- There have been vital fluctuations in Bitcoin’s long-term holders’ earnings.

- BTC has remained on the $57,000 value degree.

Lengthy-term holders of Bitcoin [BTC] are presently in a difficult place with their holdings. Nevertheless, this pattern may current a major accumulation alternative for different buyers.

Bitcoin SOPR hit low factors

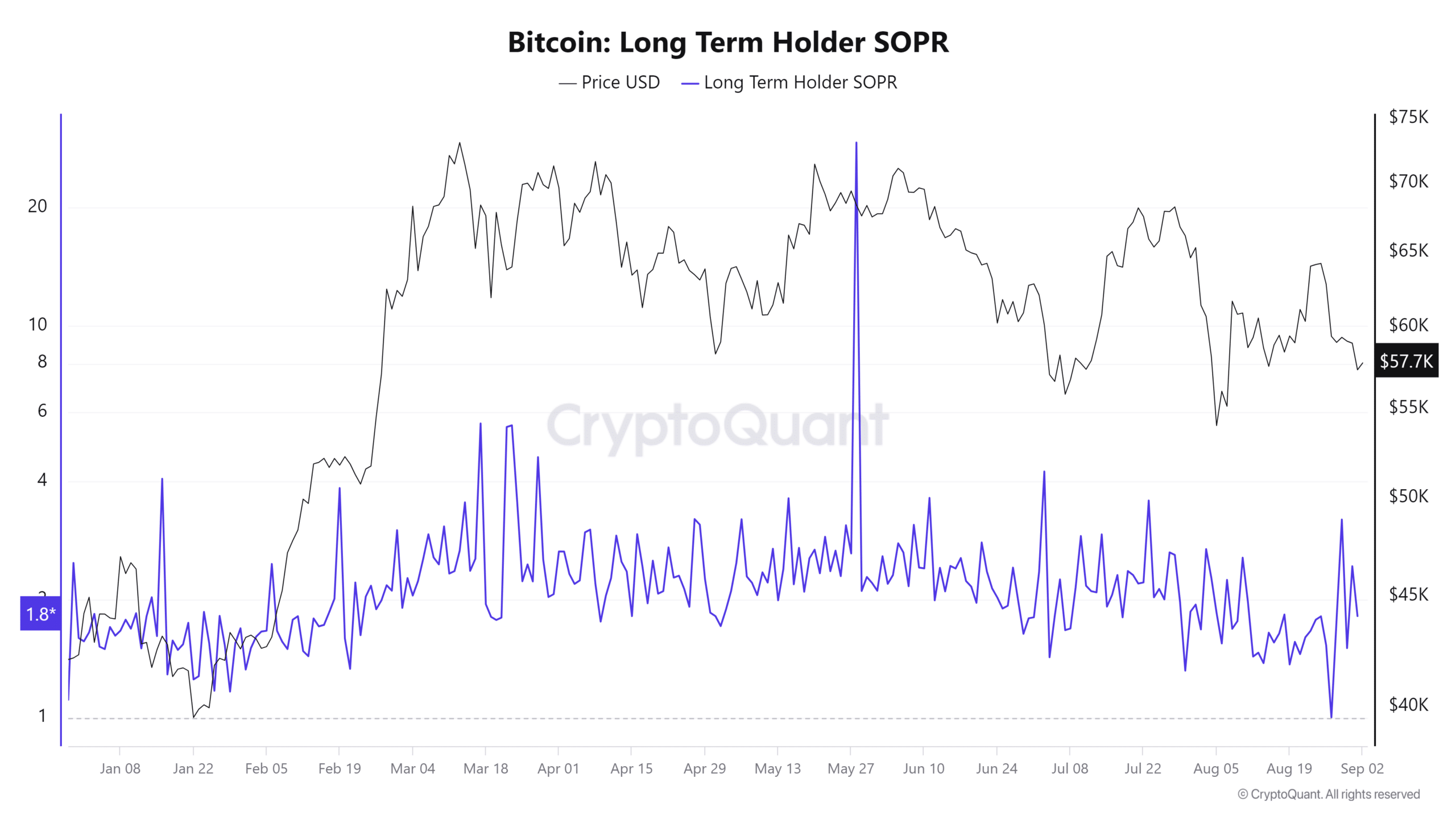

AMBCrypto’s evaluation of the Lengthy-Time period Holder (LTH) Spent Output Revenue Ratio (SOPR) on CryptoQuant revealed that Bitcoin was priced at round $57.7K at press time. Additionally, the LTH SOPR confirmed comparatively low values.

The low LTH SOPR is important as a result of it signifies that these holders should not realizing substantial earnings from their gross sales.

As an alternative, they is likely to be liquidating their positions attributable to considerations about future value declines or in response to market uncertainty.

If this pattern continues and extra long-term holders determine to promote, it may contribute to additional downward strain on Bitcoin’s value.

The SOPR (Spent Output Revenue Ratio) is essential for understanding the profitability of Bitcoin gross sales. Particularly, the LTH SOPR focuses on cash held for an prolonged interval, usually greater than 155 days.

A SOPR worth above one signifies that long-term holders are promoting at a revenue. In distinction, a worth under one suggests promoting at a loss.

The low SOPR worth for long-term holders highlights that these individuals should not capitalizing on vital positive factors and could also be promoting attributable to considerations in regards to the market’s near-term prospects.

This might be a bearish sign, suggesting that these holders are actually unsure about its speedy value path.

What this implies for Bitcoin

The low LTH SOPR signifies that long-term Bitcoin holders should not realizing vital earnings and could also be decreasing their positions.

If this pattern persists, the LTH SOPR hovering round or under one may result in continued downward strain on Bitcoin’s value. This might sign a interval of additional declines because the market processes these gross sales.

Nevertheless, such a situation additionally presents a possible accumulation alternative for these seeking to enter the market at decrease costs.

Traditionally, intervals the place the SOPR stays low have typically been adopted by market recoveries. Buyers reap the benefits of the decreased costs to build up extra Bitcoin.

A current instance of such a accumulation is noticed within the actions of a whale handle.

Knowledge from Spot on Chain exhibits that this whale bought 1,000 BTC, price roughly $57 million when Bitcoin’s value hit backside.

Additionally, the identical whale reportedly deposited 7,790 BTC, valued at $467 million, when the value dropped by roughly 14% some months again.

The present state of BTC

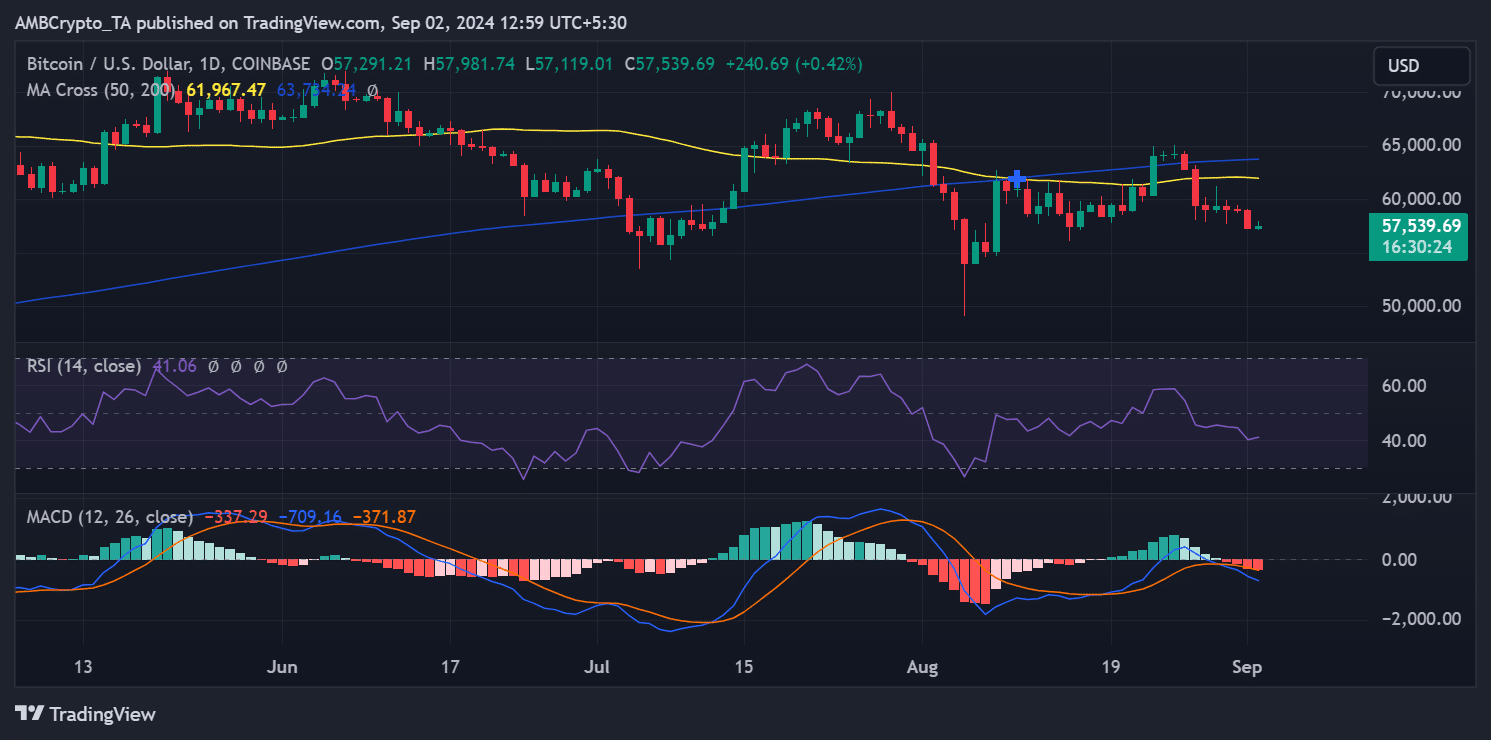

AMBCrypto’s take a look at Bitcoin’s value pattern indicated that the king coin skilled an almost 3% decline within the final buying and selling session.

Learn Bitcoin’s [BTC] Price prediction 2024-25

The worth dropped from a excessive of round $59,000 in the course of the session to roughly $57,299. As of this writing, Bitcoin was buying and selling at round $57,500, reflecting a modest improve of lower than 1%.

The chart evaluation, notably the place of the shifting averages, confirmed that Bitcoin was in a bearish pattern.