The cryptocurrency market is presently experiencing a considerable decline, as each Bitcoin and Ethereum have skilled a considerable lower in energetic addresses. This pattern, which has continued all through 2024, has triggered apprehension concerning the way forward for these distinguished cryptocurrencies. The implications for market dynamics could possibly be profound as investor enthusiasm diminishes.

Associated Studying

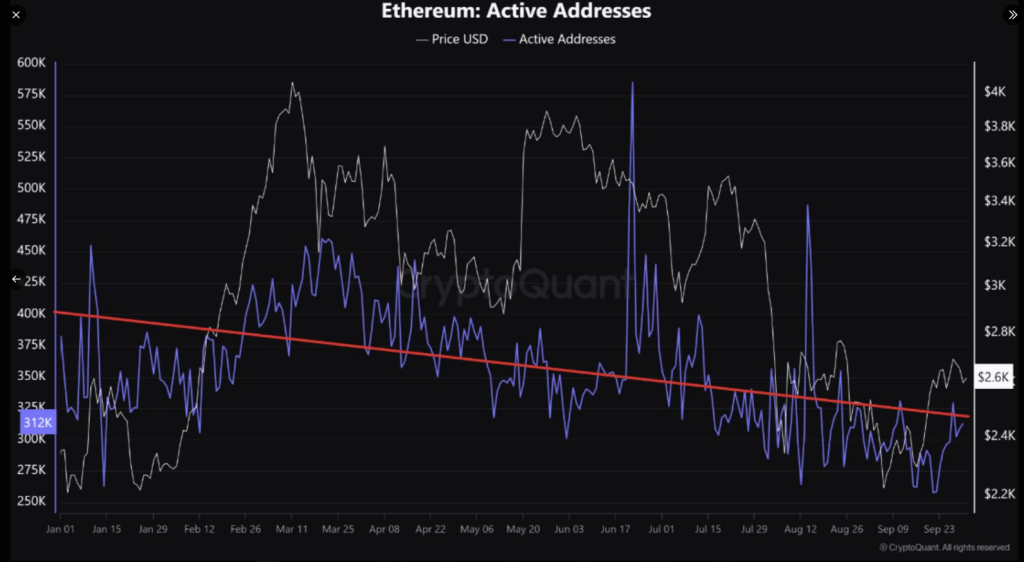

Declining Lively Addresses

In accordance with the newest stats from CryptoQuant, Bitcoin’s energetic addresses have contracted by about 1.17 million to 855,000, whereas Ethereum has lowered by about 382,000 to 312,000. This equates to a 27% drawdown for Bitcoin and an 18% decline for Ethereum year-to-date.

The absence of new investors getting into the market seems to be the first reason for this decline. That is important for sustaining favorable momentum, as current members dominate buying and selling exercise within the absence of recent capital inflows.

Since early 2024, energetic Bitcoin and Ethereum addresses have been declining

“For the bulls to dominate the market, the inflow of recent traders is a vital situation.

1. Bitcoin 1.17M -> 855K

2. Ethereum 382K -> 312K” – By @burak_kesmeciFull publish 👇https://t.co/gZftQidnxa pic.twitter.com/q5cdpv7x6t

— CryptoQuant.com (@cryptoquant_com) October 1, 2024

The anticipated pleasure surrounding the approval of spot ETFs has not translated into elevated exercise on the blockchain. Nonetheless, the present person base carries plenty of traders who would have anticipated such developments. The continued quantitative tightening of the Federal Reserve continues to strip liquidity from the market, including extra strain to the state of affairs.

Market Sentiment And Future Prospects

There are, nevertheless indications {that a} potential rebound is close to within the face of those challenges. For instance, funding charge on Ethereum has remained constructive for the previous week, which means there may be rising curiosity amongst traders in lengthy positions. This suggests that whereas plunges within the worth of Ethereum have been ongoing, a great majority of the market stays optimistic concerning its efficiency going ahead.

BTC and ETH addresses decline: BTC drops to 855K, ETH to 312K in 2024

Because the begin of 2024, the variety of energetic Bitcoin and Ethereum addresses has continued to drop. Bitcoin addresses fell from 1.17 million to 855,000, whereas Ethereum addresses declined from 382,000 to…

— CoinNess World (@CoinnessGL) October 1, 2024

It’s fairly fascinating that enormous Ethereum holders have been accumulating their belongings, reasonably than promoting them off. These giant holders lowered their outflows from 311,950 to 139,390, suggesting they’ve confidence within the long-term prospects of the altcoin. Buyers that do this sort of motion normally count on the costs to get better quickly.

Moreover, Bitcoin’s Change Stream A number of has skilled a considerable decline. This metric contrasts with short-term inflows and outflows with these over a lengthier interval, indicating that present buying and selling exercise is considerably decrease than historic averages. A low Change Stream A number of sometimes means that traders are holding their belongings in anticipation of future worth will increase reasonably than actively buying and selling them.

Associated Studying

Bitcoin & Ethereum: Broader Perspective

The broader bitcoin market is negotiating an advanced terrain molded by geopolitics issues and legislative adjustments. Latest occurrences have helped traders to be usually extra cautious. As an illustration, regardless of market volatility inflicting Ethereum to tumble to about $2,390, Bitcoin has managed to stay fixed above $61,100.

Featured picture from Vecteezy, chart from TradingView