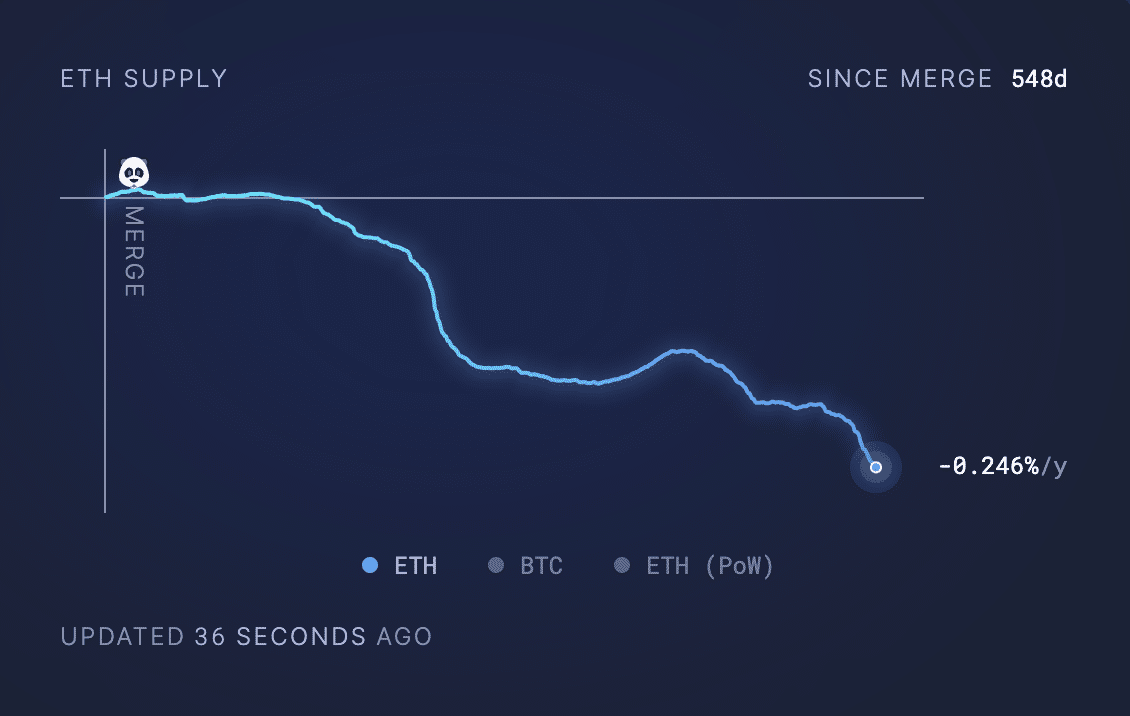

- Elevated demand for the Ethereum community has led to a surge in burn charge.

- This has caused a decline within the coin’s circulating provide.

Ethereum’s [ETH] circulating provide has fallen to a brand new post-merge low, in response to information from Ultrasound.money.

Within the final month, 86,219 ETH price round $300 million on the altcoin’s press time worth has been faraway from circulation within the final 30 days.

The decline in ETH’s circulating provide confirmed that the Proof-of-Stake (PoS) community has seen an uptick in demand and use, inflicting its burn charge to extend.

AMBCrypto beforehand reported that the every day rely of recent addresses created on the Ethereum community lately surpassed 116,000, a year-to-date (YTD) excessive.

This signaled a surge in consumer exercise on the Layer 1 (L1) community.

At press time, ETH’s circulating provide totaled 120.07 million ETH, the bottom stage in 548 days because the community transitioned from Proof-of-Work (PoW), in an occasion popularly known as “The Merge.”

Ecosystem efficiency within the final month

An evaluation of Ethereum’s decentralized finance (DeFi) ecosystem revealed an uptick in complete worth locked (TVL) within the final month.

In line with DefiLlama’s information, Ethereum’s TVL was $51 billion at press time, rising by 21% within the 30 days. Throughout that interval, Lido Finance, the main protocol on the chain, noticed its TVL enhance by 27%.

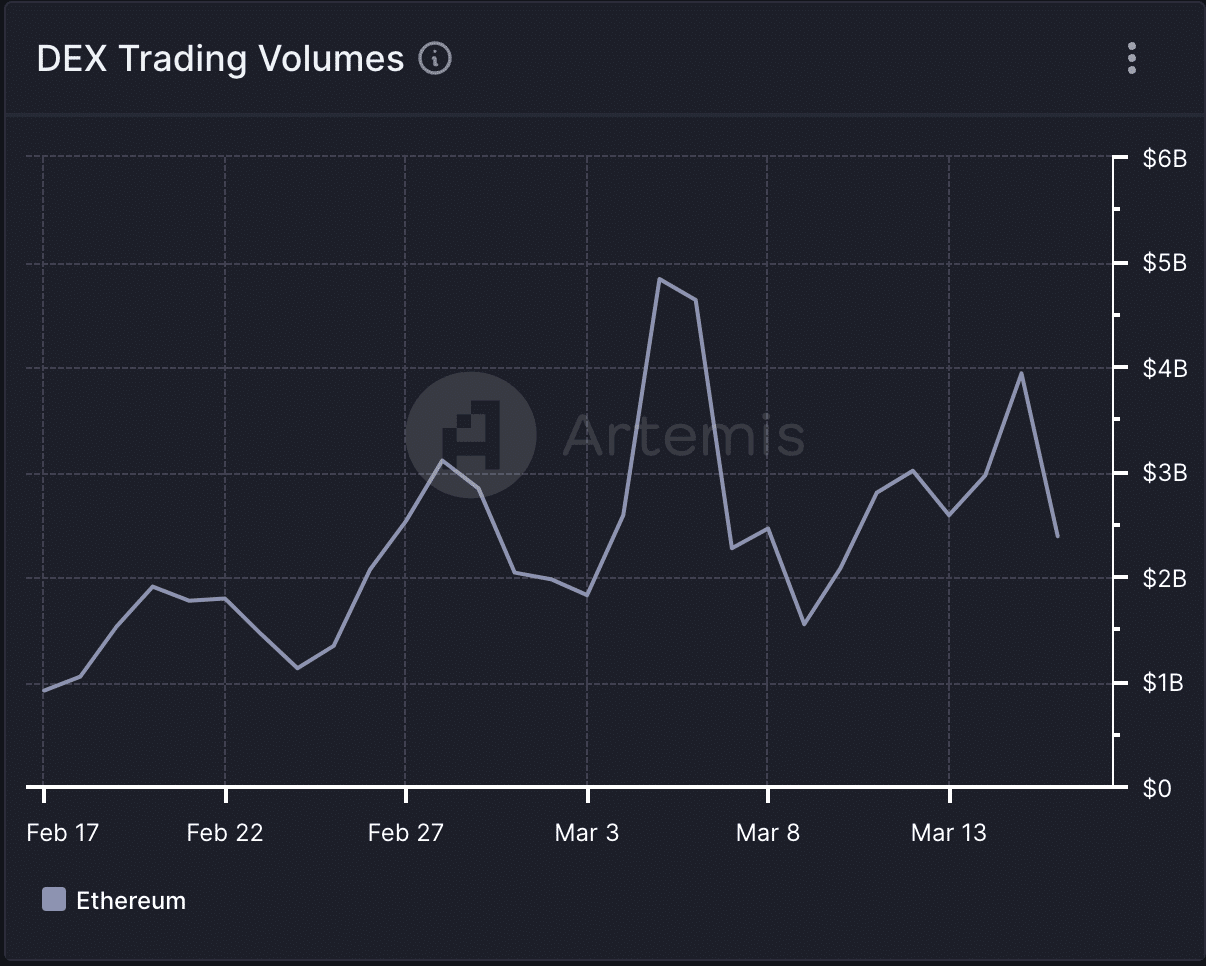

Amid the latest rally within the altcoin market, Ethereum witnessed a spike in its decentralized change (DEX) commerce volumes within the final month.

In line with information from Artemis’, the every day buying and selling quantity throughout the DEXes housed inside Ethereum has risen by 161% previously 30 days.

Concerning the community’s non-fungible token (NFT) sector, it additionally witnessed development within the final month.

In line with information from CryptoSlam, NFT gross sales quantity totaled $617 million previously 30 days, registering a 17% rally.

This spike in buying and selling quantity occurred regardless of the 57% lower within the variety of NFT gross sales transactions accomplished throughout that interval.

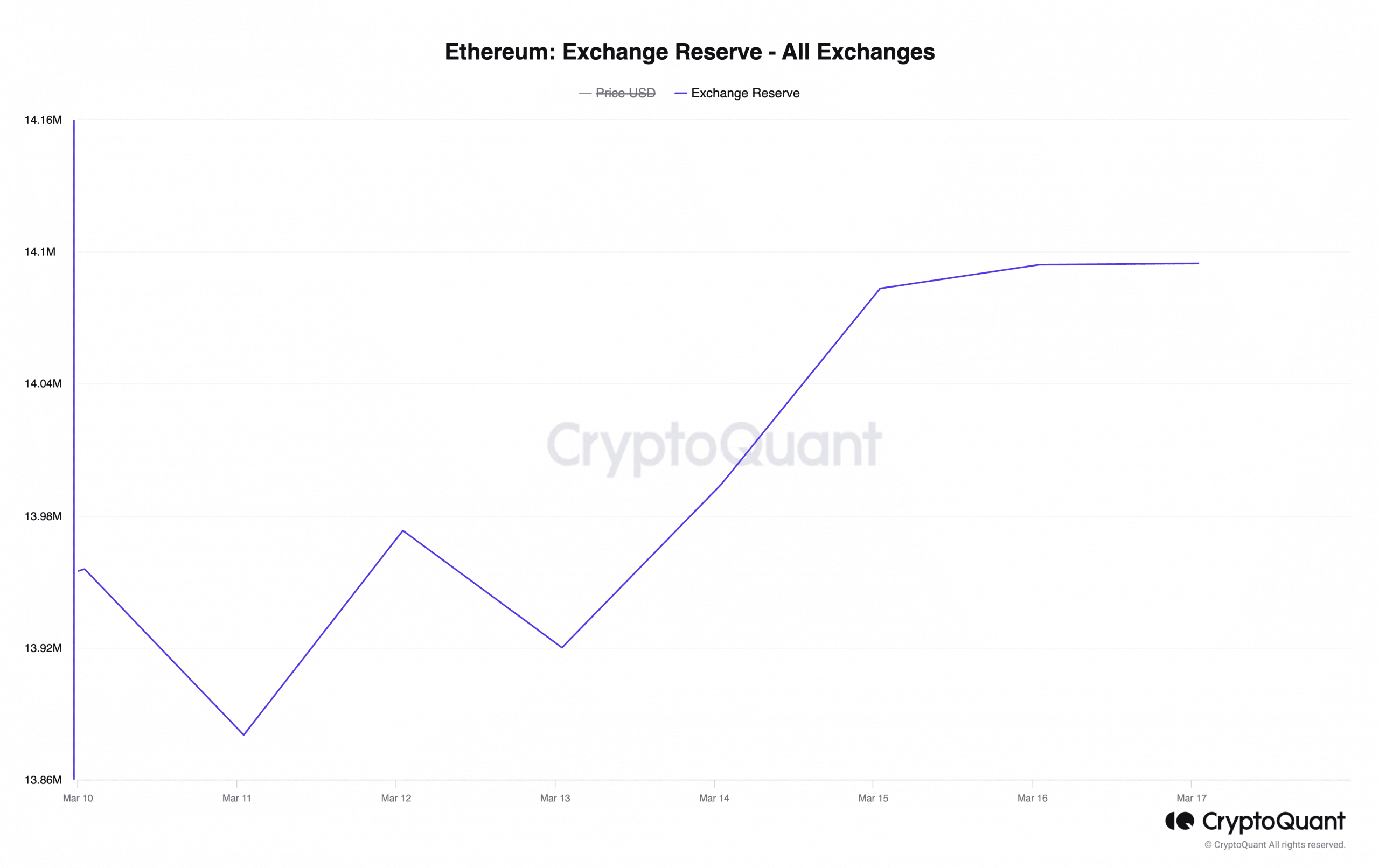

Alternate reserve climbs to a one-month excessive

Because the crypto market turns into considerably overheated, with the crypto concern & greed index indicating a marked enhance in grasping sentiment, sell-offs of ETH have surged.

How a lot are 1,10,100 ETHs worth today?

This has resulted in a spike in ETH’s provide on exchanges. Per CryptoQuant’s information, ETH’s change reserve was 14.1 million at press time, its highest stage within the final month.

When an asset’s change reserve climbs this fashion, it suggests a rise in promoting strain.