Ethereum has lastly surged after breaking via a crucial resistance stage that had stored the worth subdued since early August. This transfer has shifted market sentiment, as many traders and analysts beforehand doubted ETH’s potential within the present cycle, anticipating it to lag behind. Nevertheless, Ethereum’s latest energy is beginning to reshape these views.

Distinguished analyst and investor Ali Martinez lately shared insights indicating that whereas Ethereum’s momentum is constructing, the much-anticipated “Altseason” hasn’t arrived simply but.

Associated Studying

In response to Martinez, this stage of the cycle usually sees Bitcoin outperforming Ethereum and different altcoins—a typical sample as BTC typically leads market rallies. This dynamic may present a strategic alternative for traders seeking to enter ETH and different altcoins earlier than the broader market euphoria begins.

As Ethereum gains traction, market contributors are keeping track of additional confirmations of its breakout, with many speculating that when Bitcoin’s lead cools, capital could stream extra aggressively into altcoins.

Ethereum Waking Up

Ethereum is making a outstanding comeback, surging over 22% in simply two days of sturdy upward momentum. Whereas this efficiency is spectacular, key knowledge highlights that Bitcoin remains to be main the market, barely overshadowing Ethereum’s positive factors. For savvy traders, this might current a major alternative to begin accumulating Ethereum and choose altcoins earlier than they doubtlessly rally within the subsequent section of the cycle.

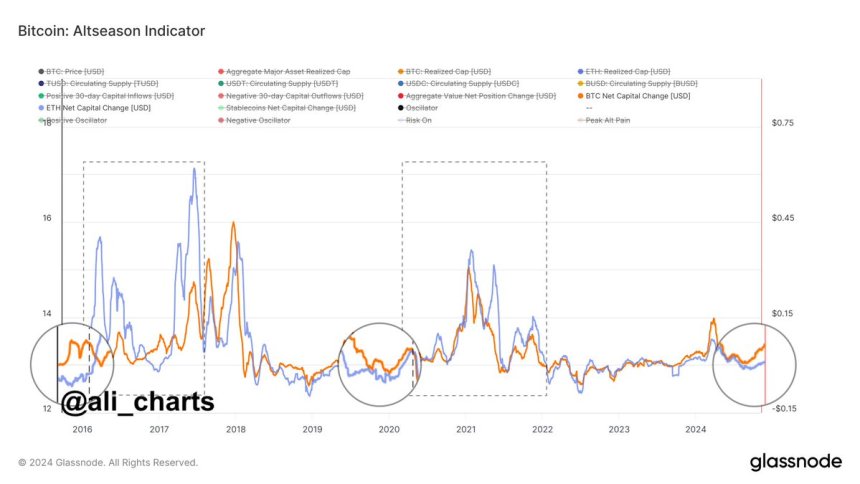

Ali Martinez, a outstanding analyst, recently shared a Glassnode chart revealing insights on the “Bitcoin Altseason Indicator.” This software compares web capital flows between Bitcoin and Ethereum, exhibiting that whereas Ethereum is on the rise, Bitcoin’s web capital change is presently outpacing it.

This pattern confirms that Altseason—the place altcoins outperform Bitcoin—hasn’t begun but. Martinez factors out that such dynamics are typical for this stage, with Bitcoin often main the preliminary rally and Ethereum following shortly after.

Associated Studying

Traditionally, Altseason typically arrives as soon as Bitcoin’s worth momentum stabilizes, as capital flows from Bitcoin into high-potential altcoins. Many seasoned traders acknowledge this a part of the cycle as a super time to build up ETH and powerful altcoins at enticing costs earlier than the broader market shifts its focus.

Within the coming weeks, the connection between BTC and ETH efficiency can be intently watched, doubtlessly organising a shift in market sentiment and capital distribution.

ETH Technical View

Ethereum lately surged previous a crucial resistance at $2,820, breaking above the 200-day exponential shifting common (EMA) and touching the 200-day shifting common (MA) at $2,955. This marks a major bullish transfer, as ETH had been buying and selling under these ranges since early August, and reclaiming these indicators is seen as a optimistic sign for additional positive factors.

For the bullish momentum to proceed, ETH should break above and maintain itself above the each day MA at $2,955, solidifying this breakout as a basis for the subsequent section of the uptrend. Nevertheless, some analysts counsel {that a} interval of consolidation just under the 200 MA might be helpful, permitting ETH to assemble energy for a extra sustained rally. This pause may mood the rising euphoria and keep away from overextension within the quick time period.

Associated Studying

Because the market sentiment turns more and more optimistic, many traders are eyeing this stage intently. Holding above these crucial indicators would give bulls extra management, doubtlessly setting Ethereum up for a extra sturdy restoration because it targets new highs.

Featured picture from Dall-E, chart from TradingView