- Vitalik Buterin explains the reasoning behind ETH gross sales.

- ETH suffers amid a bearish market.

Ethereum [ETH] co-founder Vitalik Buterin has shut down mounting criticism from the group following the ETH sell-offs by the Ethereum Basis.

AMBCrypto beforehand reported that the Basis liquidated 2,500 ETH, valued at over $6 million. This transfer stirred discontent throughout the group, with some members accusing Buterin of dumping ETH.

Whereas Buterin himself has not sold any ETH for the reason that twelfth of September, the Basis’s sell-offs have sparked considerations in regards to the broader implications of those transactions.

Vitalik Buterin’s protection of ETH gross sales

In response to the criticism, Buterin took to X, stating,

“Present some respect.”

He emphasised that the funds are important to supporting Ethereum’s core improvement efforts, which in flip profit the complete group.

Buterin highlighted that these funds are used to maintain the continuing work of researchers and builders accountable for Ethereum’s operational developments.

These initiatives, he detailed, are what make Ethereum viable and scalable by lowering the community’s reliance on proof-of-work. It additionally retains transaction charges low, ensures sooner transaction inclusion occasions by means of EIP-1559, and helps privateness enhancements like zk-rollup know-how.

Moreover, Buterin famous that the Basis’s price range covers different very important areas. These embody account abstraction know-how that improves person safety, the internet hosting of native Ethereum occasions worldwide, and sustaining the community’s resilience.

He added that the Basis has achieved “zero downtime from DoS assaults and consensus failures since 2016,” emphasizing the significance of safety efforts funded by means of these gross sales.

Neighborhood criticism: Why not stake ETH?

Nevertheless, a recurring query throughout the group was why doesn’t the Basis merely stake its ETH holdings to cowl prices, somewhat than promoting them and probably impacting the market worth.

Buterin responded to those considerations, explaining that the explanation to keep away from staking is to forestall,

“Being pressured to make an ‘official alternative’ within the occasion of a contentious onerous fork.”

He additionally shared an revolutionary proposal at the moment being explored: providing grants the place recipients would have the autonomy to stake the Basis’s ETH on their phrases, offered it aligns with moral practices.

One other technique, the exec instructed, might contain dispersing the legitimacy and sources of Ethereum to numerous organizations, lowering the Basis’s central affect. This step would promote a extra decentralized ecosystem.

ETH’s roadmap and market place

This newest wave of responses from Buterin follows his constant updates on Ethereum’s technical roadmap. He has been vocal about how the deliberate “Merge,” “Surge,” “Scourge,” “Verge,” and “Purge” phases are anticipated to impression Ethereum’s scalability, safety, and general effectivity.

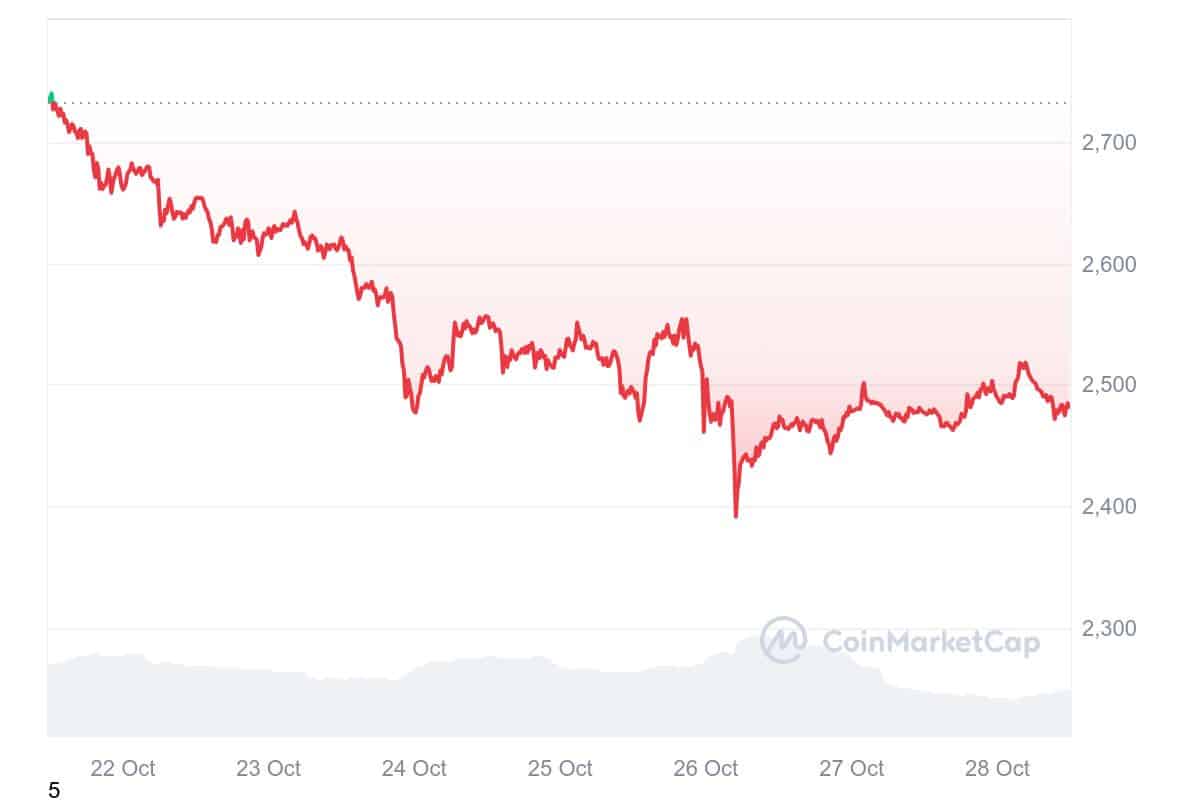

In the meantime, ETH’s worth efficiency has been lower than spectacular. After closing in on $2,800 final week, the altcoin dropped to a press time worth of $2,482.

Learn Ethereum’s [ETH] Price Prediction 2024–2025

Based on CoinMarketCap, this mirrored a 9.21% lower over the previous week. Though the altcoin gained 0.17% within the final day.

The market’s response underscores the challenges dealing with the Basis because it balances group expectations with Ethereum’s evolving monetary ecosystem.