- Bitcoin posted losses measuring 14% inside the previous six days.

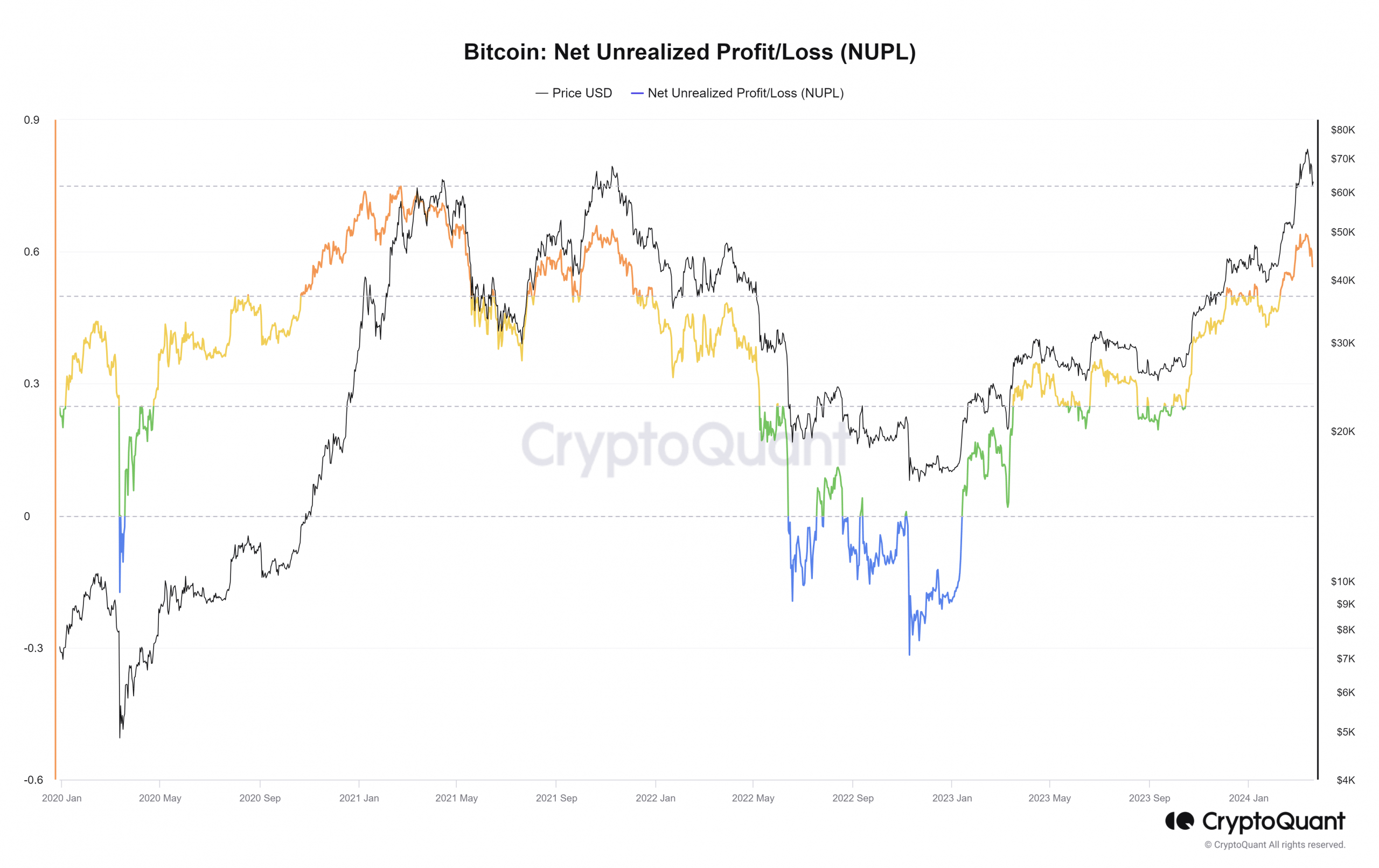

- The NUPL often doesn’t keep above +0.6 for a protracted interval.

Bitcoin [BTC] recorded losses amounting to 7.2% in ten hours earlier than press time. The BTC pullback was reside, as AMBCrypto reported earlier. Nonetheless, the $64.8k assist area didn’t halt the bearish advance.

An analyst posted on CryptoQuant’s Insights web page about how the present Bitcoin uptrend may very well be nearing its finish. They explored the NUPL metric and what it might imply for BTC traders.

Bull run situations even earlier than the halving occasion

Supply: CryptoQuant

The Web Unrealized Revenue/Loss (NUPL) is a useful gizmo for figuring out when traders are in revenue. Its calculation entails the realized cap of Bitcoin to know investor profitability higher.

The analyst famous that the NUPL metric not often stays above the 0.6 mark for lengthy. A +0.6 studying on this metric is often adopted by a pointy value correction, though this pattern will get bucked amid bull runs.

From December 2020 to April 2021, the NUPL was persistently above +0.6 as Bitcoin rallied from $19k to $60k.

On the twenty eighth of February, the NUPL climbed above +0.6 as soon as extra. Bitcoin sailed previous $73k however was unable to carry on. Because the sixteenth of March, the NUPL has fallen beneath +0.6, and the value was at $63k at press time.

Supply: CryptoQuant

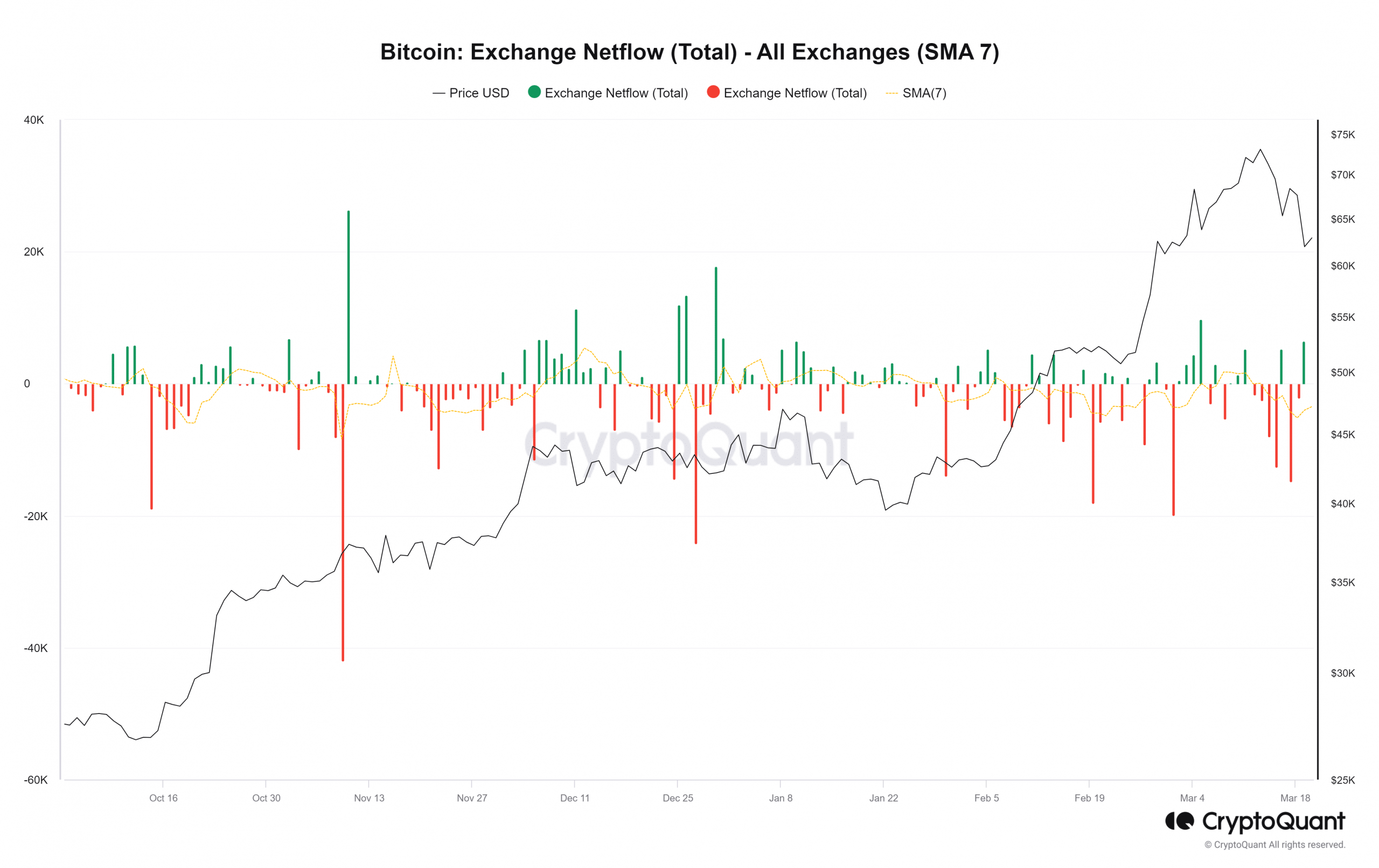

The short-term outlook favored a deeper correction towards $58k. Alternatively, the previous week noticed Bitcoin proceed to go away exchanges. This was an indication of accumulation.

The BTC netflow chart confirmed extra BTC leaving centralized exchanges than getting into them even when costs started to drag again from the $73k mark.

Lengthy-term holders maintained agency conviction

Supply: CryptoQuant

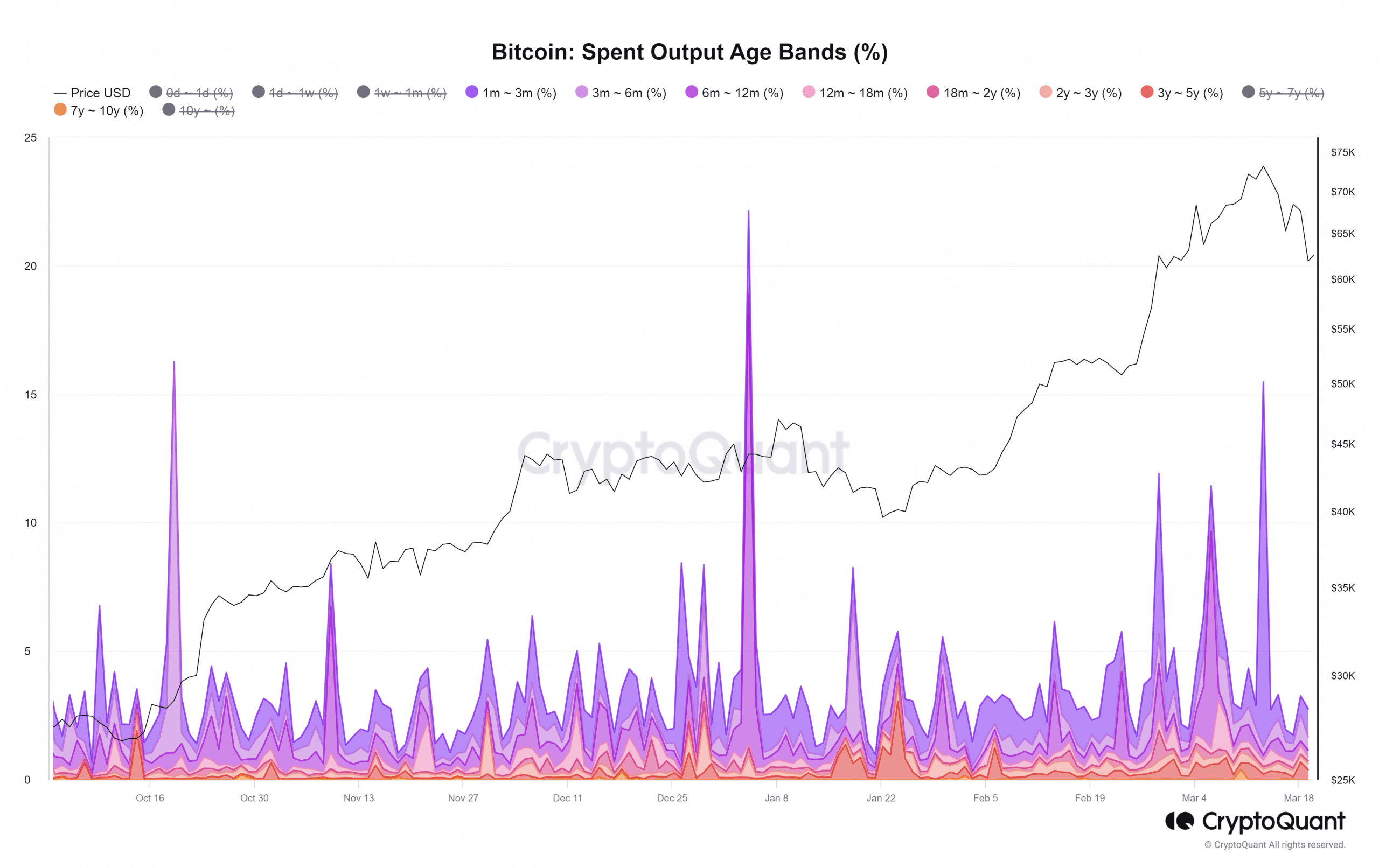

The spent output age bands noticed a big spike within the spent output of holders whose BTC had been aged simply 1-3 months on March thirteenth. This meant short-term holders booked earnings. Comparable spikes in late February and early March additionally famous holders promoting as costs rose increased.

Nonetheless, just a few of the longer-term holders whose coin age was a yr or longer didn’t relinquish their belongings as costs fell beneath the $70k degree lately. This confirmed religion in Bitcoin.

Is your portfolio inexperienced? Verify the BTC Profit Calculator

Nevertheless it should be remembered that their habits will not be an ideal information to Bitcoin’s trends- typically, the long-term holders panic and promote en masse even when BTC makes a long-term low.

A latest AMBCrypto report explored how the present retracement might play out within the subsequent 4-6 weeks. The Bitcoin halving cycle seemed to be repeating itself, however long-term traders needn’t fear concerning the short-term value volatility.