- Drop in long-term holder energetic gross sales meant sellers is perhaps exhausted

- Improve within the largest whales’ holdings whereas costs plummeted could also be seen as an indication of confidence

Bitcoin [BTC] fell again quickly from the $69k-$70k resistance zone. The weekly timeframe developed a bearish construction, and the FOMC meeting slashed bullish hopes of a Fed fee reduce in September.

On prime of this, the Sahm Rule appeared to verify financial weak spot and opened up the potential for a recession. This despatched the markets right into a panic and BTC tumbled decrease.

The $60k area is a major help zone, however there aren’t any ensures that the bulls would efficiently defend it. AMBCrypto regarded nearer at on-chain metrics to higher perceive the long-term holder sentiment.

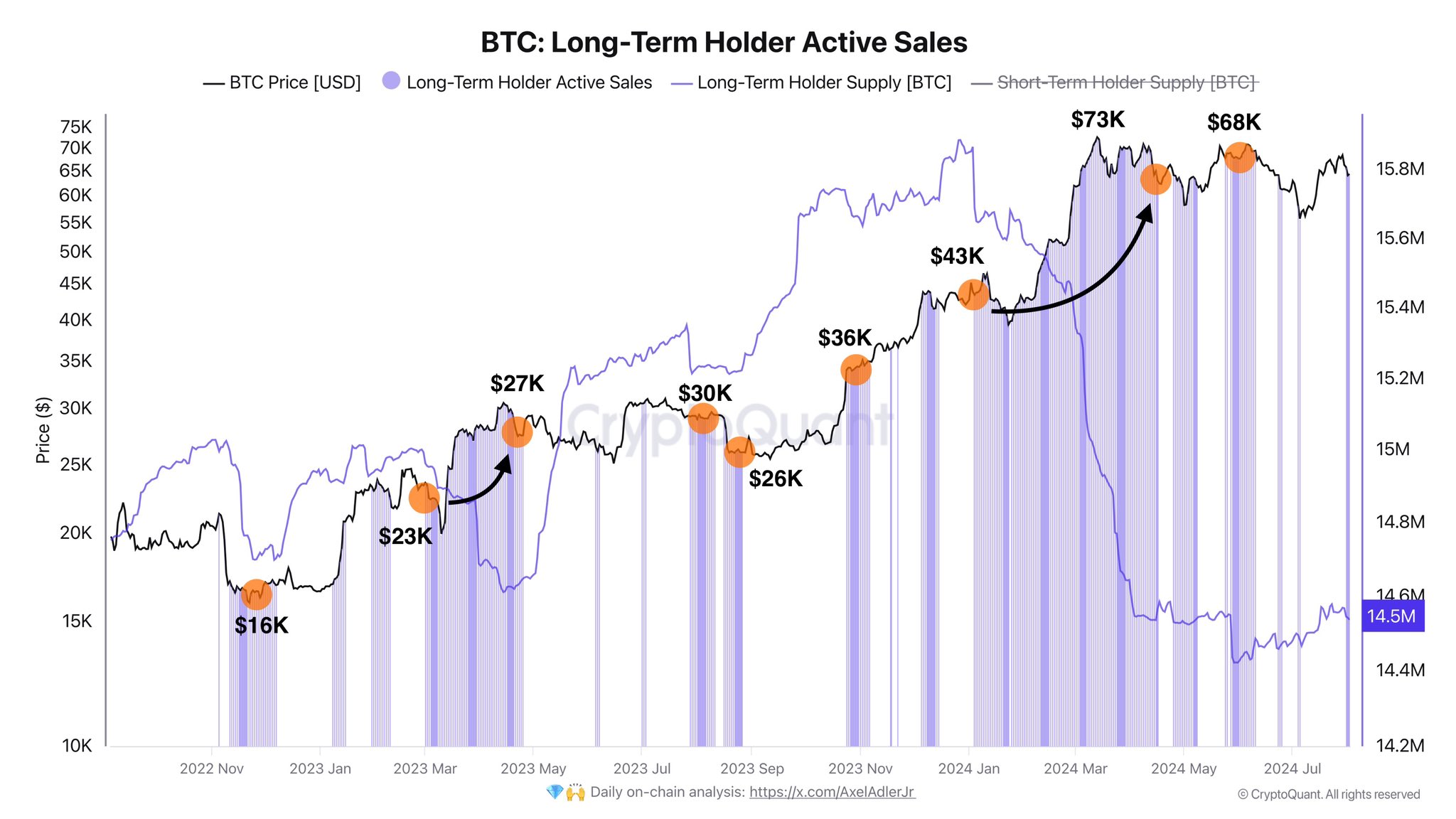

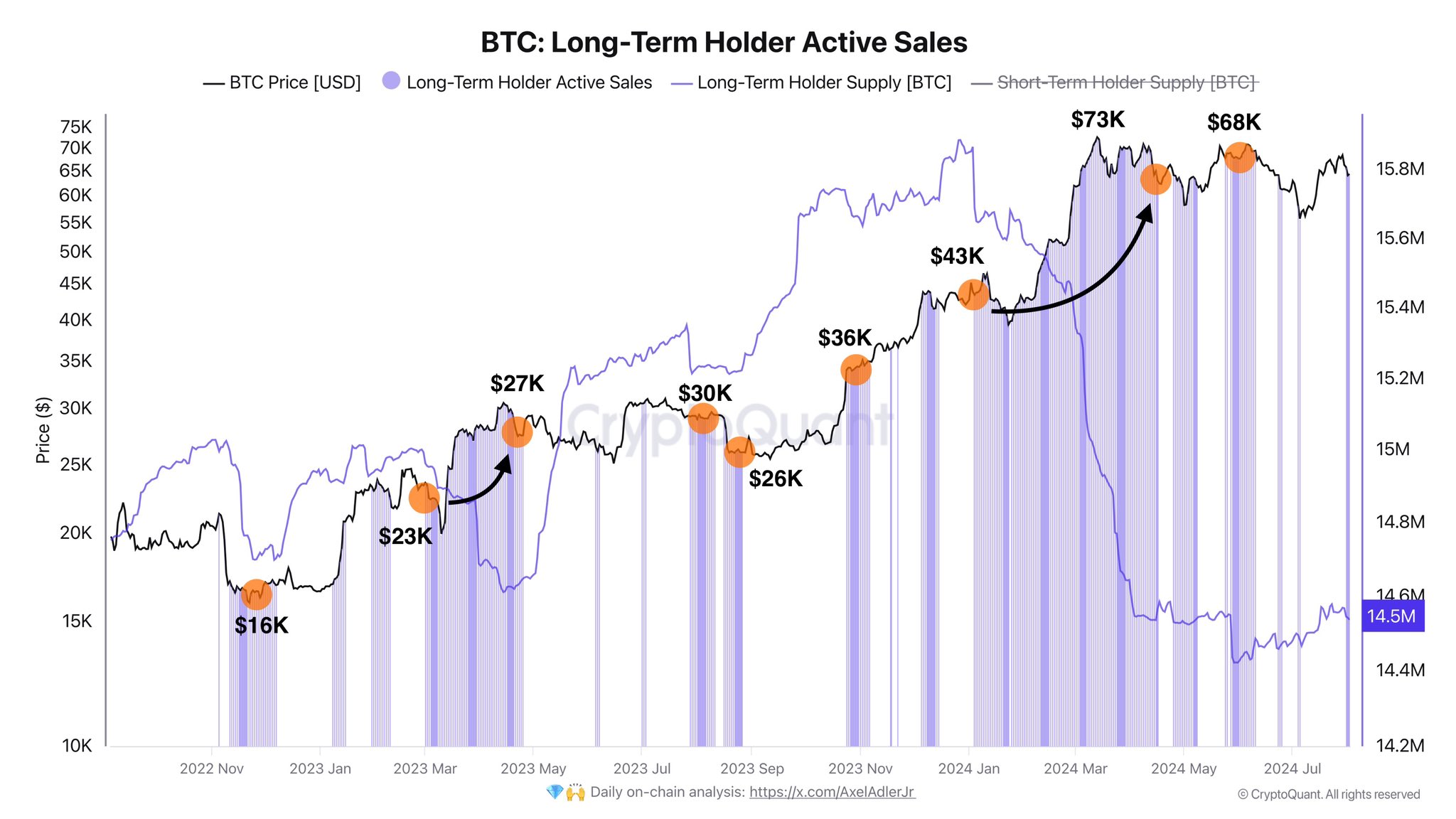

Lengthy-term holder promote strain has fallen

Supply: Axel Adler on X

In a post on X (previously Twitter) crypto-analyst Axel Adler noticed that long-term holder energetic gross sales had lowered. In comparison with early June, the promoting strain from this band of holders was “minimal.”

The long-term provide additionally fell dramatically. This urged intense profit-taking exercise when BTC was buying and selling across the $68k-$70k ranges. It pointed to a scarcity of conviction of a breakout previous $70k.

Then again, this may additionally be constructive information as a result of this meant the promoting strain is probably going exhausted.

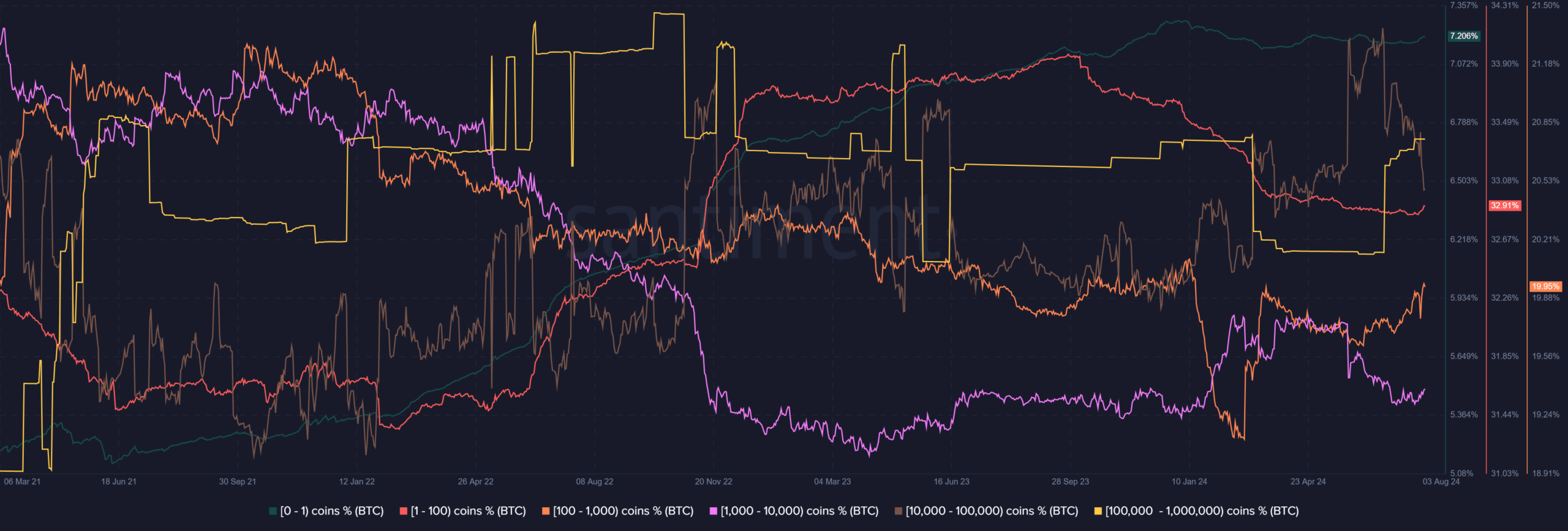

Whale cohort’s conduct is thrilling information

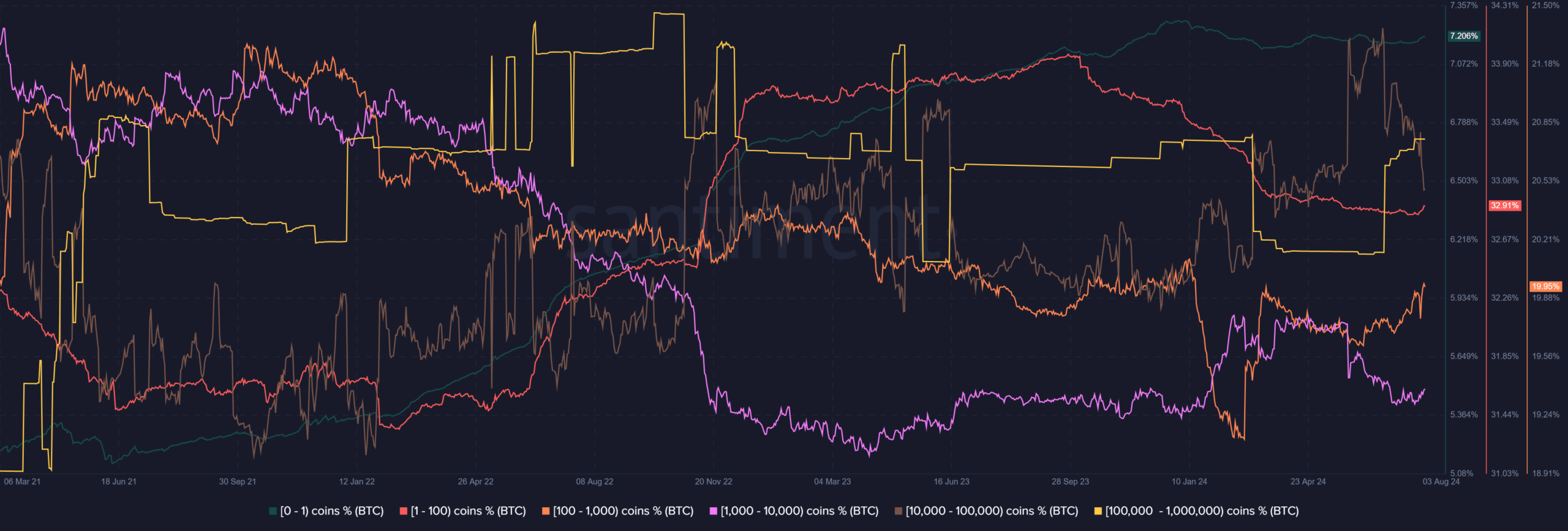

Supply: Santiment

The cohort of wallets with 100k-1M BTC of their wallets climbed greater as a proportion of the entire. The final time it jumped this quickly was in Might 2023, when Bitcoin started to poke its head above the $26k resistance.

Whereas this whale accumulation is encouraging, different whale cohorts have been promoting. The 1k-100k division noticed a pointy drop of their holdings over the previous two weeks, displaying promoting strain from whales.

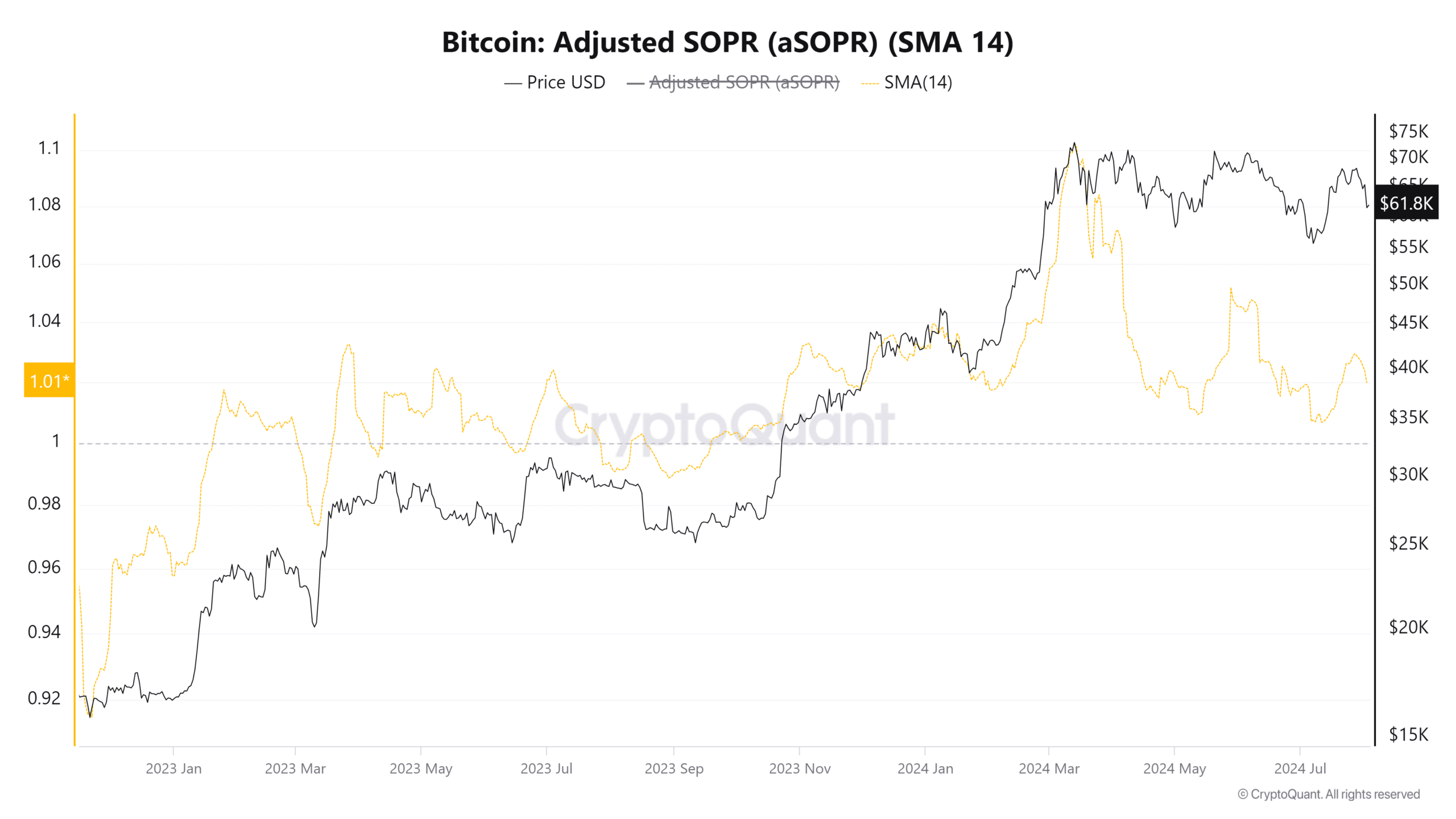

Supply: CryptoQuant

Proof for bearish sentiment over the previous few months was additionally seen within the adjusted SOPR. The worth was above 1 to indicate that on common, cash had been bought at a revenue.

Alas, the falling aSOPR pattern since March has been a bearish sign.

Learn Bitcoin’s [BTC] Price Prediction 2024-25

Total, the drop in LTH energetic gross sales, mixed with accumulation from bigger whales, is encouraging. Regardless of these positives, nevertheless, Bitcoin would possibly wrestle to get better in August as a result of bearish market-wide sentiment.