- After a brief journey above $64k, BTC as soon as once more fell underneath that stage.

- Just a few market indicators prompt that BTC was overbought.

After crossing $64k on the twenty third of September, Bitcoin [BTC] has as soon as once more fallen underneath that mark. Within the meantime, an analyst revealed that purchasing stress on the coin has elevated. Will this improvement have any main impression on BTC’s worth motion?

Persons are once more shopping for Bitcoin

After a number of wait, BTC lastly managed to cross the $64k barrier for a brief period. Although it fell underneath that mark once more, the most recent evaluation prompt that purchasing stress was excessive.

Ali, a preferred crypto analyst, just lately posted a tweet revealing that buyers had been accumulating. This evaluation was primarily based on the wicks on BTC’s month-to-month worth chart.

In truth, AMBCrypto’s evaluation of CryptoQuant’s data additionally discovered the same development. In keeping with our evaluation, Bitcoin’s internet deposit on exchanges was decrease in comparison with the final seven days’s common. This clearly signaled that purchasing stress on the king coin has elevated.

The miners had been additionally keen to carry their cash because the BTC’s Miners’ Place Index (MPI) was inexperienced. Moreover, the Coinbase premium prompt that purchasing sentiment was sturdy amongst US buyers. Usually, an increase in shopping for stress ends in a worth hike.

Will BTC’s worth rise once more?

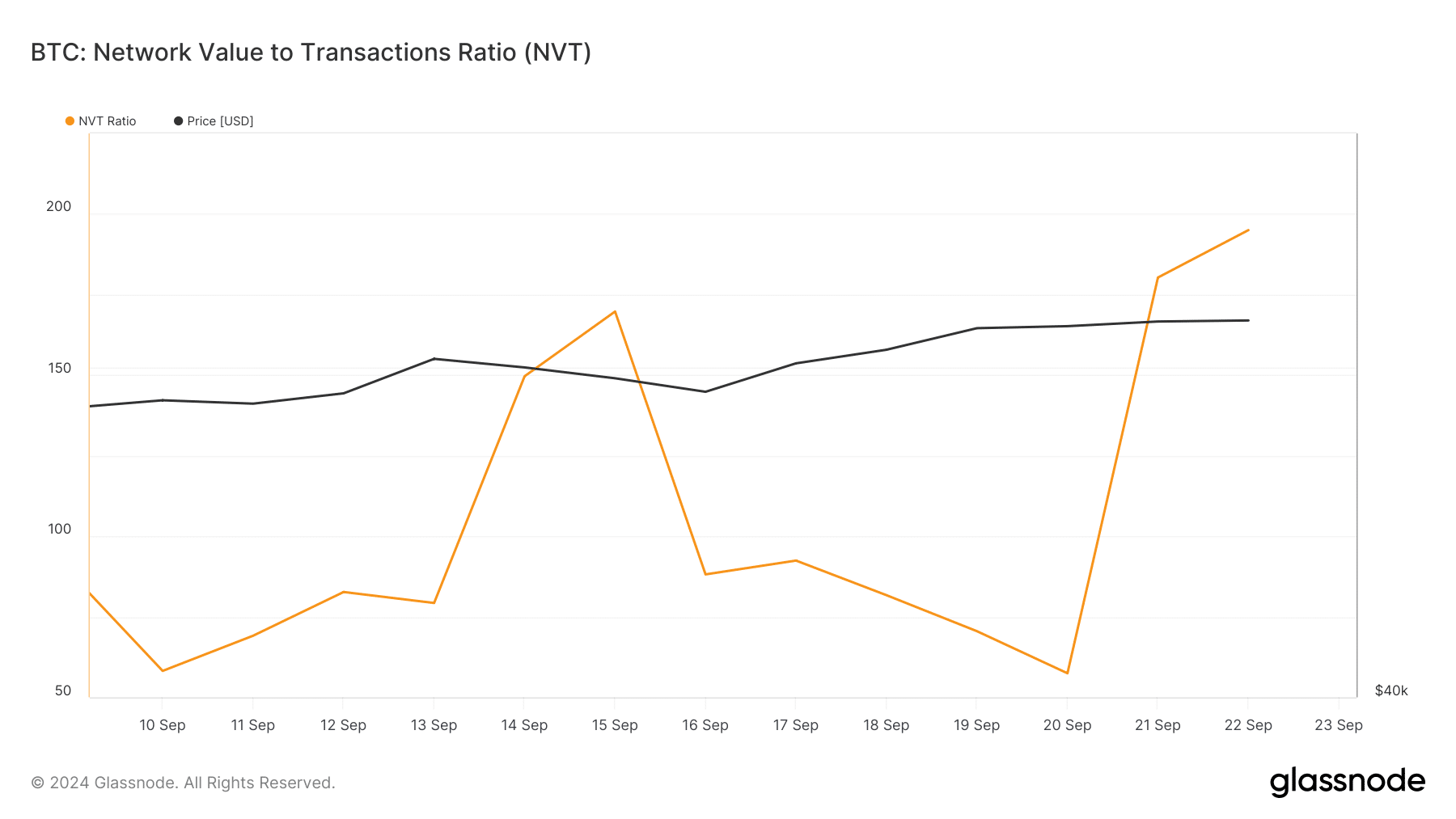

Although shopping for stress on the coin was excessive, a number of of the metrics prompt a worth correction. As an example, our have a look at Glassnode’s knowledge revealed that BTC’s NVT ratio elevated sharply.

An increase within the metric implies that an asset is overvalued, which hints at a worth correction.

Aside from that, AMBCrypto discovered that Bitcoin’s Relative Energy Index (RSI) was in an overbought zone. The stochastic was additionally in the identical zone, additional growing the probabilities of a worth correction within the coming days.

Nonetheless, on the time of writing, Bitcoin’s fear and greed index was within the “worry” zone. Often, when the metric hits this stage, it signifies a worth rise. Subsequently, AMBCrypto selected to verify BTC’s day by day chart to raised perceive what to anticipate from the king coin.

As per our evaluation, BTC was as soon as once more approaching an important resistance at $64.1k. The excellent news was that the MACD displayed a bullish benefit out there. BTC’s Chaikin Cash Movement (CMF) additionally was bullish because it moved northwards.

Learn Bitcoin (BTC) Price Prediction 2024-25

These indicated that the probabilities of a profitable break above the resistance had been doubtless. If that occurs, then BTC may quickly goal $68k.

Nonetheless, within the occasion of a bearish development reversal, buyers may witness BTC dropping to $57k once more.