- Solana’s value momentum is approaching key resistance ranges as whale accumulation intensifies.

- Rising open curiosity and vital liquidations recommend elevated market volatility forward for Solana.

Solana [SOL] has flipped Ethereum in a shocking growth, taking the highest spot in 7-day DEX (Decentralized Alternate) quantity with $11.8 billion in comparison with Ethereum’s $9.2 billion. This surge has many questioning whether or not Solana is gearing up for a significant bull run.

Consequently, a deeper look into Solana’s value motion, whale exercise, liquidation knowledge, and open curiosity ranges is critical to know if this could possibly be a defining second within the crypto market.

Can Solana break resistance and rally?

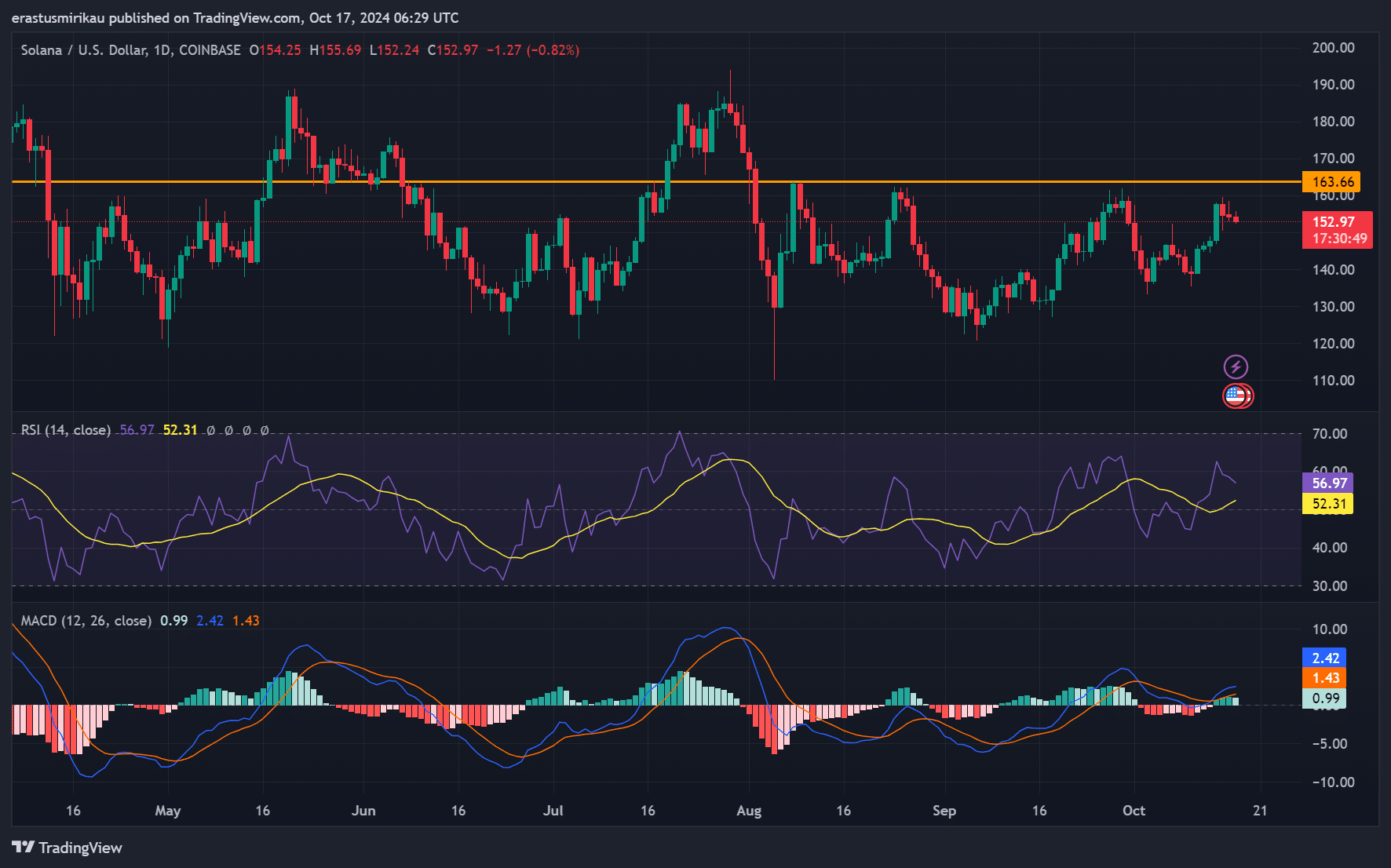

At press time, SOL was buying and selling at $153.09, reflecting a 0.99% decline over the previous day. Nevertheless, regardless of the minor drop, the worth stays on an upward trajectory.

Extra importantly, the $163.66 stage stands as a significant resistance level. If Solana breaks by this stage, a rally might comply with.

Moreover, the RSI studying of 52.31 exhibits impartial momentum, whereas the MACD hints at potential bullish energy constructing. Due to this fact, all eyes are on whether or not Solana can preserve its momentum and push larger.

SOL whale accumulation alerts potential surge

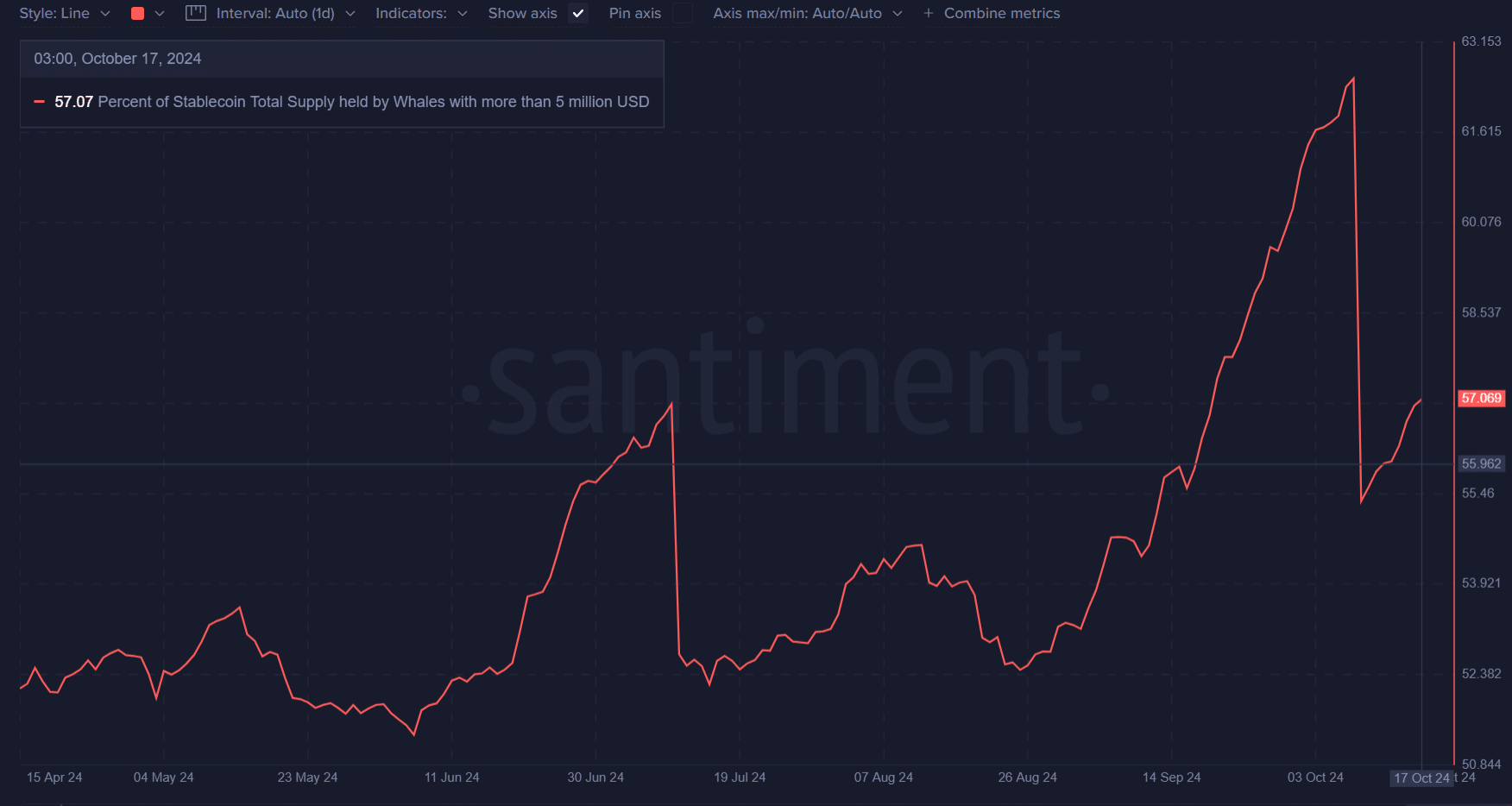

Curiously, Solana’s high holders—whales with greater than $5 million—now management 57.07% of the stablecoin provide. This rise in whale focus suggests strategic accumulation. Traditionally, such habits from massive holders has typically preceded value will increase.

Consequently, this buildup raises expectations that SOL might quickly see vital upward motion. The whales are possible positioning themselves for a robust push, indicating confidence within the long-term outlook of Solana.

Are SOL liquidations organising for extra volatility?

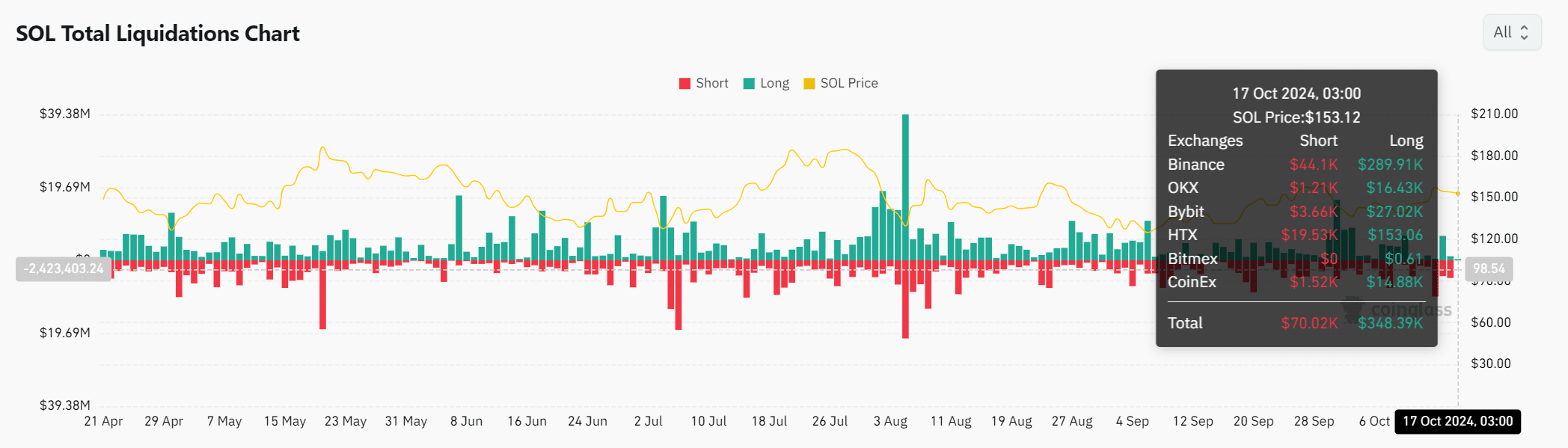

Liquidation knowledge reveals that $348.39K value of lengthy positions had been liquidated within the final 24 hours, alongside $70.02K in shorts. This excessive stage of liquidation in lengthy positions factors to merchants betting on a continued rise.

Nevertheless, it additionally signifies a excessive stage of leverage out there, which might backfire if key resistance ranges fail to carry. Because of this, additional value swings might happen if the market strikes towards overextended merchants.

Rising open curiosity hints at market optimism

Open curiosity in SOL has elevated by 2.26%, reaching $2.45 billion. This rise alerts rising dealer curiosity and an expectation of heightened volatility within the close to future.

Furthermore, with Solana dominating DEX quantity, merchants are betting on its potential to outperform the broader market.

Is your portfolio inexperienced? Take a look at the Solana Profit Calculator

Given SOL’s robust efficiency and whale accumulation, the potential for a bull run is simple. If the worth breaks by resistance and avoids additional liquidations, the market might see a speedy surge.

Nevertheless, merchants ought to proceed cautiously because of liquidation dangers. Nonetheless, Solana is well-positioned to steer the subsequent main crypto rally.