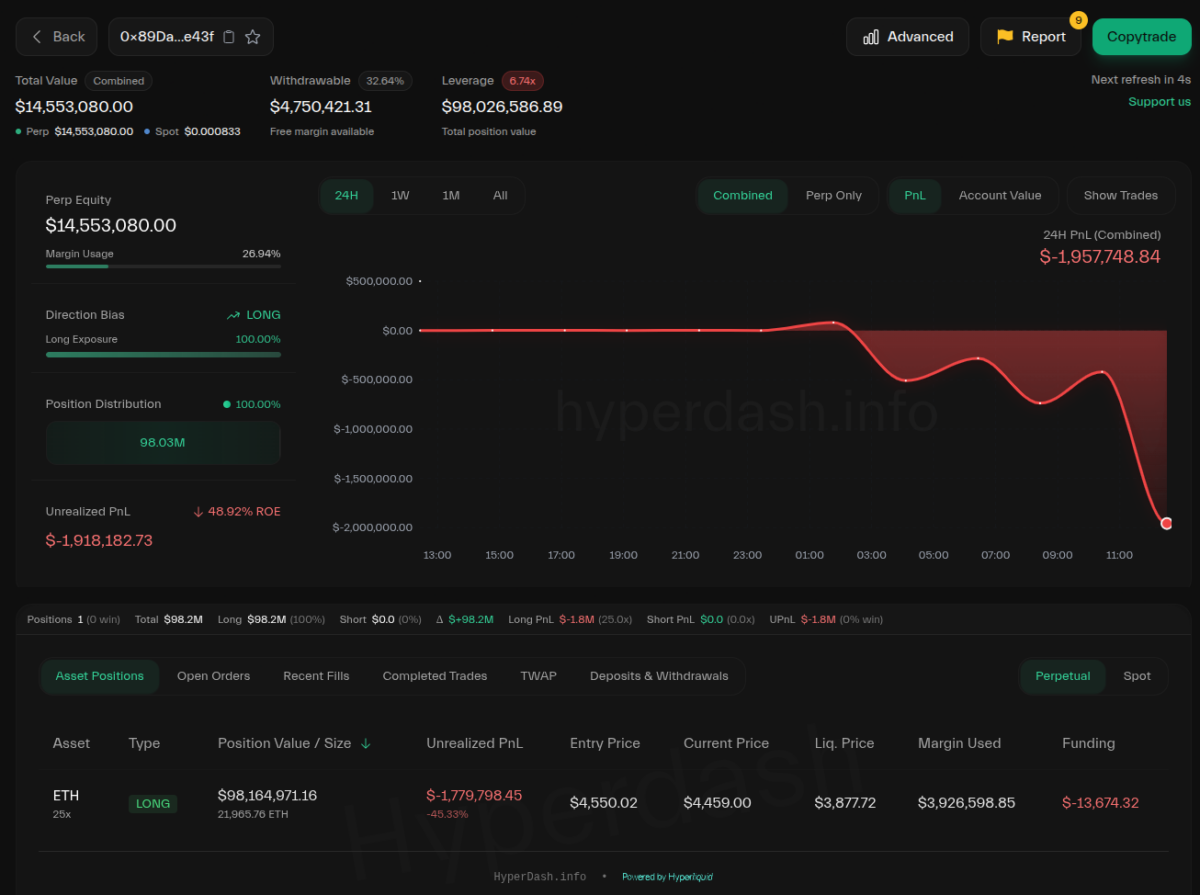

- Whale dealer bought 21,966 ETH at $4,550 utilizing $3.99 million margin for almost $100 million publicity place.

- Regardless of 81% historic win fee, some analysts report this might be a delta-neutral buying and selling technique reasonably than directional.

- Ethereum reveals combined alerts with cooling momentum and conflicting whale exercise creating market uncertainty.

A sensible whale—a big dealer with a strong profitable monitor document—is bullish on Ethereum

ETH

$4 477

24h volatility:

1.3%

Market cap:

$540.38 B

Vol. 24h:

$24.33 B

, opening an almost $100 million lengthy place on ETH with 25x leverage by way of HyperLiquid. The place, nevertheless, is at present dropping round $2 million, because the ETH value has fallen under the dealer’s entry level.

Notably, this whale (0x89D…) has concluded 53 trades, closing 43 of them in revenue for an 81.13% win fee. Specifically, their most up-to-date commerce bought 21,966 ETH at $4,550.02, price $99.95 million, utilizing a $3.99 million margin. On the time of this writing, the place was down near $2 million.

Whereas this dealer’s profitable historical past makes them a wise whale, the account has already obtained 9 stories of being a “Delta Impartial Dealer” on the evaluation platform. A delta-neutral dealer is somebody who employs methods to maintain a web delta near zero. This technique can be utilized whereas looking for revenue from different sources reasonably than the commerce itself—for instance, from funding charges—or as a part of a hedge technique to get rid of directional dangers. But, anybody can open these stories, missing conclusive proof.

Ethereum tackle 0x89Da4BAEC446F35a1cbE17a9d1EE5C70B05Ee43f on Hyperliquid | Supply: HyperDash

Sensible whales are often seen as an indicator of what will occur subsequent, price-wise, and lots of merchants might attempt to copy their methods in an try and mirror the outcomes. This, nevertheless, is dangerous, as copy merchants typically lack understanding of the reasoning behind every transfer and might be, for instance, trapped right into a delta-neutral dealer’s incomplete technique, making errors.

Ethereum (ETH) Value Evaluation

Ethereum is the second-largest cryptocurrency by market capitalization and is at present buying and selling at $4,485 per token, making it a $540 billion asset. With a present 24-hour quantity of $33 billion, according to CoinMarketCap data, ETH checks an area value assist whereas merchants resolve its subsequent transfer.

Total, ETH nonetheless reveals some indicators of power, though the momentum is cooling off in response to its day by day relative power index (RSI) of 52.24 factors and is heading right down to the impartial zone. From a better time-frame perspective, Ethereum sustains its development above the 50-day exponential shifting common, nonetheless in bull market ranges.

Ethereum (ETH) day by day (1D) value chart | Supply: TradingView

On September 17, Coinspeaker reported Ethereum whales dumping 90,000 ETH, suggesting a bearish outlook, whereas staking inflows had been rising on-chain, suggesting a bullish outlook—leading to conflicting indicators, which match the “impartial” momentum seen within the RSI.

Citigroup analysts issued a neutral-to-bearish price target for ETH of $4,300 by the end of the year, whereas the supposed notorious Coinbase hacker appears to be buying the asset.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed info however shouldn’t be taken as monetary or funding recommendation. Since market situations can change quickly, we encourage you to confirm info by yourself and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material.

Vini Barbosa has coated the crypto business professionally since 2020, summing as much as over 10,000 hours of analysis, writing, and enhancing associated content material for media retailers and key business gamers. Vini is an energetic commentator and a heavy consumer of the know-how, actually believing in its revolutionary potential. Subjects of curiosity embody blockchain, open-source software program, decentralized finance, and real-world utility.