- At press time, Bitcoin was buying and selling at round $69,000

- Open Curiosity figures had been round $36 billion, regardless of BTC’s value decline

Following a number of days of uptrends, Bitcoin’s current ascent above $71,000 sparked optimism amongst sure merchants. Nevertheless, its subsequent dip beneath $70,000 elicited blended sentiments, with shopping for and promoting sentiment each displaying comparable figures.

A weak bull development?

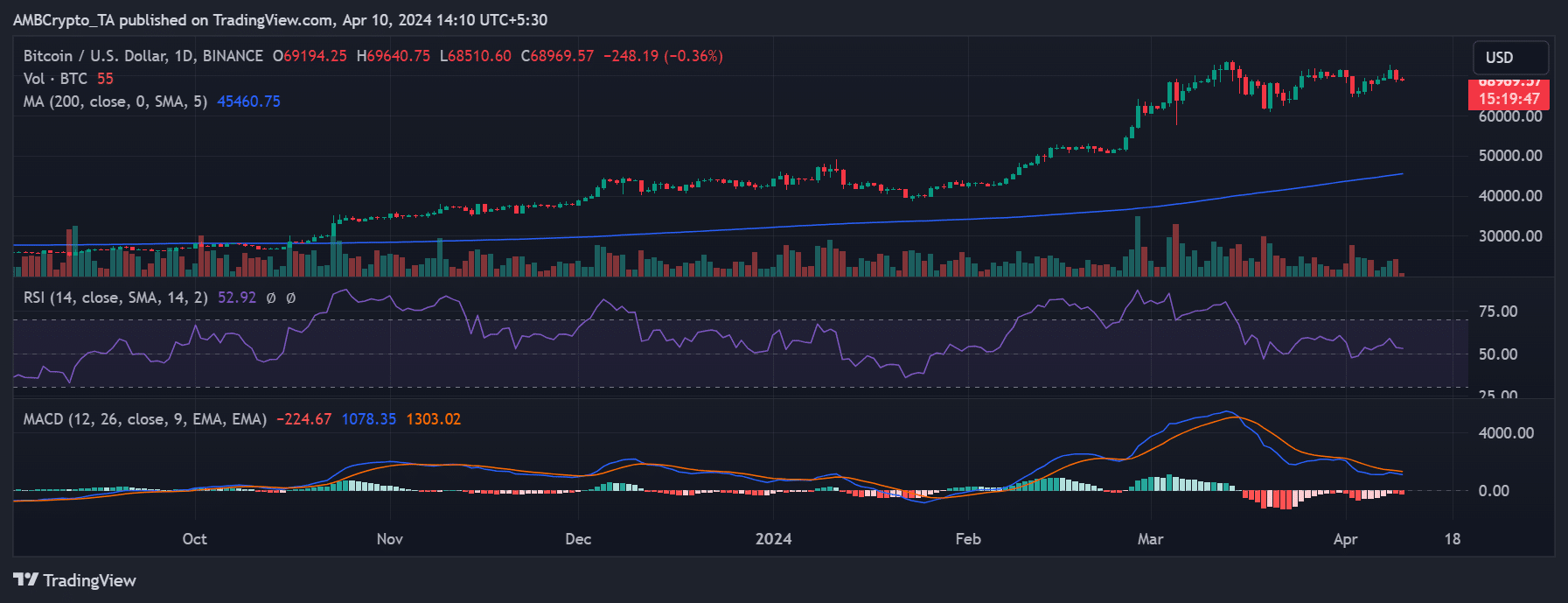

Bitcoin registered a major setback on 9 April, deviating from the anticipated value development with a decline of almost 3% on the charts. Evaluation of the every day timeframe value chart revealed a drop to round $69,217 by the top of the buying and selling session, down from its start line above $71,000.

This decline outweighed yesterday’s beneficial properties of over 2.7%.

On the time of writing, this downtrend persevered, albeit marginally. The Relative Energy Index (RSI) line appeared nearly flat too, hovering barely above the impartial line. This place urged that Bitcoin was nonetheless in a bullish uptrend, however it was a weak one.

Purchase or promote?

The aforementioned decline in Bitcoin’s value has sparked nice dialogue about whether or not to purchase or promote the asset. Actually, Social dominance and quantity on Santiment indicated a comparatively balanced debate between these positions. Think about this – An evaluation of social quantity confirmed round 164 mentions of purchase sentiment, in comparison with 125 mentions of promote sentiment.

Moreover, an examination of social dominance revealed that the purchase sentiment was round 4.9%, whereas the promote sentiment was round 3.7%. Moreover, on the time of writing, “Bitcoin halving” ranked because the second-highest trending phrase. These metrics counsel that regardless of the worth decline, merchants stay largely targeted on the potential influence of the upcoming halving occasion.

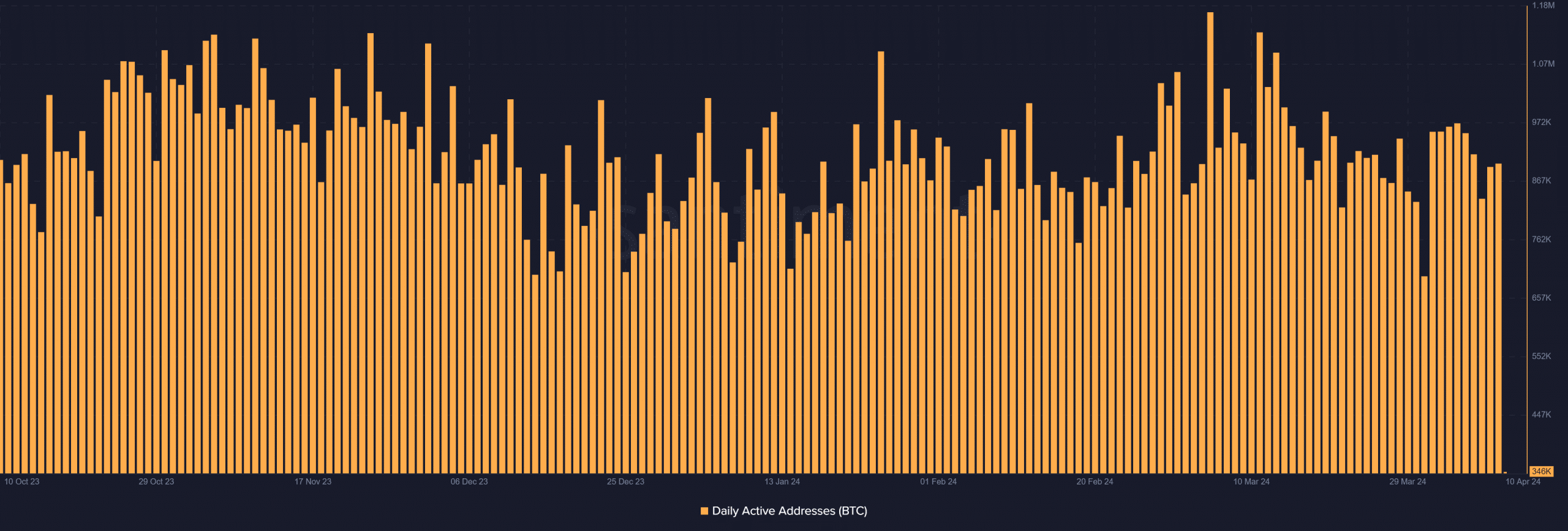

Minimal exercise in energetic addresses

An evaluation of Bitcoin‘s every day energetic addresses revealed a slight enhance over the previous 4 days too, with the identical hovering across the 800,000 threshold. Between 7 and eight April, energetic addresses rose from round 835,000 to over 892,000, with an extra hike to over 898,000 by 9 April.

Quite the opposite, the 7-day energetic addresses chart highlighted a current decline. From 7 to 10 April, energetic addresses decreased from over 4.9 million to roughly 4.7 million. These metrics counsel that whereas a notable variety of energetic wallets exist, many individuals could also be adopting a wait-and-see strategy.

– Learn Bitcoin (BTC) Price Prediction 2024-25

At press time, Bitcoin’s Open Curiosity had fallen too. Knowledge from Coinglass revealed that Open Curiosity stood at roughly $36.89 billion, down from $37.84 billion on 9 April. What could be inferred right here? Nicely, regardless of figures for a similar falling, a substantial quantity of capital remains to be getting into the market. Bitcoin’s short-term value motion is unlikely to make a dent right here both.