- Crypto speculators stay cautious of profit-taking and value correction considerations

- There haven’t been consecutive ETH/BTC inexperienced weekly candles since April 2024

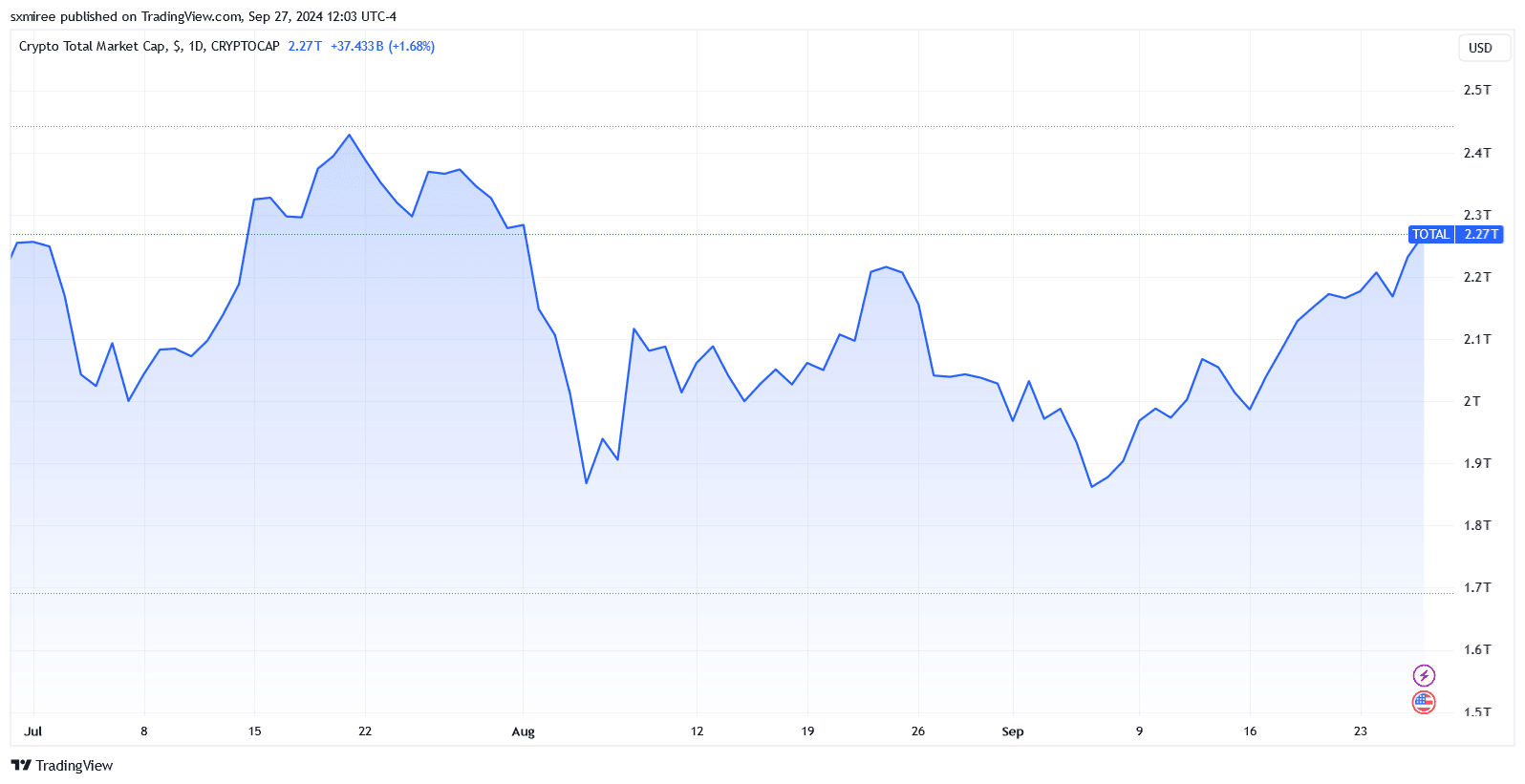

Most cryptocurrencies had been buying and selling within the inexperienced on Friday after making first rate advances between Wednesday and Thursday. Actually, the market-wide positive factors reversed an early midweek dip, one which ensued after a sluggish begin to the week.

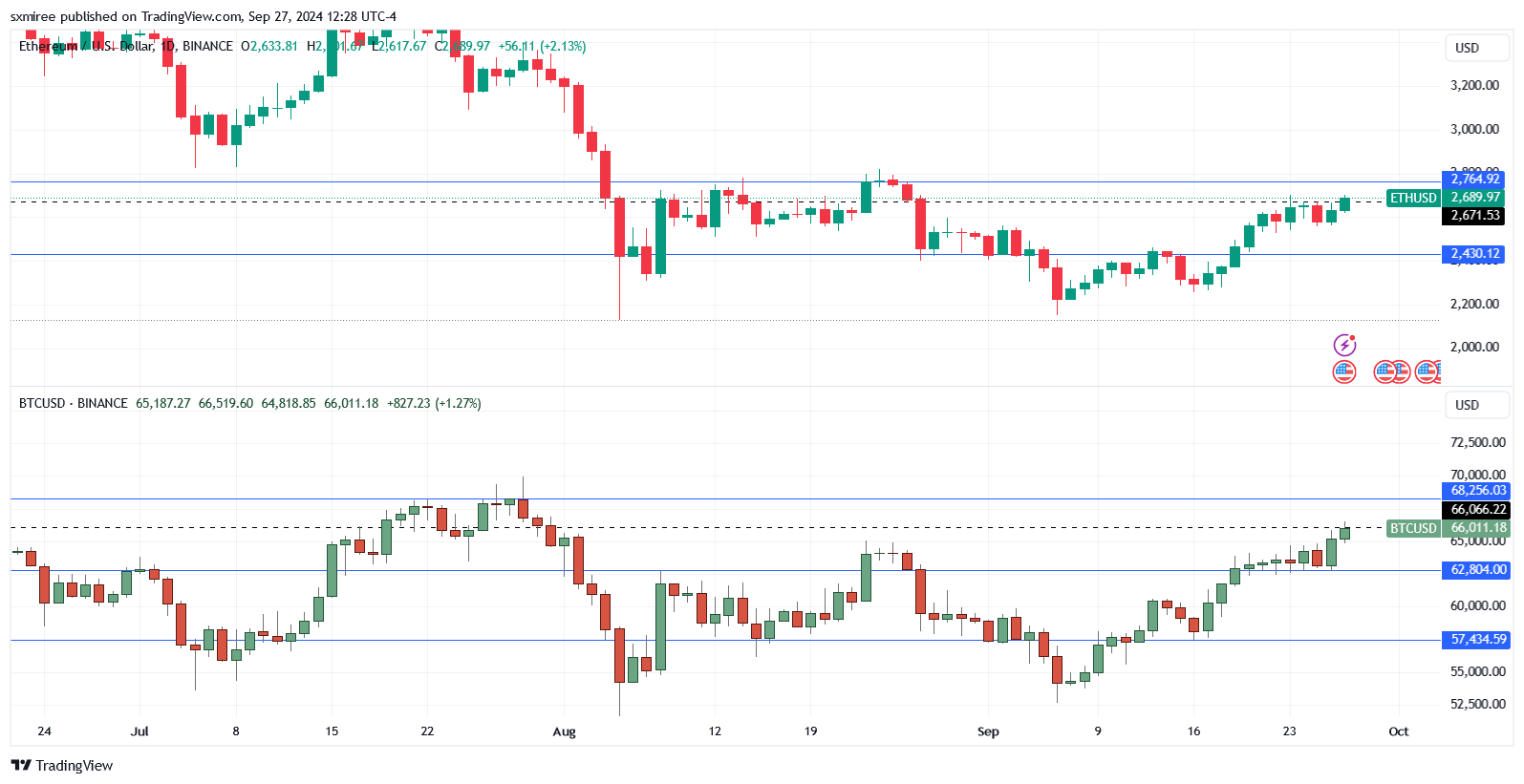

Ethereum (ETH), which has seen renewed its power in current weeks, was buying and selling at $2,689 at press time, with bulls concentrating on an in depth above $2,770 for the primary time since August 24.

Right here, it’s value declaring that ETH has been pushing previous Bitcoin within the second half of the month, racking up positive factors of 16.34% since 15 September.

That’s not all although. Coinglass data revealed that ETH’s value moved up 11.26% final week, whereas BTC registered a 7.38% uptick. Whereas each cryptocurrencies have slowed this week, they continue to be on track for third consecutive weekly positive factors.

Bitcoin bulls goal double-digit month-to-month positive factors

Overlooking its not too long ago rejuvenated motion although, Ethereum has fallen by 20.75% during the last three months. This decline is very pronounced given the expectations of a rally after the 23 July launch of a U.S spot Ethereum exchange-traded fund (ETF). The institution-focused providing has didn’t reside as much as the hype, posting blended outcomes to this point.

With three extra days to go, Bitcoin leads the flagship altcoin in month-to-month returns. Actually, BTC value’s trajectory has put it on observe to lock in double-digit month-to-month income if it maintains a value above $65K. Quite the opposite, Ether is positioned for a 5.70% positive factors throughout September at its press time value.

BTC and ETH value targets forward of This fall

Heading into the weekend, speculators have their eyes on month-to-month closes for the respective cryptocurrencies. At press time, Bitcoin was buying and selling in no-man’s land close to $66,000, with assist established round $62,800. In the meantime, Ethereum was holding regular above $2,600.

Analysts have set a short-term value goal within the $68k to $70k vary for BTC and within the $2,760 to $2,820 vary for ETH. Nonetheless, a potential pullback, particularly if the momentum wanes, requires warning on lengthy positions. Momentum exhaustion would pave the way in which for bears to grab the weekend and drag costs down, as was the case in July.

Bitcoin retracement targets to the draw back embody a return under $62,000, with a chance of a stoop as deep as $57,400. Ether, for its half, noticed rejection at $2,770 on 24 August, pulling its value again to $2,430 three days later.

ETH value’s upside potential additionally confronted strain from higher Ether issuance, which may weigh on the spot motion. Actually, information from Ultrasound Cash revealed {that a} whole of 54,098.4 ETH has been added to the provision during the last 30 days, translating to a 0.547% annualized inflation price.