- Quantity of huge transactions by whales and buyers surged by 7.85%, indicating a bullish outlook

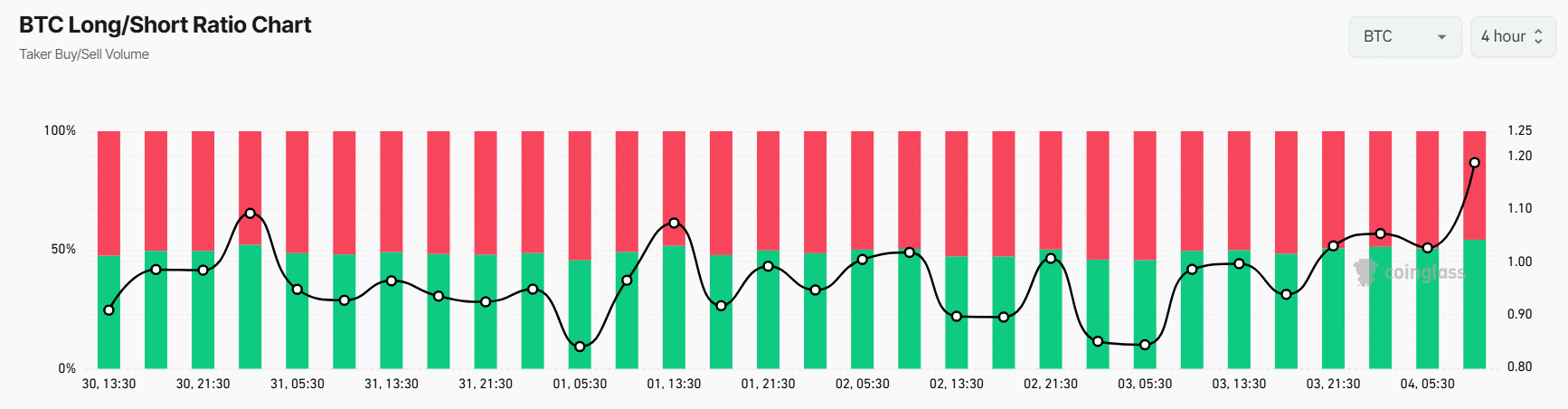

- At press time, 55% of prime BTC merchants have been holding lengthy positions, whereas 45% held brief positions

Bitcoin (BTC), the world’s largest cryptocurrency by market cap, is poised for an upside rally after recording an 8% worth decline in latest days.

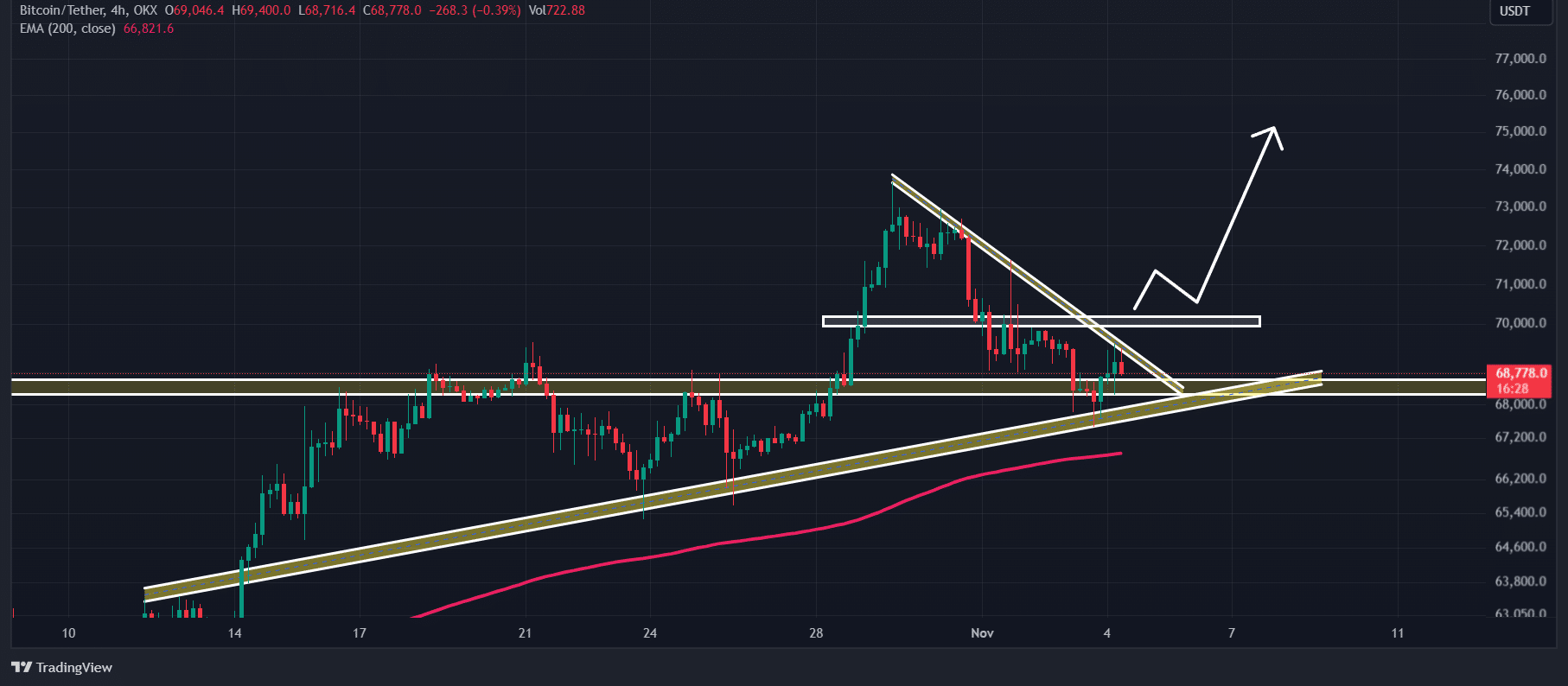

Following a breakout from the descending channel sample on 28 October, BTC soared by greater than 8%. Nonetheless, the most-recent decline seems to be a worth correction – A optimistic signal for the upcoming rally.

Bitcoin worth evaluation and key ranges

In keeping with AMBCrypto’s technical evaluation, the cryptocurrency gave the impression to be going through resistance from a declining trendline on the four-hour timeframe. If Bitcoin does register an upside rally, there’s a excessive probability that the asset might breach this aforementioned hurdle.

If BTC breaches this trendline and closes a four-hour candle above $70,000, there’s a sturdy risk the asset might soar considerably. Probably to hit a brand new all-time excessive within the coming days.

Nonetheless, this bullish thesis will solely work if Bitcoin maintains help above the $67,500-level. In any other case, it could fail.

On the time of writing, BTC gave the impression to be buying and selling above its 200 Exponential Transferring Common (EMA) on each the four-hour and each day timeframes, indicating an uptrend.

BTC’s bullish on-chain metrics

this bullish outlook, it appeared that whales and buyers have elevated their participation. In keeping with the on-chain analytics agency IntoTheBlock, BTC’s giant transaction quantity surged by 7.85% over the previous 24 hours. This might assist drive the asset’s worth larger.

Moreover, BTC’s Lengthy/Brief ratio had a price of 1.20, underlining sturdy bullish sentiment amongst merchants. In the meantime, its Open Curiosity rose by 2.9% over the past 24 hours, indicating rising curiosity and the formation of recent positions from merchants.

Primarily based on an evaluation of Coinglass information, 55% of prime merchants held lengthy positions, whereas 45% held brief positions.

Worth efficiency

At press time, Bitcoin was valued at $69,100, after appreciating by almost 1.1% over the past 24 hours. Throughout the identical interval, its buying and selling quantity skyrocketed by 45%, indicating heightened participation from merchants and buyers.