- BlackRock purchased ETH price $109.9 million, spurred by the most recent worth decline.

- Slight accumulation noticed, particularly from whales, however retail remains to be fearful.

With the most recent discounted Ethereum [ETH] costs, one would anticipate consumers to ape again into the market.

Until there have been expectations of extra promote aspect strain within the coming days. ETFs have been driving up demand for ETH, therefore it’s important to maintain up with their exercise.

Recent data indicated that the bears had been falling again after their aggressive assault in the marketplace final week. Some Bitcoin [BTC] ETFs are taking benefit, similar to BlackRock, who purchased ETH price $109.9 million on the sixth of August.

This was a large increment, examine to the quantity that Blackrock bought in the day past.

Blackrock had beforehand halted accumulation on the 2nd of august as promote strain intensified. It resumed on the fifth of August, throughout which it added $47.1 million price of ETH.

There was $98.4 million internet shopping for strain on that day, in comparison with $48.8 million throughout the day past.

This enhance within the final two days indicators the return of confidence after the current crash. It additionally signifies that the ETFs are capitalizing on the ETH worth low cost.

Nonetheless, many of the different ETH ETFs have both been sitting on the sidelines or including smaller quantities.

Essentially the most notable on the alternative aspect of the spectrum was the Grayscale ETHE ETF, which has been experiencing outflows. It additionally occurs to be the ETF with the best annual price at 2.5%.

It contributed $39.7 million price of promote strain in the course of the buying and selling session on the sixth of August.

Outflows have notably decreased in comparison with the final week of July, indicating disinterest in promoting at discounted costs.

Is ETH accumulation gaining traction?

ETH has little question been experiencing a resurgence of promote strain within the final two days. However simply how a lot shopping for strain at the moment exists?

We in contrast ETH focus earlier than and after the crash, and right here’s what we discovered.

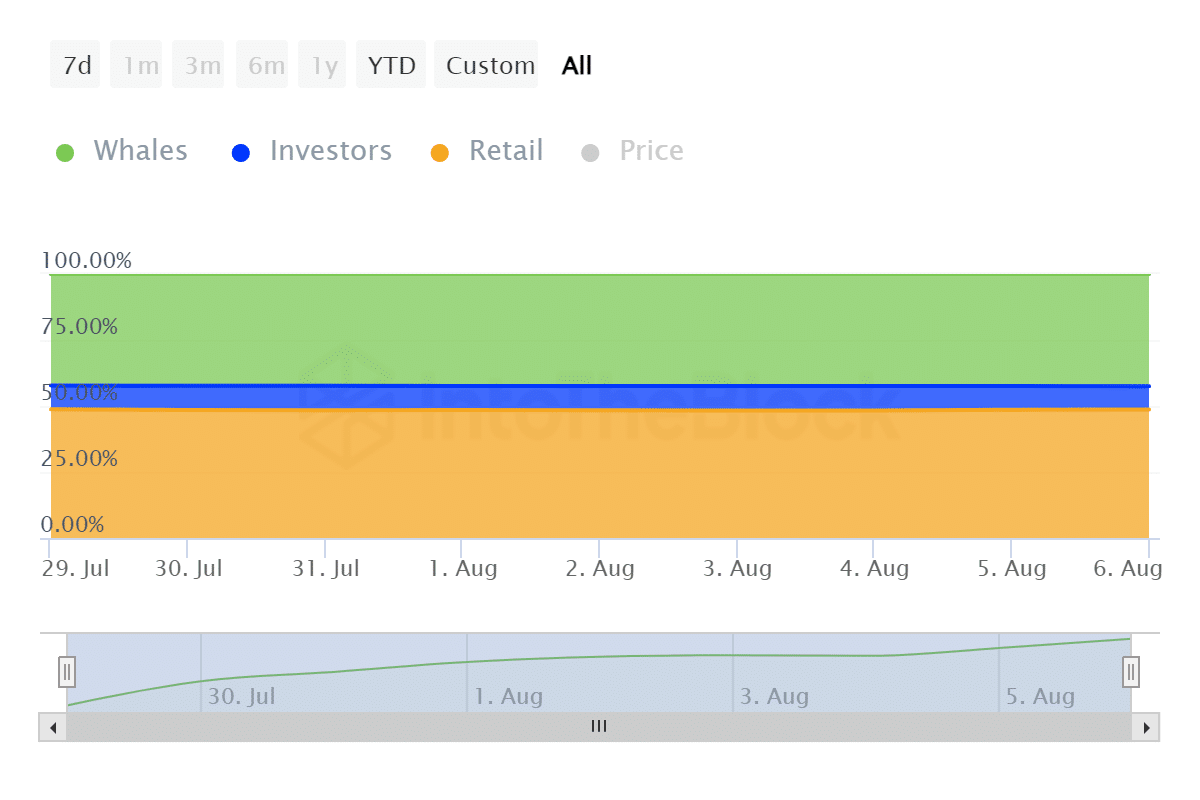

Simply seven days in the past, whales owned 56.66 million ETH, buyers held 12.2 million ETH and retail merchants held 65.43 million ETH. This represented 42.19%, 9.09% and 48.72% respectively.

The newest information indicated that whales held 57.13 million ETH, buyers at 11.93 million ETH and retail was at 65.39 million.

The above findings indicated that whales added to their holdings in the course of the dip. Traders and retail merchants, at press time, had been holding much less ETH than they did every week in the past.

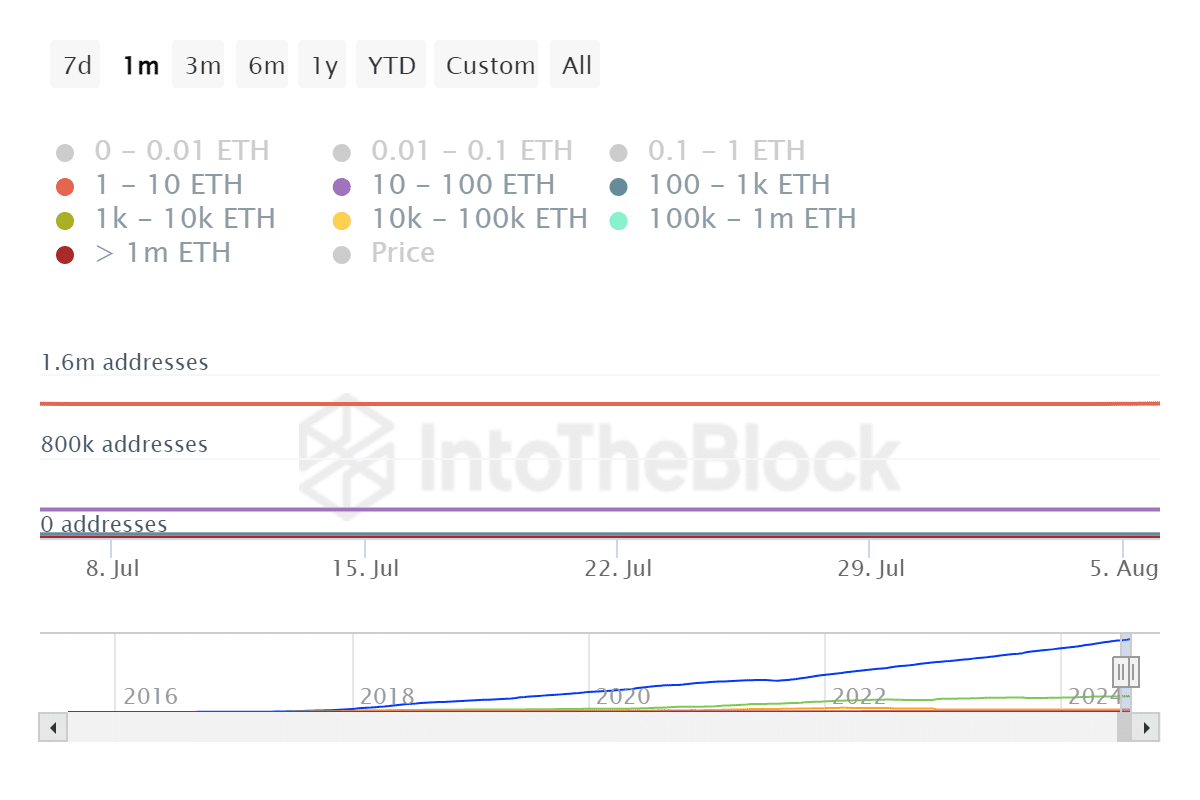

We additionally determined to discover handle holdings to find out which class of whales had been accumulating.

Learn Ethereum’s [ETH] Price Prediction 2024-25

Our findings revealed that there have been 5 addresses proudly owning over 1 million ETH over the past 30 days. Addresses holding between 100,000 ETH and 1 million ETH dropped from 93 to 92.

These within the 10,000 t0 100,000 ETH vary dropped by 32 addresses. The class of addresses holding between 10 and 100 ETH had a internet optimistic final result from 281,750 addresses to 282,530 addresses.