- Bitcoin’s long-term holder SOPR hit 1, indicating common sells at break-even

- Evaluation of BTC’s key metrics and patterns steered the bull run continues to be on.

Bitcoin’s [BTC] latest worth motion and on-chain metrics are essential for understanding market sentiment, given its place because the cryptocurrency with the most important market cap.

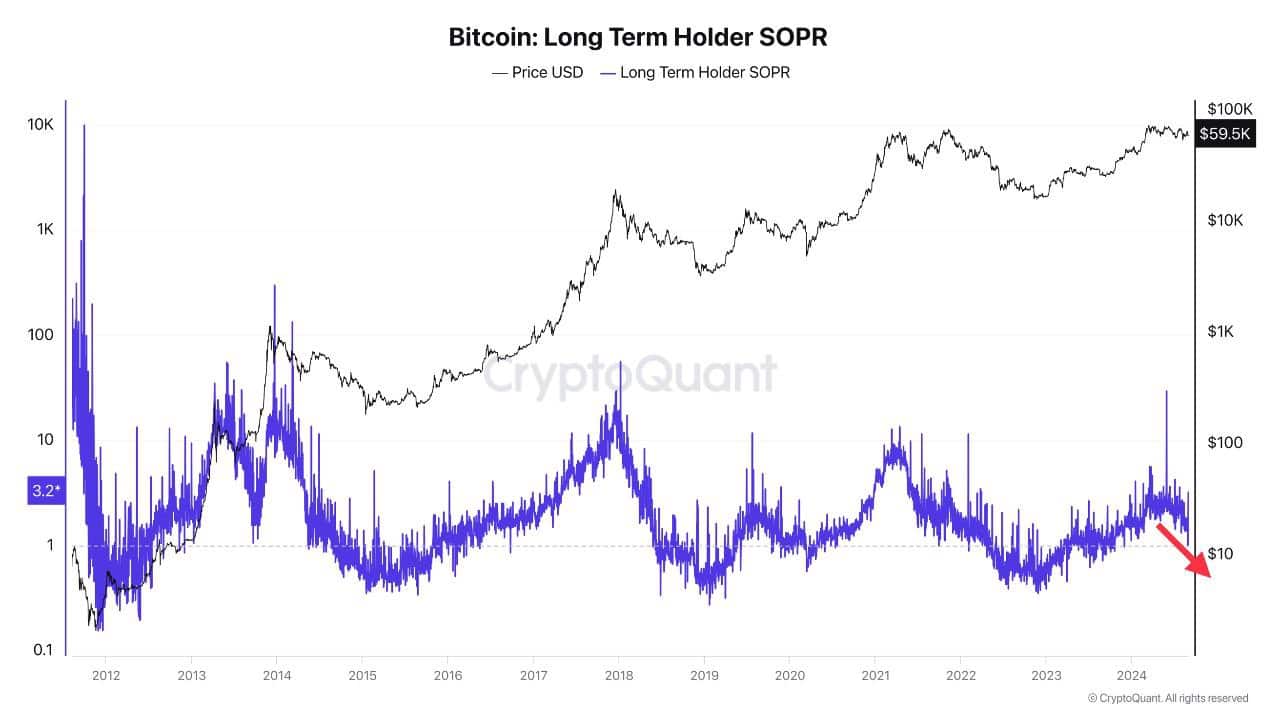

The Lengthy-term Holder SOPR that tracks Bitcoin transactions by those that’ve held BTC for over 155 days is a key metric. When the SOPR’s worth is above 1, it signifies earnings, whereas a worth under 1 indicators losses.

After the latest Bitcoin worth drop, the SOPR hit 1, which means many merchants offered at break-even – An indication of market warning.

Bitcoin [BTC], which had beforehand surged to $62k, is now buying and selling under this stage because of huge liquidations across the aforementioned stage.

BTC’s broadening wedge at essential assist stage

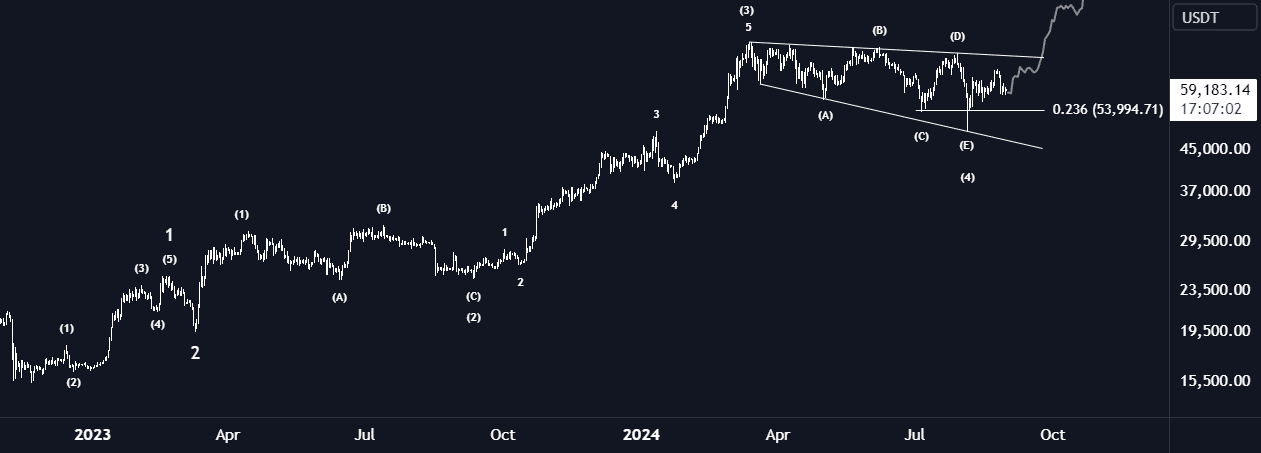

Proper now, Bitcoin’s worth motion within the BTC/USDT pair is advancing inside a broadening wedge sample. That is sometimes a consolidation part, signaling the calm earlier than a possible market transfer.

This sample is sitting at a essential assist stage, with accumulation persevering with as merchants stay skeptical about Bitcoin’s potential for an upward projection.

Now, there may be potential for Bitcoin to slide to the $53k worth stage earlier than a doable upturn, doubtless in This autumn 2024. The worth stalling round $59k provides to the uncertainty surrounding this essential interval.

Additional evaluation of funding charges from Coinglass revealed little change over the previous month. This, regardless of the large market flush on 5 August triggered by Japan’s inventory market crash because of charge hikes.

Since then, whereas funding charges have stabilized, they’ve remained comparatively low. This helps the concept that Bitcoin is in an accumulation part.

BTC RSI breakout pointed to a rebound

Furthermore, Bitcoin’s Relative Power Index (RSI) just lately recorded its second vital breakout throughout this bull cycle, which could possibly be setting the stage for an additional rally.

If Bitcoin [BTC] dips additional under the $53k stage, it would set off panic promoting, probably resulting in a rebound.

The RSI breakout, just like a earlier occasion that led to a significant bullish rally, steered that BTC could be gearing up for an additional northbound surge.

Historical past of final quarter’s post-halving

Traditionally, the final quarter of the yr following a Bitcoin [BTC] halving has been bullish. This pattern may proceed in 2024.

Regardless of a irritating and stagnant summer time market, Bitcoin traders and merchants ought to stay affected person, because the market has a historical past of rewarding those that maintain on throughout such intervals.

This could possibly be an opportune time to build up extra BTC, anticipating a possible rally within the ultimate quarter of the yr.