- The FOMC minutes for the July 30-31 assembly revealed {that a} overwhelming majority of Fed officers agreed to an rate of interest reduce in September.

- Bitcoin briefly reclaimed $61K following the information, as Open Curiosity surged by practically $2 billion.

The Federal Open Market Committee (FOMC) launched its highly-anticipated minutes for the July 30-31 assembly.

The minutes eliminated any doubt of rate of interest cuts in September, with a overwhelming majority of Federal Reserve officers agreeing that inflation has eased.

Such macroeconomic information tends to stir worth strikes throughout the crypto market. Most high ten cash by market capitalization noticed small bouts of volatility, with Bitcoin [BTC] breaking the psychological stage of $60,000.

First Fed fee reduce since 2020

Per the minutes of the July 30-31 assembly, most Fed officers are supporting an rate of interest reduce in September. Some members have been additionally keen to assist a 25 foundation level reduce through the July assembly.

The minutes learn,

“The overwhelming majority noticed that, if the info continued to come back in about as anticipated, it might possible be applicable to ease coverage on the subsequent assembly.”

The officers additional famous that whereas inflation remained elevated, it had lowered considerably and was on monitor to succeed in the two% goal. Different financial indicators such because the labor market have been additionally robust.

The reduce will mark the primary time the Federal Reserve has deserted money-tightening measures since 2020.

69% of buyers on the CME FedWatch Tool additionally anticipate the identical drop. Nonetheless, 30% of buyers anticipate a steeper reduce of fifty foundation factors.

Bitcoin jumps on “dovish” minutes

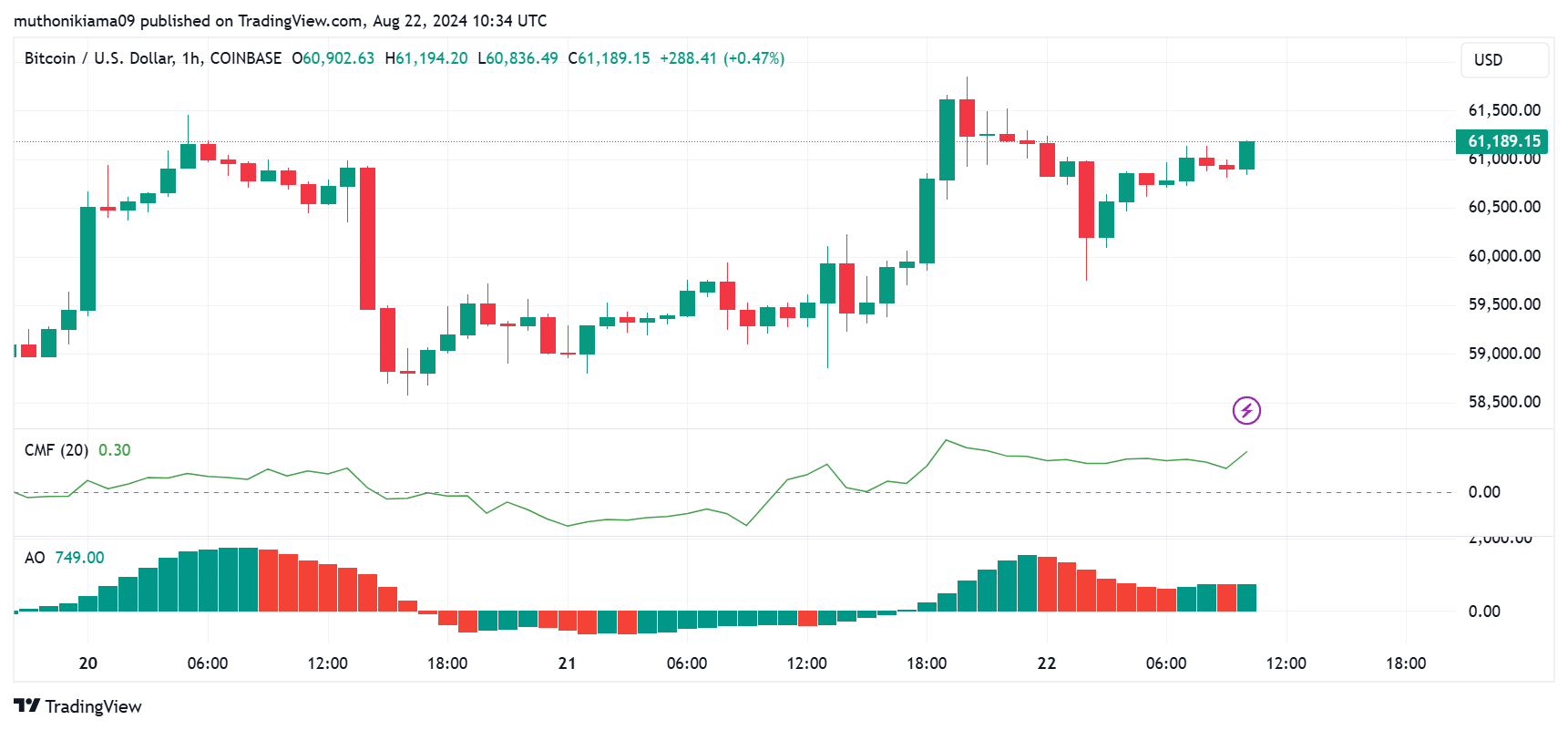

Bitcoin has jumped by 2.6% to commerce at $61,189 earlier than falling all the way down to $60,890.81 on the time of writing. BTC’s buying and selling volumes have additionally spiked by 26% per CoinMarketCap information, as market curiosity across the coin grew.

The spike comes amid an increase in shopping for strain, as seen within the Chaikin Cash Movement (CMF) index.

The CMF was within the optimistic area at press time, spiking considerably on the twenty second of August, coinciding with the FOMC minutes launch.

Nonetheless, the uptrend remained weak, as seen within the Superior Oscillator (AO). The AO was optimistic on the hourly chart and in addition shifted inexperienced at press time.

Whereas this means an uptrend, extra affirmation is required to substantiate its power.

Learn Bitcoin’s [BTC] Price Prediction 2024-25

Information from Coinglass additionally confirmed a virtually $2 billion improve in Open Curiosity from round $30 billion on the twenty first of August to $32 billion at press time.

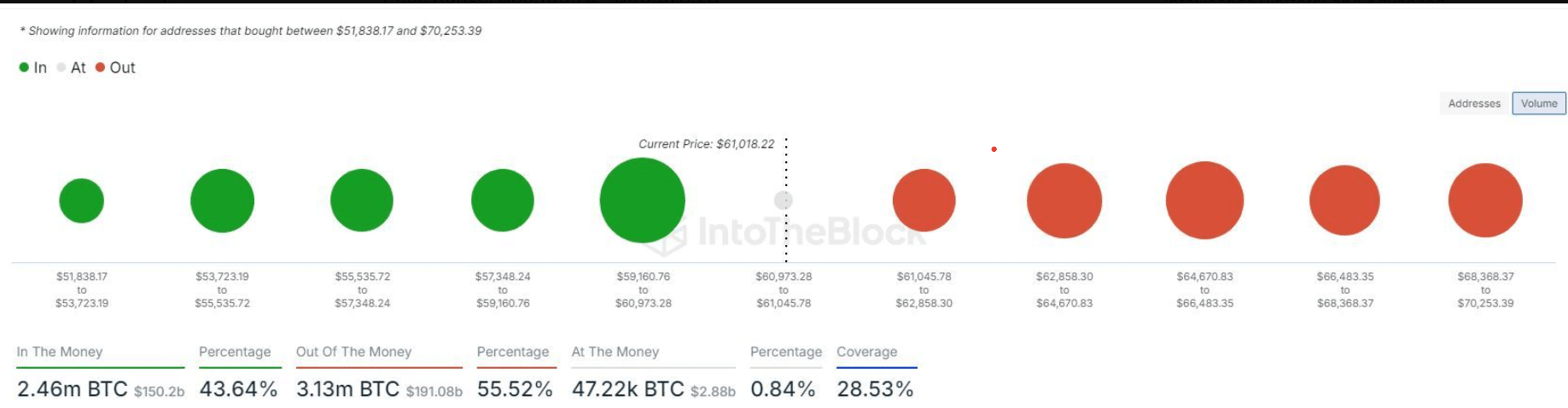

Bitcoin’s key resistance continued to lie on the $64K-$66K vary, as a majority of cash have been purchased at these ranges per IntoTheBlock information. Subsequently, sellers may emerge as soon as BTC approaches this worth vary.