As international geopolitical tensions escalate, the cryptocurrency market finds itself in a precarious place, with Bitcoin, the flagship digital asset, dealing with a big take a look at of its resilience.

MicroStrategy co-founder Michael Saylor’s current remarks on the potential advantages of chaos for Bitcoin have sparked discussions throughout the crypto neighborhood. Nonetheless, the present market situations paint a contrasting image, elevating questions in regards to the true influence of worldwide turmoil on digital currencies.

Saylor’s Optimism Vs. Market Realities

Michael Saylor’s optimism concerning Bitcoin’s prospects amidst geopolitical unrest stems from the cryptocurrency’s fame as a hedge in opposition to financial uncertainty. In a current publish on platform X, Saylor expressed his perception that chaos might in the end profit the crypto.

Chaos is sweet for #Bitcoin.

— Michael Saylor⚡️ (@saylor) April 13, 2024

Nonetheless, the market response has been much less optimistic. Regardless of Saylor’s bullish sentiment, Bitcoin and different cryptocurrencies have skilled a notable decline in costs within the wake of escalating geopolitical tensions.

Bitcoin Efficiency Amidst Turmoil

Opposite to Saylor’s expectations, Bitcoin’s efficiency has faltered amidst the present geopolitical turmoil. The Israeli army’s studies of drone assaults by Iran have contributed to a way of unease in international markets, prompting traders to hunt safer belongings.

This flight to security has not translated into elevated demand for the main crypto asset, as evidenced by the current downward pattern in costs.

Whole crypto market cap is at the moment at $2.273 trillion. Chart: TradingView

Moreover, the broader cryptocurrency market has additionally suffered, with meme cash experiencing vital losses alongside Bitcoin. In reality, the meme coin market fell by practically 20%, reflecting the widespread influence of geopolitical instability on all the cryptocurrency sector.

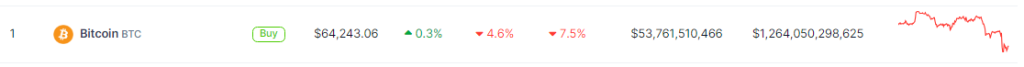

On the time of writing, Bitcoin was buying and selling at $64,223, down 4.6% and 7.5% within the day by day and weekly timeframes, knowledge from Coingecko reveals.

Supply: Coingecko

The disconnect between Saylor’s optimism and market realities underscores the advanced nature of its relationship with international occasions. Whereas Bitcoin has typically been touted as a hedge in opposition to geopolitical instability, its value actions are influenced by a myriad of things, together with investor sentiment and market dynamics.

Market Evaluation And Investor Sentiment

Market analysts attribute the current downturn in cryptocurrency costs to a mixture of things, together with investor uncertainty and macroeconomic considerations. The approaching US tax deadline has additionally performed a job in shaping market sentiment, with traders opting to withdraw from riskier belongings in favor of extra secure investments.

This pattern is mirrored within the vital sell-offs noticed in each Bitcoin and meme cash, highlighting the influence of exterior occasions on cryptocurrency markets.

Regardless of the present challenges dealing with the digital forex, some analysts stay optimistic about its long-term prospects. The upcoming Bitcoin halving occasion is predicted to supply reduction to traders, probably mitigating a few of the short-term volatility brought on by geopolitical turmoil.

Featured picture from Pixabay, chart from TradingView

Supply: Coingecko

Supply: Coingecko