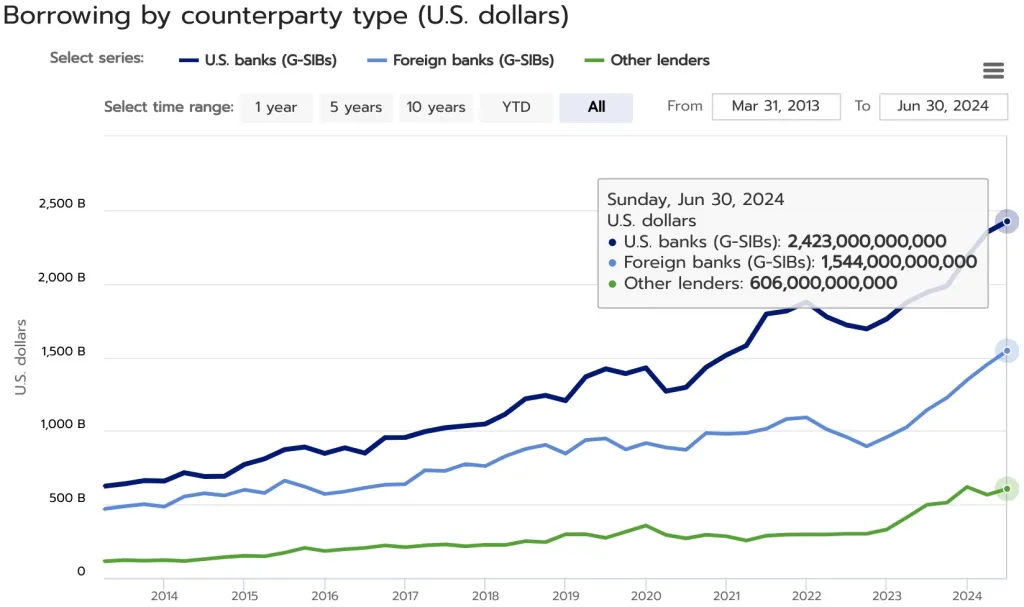

JPMorgan Chase, Wells Fargo, Financial institution of America and different systemically necessary US banks are actually financing $2.423 trillion in leveraged bets on Wall Avenue, based on new numbers self-reported by the business.

The Monetary Business Regulatory Authority (FINRA) says information up to date by means of the tip of June reveals the massive banks’ complete margin loans to hedge funds are at a document excessive, based on numbers relationship again to March of 2013.

Each US and overseas banks are fueling giant ranges of leverage in American markets, with overseas systemically necessary banks financing a further $1.544 trillion in margin debt.

Margin debt performed a serious function within the 2008 monetary disaster, as outlined in a 2014 study from the Federal Reserve Financial institution of San Francisco.

“Hedge funds could also be a very powerful transmitters of shocks throughout crises, extra necessary than industrial banks or funding banks…

Hedge funds are opaque and extremely leveraged. If extremely leveraged hedge funds are pressured to liquidate belongings at fire-sale costs, these asset courses could maintain heavy losses. This will result in additional defaults or threaten systemically necessary establishments not solely immediately as counterparties or collectors, but additionally not directly by means of asset worth changes.

One channel for this threat is the so-called loss and margin spiral. On this state of affairs, a hedge fund is pressured to liquidate belongings to lift money to satisfy margin calls. The sale of these belongings will increase the availability available on the market, which drives costs decrease, particularly when market liquidity is low. This in flip results in extra margin calls on different monetary establishments, making a downward spiral.”

Lawmakers tackled margin debt in a number of methods within the aftermath of the 2008 monetary disaster.

New laws imposed stricter leverage and capital necessities on banks whereas limiting their capacity to conduct proprietary buying and selling utilizing their very own capital.

As well as, the Dodd-Frank Act required monetary companies to make use of clearinghouses that submit collateral and act as a intermediary on each side of the transaction, a course of designed to extend transparency and mitigate the chance of 1 occasion defaulting.

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Examine Price Action

Observe us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Each day Hodl usually are not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual threat, and any losses chances are you’ll incur are your accountability. The Each day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Each day Hodl an funding advisor. Please be aware that The Each day Hodl participates in affiliate marketing online.

Generated Picture: Midjourney