The crypto market has not too long ago skilled a wave of liquidations, amounting to almost $300 million, carefully following Bitcoin’s sharp reclaim of the $67,000 mark.

This surge in Bitcoin’s value, a stark reversal from its earlier downtrend, caught many merchants off guard, particularly those that had positioned bets on the continuation of the market’s decline.

Over 80,000 Merchants Faces Liquidation

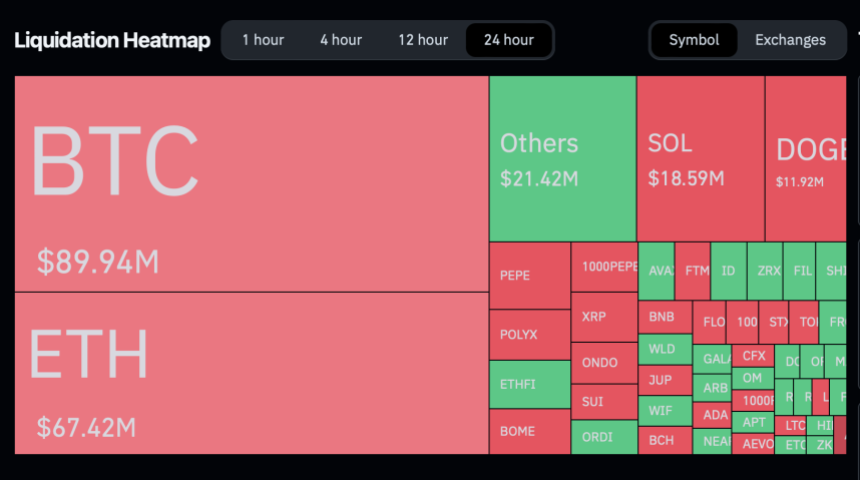

The data offered by Coinglass sheds mild on the magnitude of the liquidations, revealing that roughly 86,047 merchants suffered losses exceeding $250 million inside a mere 24-hour interval.

Main exchanges like Binance, OKX, Bybit, and Huobi had been the arenas for these important monetary setbacks, with Binance merchants bearing the brunt of the liquidations.

Significantly, Binance recorded $128.7 million in liquidations, whereas different main platforms reminiscent of OKX, Bybit, and Huobi additionally skilled important liquidations, amounting to $99.87 million, $33.18 million, and $17.70 million, respectively. In the meantime, regardless of additionally dealing with liquidations, the smaller exchanges had a relatively minor impression.

Most affected positions had been brief trades, reflecting a widespread anticipation of a market downturn that didn’t materialize as anticipated. Quick positions recorded an estimated 57.55% of the liquidations, equal to $164.10 million, from merchants betting in opposition to the market.

On the flip facet, lengthy place holders additionally confronted their share of losses, contributing to almost 40% of the full liquidations, amounting to $121.07 million.

Bitcoin Restoration And Future Prospects

The sharp restoration of Bitcoin, momentarily reclaiming highs above $67,000, has reignited curiosity in its market behavior and future trajectory.

Regardless of a 6.6% dip in its market capitalization over the previous week, Bitcoin’s worth noticed a notable 6% improve within the final 24 hours, with its market cap presently sitting above $140 billion. This resurgence in buying and selling exercise, with each day volumes climbing from under $60 billion to heights above this mark, signifies renewed investor confidence and heightened trading interest.

Including to the discourse, cryptocurrency analyst Willy Woo presents an optimistic outlook for Bitcoin, suggesting the possibility of a “double pump” cycle harking back to the market patterns noticed in 2013.

In accordance with Woo, this sample might herald two important value surges for Bitcoin within the coming years, with the primary peak anticipated by mid-2024 and a subsequent, extra substantial rise in 2025.

Whereas such twin surge situations are uncommon, Woo’s evaluation, based mostly on present market situations and Bitcoin’s progress potential, provides a glimpse into the way forward for the world’s main cryptocurrency.

On the fee the #Bitcoin Macro Index is pumping, I wouldn’t be stunned if we get a prime by mid-2024, which might trace at a double pump cycle like 2013… a second prime in 2025. pic.twitter.com/i2a0V5ytPv

— Willy Woo (@woonomic) March 19, 2024

Featured picture from Unsplash, Chart from TradingView

Disclaimer: The article is offered for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding choices. Use data offered on this web site fully at your individual danger.