- Over 45,000 ETH have been deposited to exchanges on eighth April

- ETH has fallen by over 1%.

Ethereum [ETH] skilled a value rise on the finish of buying and selling on eighth April. This surge in value coincided with a rise in alternate influx as Alameda seized the chance to capitalize on its holdings.

Alameda dumps extra Ethereum

Latest knowledge tracked by Spot on Chain revealed that Alameda Analysis of FTX deposited Ethereum to the Coinbase alternate. The info indicated that Alameda deposited 4,000 ETH, valued at round $14.7 million when ETH was buying and selling at roughly $3,688.

This accretion marked the primary vital transfer by Alameda since February, coinciding with a rally in ETH costs.

FTX and Alameda have deposited over 21,000 ETH, amounting to greater than $72 million. Alameda’s current transfer mirrors the sample noticed out there on eighth February, characterised by a big inflow of ETH into exchanges.

Merchants benefit from the Ethereum rally

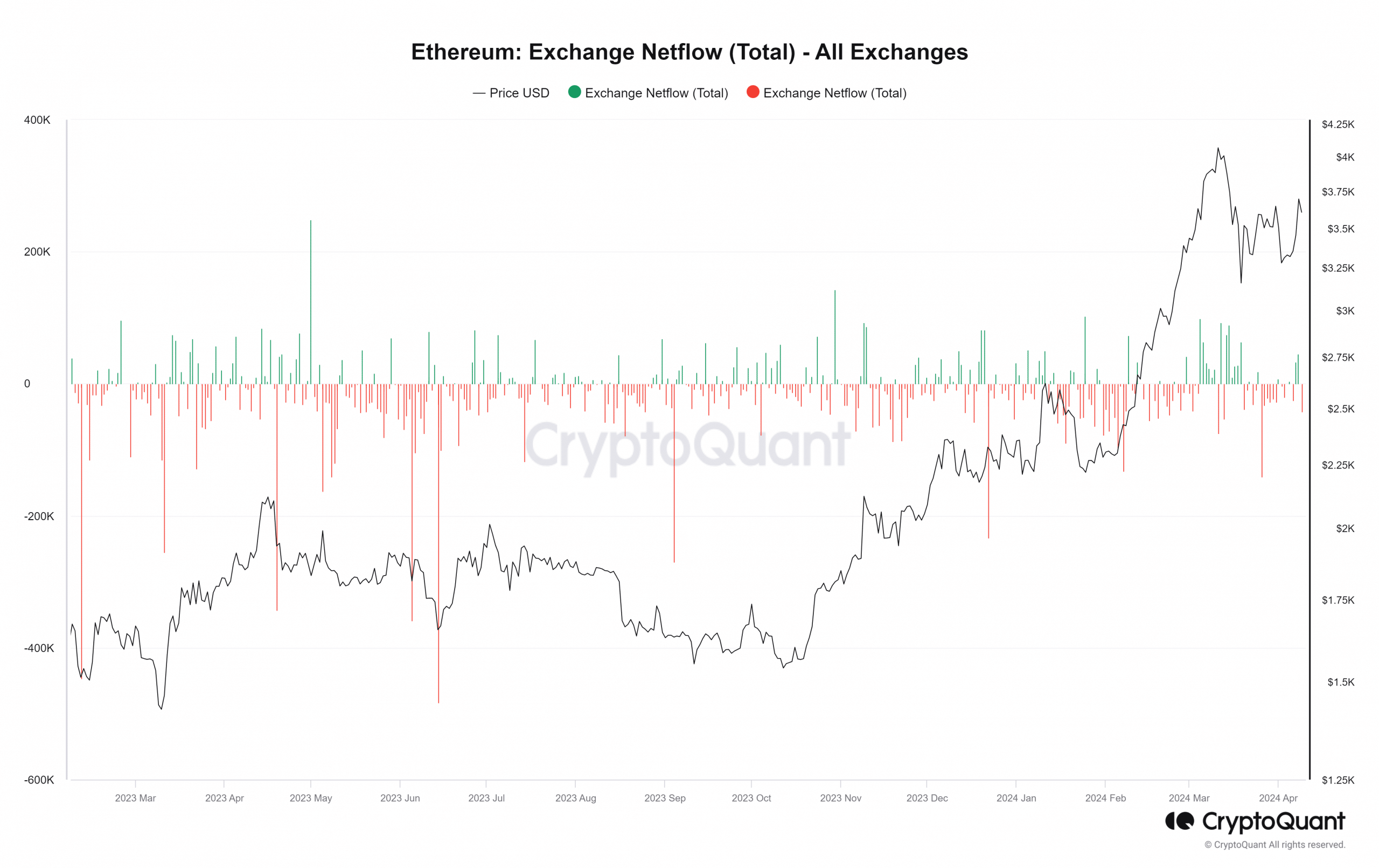

The Trade Netflow knowledge evaluation revealed that Ethereum skilled its highest alternate movement for the month on eighth April. Furthermore, the evaluation indicated that ETH influx predominated the movement, indicating that extra merchants have been depositing their holdings onto exchanges.

The chart displayed over 45,000 ETH deposited into these exchanges on eighth April, suggesting that, like Alameda, different merchants took benefit of the ETH value rally.

Nonetheless, there was a reversal within the movement on the time of writing, with extra outflow recorded. Over 35,000 ETH have been withdrawn from exchanges to date. This motion could possibly be attributed to the slight pullback in ETH’s value on the time of writing.

ETH sees 1% decline

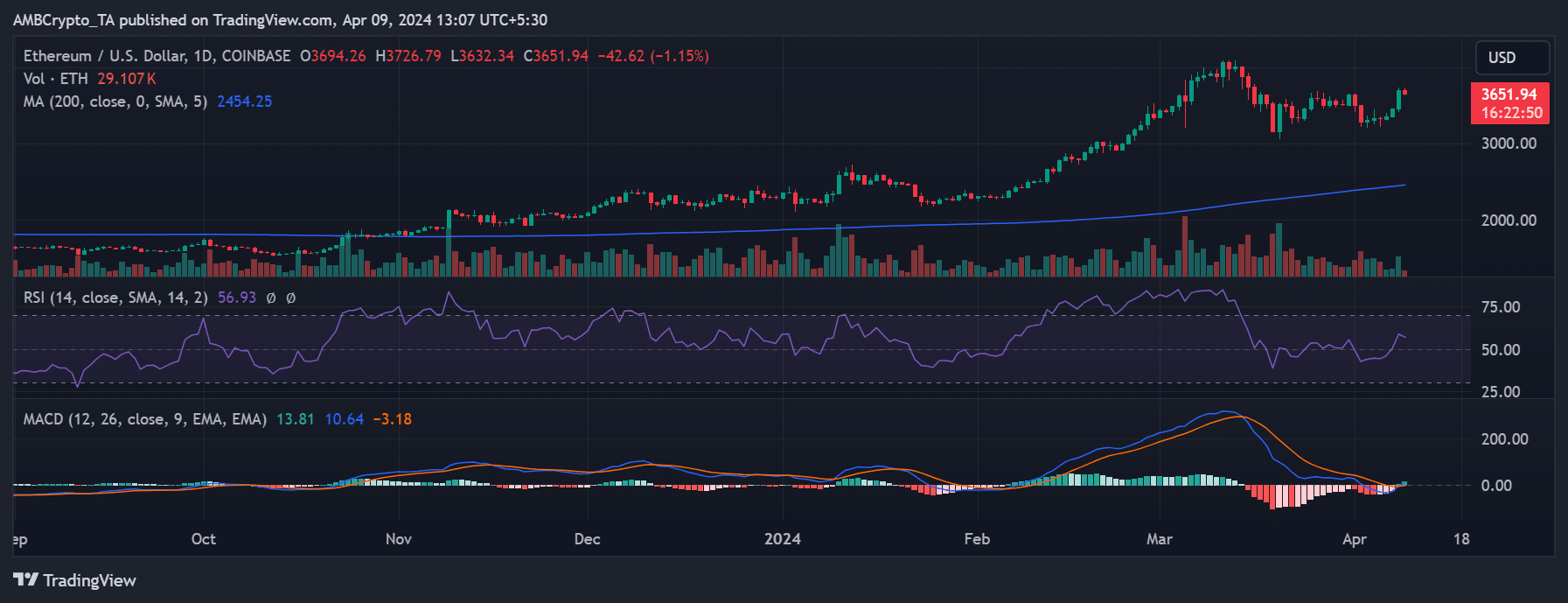

On eighth April, Ethereum witnessed a big surge, marking its largest improve in a while. Evaluation of the every day timeframe chart revealed a virtually 7% rise, with ETH closing at roughly $3,694.

Concurrently, the amount chart depicted a considerable improve in ETH quantity, exceeding $19 billion as its value surged.

On the time of writing, ETH’s value had skilled a slight decline of over 1%, but it remained throughout the $3,600 area.

Learn Ethereum (ETH) Price Prediction 2024-25

Regardless of this decline, Ethereum maintained its present bull development, as indicated by its Relative Energy Index.

Moreover, evaluation of its quantity indicated an uptick. On the time of this writing, the amount was over $20 billion, reflecting ongoing market exercise and investor curiosity in Ethereum.