- Ethereum mirroring previous patterns is a sign of a possible drop.

- Greater than 73% of ETH whales are nonetheless holding their positions.

Ethereum [ETH] has been mirroring previous market patterns as the top of 2024 approaches, with merchants watching carefully for any potential worth drops.

In 2016, ETH noticed vital drops in April, August, and December.

This 12 months, the cryptocurrency has already skilled declines in April and August, main analysts to invest {that a} comparable drop might occur earlier than year-end, presumably in December.

Whereas patterns counsel a dip, the important thing stage to look at is $2,800. If Ethereum can break and holds above this, a deeper dip could also be prevented.

Nonetheless, failure to maneuver in the direction of the $2800 stage might see ETH take a look at the $2300 mark then $2000 earlier than year-end.

ETH/BTC pair’s lack of ability to interrupt above the 50-day SMA

One other key issue is the ETH/BTC pair’s lack of ability to interrupt above the 50-day easy transferring common (SMA).

In earlier cycles, as soon as ETH/BTC moved above this SMA, a powerful bullish transfer adopted. This hasn’t occurred but, which suggests the low may not be in place.

Previous patterns assist the concept merchants are sometimes too desirous to flip bullish with out ready for affirmation.

At present, competitors from different platforms like Solana and inherent ecosystem challenges are including bearish stress on Ethereum.

Primarily based on the present worth motion, Ethereum might have additional draw back forward.

Merchants trying to capitalize on this might think about brief positions, as extra declines appear possible.

On the identical time, the Ethereum Basis has continued to take earnings, with current gross sales of 100 ETH contributing to the bearish sentiment.

Whales stay lengthy

Regardless of these similarities, Ethereum has undergone main modifications since 2016, together with the Merge and 4844 improve, making it essentially totally different.

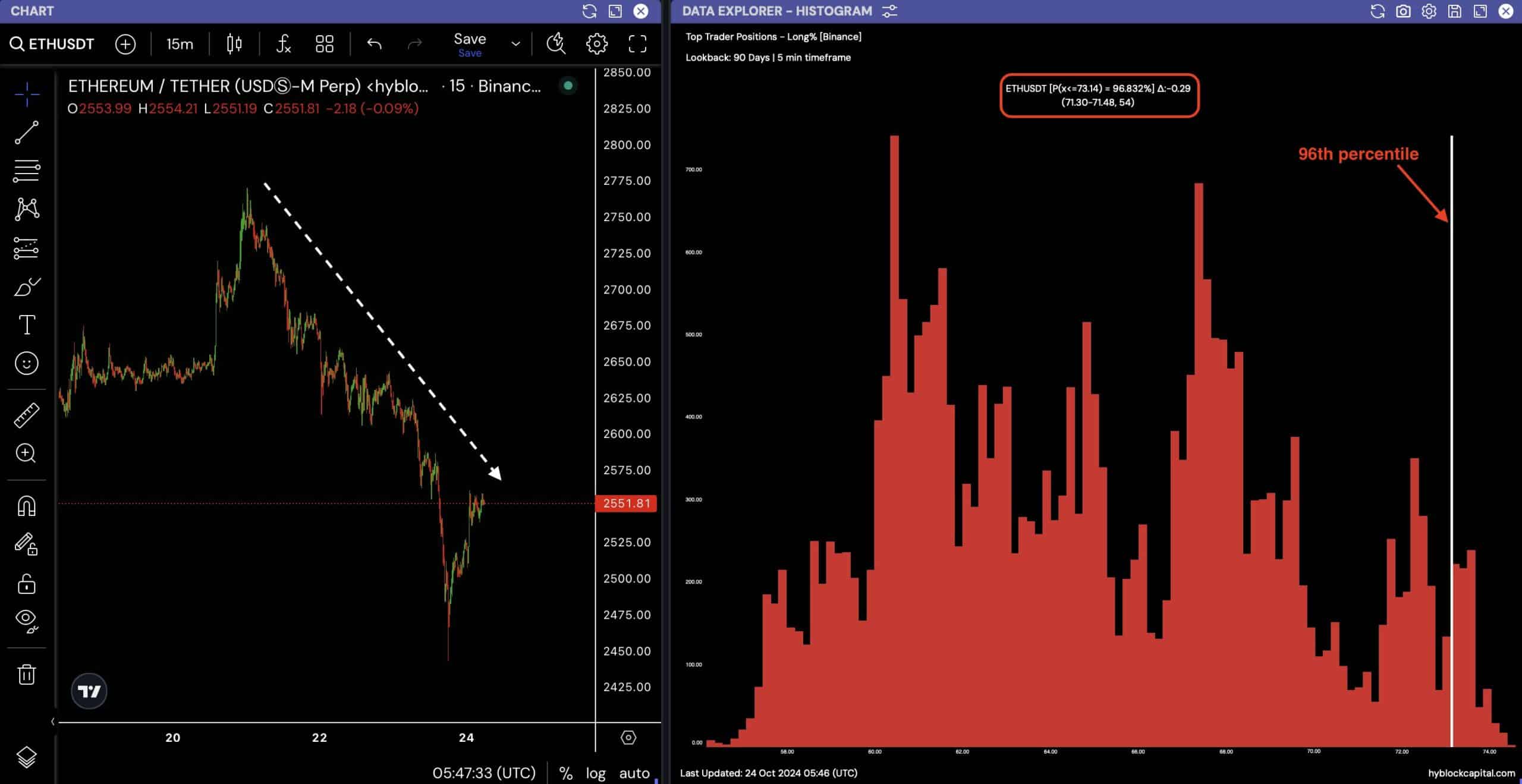

Regardless of the continuing downtrend, whale exercise reveals little change.

Information from Binance signifies that 73.14% of accounts nonetheless maintain lengthy positions on Ethereum, reflecting confidence in its long-term prospects.

Whereas the short-term outlook could also be bearish, these massive holders counsel that there’s nonetheless perception in a restoration.

As soon as the value stabilizes and each ETH/USDT and ETH/BTC set up their bottoms, merchants might discover sturdy shopping for alternatives for the long run.

Whereas Ethereum might face yet another drop earlier than the top of 2024, its long-term outlook stays optimistic.

Learn Ethereum’s [ETH] Price Prediction 2024–2025

Merchants ought to keep cautious within the brief time period, however the potential for a restoration presents promising alternatives for these trying to go lengthy as soon as a confirmed backside is in place.

ETH’s worth trajectory stays some of the carefully watched within the crypto area because the 12 months winds down.