- Altcoin season appears nearer than most suppose amid sturdy market shifts.

- Savvy merchants are reportedly shifting focus to altcoins from BTC.

Bitcoin [BTC] made a outstanding restoration in September, rallying from $52.5K to $65K.

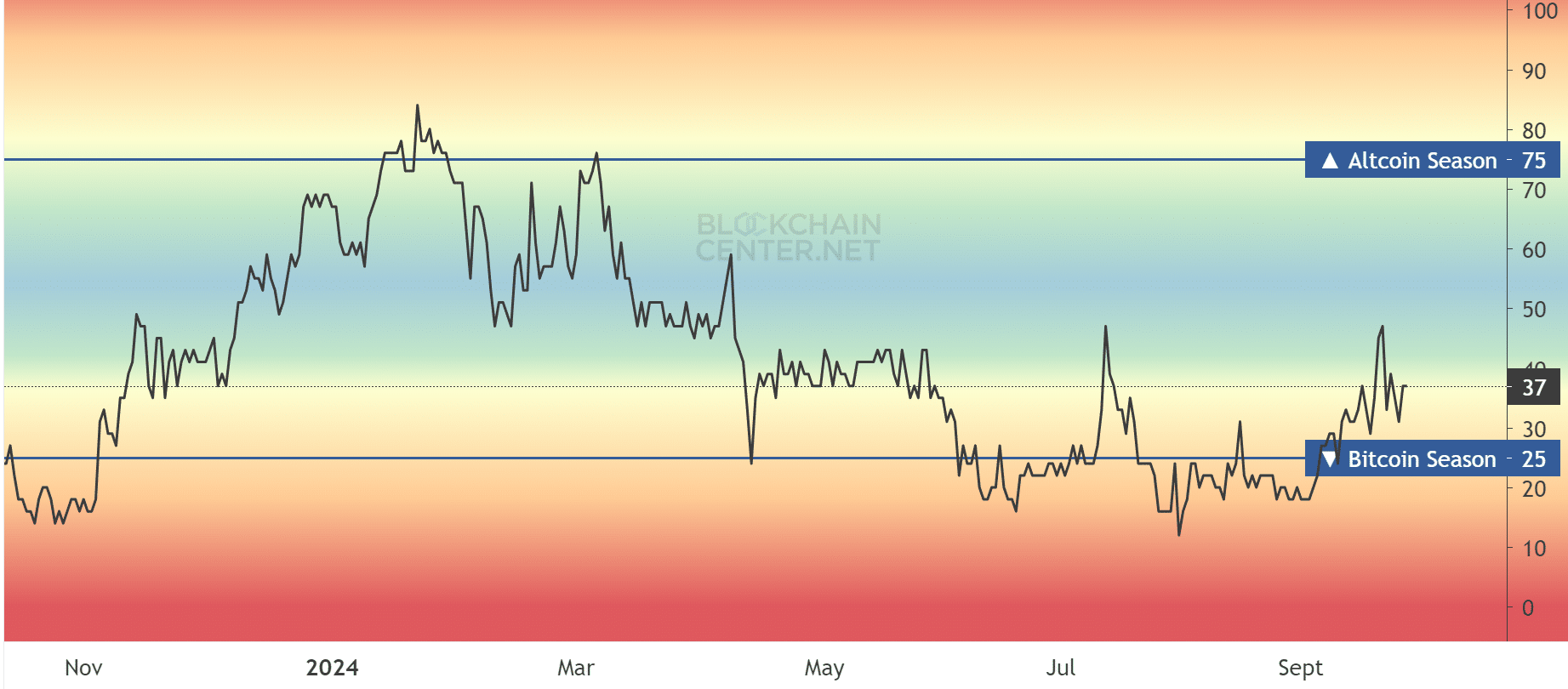

The restoration additionally boosted altcoins, because the Altcoin Season Index climbed to July ranges. Choose altcoins noticed large positive factors in the course of the rally, particularly amongst AI and memecoin segments.

Nevertheless, the Alt season was not but in full swing, as proven by the Altcoin Season Index studying of 37.

Altseason setting stage?

Nevertheless, key alerts indicated a optimistic outlook for a wild altcoin season. For instance, Bitcoin dominance (BTC.D), which has elevated in 2024, confronted essential resistance across the 58% degree.

A drop in BTC.D worth may sign a breather for altcoins to choose up higher momentum.

One other optimistic outlook was from the altcoin’s market cap, excluding BTC and ETH. In line with Henrik Zeberg, Head Macro Economist at Swissblock, the Altcoin sector was primed to blow up to a $3 trillion market cap.

“Bull flag and momentum indicators inform us, that Altcoins market may very well be heading for ~$3 trillion in market capitalization”

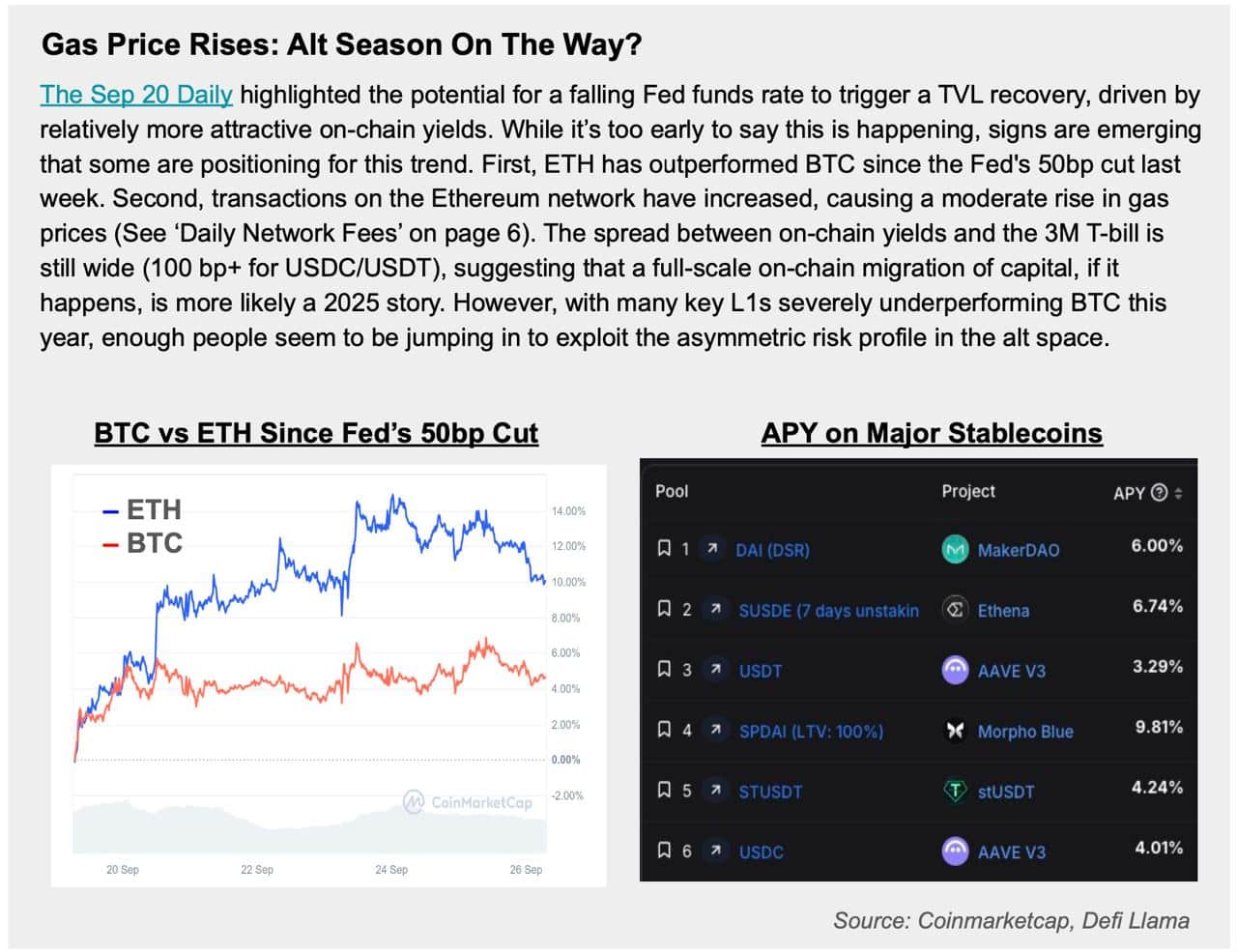

Presto Analysis additionally noted a possible shift, citing a surge in ETH fuel costs that might sign rising positioning to seize a possible windfall from an altcoin rally.

The analysis agency added that ETH has outperformed BTC because the Fed pivot.

The crypto analysis agency added that some speculators may be positioned to capitalize on the large uneven danger profile since most altcoins had been at yearly lows after current headwinds.

ETHBTC ratio recovered almost 10% and hiked from a low of 0.038 to 0.042 after the Fed price cuts. Nevertheless, it has since retraced barely on the time of writing.

This meant that ETH’s worth gained floor relative to BTC. Because it’s additionally a barometer of the altcoin market’s well being, it advised that altcoins noticed an enormous reduction rally.

10X Analysis’s Mark Thielsen additionally shared an identical trajectory for altcoins. He famous a major shift by savvy Korean and general merchants from BTC to altcoins.

“As Bitcoin soared above $60,000 and set its sights on breaking by way of $65,000, savvy merchants have been accruing undervalued altcoins, an inventory consisting of TAO, ENA, SEI, APT, SUI, NEAR, and GRT.”