- ETH attracted low investor curiosity in comparison with BTC, SOL.

- Per crypto hedge fund, ETH may see renewed curiosity in 2025.

Ethereum’s [ETH] has struggled this cycle amid record-high FUD, and traders’ consideration shifted elsewhere.

In line with Zaheer Ebtikar of crypto hedge fund Cut up Capital, ETH has lagged behind others attributable to ‘center youngster syndrome.’

“$ETH very a lot struggles with middle-child syndrome. The asset shouldn’t be in vogue with institutional traders, the asset misplaced favor in crypto personal capital circles, and retail is nowhere to be seen bidding something at this measurement.”

Traders abandon ETH

Among the many crypto majors, ETH supplied traders solely 8% on a YTD (year-to-date) foundation, in comparison with double digits seen in Bitcoin [BTC] and Solana [SOL].

Ebtikar linked the underperformance to traders’ concentrate on BTC and different ETH rivals like SOL and Sui [SUI].

The manager famous that there are three capital sources within the crypto area: institutional (by ETFs/futures), personal capital (liquid funds, VCs), and at last, retail. However solely the primary two mattered in the mean time.

He added that institutional capital was closely centered on BTC (by ETFs). ETH ETFs have seen net negative flows of $546 million since they debuted in July, underscoring the low curiosity.

Then again, Ebtikar said that non-public capital seen ETH as overvalued and redirected capital to different ETH rivals perceived as undervalued, resembling SOL, Celestia [TIA], and SUI.

“$ETH is just too massive for native capital to help whereas concurrently having the ability to help different index property like $SOL and different massive caps like $TIA, $TAO, and $SUI.”

Coinbase analysts additionally echoed the above sentiment of their September report.

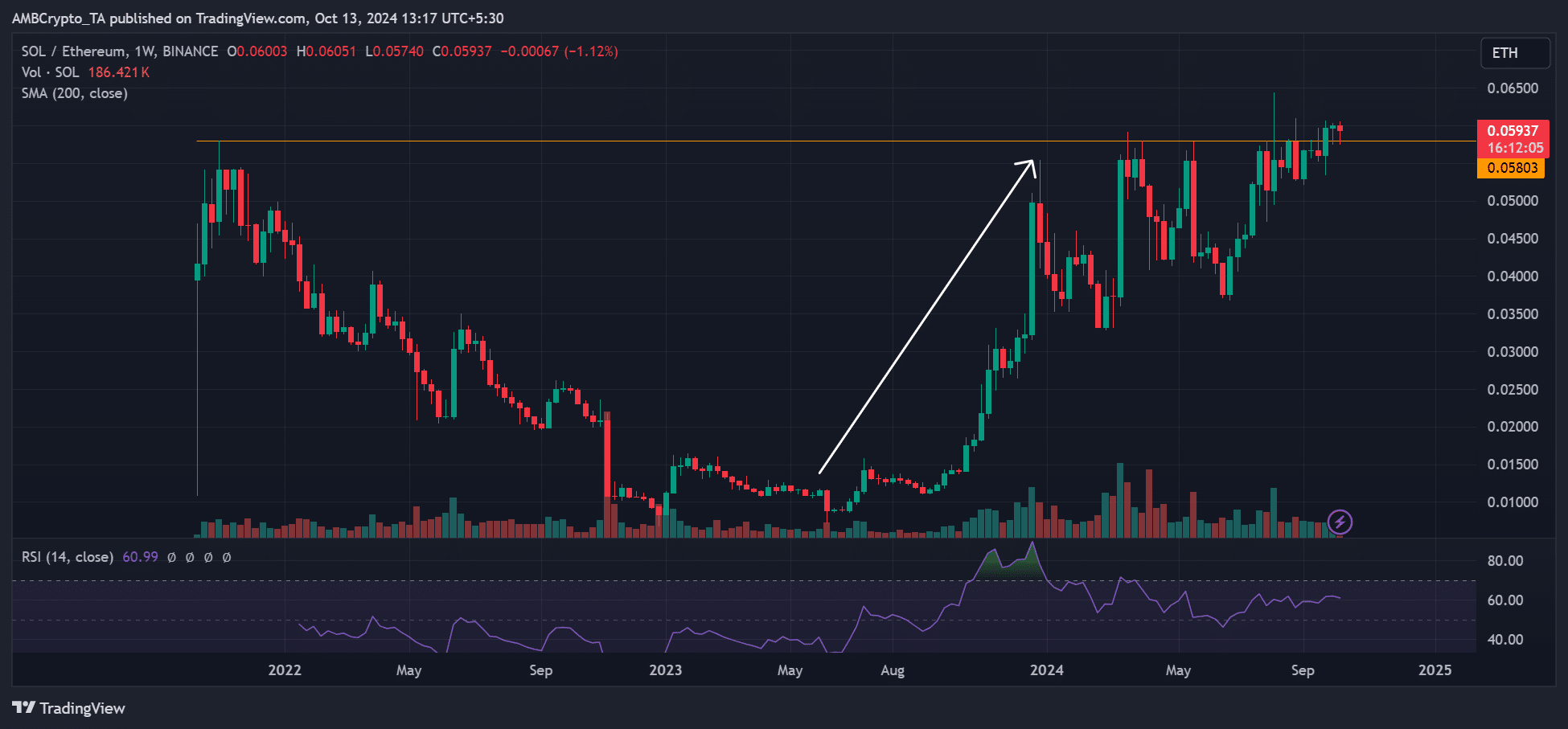

The SOLETH ratio, which tracks SOL’s worth relative to ETH, has exploded since final 12 months, cementing Ebtikar’s thesis that traders may need rotated to SOL from ETH.

That being mentioned, Ebitaker additionally acknowledged that ETH was the one altcoin with an authorized ETF within the US.

As such, he projected that the asset may see renewed curiosity, particularly from institutional traders, from 2025.

He cited probably elevated demand from ETF consumers, modifications throughout the Ethereum Basis and Trump’s win.

At press time, ETH was valued at $2.4k and has been consolidating between $2.3K and $2.5K because the starting of October.