Key Notes

- Regardless of the drop in XRP ETF approval odds, XRP value stays steady round $3.05.

- Hypothesis continues round a possible BlackRock XRP ETF, and Ripple associate SBI Holdings has filed for a Bitcoin-XRP twin ETF in Japan.

- All 13 latest inner SEC votes on crypto ETPs handed with a 3-1 margin, with Crenshaw as the only real dissenting vote.

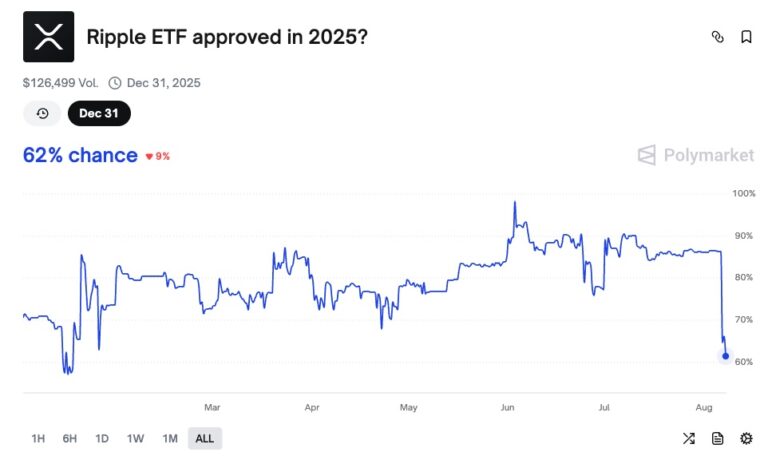

The percentages of spot XRP ETF approval have tanked greater than 9% to 62% quickly after Caroline Crenshaw, the Commissioner of U.S. Securities and Trade Fee (SEC), mentioned that she stays against crypto ETFs.

Nevertheless, the XRP

XRP

$3.06

24h volatility:

3.4%

Market cap:

$181.42 B

Vol. 24h:

$4.57 B

value is exhibiting power, as bulls proceed to carry it at $3.05 ranges.

XRP ETF Approval Possibilities Drop to 62%

As per the Polymarket data, the percentages of approval for XRP ETFs stood at 86% on August 5. Within the final two days, nevertheless, this quantity has tanked to 62% as of now.

XRP ETF approval Odds | Supply: Polymarket

Final week, Bloomberg ETF strategist Eric Balchunas stated that the percentages of approval in September-October have gone up.

The optimism stems from XRP now assembly the SEC’s up to date itemizing standards, which require tokens to have had spinoff buying and selling exercise for at least six months.

Hypothesis is constructing {that a} BlackRock XRP ETF might be in improvement. Nate Geraci, President of the ETF Retailer, said that the world’s largest asset supervisor might quickly make a transfer on this course.

Within the newest improvement, Ripple partner SBI Holdings filed for a twin ETF, involving Bitcoin and XRP, within the Japanese market.

This reveals that the demand for XRP ETFs is already rising within the abroad markets as nicely.

SEC Commissioner Votes In opposition to Crypto ETFs

On August 6, the U.S. Securities and Trade Fee (SEC) performed 13 inner votes associated to numerous crypto exchange-traded merchandise (ETPs), together with IBIT, BITB, GBTC, Bitwise’s Bitcoin and Ethereum funds, and in-kind redemption mechanisms.

All votes handed with a 3-1 margin, with Commissioner Caroline Crenshaw alone rising objecting to it.

Crenshaw, presently the one Democrat on the Fee, has persistently opposed the rising approval of crypto ETFs.

In accordance with journalist Eleanor Terrett, her repeated objections ship a robust sign of her agency opposition to crypto ETPs, notably any potential developments involving an XRP ETF.

Lone Democrat @SECGov commissioner Caroline Crenshaw is sending a transparent message: she stays firmly against crypto ETFs. https://t.co/NT4gCLH2k9

— Eleanor Terrett (@EleanorTerrett) August 7, 2025

The SEC not too long ago accepted in-kind creation and redemption processes for each Bitcoin and Ethereum ETFs.

Then again, Crenshaw’s objections additionally prolong to broader crypto coverage, together with latest SEC steering on liquid staking.

She describes it as legally weak and disconnected from real-world purposes.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed info however shouldn’t be taken as monetary or funding recommendation. Since market circumstances can change quickly, we encourage you to confirm info by yourself and seek the advice of with an expert earlier than making any choices based mostly on this content material.

Bhushan is a FinTech fanatic and holds aptitude in understanding monetary markets. His curiosity in economics and finance draw his consideration in direction of the brand new rising Blockchain Expertise and Cryptocurrency markets. He’s constantly in a studying course of and retains himself motivated by sharing his acquired data. In free time he reads thriller fictions novels and typically discover his culinary abilities.