- There’s a excessive likelihood that ETH might attain $3,000 or extra within the coming days.

- ETH’s Open Curiosity has jumped by 5.5% within the final 24 hours, indicating elevated curiosity from buyers.

On the 14th of August, the general cryptocurrency market had skilled spectacular upside momentum, following the large 4.5% worth surge in Bitcoin [BTC].

Amid this bullish development, Ethereum [ETH], the world’s second-biggest cryptocurrency, gained vital consideration from the crypto group as a result of its notable worth surge and up to date breakout.

Ethereum: Upcoming ranges

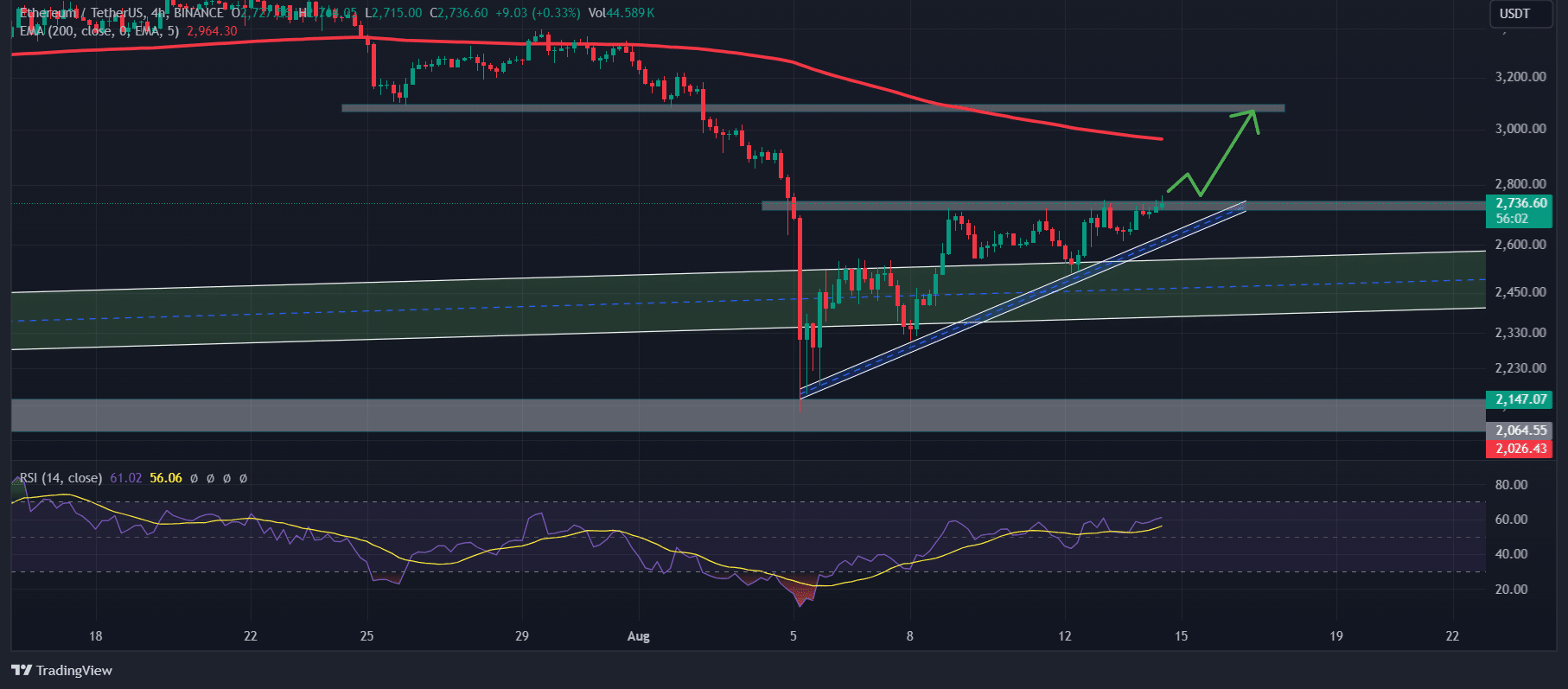

In keeping with professional technical evaluation, ETH regarded bullish because it lately gave a breakout of an ascending triangle worth motion sample in a 4-hour time-frame.

Nonetheless, this breakout occurred close to a powerful assist stage of a rising trendline.

Primarily based on the historic worth momentum since 2022, at any time when ETH has reached this trendline it has at all times skilled a large upside rally.

Nonetheless, this breakout has shifted the sentiment to bullish and there’s a excessive likelihood that ETH might attain $3,000 within the coming days.

If the bullish momentum continues, it has the potential to hit the $3,200 stage.

At press time, ETH was buying and selling beneath the 200 Exponential Shifting Common (EMA) in a 4-hour time-frame.

ETH’s technical evaluation

Following this breakout, the ETH’s Open Curiosity has jumped by 5.5% within the final 24 hours, indicating elevated curiosity from buyers and merchants.

At press time, ETH was buying and selling close to the $2,750 stage, having skilled a worth surge of over 4.5% throughout this era.

In the meantime, its buying and selling quantity has decreased by 24%, displaying decrease participation from merchants and buyers.

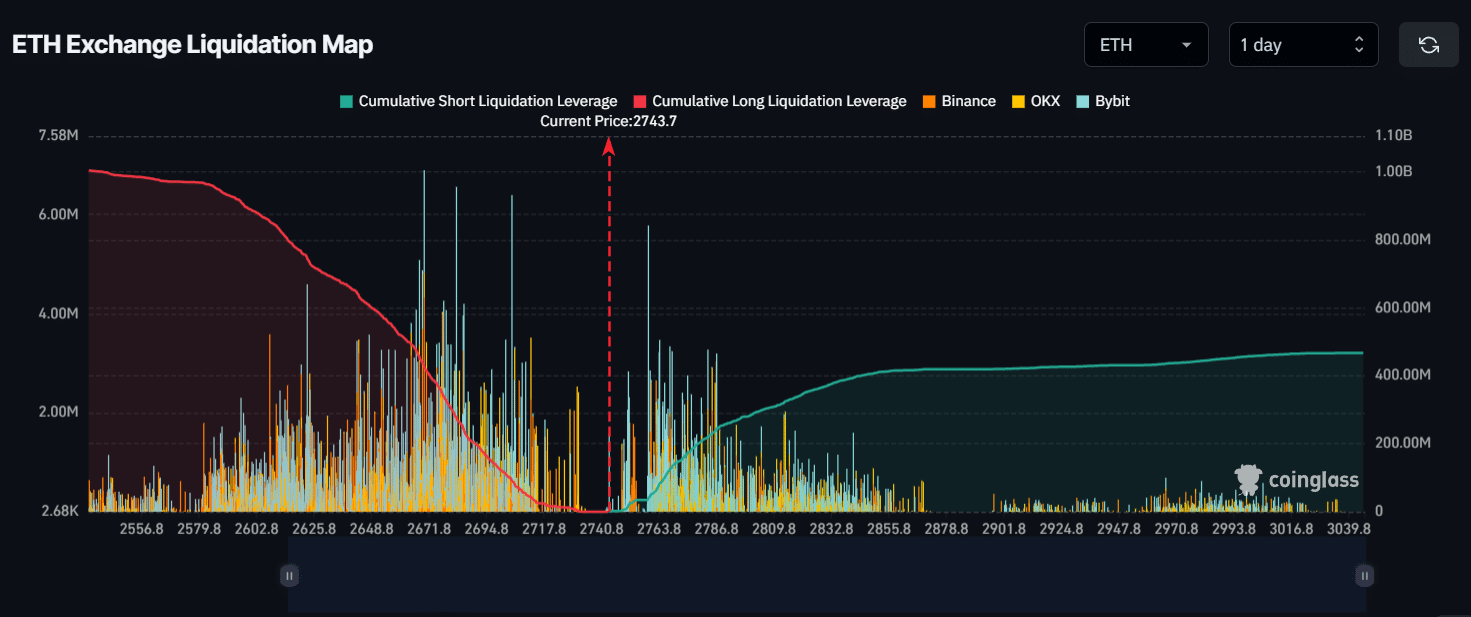

Additionally, main liquidation ranges have been at $2,670 on the decrease facet and $2,760 on the higher facet, in line with the on-chain analytic agency Coinglass.

Is your portfolio inexperienced? Take a look at the ETH Profit Calculator

If the sentiment stays bullish and the worth rises to the $2,760 stage, almost $34.75 million of brief positions shall be liquidated.

Conversely, if sentiment shifts and the ETH worth falls to the $2,670 stage, almost $430 million of lengthy positions shall be liquidated.