- ETH has declined by 6.18% in 24 hours.

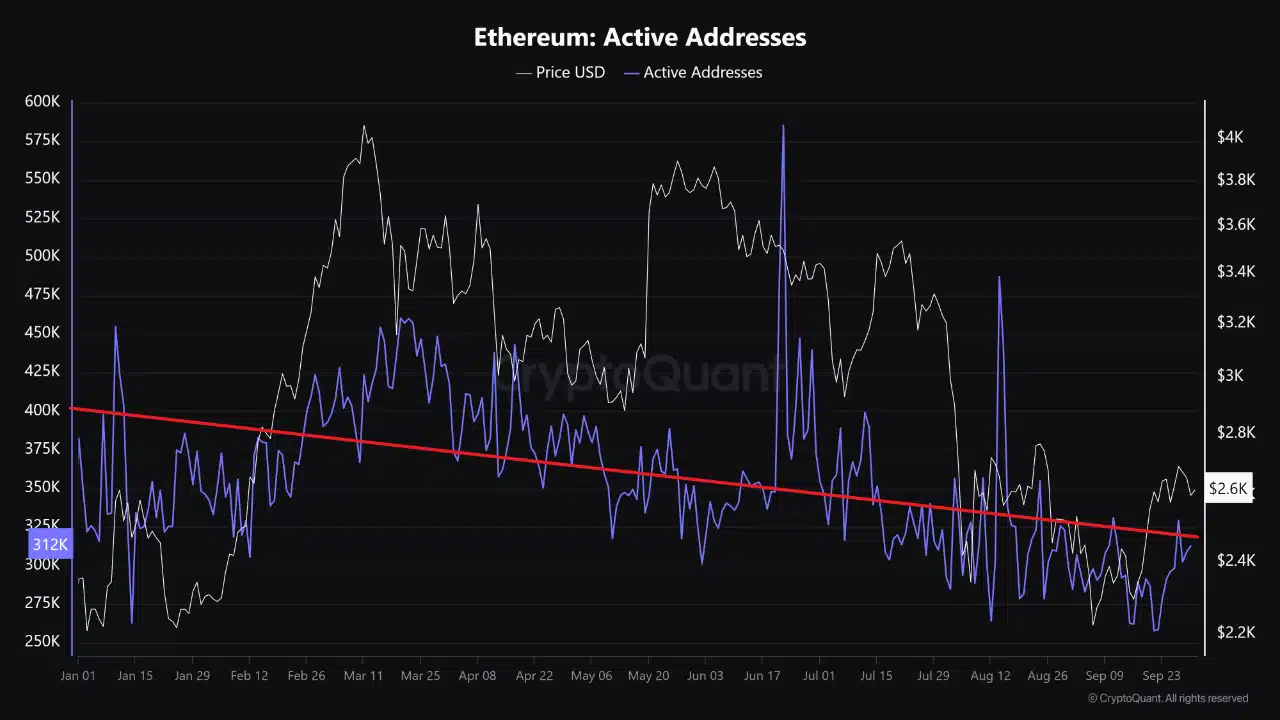

- Ethereum day by day energetic addresses have declined by 18.32% from 382k to 312k YTD.

Ethereum [ETH] has skilled a pointy decline over the previous week. Over this era, ETH has declined by 5.46%. The truth is, as of this writing, Ethereum was buying and selling at $2480. This marked a 6.18% decline over the previous day.

Previous to this, ETH has been on an upward trajectory climbing by 1.57% on month-to-month charts. Nonetheless, since hitting a excessive of $2729, the altcoin has failed to take care of an upward momentum. Thus, the latest losses are virtually outweighing the month-to-month features.

The latest losses on value charts are usually not an remoted case because the altcoin has additionally declined in different elements particularly energetic addresses.

Ethereum day by day energetic addresses decline

In response to Cryptoquant, identical to Bitcoin [BTC], Ethereum has skilled a sustained decline in energetic addresses all year long.

Primarily based on this knowledge, Ethereum’s day by day energetic addresses have declined from a excessive of 382k to 312k.

The analysts cited the principle explanation for the decline as the shortage of recent buyers. Thus though 2024 has seen liquidity enhance following the approval of Ethereum ETFs, on-chain actions doesn’t replicate it.

Equally the anticipated rally following Fed price cuts has did not materialize. This market failure means no new addresses have entered the market.

Implications for ETH value charts

Notably, a decline in day by day energetic addresses as identified above normally results in value dips.

Nonetheless, regardless of the decline in energetic addresses, the present market situation may set Ethereum for a big restoration on value charts.

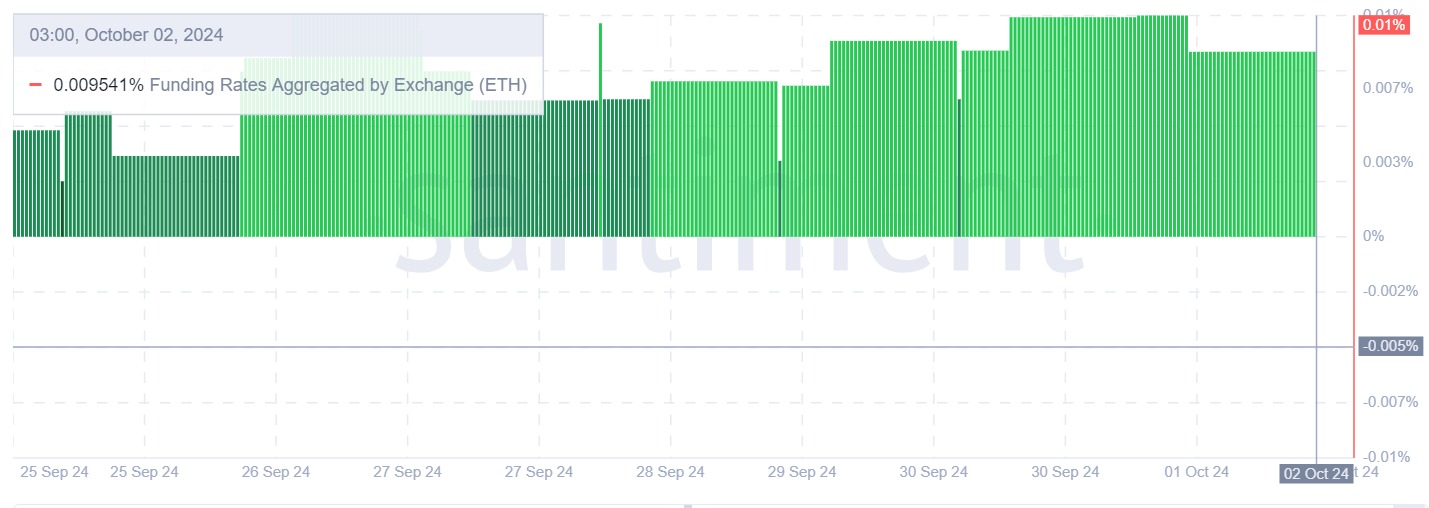

For instance, Ethereum’s funding price aggregated by trade has skilled a sustained rise remaining constructive over the previous week. This indicators a rising demand for lengthy positions as buyers anticipate additional features.

The truth that buyers are holding lengthy positions regardless of the worth decline suggests market confidence.

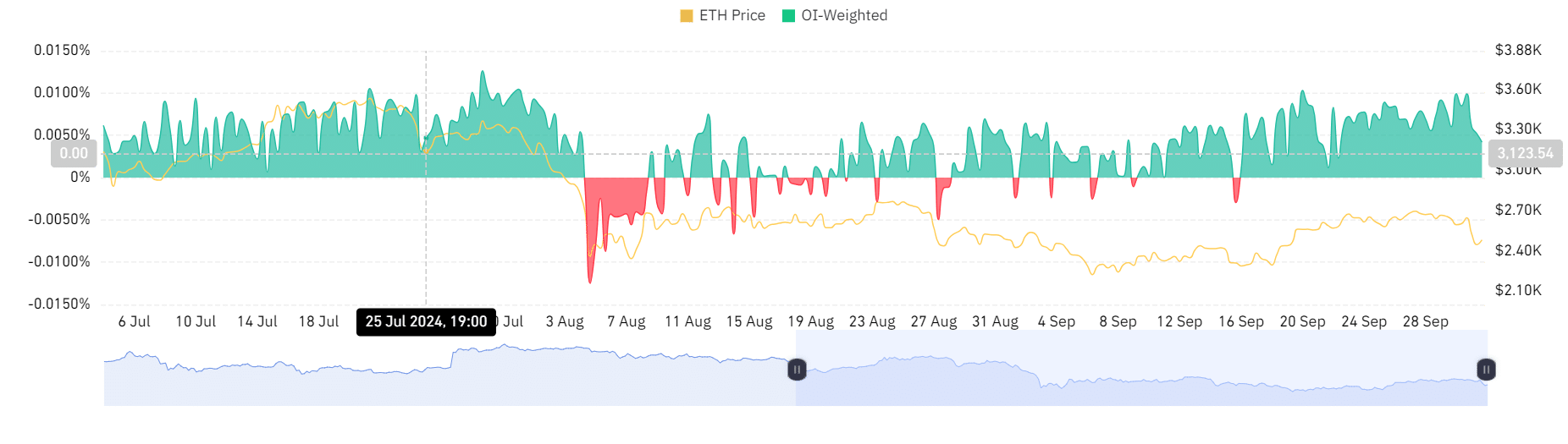

This demand for lengthy positions is additional supported by a constructive Open Curiosity Weighted funding price.

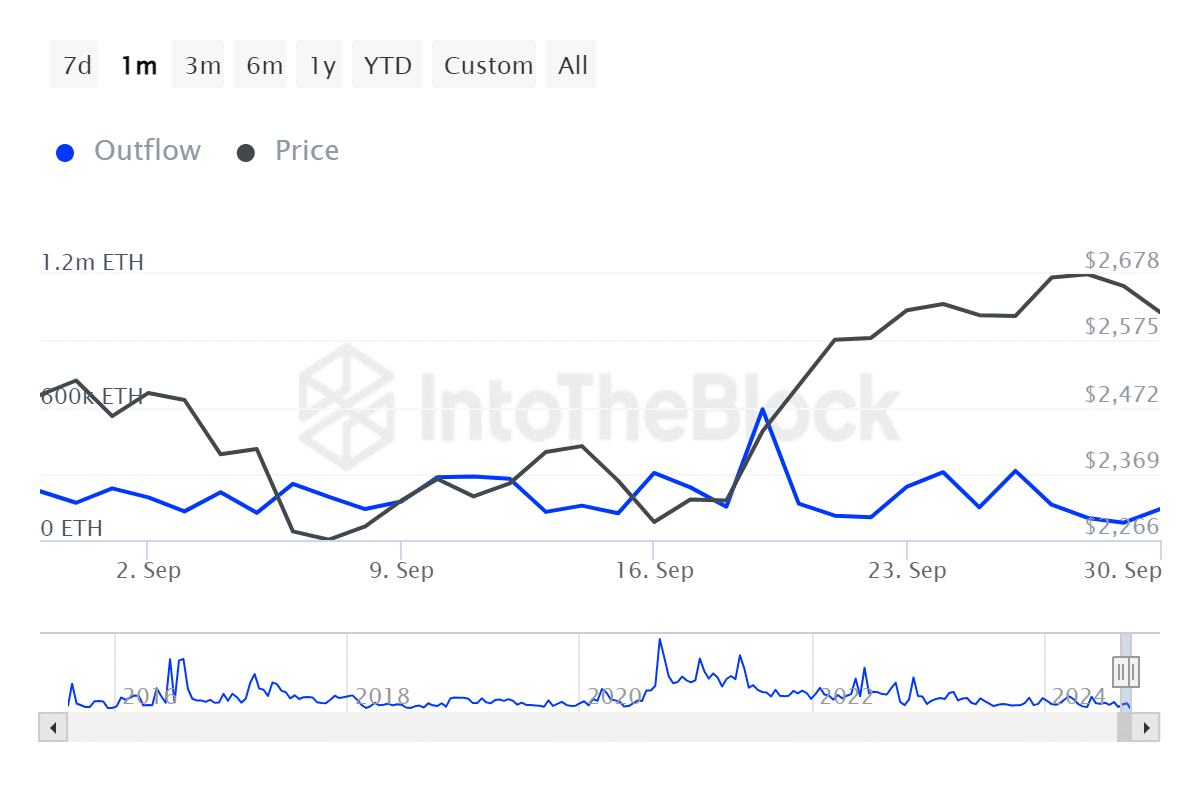

Moreover, Ethereum’s giant holders outflow has declined from a excessive of 311.95k to a low of 139.39k. This counsel that enormous holders are nonetheless accumulating their belongings and proceed to carry their positions regardless of market downturn.

Such holding habits counsel confidence with the altcoin’s future.

Learn Ethereum’s [ETH] Price Prediction 2024–2025

Due to this fact, regardless of the decline in energetic addresses, ETH has proven power on value charts. This suggests that the market is having fun with general constructive sentiment.

As such, ETH may get well and reclaim the following important resistance degree at $2668. Nonetheless, if the present decline persists, ETH will discover its help at $2728.