- Ethereum rocketed previous the $2.8k resistance to succeed in $3.4k inside every week

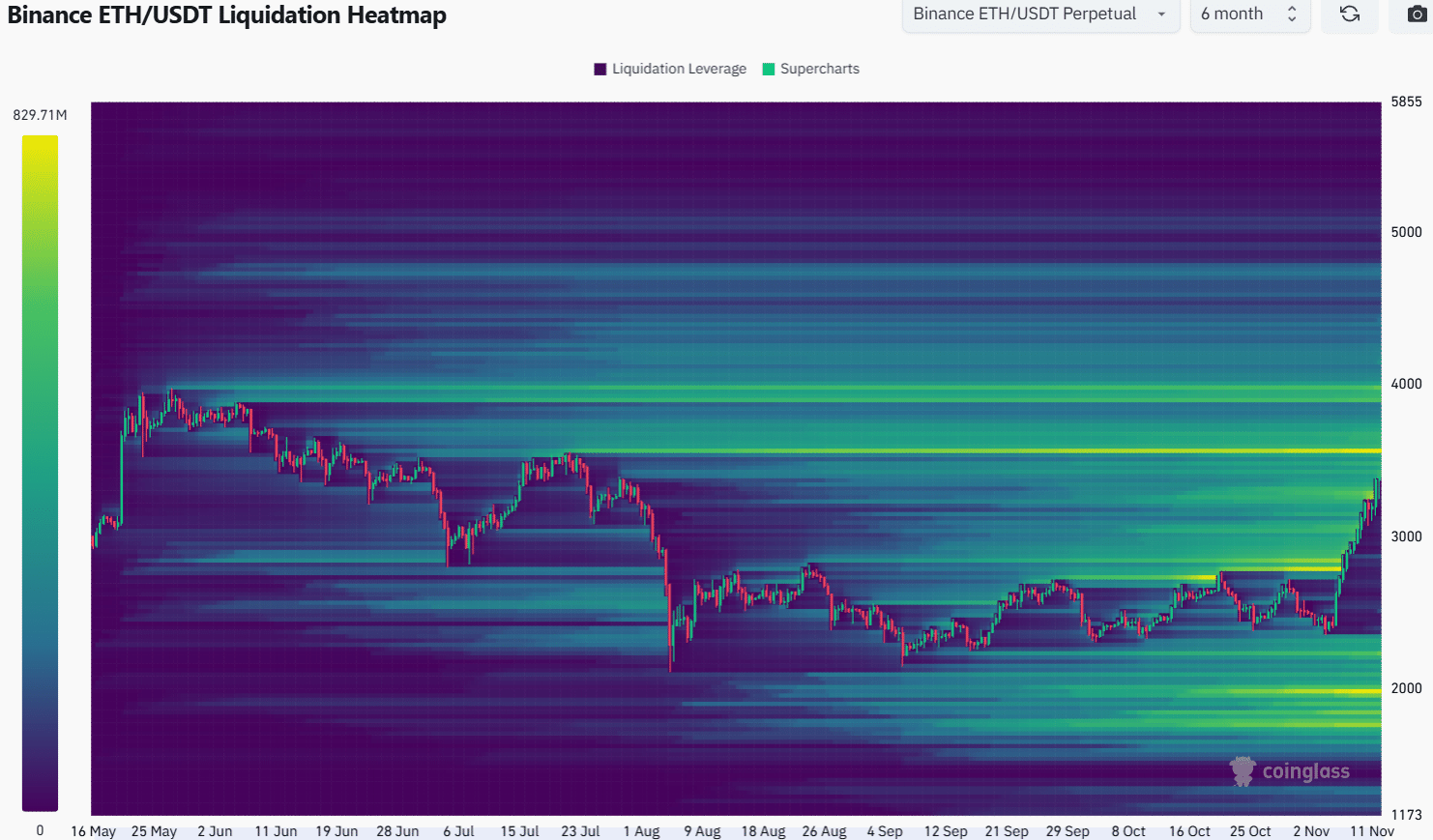

- The liquidation ranges increase at and under $4k have been cheap targets for ETH costs

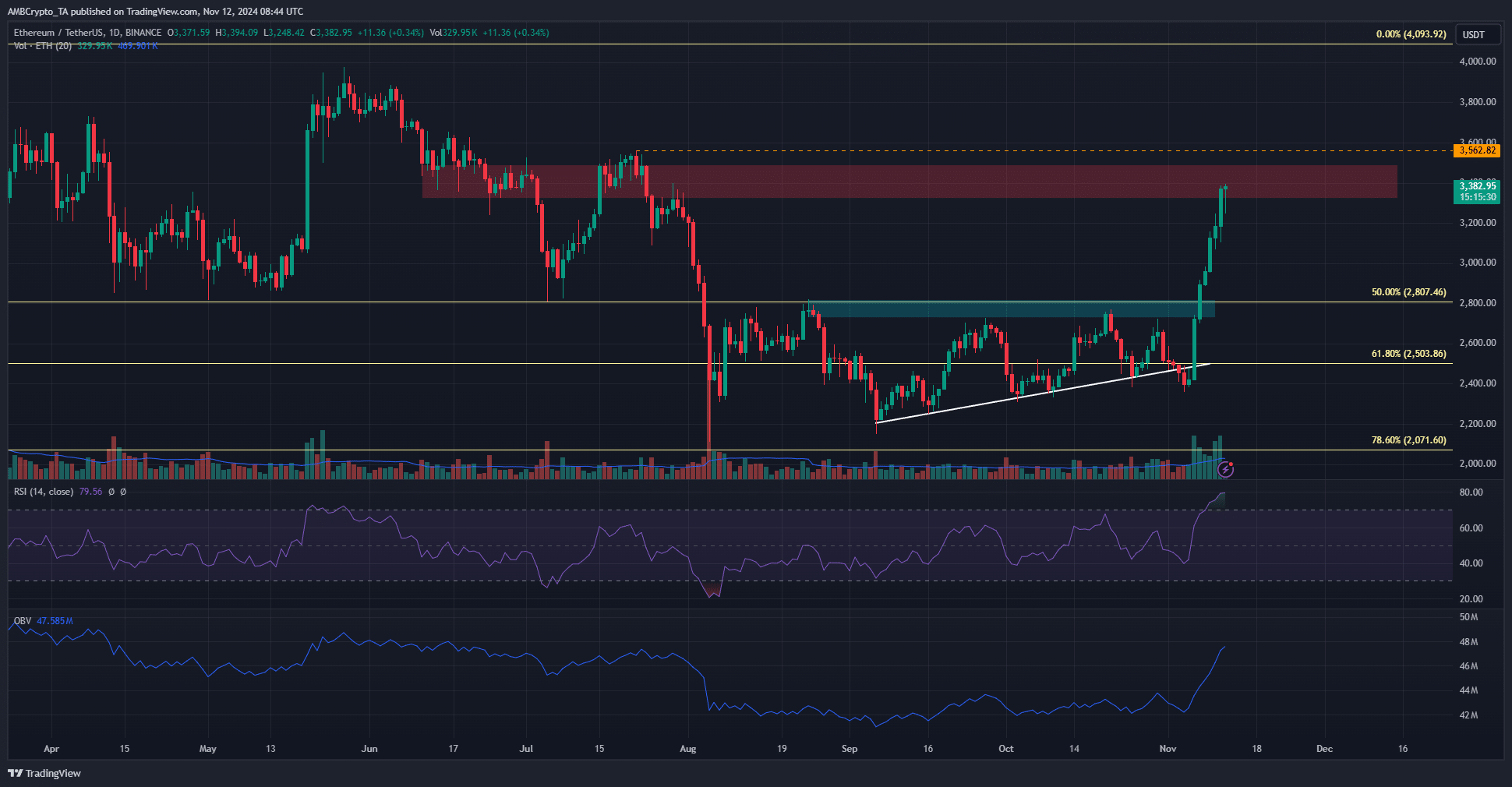

Ethereum [ETH] bulls have handed the $3,200 test and focused the $3.5k and $4k psychological ranges. AMBCrypto’s technical evaluation confirmed that the $3,562 space might be key to the subsequent impulse transfer.

The elevated community exercise and excessive transaction volume highlighted demand for the community. The Ethereum value prediction is strongly bullish on the upper timeframes after the current rally.

The significance of $3,562 on the upper timeframes

Per week in the past, Ethereum appeared to interrupt down beneath the ascending triangle sample. This was a bearish signal, however the value was fast to reverse, and has had 43.1% positive factors since final Tuesday.

This confirmed that the breakdown was a pretend transfer, and studying the previous two months as a variety formation would have been extra correct.

The OBV surged previous three-month highs and was close to the degrees from June. The RSI was at 79.5 to indicate intense bullish momentum.

ETH might require just a few days to consolidate, particularly because it encountered resistance from June and July.

On the weekly timeframe, the $3,562 was the decrease excessive that heralded the downtrend after July. A transfer past this degree would make $4k the subsequent value goal for ETH.

Additional positive factors extremely possible for Ethereum

Supply: Coinglass

AMBCrypto analyzed the six-month look-back interval liquidation heatmap and located that there have been bands of liquidity that reached as much as the $4k mark.

Learn Ethereum’s [ETH] Price Prediction 2024-25

Of explicit significance have been the July highs at $3,562- vital on the weekly chart in addition to being a concentrated liquidity pool.

The sparsity of liquidation ranges to the south recommended that, within the coming days and weeks, Ethereum is more likely to be drawn upward. Merchants ought to be careful for volatility on the decrease timeframes.

Disclaimer: The knowledge introduced doesn’t represent monetary, funding, buying and selling, or different forms of recommendation and is solely the author’s opinion