- Bitcoin confirmed indicators of restoration as its weekly and every day charts had been inexperienced.

- Market indicators and metrics hinted at a value correction.

Bitcoin [BTC] has confronted back-to-back value corrections over the previous few weeks, which has induced bother for its rally. The final week was considerably in buyers’ favor because the king coin witnessed value hikes.

Nevertheless, a brand new report has urged that BTC may as soon as once more fall sufferer to a correction.

Bitcoin rally is going through bother

The Bitcoin rally has been going through bother of late because it’s been struggling to maneuver above $66k. Nevertheless, the final 24 hours confirmed higher indicators. As per CoinMarketCap, the coin’s value elevated by greater than 1.5%. At press time, Bitcoin was buying and selling at $63,896.05.

The newest value hike has pushed 48.9 million BTC addresses in revenue, which accounted for 91% of the full variety of BTC addresses. However BTC’s troubles are usually not over but, as there have been possibilities of the Bitcoin rally ending.

Ali, a well-liked crypto analyst, posted a tweet revealing an fascinating improvement. As per the tweet, BTC’s value was transferring inside a channel.

The unhealthy information was that the coin had already confronted rejection 3 times when it approached the resistance of the sample. Due to this fact, it indicated that this lately gained bullish momentum won’t final. So, AMBCrypto deliberate to dig deeper.

What’s subsequent for BTC?

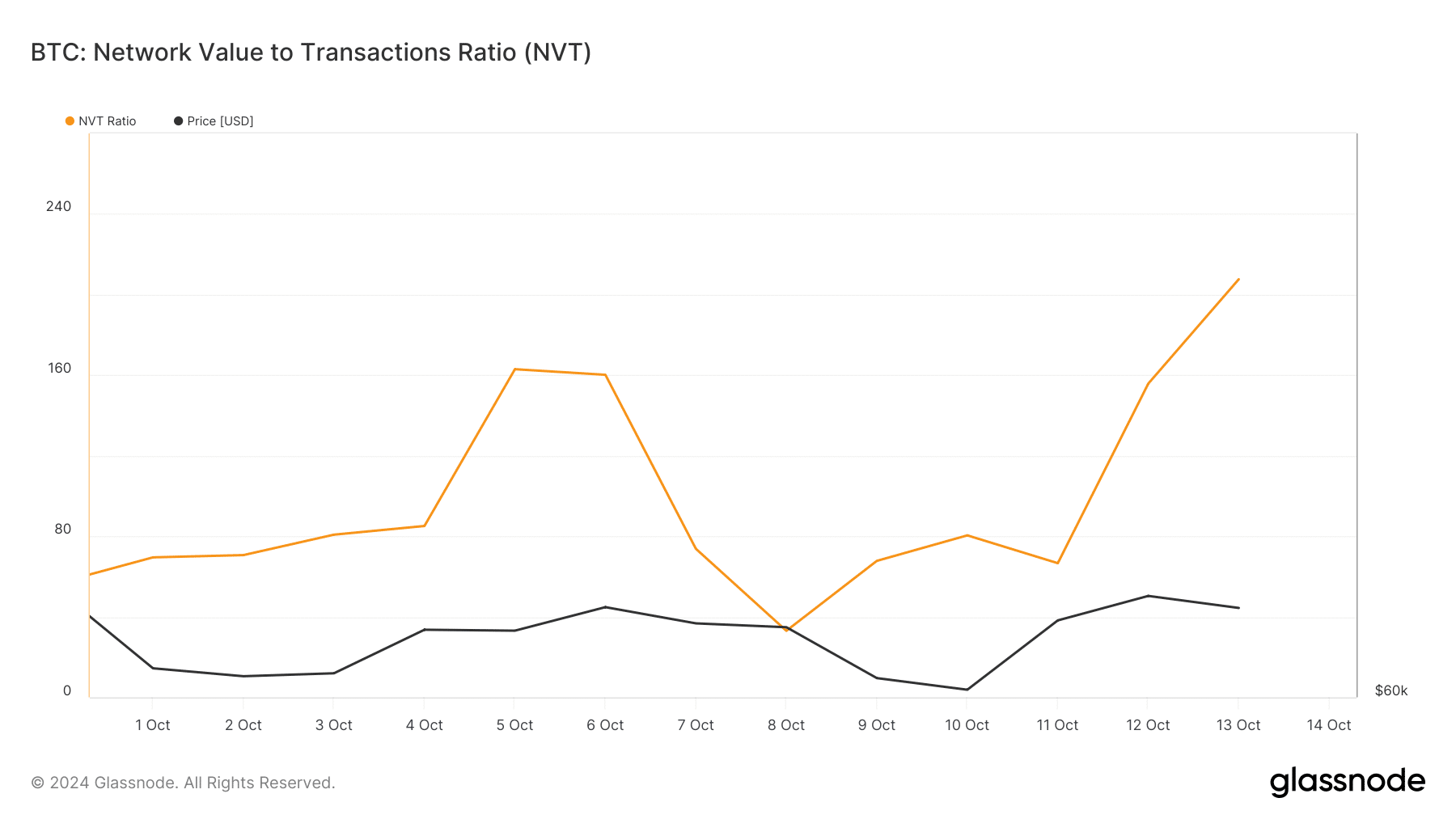

As per our evaluation of Glassnode’s information, a metric urged a halt to the Bitcoin rally. We discovered that the king coin’s NVT ratio elevated. Each time the metric rises, it signifies that an asset is overvalued, hinting at a value correction.

We additionally discovered that the coin’s lengthy/quick ratio dropped. This meant that there have been extra quick positions available in the market than lengthy positions. An increase within the variety of quick positions could be interpreted as a bearish sign.

Nevertheless, not the whole lot was within the bears’ favor. For instance, BTC’s alternate reserve was dropping, in line with CryptoQuant. A decline on this metric signifies that shopping for strain was rising, which regularly leads to value hikes.

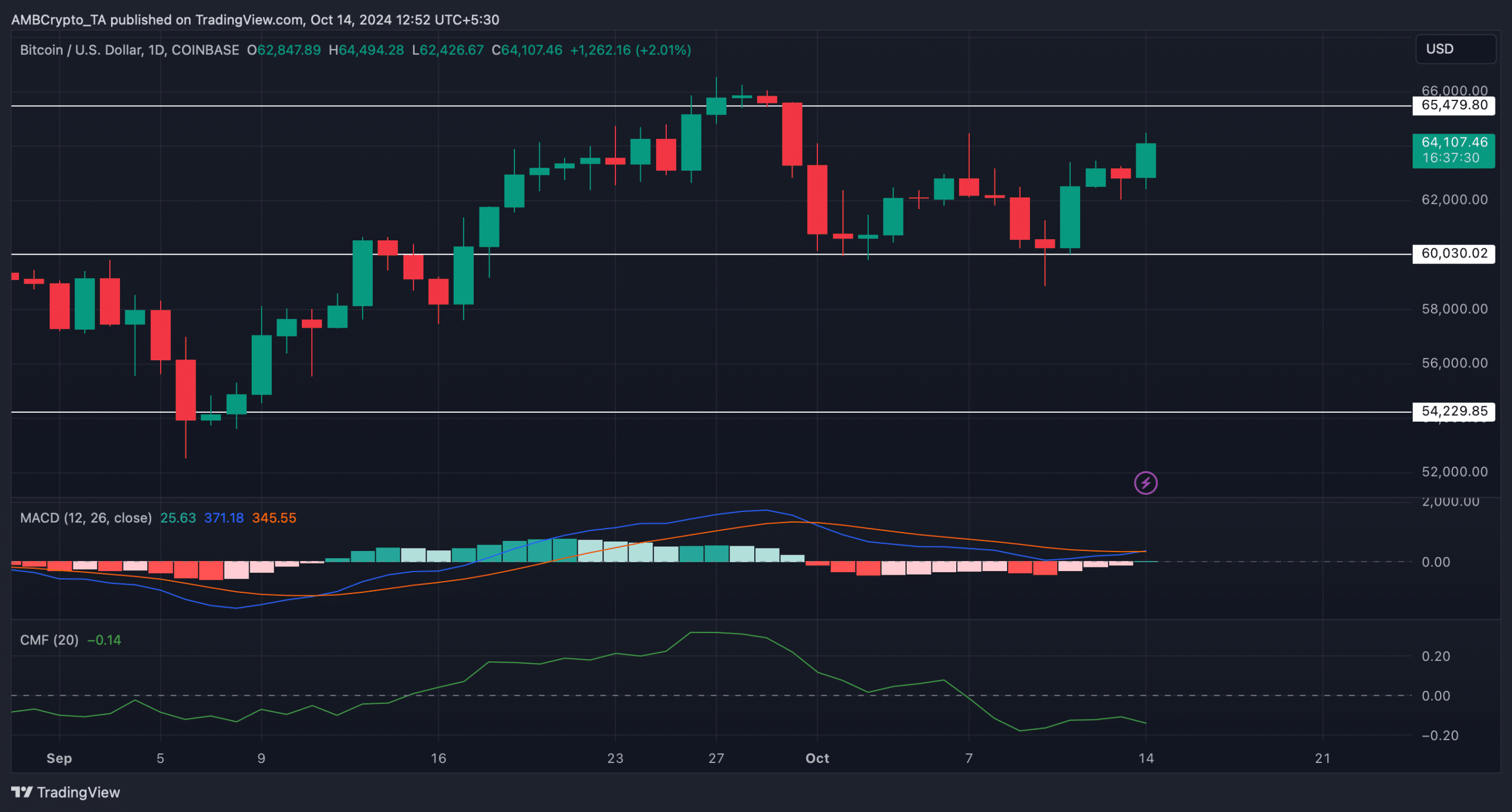

To higher perceive what to anticipate from the bitcoin rally, AMBCrypto checked the coin’s every day chart. The technical indicators regarded fairly bearish. BTC’s MACD displayed a bearish benefit available in the market.

Learn Bitcoin’s [BTC] Price Prediction 2024-25

Moreover, the coin’s Chaikin Cash Movement (CMF) additionally registered a downtick, hinting at a value drop. If that occurs, then the Bitcoin rally may finish and the coin may drop to $60k once more.

Nonetheless, in case of a continued value rise, BTC may take a look at its resistance at $65.4k once more.