- Like BTC ETFs, Ethereum ETFs additionally witnessed outflows over the previous few days

- Metrics and market indicators advised that Bitcoin’s bear rally may finish quickly although

Regardless of the bearish market circumstances, Bitcoin [BTC] ETFs witnessed promising inflows a couple of days in the past. Nevertheless, the pattern modified during the last 24 hours.

Therefore, it’s price taking a more in-depth have a look at what’s happening with ETFs, whereas additionally drawing a comparability with the state of Ethereum [ETH] ETFs.

How are Bitcoin ETFs doing?

In line with latest knowledge, Bitcoin ETFs noticed inflows price $200 million on 8 August, which appeared optimistic. Alas, this pattern didn’t final because the figures turned damaging simply the subsequent day.

As per SoSoValue, BTC ETFs netflows dropped below -$90 million on 9 August. Right here, it was attention-grabbing to notice that whereas Blackrock elevated its holdings, Grayscale selected to promote, in keeping with Dune’s data.

Like Bitcoin, Ethereum ETFs additionally witnessed an identical scenario over the previous few days. To be exact, ETH ETFs netflows reached $98 million on 6 August. Nevertheless, the quantity dropped to -$15.7 million on 9 August.

A potential cause for the drop in netflows might be the bearish market circumstances, as each BTC and ETH noticed value declines on the charts.

The truth is, in keeping with CoinMarketCap, whereas BTC’s value dropped by 1.2% final week, ETH’s worth plunged by greater than 12% throughout the identical interval. On the time of writing, BTC was buying and selling at $60.4k whereas ETH had a worth of $2.6k.

What to anticipate from Bitcoin?

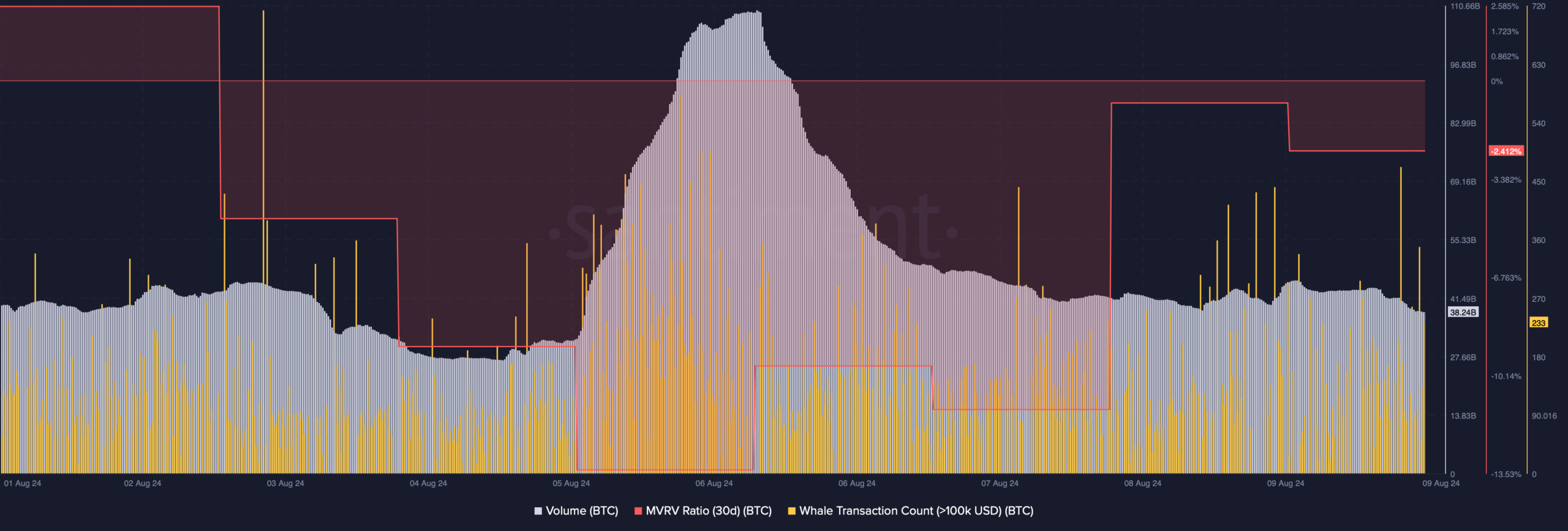

AMBCrypto then deliberate to have a more in-depth have a look at BTC’s present state to see whether or not it may showcase a bullish comeback within the coming days. As per our evaluation of Santiment’s knowledge, BTC’s MVRV ratio improved – A bullish sign.

One other optimistic metric was the amount, which dropped. A decline within the metric throughout a bear market signifies that the bearish pattern may finish quickly. Moreover, Bitcoin’s whale transaction depend additionally remained excessive final week, that means that whales have been actively buying and selling BTC.

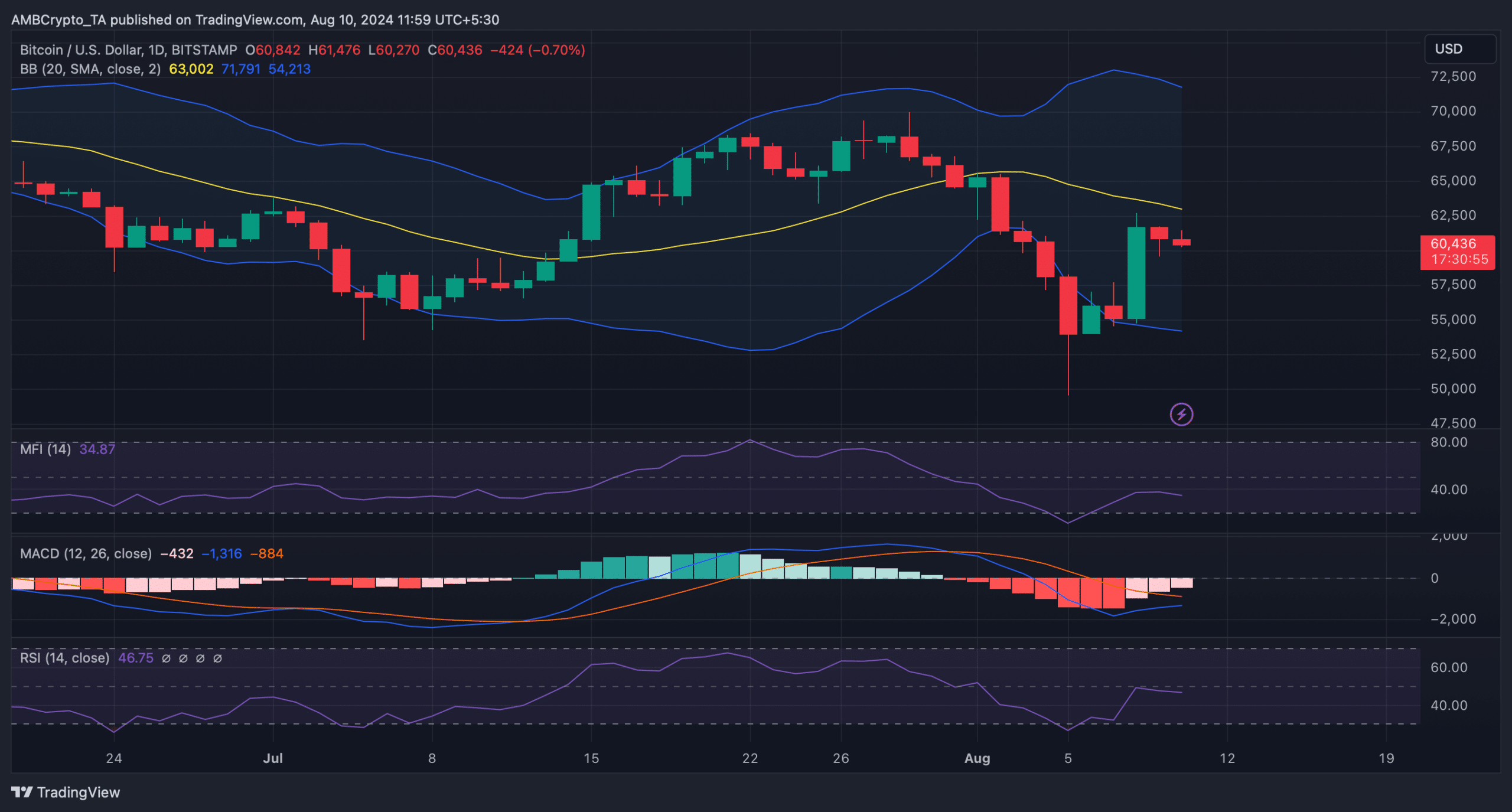

Quite the opposite, our have a look at Bitcoin’s every day chart revealed that its Relative Energy Index (RSI) registered a downtick. The Cash Circulation Index (MFI) went south too – An indication that BTC’s value may drop additional.

Is your portfolio inexperienced? Take a look at the BTC Profit Calculator

Even so, the MACD displayed the opportunity of a bullish crossover. Furthermore, the Bollinger Bands revealed that it was about to check its resistance close to the 20-day Easy Transferring Common (SMA).

A profitable breakout above that degree would guarantee the start of a bull rally.