In an evaluation shared on X, crypto analyst Patric H. from CryptelligenceX outlines seven explanation why traders must be bullish in regards to the Bitcoin worth trajectory this week. “How can anybody be bearish right here?! BTC broke the weekly downtrend, closing above key ranges, and a few folks nonetheless name for sub-$40k?! Sorry, bears, you clearly missed the elemental modifications of the previous two weeks,” he states.

#1 Mt. Gox Bitcoin Compensation Deadline Extension

The defunct change Mt. Gox has filed for a change in its reimbursement deadline, which has been approved by the courtroom. The brand new deadline to refund the remaining collectors is now set for October 31, 2025, a full 12 months later than the beforehand scheduled October 2024. This extension removes the speedy market promoting stress of roughly 44,905 BTC (round $2.9 billion), which was anticipated to flood the market.

#2 China’s Financial Stimulus

China is ready to challenge $325 billion in bonds to stimulate its financial system. Concurrently, crypto change OKX has launched a totally licensed buying and selling platform within the United Arab Emirates (UAE), providing a authorized avenue for Chinese language traders to interact in cryptocurrency buying and selling below UAE jurisdiction. Patric H. predicts, “Chinese language cash is gonna enter crypto in This fall.”

Associated Studying

#3 Declining Bitcoin Change Reserves

Bitcoin change reserves proceed to dwindle as institutional traders and whales accumulate the cryptocurrency at unprecedented charges. This pattern signifies a provide scarcity on exchanges, which, coupled with rising demand, may result in a provide shock. “Finally, this can trigger a supply shock, resulting in increased costs in due time,” notes the analyst.

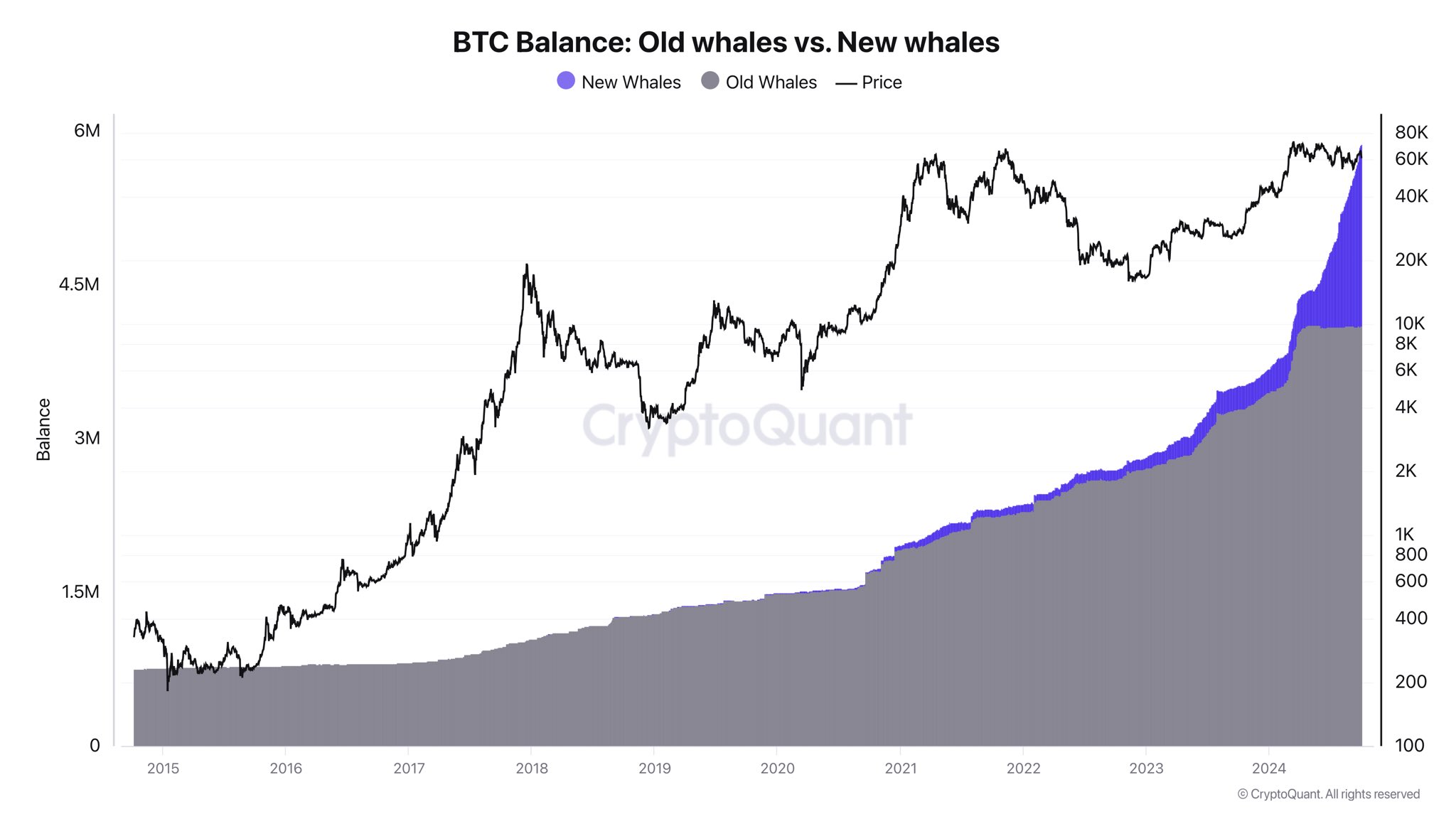

#4 Surge In Bitcoin Whale Accumulation

On-chain knowledge reveals that new Bitcoin whales are accumulating belongings like by no means earlier than. Ki Younger Ju, CEO and founding father of CryptoQuant not too long ago, commented, “The present market volatility is only a recreation within the futures market. Actual whales transfer the market by spot buying and selling and OTC markets. That’s why on-chain knowledge is essential.”

Associated Studying

He added that these new whales are unlikely to promote till substantial liquidity from retail traders enters the market. “Take a look at how fiercely the brand new whales are stacking Bitcoin; this market has by no means seen such accumulation,” he emphasised. Notably, the shortage of correlation with the US spot ETF inflows means that these may very well be strategic institutional accumulations.

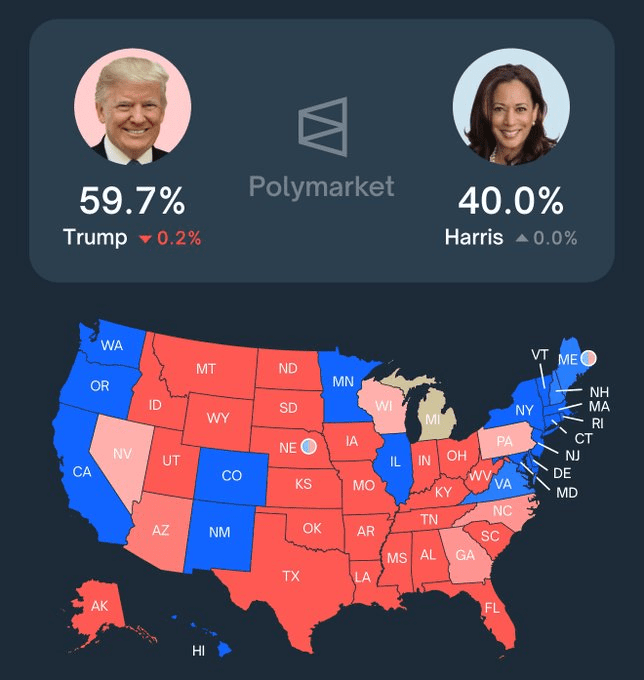

#5 Trump Is Main The Polls

Political forecasts point out that former US President Donald Trump is gaining favor in swing states forward of the upcoming elections. In accordance with Polymarket’s newest knowledge, Trump is projected to win all seven key swing states. Patric H. reminds readers, “Trump is pro-crypto; Elon Musk will lead a Division of Authorities Effectivity (DOGE).”

#6 S&P 500 As Trailblazer

The S&P 500 index is buying and selling at an all-time excessive, traditionally signaling constructive momentum for Bitcoin and crypto. “There has not been a time in historical past when Bitcoin and the altcoins market didn’t catch as much as the efficiency of the S&P 500,” Patric H. factors out, dismissing skepticism with, “However ‘this time is totally different’… yeah, certain.” The correlation between conventional markets and cryptocurrencies means that bullish developments in equities may spill over into the Bitcoin and crypto sector.

#7 Seasonality

Traditionally, the fourth quarter (This fall) has been the most bullish period for Bitcoin, particularly in halving years. “Bitcoin and the crypto market are likely to outperform all asset courses in a halving 12 months,” argues the analyst.

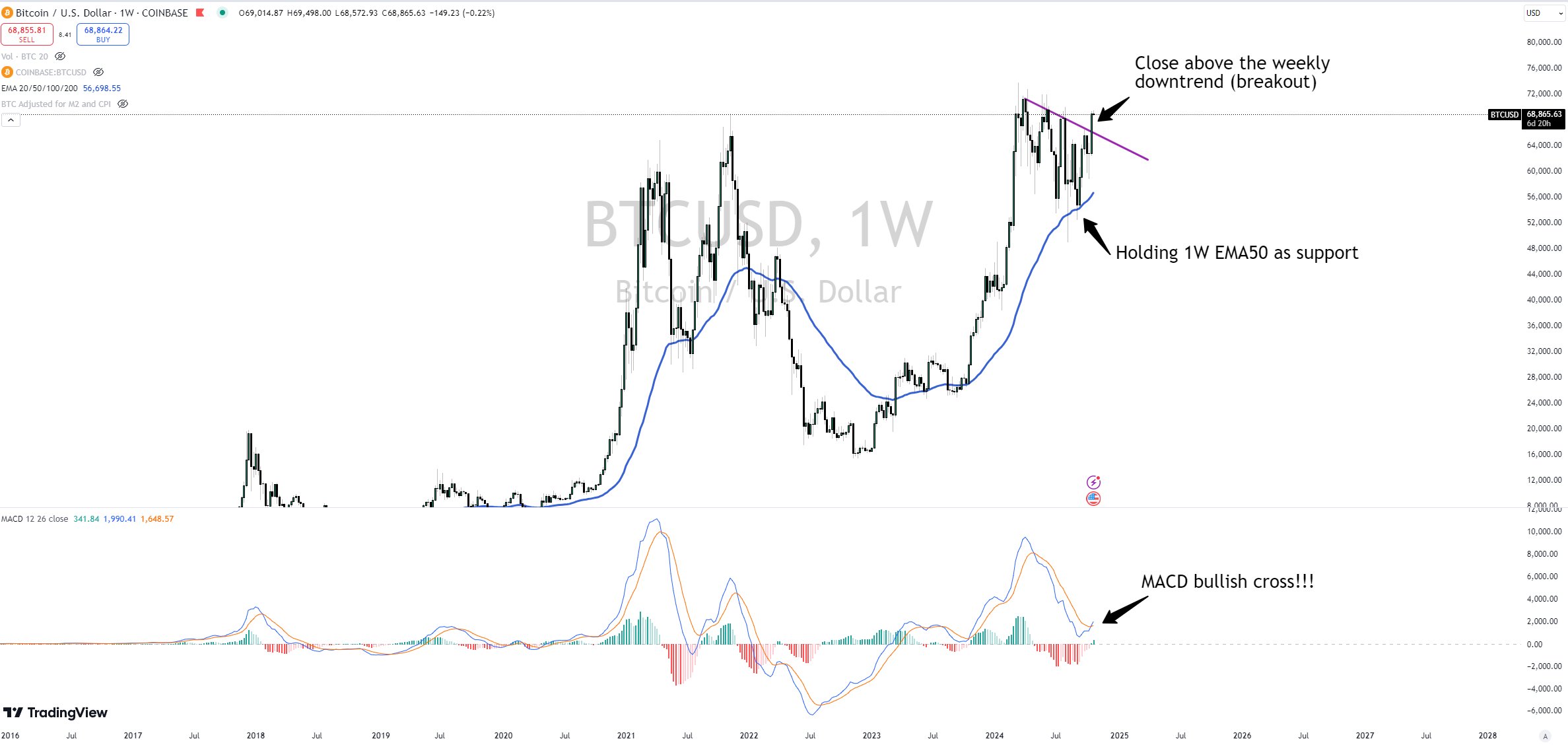

Supporting these basic causes, technical evaluation additionally paints a constructive image for Bitcoin. Patric H. highlights that Bitcoin has closed above its weekly downtrend line, signaling a possible reversal from bearish to bullish momentum. Furthermore, the cryptocurrency is holding firmly above the 50-week Exponential Shifting Common (EMA), a crucial assist degree. Additionally, the Shifting Common Convergence Divergence (MACD) indicator has made a bullish cross for the primary time since April, usually interpreted as a purchase sign.

“Sure, there might be pullbacks once in a while. However any more, dips are for purchasing because the market construction clearly shifted from a downtrend to an uptrend,” Patric concludes.

At press time, BTC traded at $68,397.

Featured picture created with DALL.E, chart from TradingView.com