- BTC spot ETF noticed an outflow of over $200 million.

- Trade netflow was dominated by constructive movement.

Following the approvals of spot Bitcoin [BTC] ETFs within the US, Bitcoin has skilled sustained excessive volumes of flows. As the worth of BTC appeared poised to reclaim its all-time excessive, the movement of ETFs peaked for the month.

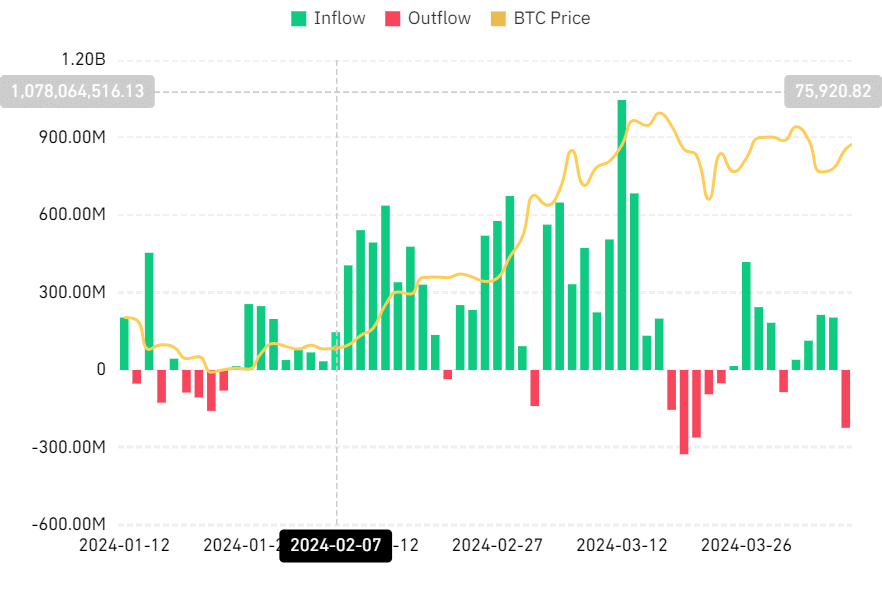

Outflow dominates Bitcoin spot ETF quantity

Evaluation of the Bitcoin spot ETF Netflow on Coinglass revealed that it noticed its highest movement since twenty seventh March on eighth April. Nonetheless, this movement marked a deviation from the pattern noticed in current days.

In keeping with the chart, eighth April noticed a big outflow, the primary of its form since twentieth March. The info confirmed an outflow of over $223 million price of BTC on eighth April.

Apparently, the final time such a quantity of outflow occurred, Bitcoin was experiencing a value decline. Opposite to earlier cases, this outflow occurred whereas Bitcoin rose, surpassing $71,000.

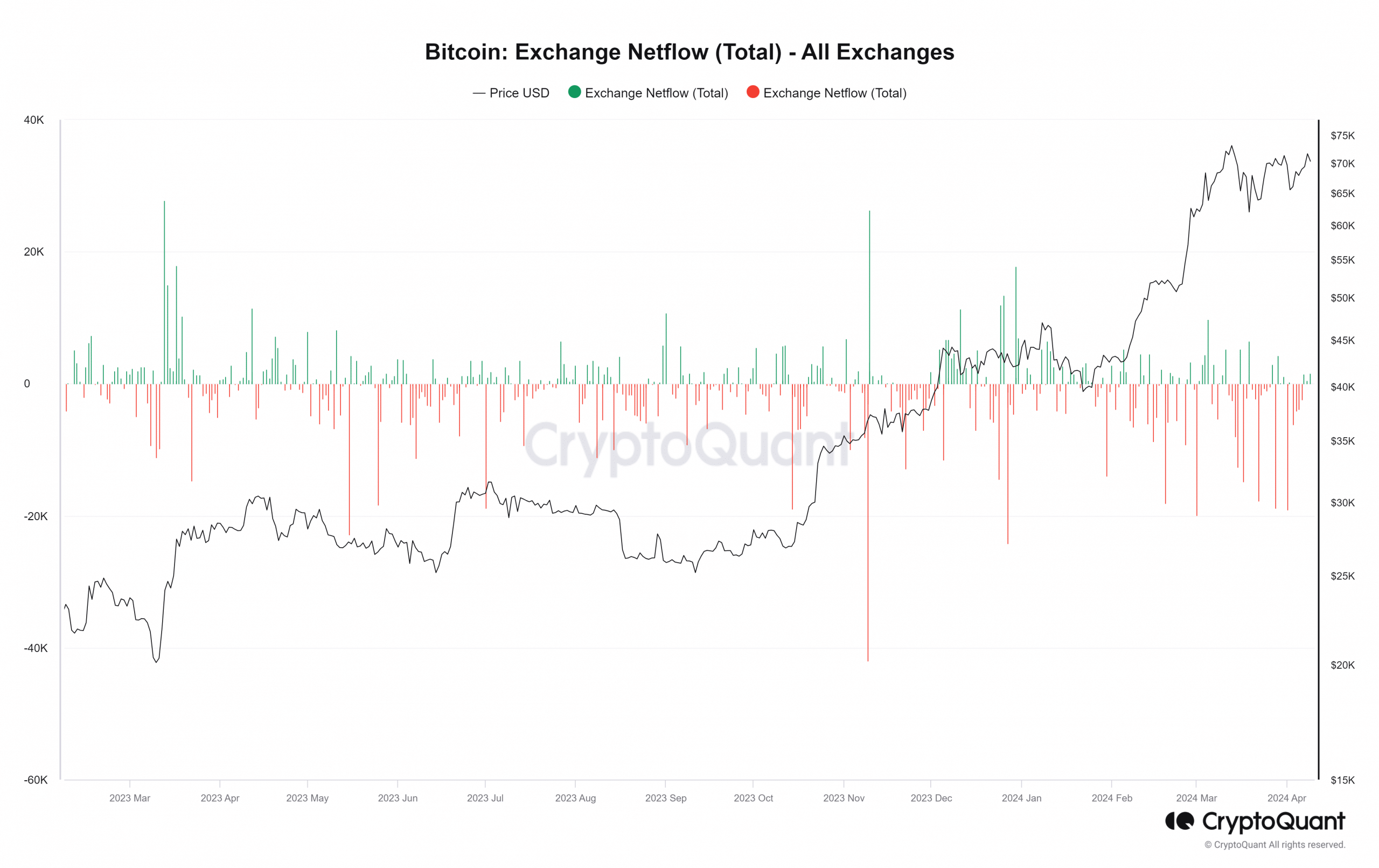

Bitcoin sees extra change influx

Whereas the Bitcoin spot ETF skilled a big outflow amidst the worth rise, the final BTC netflow exhibited the alternative pattern on eighth April. Evaluation of the netflow indicated a dominance of inflows, suggesting that extra merchants have been depositing their holdings into exchanges.

Nonetheless, it’s noteworthy that regardless of the dominance of inflows, the quantity was not notably important. The overall influx recorded was roughly 555 BTC. In the intervening time, the influx has elevated to over 1,300 BTC.

Though the Bitcoin spot ETF and Trade Netflow metrics seemingly moved in reverse instructions, their underlying responses are related.

A surge in spot ETF outflow signifies that shareholders are promoting, probably motivated by numerous components, together with profit-taking. Equally, the prevalence of inflows in change netflow means that holders additionally promote to safe income.

In each eventualities, the driving power is the rise in BTC value, a typical issue influencing these actions.

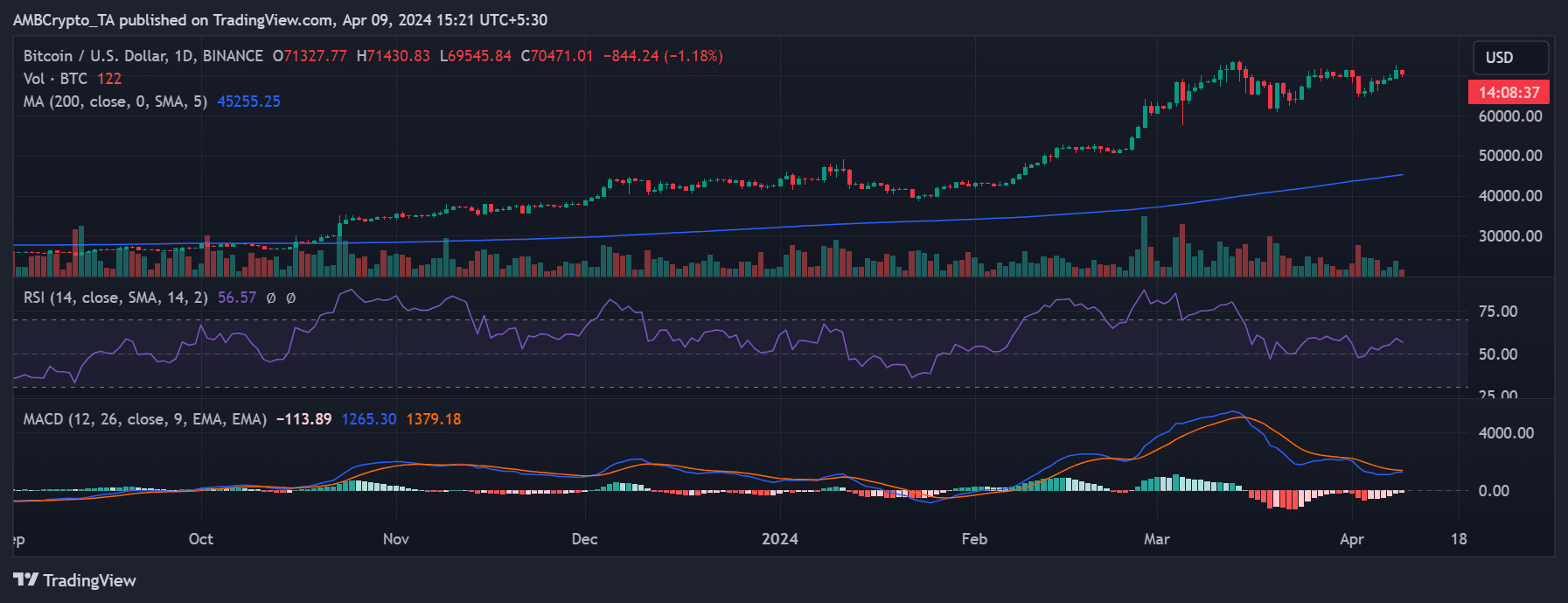

BTC value rise takes a breather

On eighth April, the worth of Bitcoin surged by roughly 1.73%, reaching round $71,313. Whereas this wasn’t Bitcoin’s peak, evaluation indicated it marked the third-highest value in its historical past.

Learn Bitcoin (BTC) Price Prediction 2024-25

Nonetheless, by the point of this writing, the worth had skilled a decline. BTC was buying and selling at round $70,400, reflecting a lower of over 1%.

Though this decline represented a setback from the day prior to this’s rally, BTC remained inside a bullish pattern regardless.