- Ethereum broke the $3,000 value stage lately.

- Over 2.8 million addresses purchased ETH on the present value stage, making it a key stage.

Whereas Bitcoin[BTC] captured headlines with its all-time highs, Ethereum[ETH], usually known as the ‘digital silver’ additionally made a notable transfer.

The second-largest cryptocurrency by market capitalization broke above the $3,000 mark, a resistance stage that had held sturdy for months.

This breakthrough coincided with record-breaking optimistic flows in Ethereum’s spot ETF, marking a brand new part of bullish momentum.

Can Ethereum maintain this rally because it navigates a brand new territory?

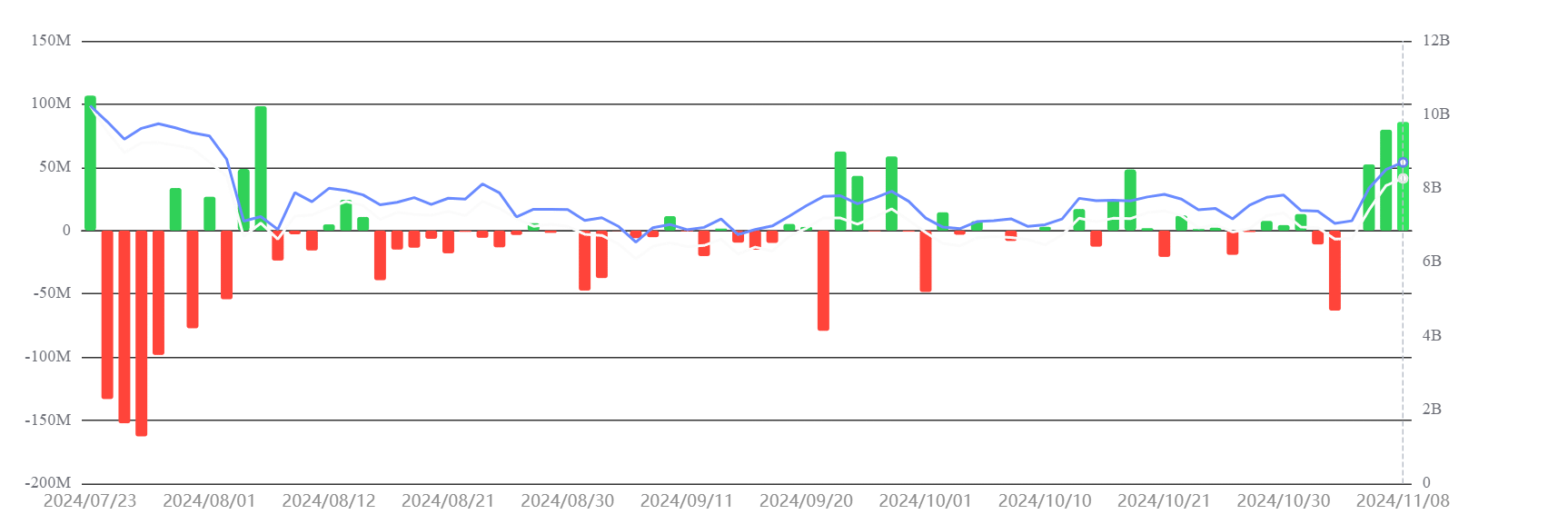

Document spot ETF influx fuels Ethereum’s breakout

Ethereum’s ETF circulation evaluation for the previous week revealed a internet influx of $154.66 million. This set a brand new excessive for weekly optimistic flows.

Information from SosoValue confirmed that that is Ethereum’s second consecutive week of internet inflows—a historic milestone for the ETF.

The biggest weekly internet circulation for Ethereum’s ETF occurred throughout its launch week, with a adverse circulation of $341.35 million. Now, the pattern has shifted decisively into optimistic territory, with consecutive inflows supporting ETH’s value rally.

This surge in institutional assist has helped ETH break previous the $3,000 barrier, bolstering its upward momentum.

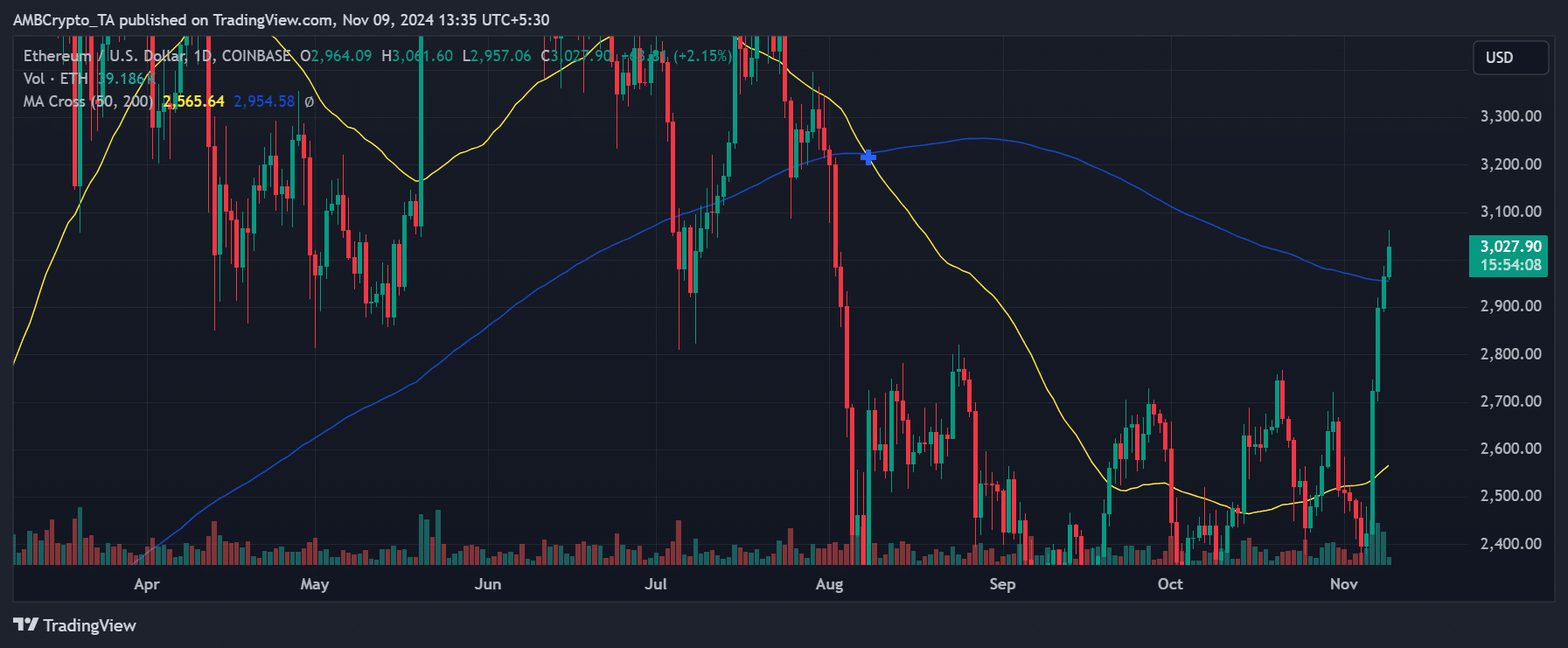

Ethereum strikes to safe its place above $3k

At press time, Ethereum surged to $3,027.90, experiencing a robust bullish breakout. It has pushed properly above each its 50-day and 200-day Shifting Averages(MA).

This transfer marked a big rally as ETH surpassed the $3,000 psychological resistance. This reveals momentum that implies investor confidence within the asset.

The 50-day MA was positioned at $2,565.64, and the 200-day MA at $2,954.58, each serving as assist ranges for the present bullish run. The amount additionally elevated, highlighting a robust shopping for curiosity.

Given this pattern, ETH might goal increased ranges if it sustains this bullish momentum, with the subsequent resistance zones probably round $3,200 or increased.

A pullback to check assist on the 200-day MA might also be possible, offering a possible entry level for merchants watching this pattern carefully.

Ethereum’s breakthrough of the $3,000 resistance stage is a big achievement, supported by file ETF inflows and powerful technical indicators.

If this momentum persists, ETH might proceed to rally, establishing $3,000 as a brand new assist stage because it heads towards the yr’s finish.

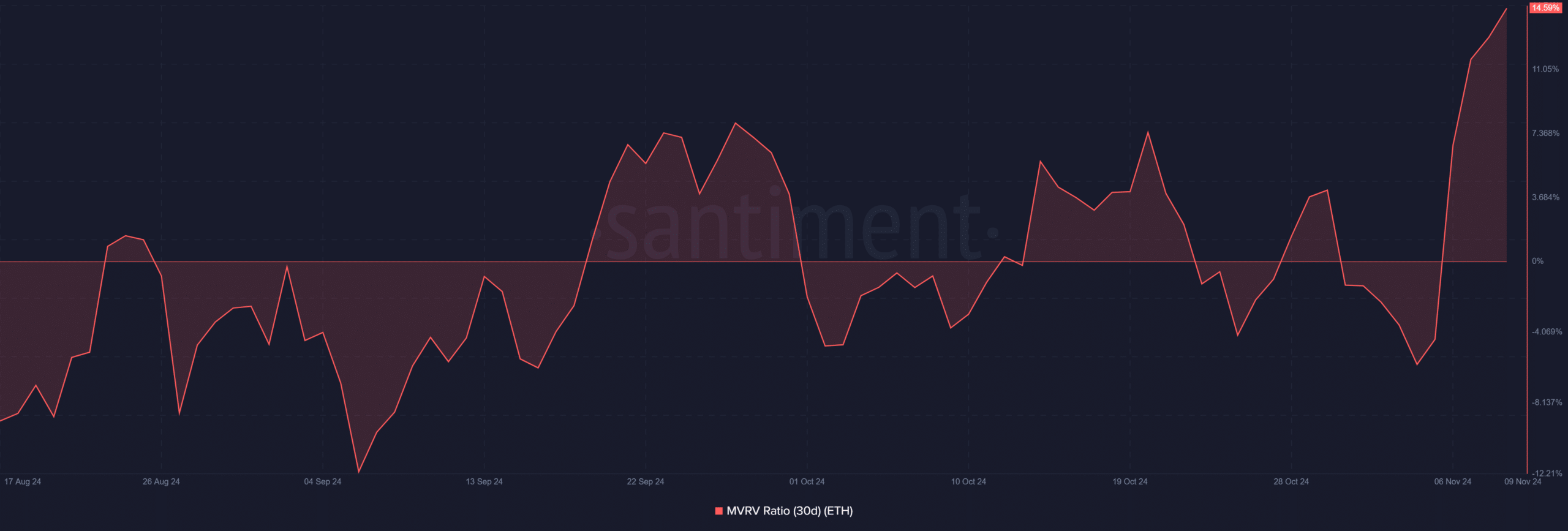

MVRV ratio reveals rising profitability amongst holders

The 30-day Market Worth to Realized Worth (MVRV) ratio for Ethereum indicated that many holders are in revenue as ETH trades above $3,000.

A rising MVRV ratio steered that profit-taking might quickly start, which could introduce promoting strain.

On the time of writing, the MVRV was nearly at 15.6%, the very best since Could.

Moreover, evaluation from IntoTheBlock confirmed that 2.86 million addresses purchased ETH across the present value. This makes the present stage very vital, as an increase past it might set off an ATH.

– Is your portfolio inexperienced? Try the Ethereum Profit Calculator

If the MVRV ratio continues to climb, extra holders will likely be in worthwhile positions, and the market might see pure corrections.

With rising institutional curiosity, Ethereum’s new assist stage may very well be close to the $3,000 mark, lowering the influence of minor sell-offs.