- Hong Kong-based Metalpha offloaded over 33,589 ETH value $77.55 million to Binance prior to now 4 days.

- Based mostly on the historic value momentum, there’s a excessive risk that ETH might soar by 23% to the $2,700 degree.

Regardless of the continuing market restoration, it seems that Ethereum [ETH] is poised for a major value decline. At present, each traders and establishments are bearish as they proceed to dump ETH on exchanges.

Institutional promoting spree

On the tenth of September, on-chain analytic agency Lookonchain famous on X (previously Twitter) that Metalpha, a Hong Kong asset administration large, had dumped 10,000 Ether value $23.45 million to Binance [BNB].

The agency offloaded over 33,589 ETH value $77.55 million to Binance prior to now 4 days.

However regardless of the notable dump, the asset supervisor nonetheless held a major 51,300 ETH, value $120 million, at press time.

Are whales transferring away from ETH?

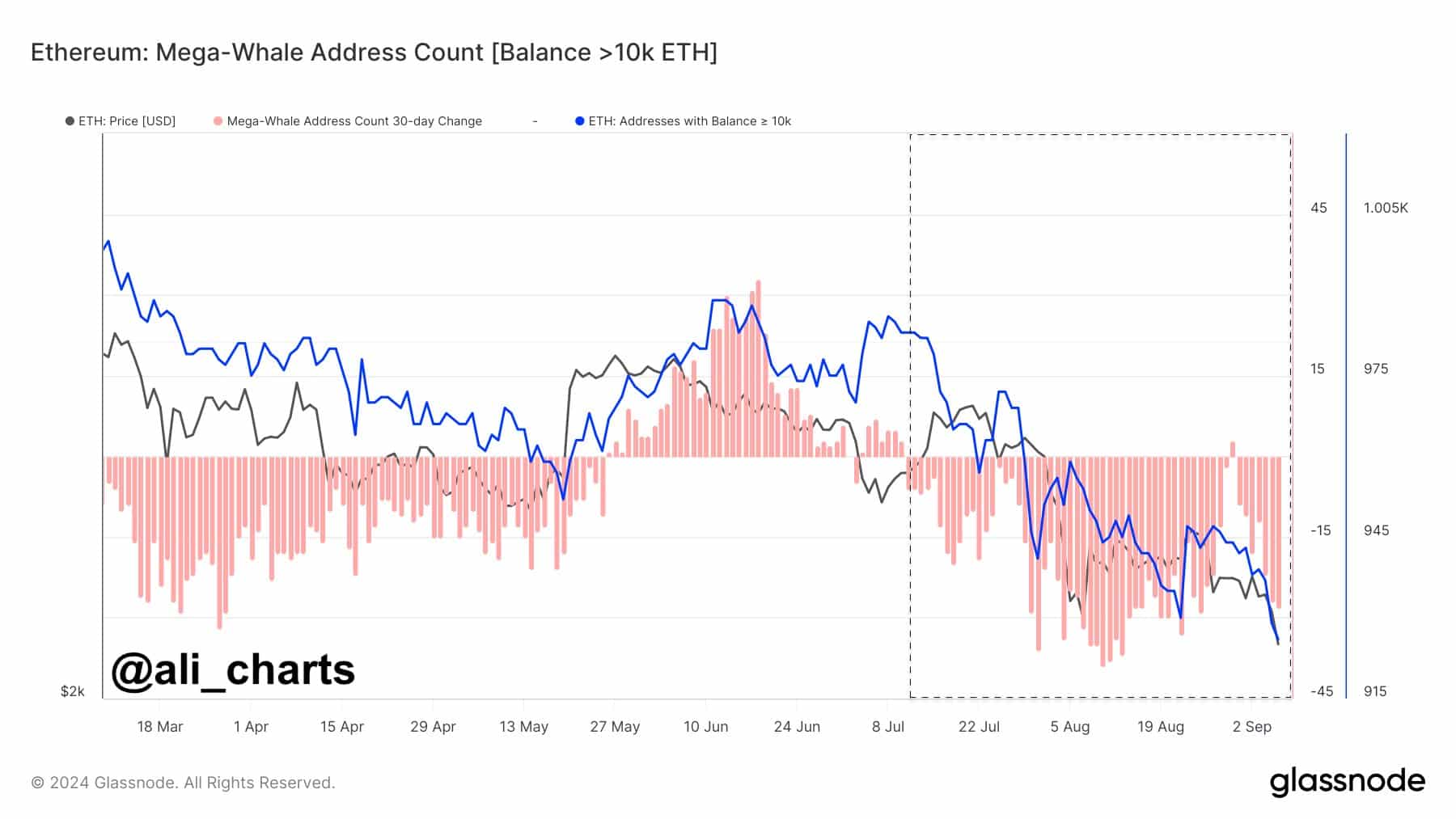

Not too long ago, a outstanding crypto skilled made a put up on X, stating that Ethereum whales have stopped accumulating ETH since early July. As a substitute, they’ve both been promoting or redistributing their ETH holdings.

This means a scarcity of curiosity from traders and whales prior to now few weeks.

Nevertheless, if whales and establishments proceed with vital ETH dumps, there’s a excessive risk that it might set off a large sell-off within the coming days.

Key ranges to observe for

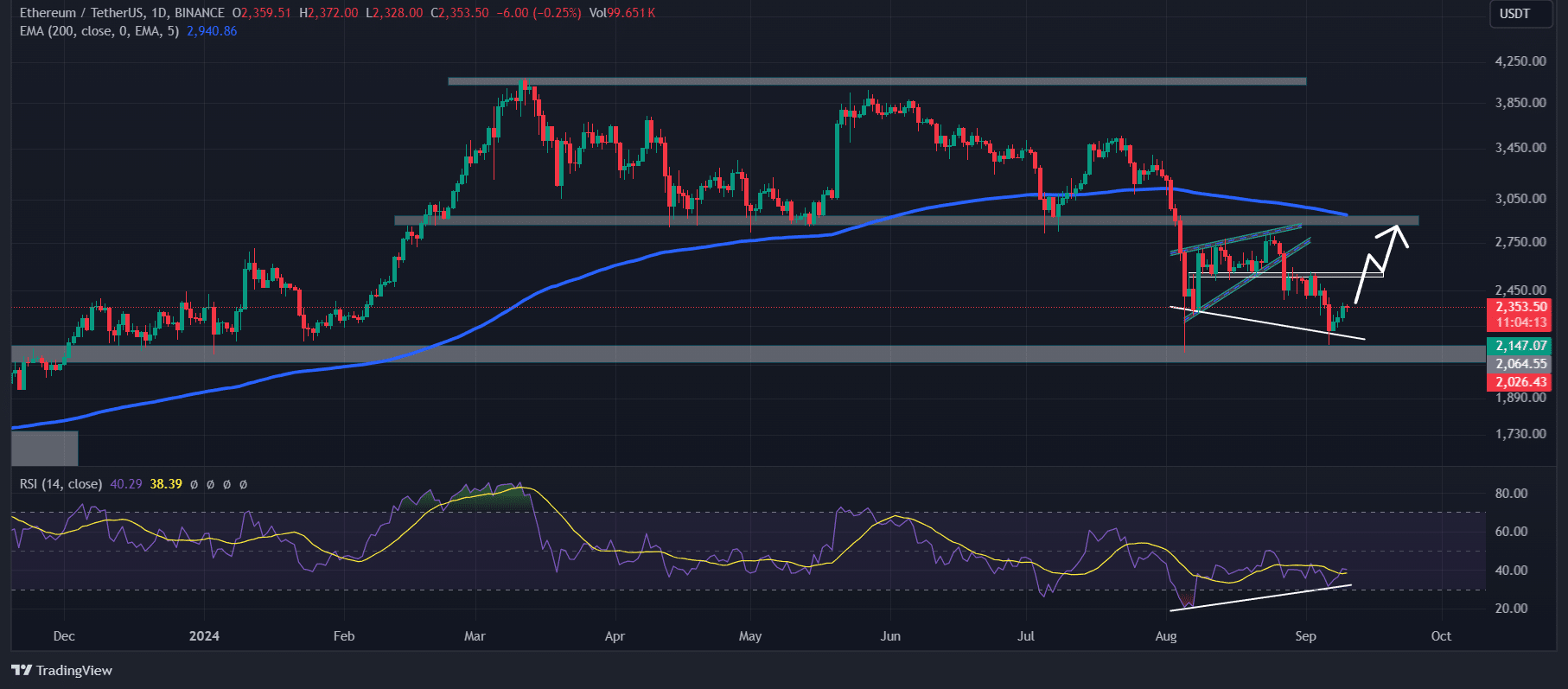

AMBCrypto’s have a look at Ethereum confirmed encouraging indicators.

Notably, the king of altcoins might expertise an upside rally as a result of present bullish divergence on its Relative Power Index (RSI). Moreover, it has discovered help on the essential $2,150 degree.

Based mostly on the historic value momenta, each time ETH’s value reaches this help degree, it all the time tends to expertise a large value surge of over 23%. This time, there’s a comparable expectation is that ETH might soar to $2,700.

Nevertheless, this bullish outlook thesis will solely work till ETH maintains itself above the essential help degree of $2,150 degree.

Bullish on-chain knowledge

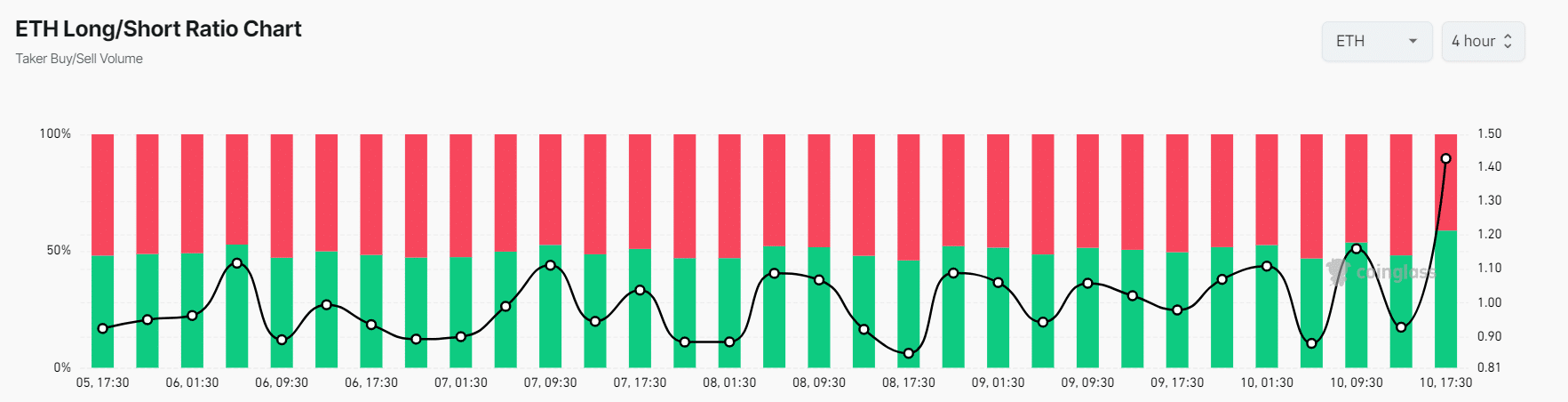

On-chain knowledge additionally supported the bullish outlook. Coinglass’s ETH Lengthy/Brief Ratio Chart stood at +1.424 at press time, the very best degree prior to now week, indicating merchants’ bullish sentiment.

Moreover, ETH’s Futures Open Curiosity elevated by 2.5%, indicating that merchants are probably betting extra on lengthy positions.

A optimistic Lengthy/Brief Ratio and elevated Open Curiosity indicators potential shopping for alternatives. At press time, 58.75% of high ETH merchants held lengthy positions, whereas 41.25% held quick positions.

This steered that bulls have been dominating the asset, and have the potential to liquidate quick positions.

Learn Ethereum’s [ETH] Price Prediction 2024–2025

At press time, ETH was buying and selling close to the $2,350 degree, having skilled a value surge of over 2.35% within the final 24 hours.

Its buying and selling quantity elevated by a modest 14% throughout the identical interval, suggesting increased participation from merchants amid the market restoration.