- On-chain metrics supported a Litecoin important improve earlier than the halving.

- Those that purchased LTC at decrease costs have give up profit-taking.

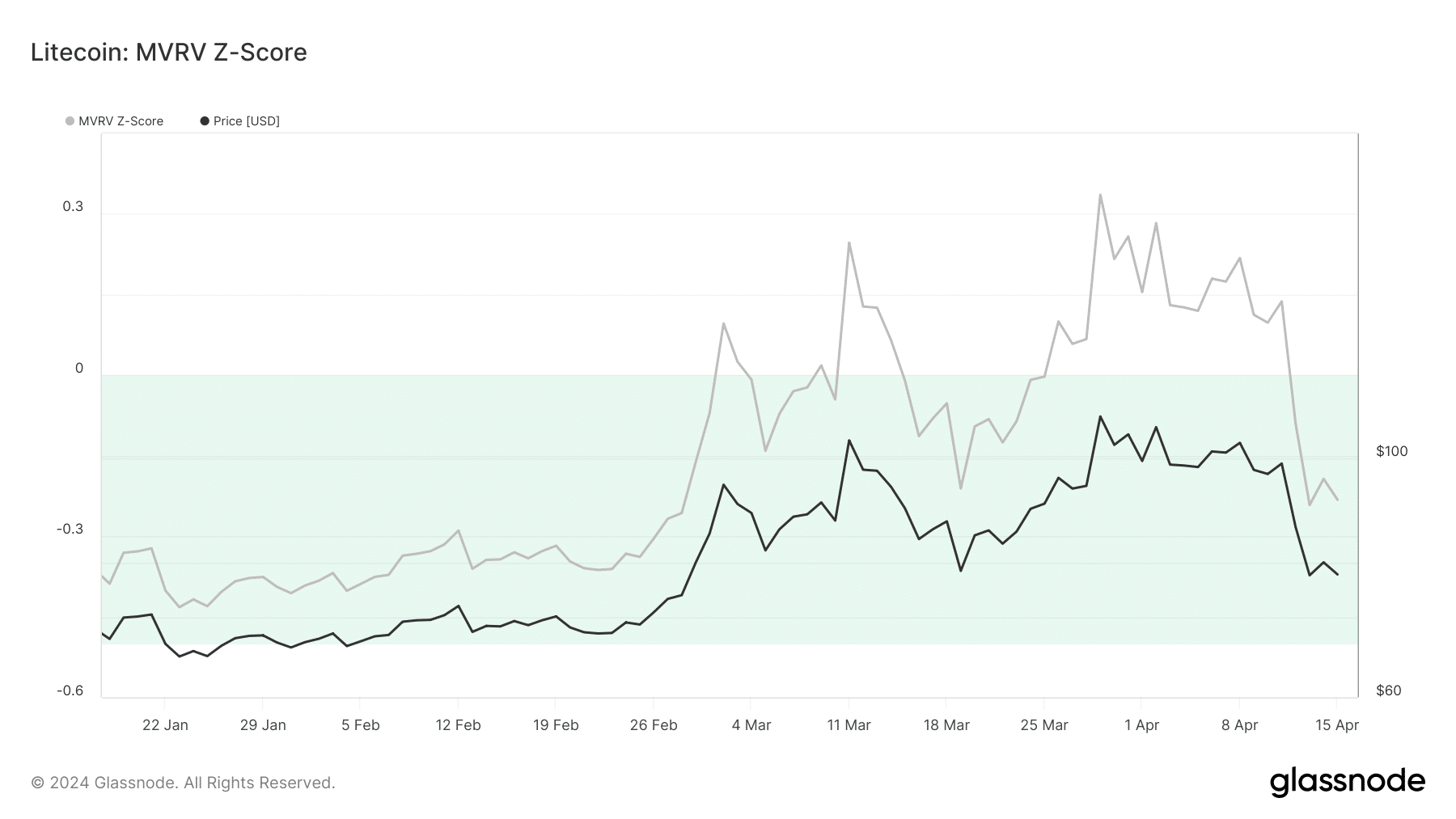

Litecoin [LTC] has reached a crucial spot that would set off a bounce, AMBCrypto observed. At press time, the Market Worth to Realized Worth (MVRV) Z-Rating, obtained from Glassnode, was -0.23.

This indicator measures the valuation of a cryptocurrency. Across the twenty ninth of February, the MVRV Z-Rating had an analogous studying.

At the moment, LTC modified arms at $74.62. Two days later, the value of the coin jumped to $94.47.

However that was not the one occasion by which Litecoin displayed such. In March, the metric was detrimental, and its worth had dropped. However 10 days later, the worth rose to $109.29.

Does LTC care about 2020?

At press time, LTC’s worth was $78.62, with the Bitcoin [BTC] halving taking place in lower than 5 days. If historical past repeats itself, the value of Litecoin may bounce earlier than the Bitcoin occasion.

However earlier than we conclude {that a} worth improve was inevitable, it is very important test the coin’s performance over the past two halvings.

In 2016, Litecoin’s worth was $3.19 a couple of days earlier than the halving. And on the day of the occasion, the worth was $4.12. However throughout the 2020 halving, LTC moved sideways as the value traded between $43 and 46.

Nonetheless, occasions have modified, because the market situation then was not what it’s now. Because of this, AMBCrypto thought of it mandatory to guage different metrics that would have an effect on LTC.

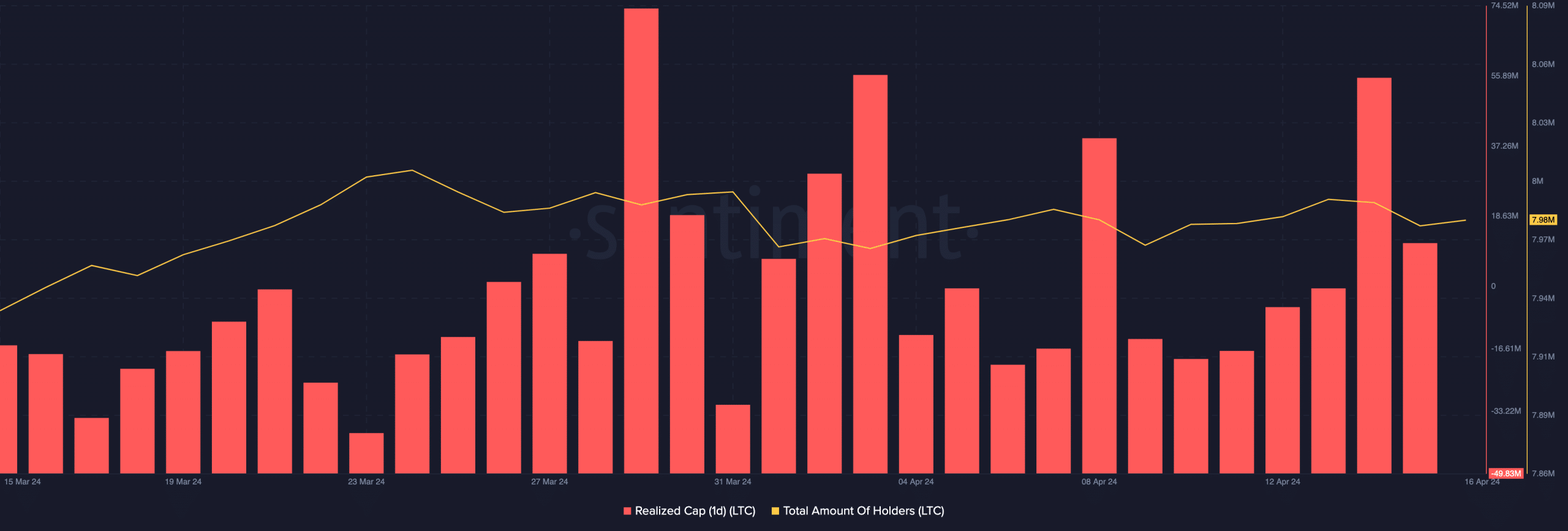

One of many metrics we analyzed was the Realized Cap. This metric tells a bit concerning the sentiment out there.

If the Realized Cap spikes, it signifies that cash purchased at decrease costs are being spent, and contributors are realizing income.

This pattern may result in additional correction, Nonetheless, a falling Realized Cap reveals perceived undervaluation. At press time, Litecoin’s one-day Realized Cap was -49.83 million, suggesting a bounce could possibly be shut.

After the occasion comes the parabola

Ought to the metric drop decrease, the possibility of LTC’s rise earlier than Bitcoin’s halving may improve. But when the metric rises, that prediction could possibly be annulled.

Regardless of the bullish potential, not each market participant was satisfied concerning the coin’s short-term potential. This was evident within the quantity of holders.

In keeping with Santiment, Litecoin’s complete variety of holders had decreased from 8 million to 7.98 million.

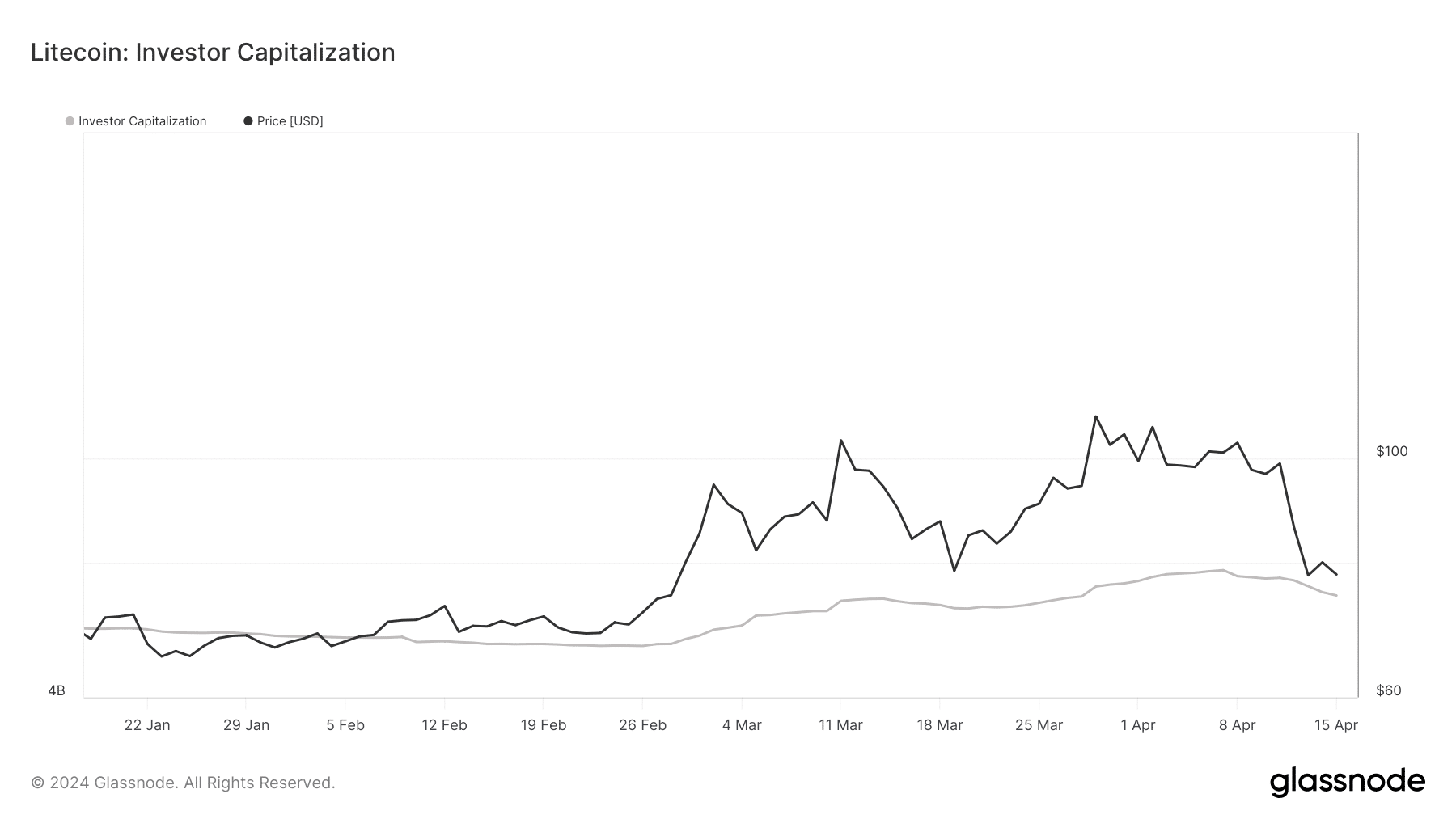

To conclude, AMBCrypto evaluated the Investor Capitalization. That is the distinction between the Thermocap and the Realized Cap. It additionally serves as a method to establish bottoms or tops in a cycle.

Practical or, not, right here’s LTC’s market cap in BTC terms

As of this writing, the Investor Capitalization confirmed that Litecoin was nearer to its backside than the highest.

Due to this fact, LTC’s worth has the potential to swing upwards earlier than Bitcoin’s halving, and after it, the worth may additionally improve.