- ETH has declined by 7.95% during the last 30 days.

- Regardless of the unfavorable market circumstances an analyst is eyeing 48% surge to $3,550.

Whereas the crypto market has tried to get better with Bitcoin [BTC] surpassing $60k ranges, Ethereum [ETH] has remained behind. ETH, the second largest cryptocurrency by market cap, has skilled a powerful downtrend.

Actually as of this writing, Ethereum was buying and selling at $2,410. This marked a 7.95% decline on month-to-month charts.

Since hitting a neighborhood excessive of $2,820, the altcoin has failed to keep up an upward momentum declining to a low of $2150.

Previous to this market situation, ETH was having fun with favorability after hitting $3,563 in July amidst an elevated ETFs frenzy. Since then, the market has been in a downward spiral inflicting fears of extra losses.

Though the market circumstances stay unfavorable, analysts proceed to point out optimism. Inasmuch, widespread crypto analysts CryptoWZRD has steered an upcoming rally citing Bitcoin’s breakout.

What market sentiment says

In his evaluation, CryptoWZRD cited the present BTC market situation. In line with this evaluation, if BTC rallies, ETH will expertise a 48% to $3,550.

Primarily based on this analogy, Ethereum’s rally is tied to BTC. Thus, if Bitcoin manages to surge, the altcoin will get better and return to July ranges.

In context, Bitcoin’s efficiency tends to have an effect on altcoin markets. When BTC is performing, altcoins additionally carry out. Consequently, a BTC downturn leads to altcoins together with, ETH declining.

Due to this fact, when BTC has favorable market circumstances, Ethereum will observe.

What ETH charts recommend

Whereas CryptoWZRD evaluation supplies a constructive outlook, different indicators inform a unique story. Thus the present market circumstances may place ETH for additional decline.

For instance, Ethereum’s alternate netflow has remained largely constructive over the previous month. A constructive alternate netflow signifies that ETH is flowing into exchanges moderately than withdrawals.

It is a bearish market sentiment as traders are depositing into exchanges to promote as they anticipate additional value decline. A constructive netflow suggests promoting stress within the close to future which leads to a value decline.

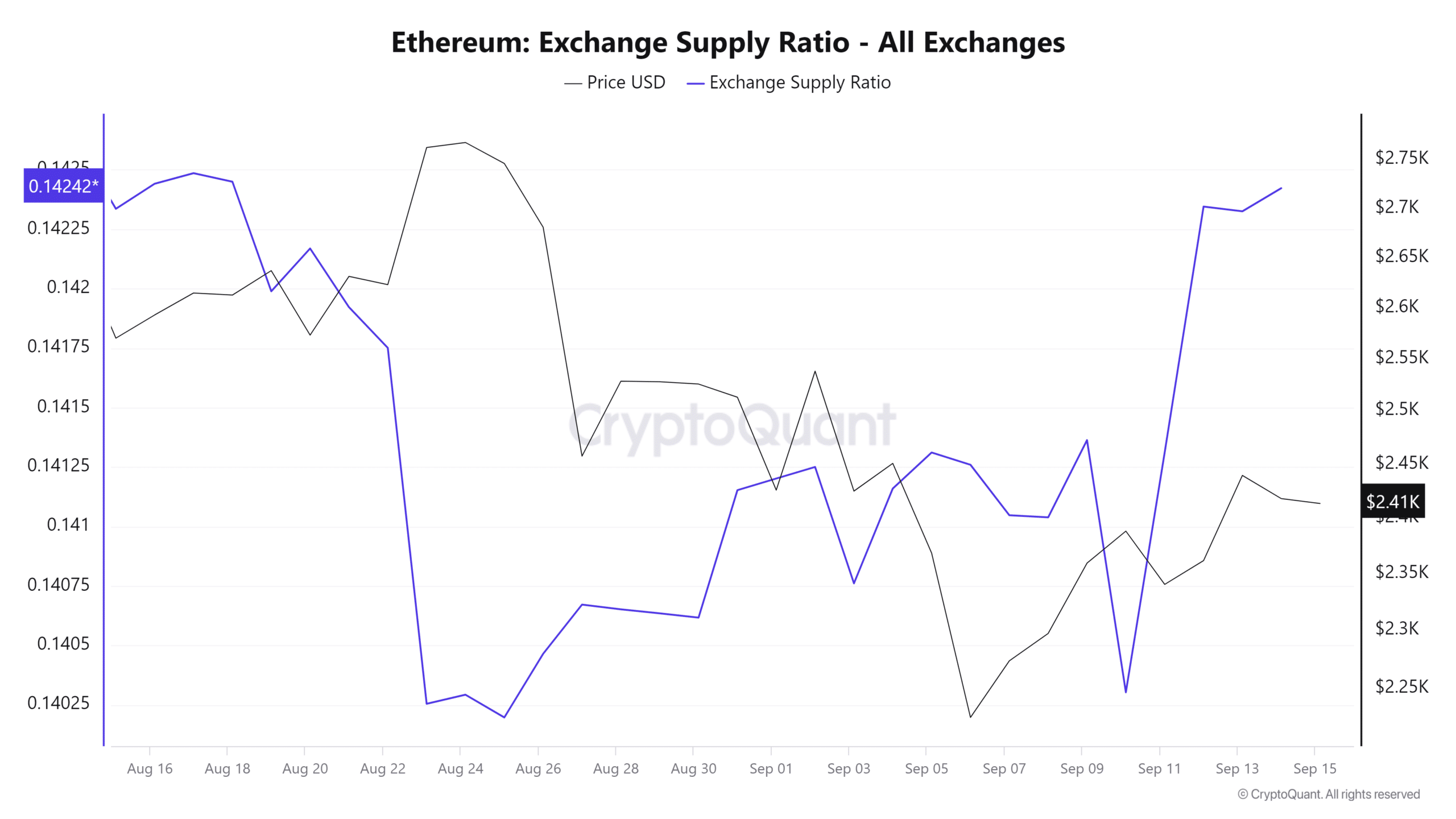

Moreover, the alternate provide ratio has spiked for the final 5 days. This additional reveals elevated influx into exchanges, suggesting bearish market sentiment as traders are getting ready to promote.

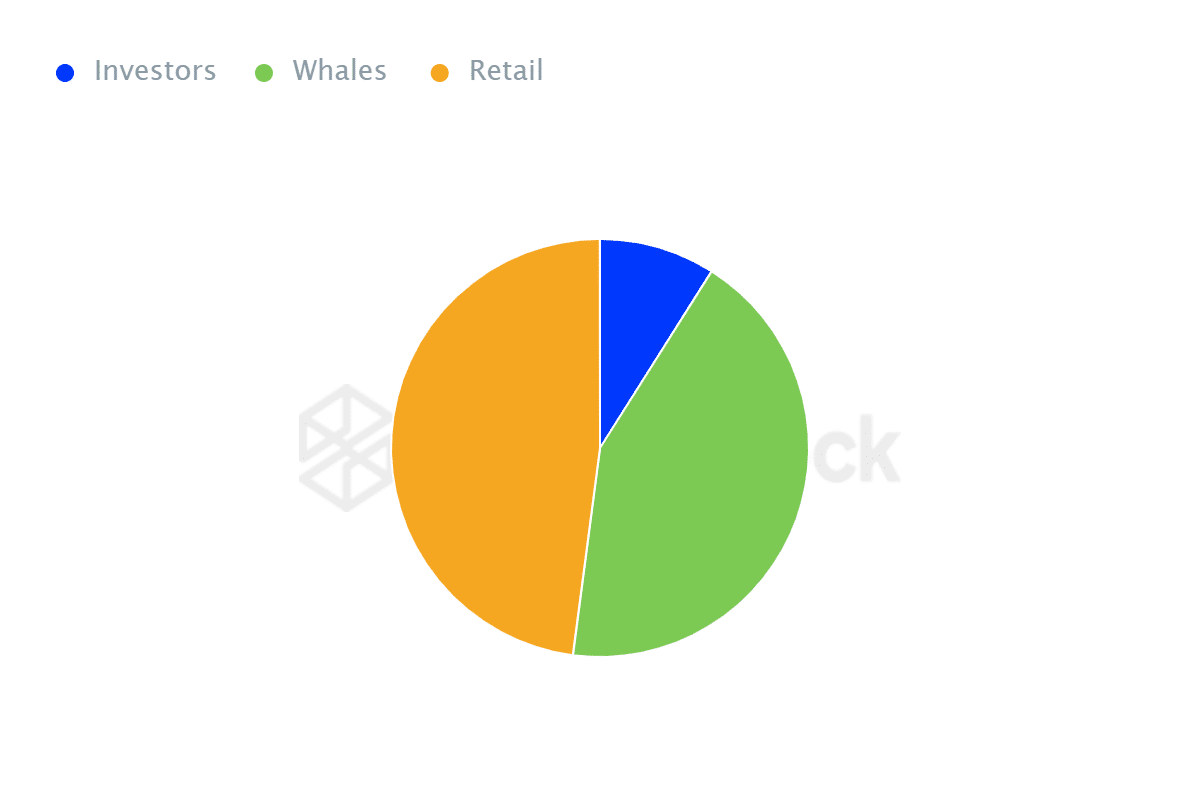

Lastly, Ethereum’s possession by focus reveals retail merchants maintain extra ETH than whales and traders. In line with IntoTheBlock, retail merchants maintain 47.93% whereas whales maintain 43.10%.

When retail merchants maintain greater than whales, markets expertise excessive volatility. Small merchants are emotional sellers and would promote primarily based on information in comparison with institutional traders or whales.

Learn Ethereum (ETH) Price Prediction 2024-25

Whales will maintain even throughout downturns and accumulate anticipating additional positive factors. Whereas retail merchants would promote to keep away from extra losses.

Due to this fact, primarily based on prevailing market circumstances, ETH is experiencing bearish market sentiment. If the present circumstances maintain, ETH will decline to $2224. Nonetheless, if it breaks out, from this development, it can rise to $2527.