- A whale strategically offered 15K ETH into an trade, responding to present market dynamics.

- Nonetheless, a reversal may very well be on the horizon for ETH.

Ethereum [ETH] surged over 14% this previous week, priced at $2,641, with the following goal at $2,769. In the meantime, Bitcoin bulls have been working to keep up a place above $62K.

Sometimes, when BTC faces strain at essential resistance, it will probably point out growing curiosity in altcoins.

Nonetheless, current exercise from a “diamond hand” ETH whale, who transferred 15K ETH to a significant trade, has sparked concern amongst buyers.

Worry has reached ETH whales

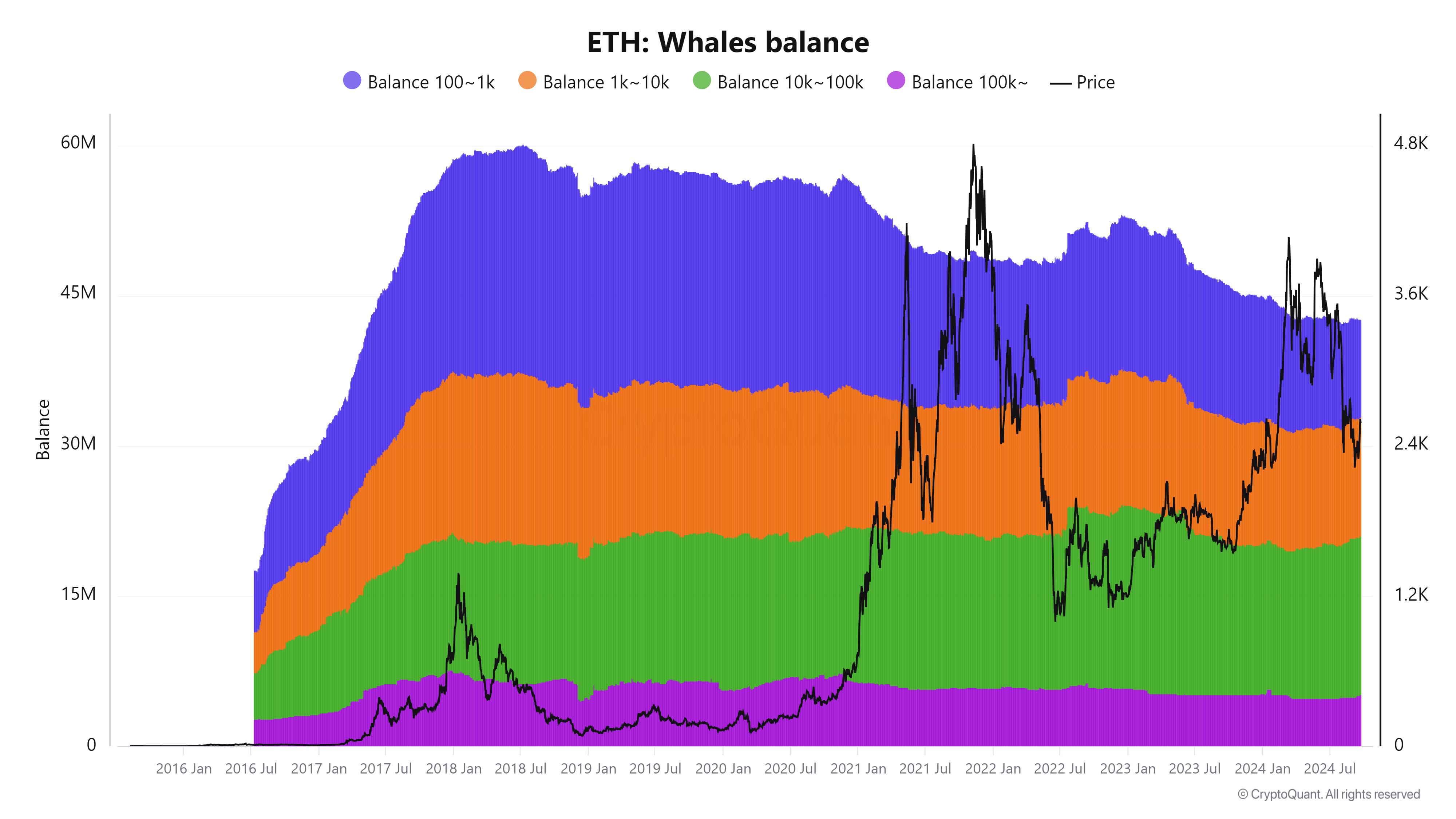

Trying on the chart under, the whale cohort holding between 100 and 1K ETH has persistently declined since peaking in early 2021, whereas the remaining have proven confidence in future beneficial properties.

Nonetheless, a current X post revealed that an nameless whale offered ETH valued at $38.4 million from their pockets into Kraken.

Apparently, this whale was thought-about a “diamond hand” – a time period that describes buyers who HODL their cash for prolonged intervals with out plans to promote.

Understandably, their sell-off might instill worry amongst stakeholders. If this development continues, promoting strain on the alt might push it under $2,600.

Sometimes, on this scenario, most buyers try to retreat to breakeven – a method this whale appears to have adopted as nicely.

Understanding THIS technique would possibly fight strain

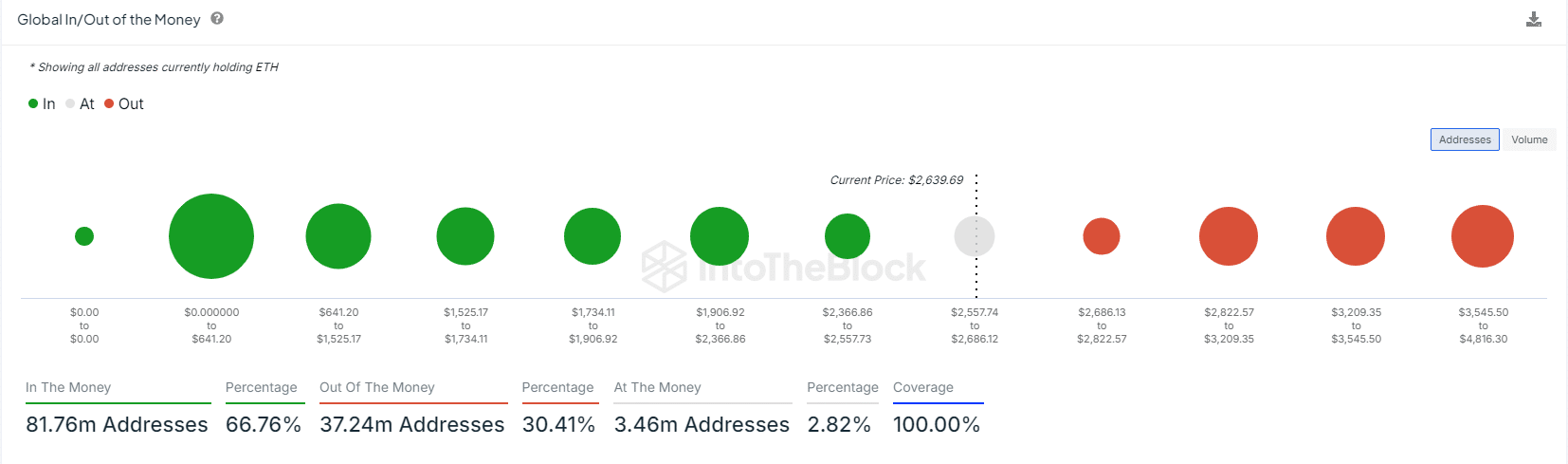

At present, ETH bulls are tasked with defending the $2.6K help in opposition to the promoting strain. As famous earlier, a bearish pullback might ensue if this stage is retested.

In such a situation, roughly 4 million addresses holding $8 million value of ETH would shift right into a loss place.

On the day by day value chart, the alt final peaked at $2,700 on the twenty third of September. This stage has change into contentious, having been examined in mid-August earlier than bears pushed ETH under $2.2K.

Earlier than the same development might emerge, coinciding with BTC consolidating under $64K, the whale closed its place to breakeven.

If extra whales comply with go well with, extra stakeholders might slip into loss positions, doubtlessly triggering a bearish cycle that might forestall bulls from surpassing the $2,700 ceiling.

The bulls are regaining management

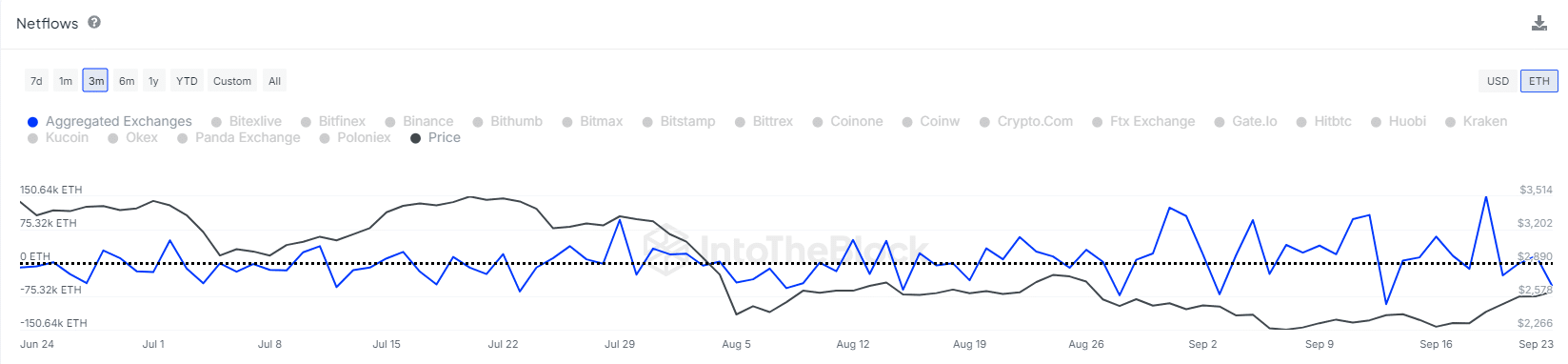

Whereas the whale technique has as soon as once more thwarted a direct breakout alternative, buyers are positioning themselves for a bullish reversal, as illustrated within the chart under.

Learn Ethereum’s [ETH] Price Prediction 2024-25

A surge in internet outflows factors to a possible correction, indicating that buyers are actively making an attempt to soak up promoting strain by accumulating ETH.

If this development holds, a push above $2.7K may very well be imminent, although vigilance concerning whale exercise stays essential. Conversely, if this uptick proves to be a brief blip, a retracement to $2.2K might change into more and more probably.