- Ethereum sees a 20% value improve pushed by whale accumulation and trade outflows.

- Whale exercise suggests rising bullish sentiment and decreased provide on exchanges.

Ethereum [ETH] has surged by 20% over the previous week, fueled by vital outflows from exchanges and rising whale accumulation, reflecting rising confidence within the asset.

Regardless of the bullish momentum, current minor corrections have put ETH at a vital juncture, testing key help and resistance ranges. Because the market waits for readability, these ranges will play a vital position in figuring out the subsequent path for Ethereum’s value.

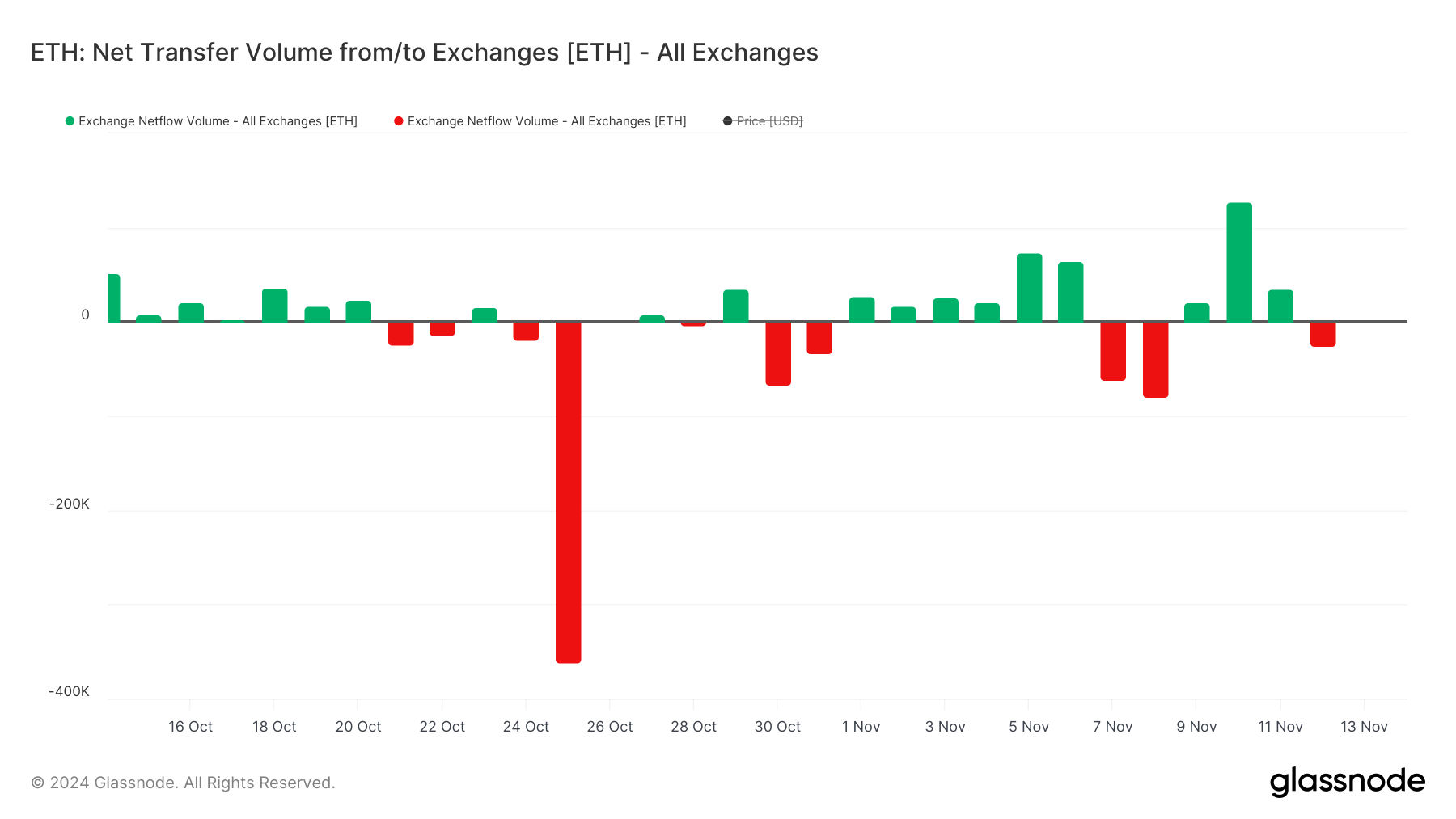

Ethereum trade flows

Ethereum noticed vital outflows round twenty sixth October, with large-scale withdrawals from exchanges signaling elevated confidence amongst holders.

These outflows have dominated the development, particularly over the previous week, aligning with ETH’s value rally as whales accumulate and scale back provide on exchanges.

Whereas minor inflows across the seventh and tenth of November recommend some profit-taking, the general sentiment stays bullish. Nevertheless, any sustained shift in direction of inflows may problem ETH’s help ranges, introducing potential volatility.

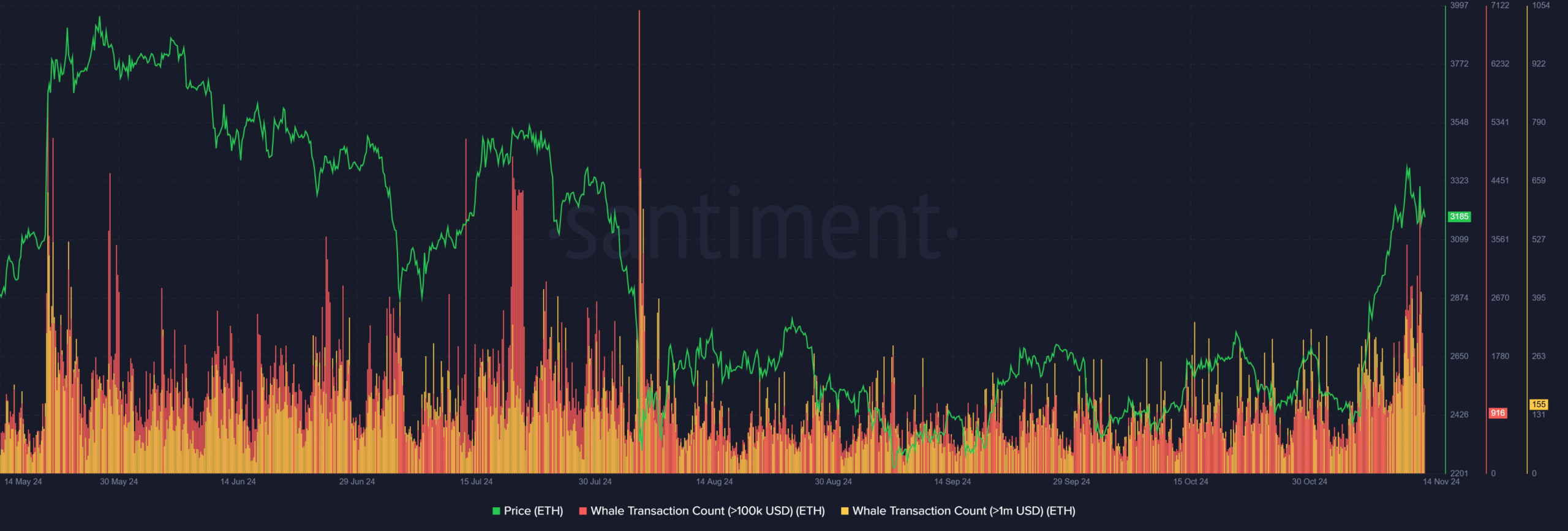

Whale exercise driving ETH’s bullish momentum

Whale transactions surged in late October and early November, correlating with ETH’s 20% value rally, suggesting that enormous holders have been pivotal in pushing costs larger.

Traditionally, spikes in whale exercise usually precede main value actions, reinforcing the concept whales are each an indicator and a catalyst for ETH’s value motion.

Nevertheless, as ETH reaches vital resistance ranges, whale transactions have tapered off, probably signaling profit-taking or warning at elevated costs.

Continued whale engagement can be essential in sustaining upward momentum. A sustained decline in whale exercise may point out a possible correction or elevated volatility.

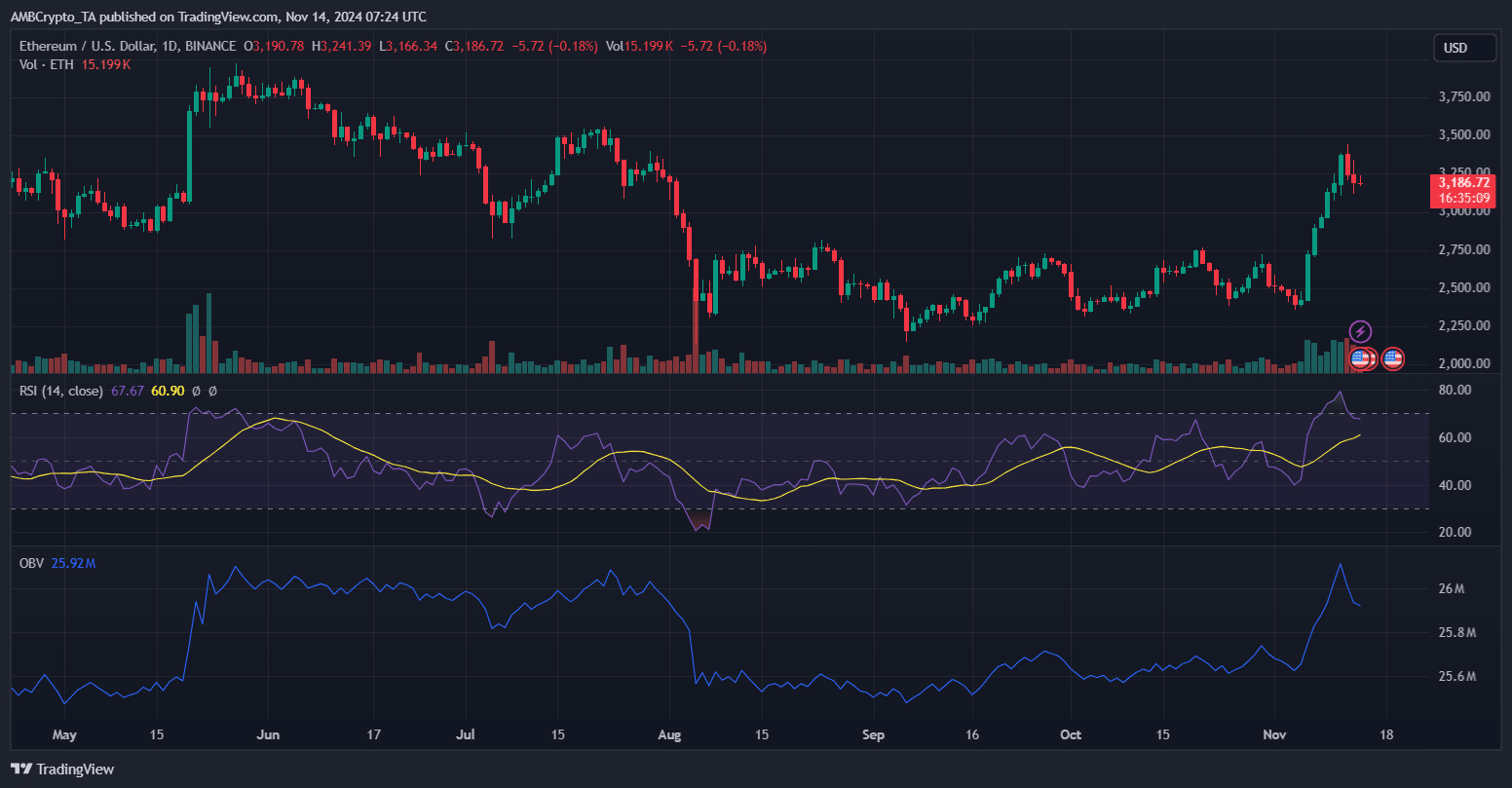

Ethereum’s path to an ATH

Ethereum’s current rally and robust whale accumulation elevate the potential of revisiting or surpassing its ATH. The RSI at 67 indicators bullish momentum with out being overbought, suggesting room for additional progress.

In the meantime, the OBV exhibits robust shopping for strain, indicating sustained demand.

Learn Ethereum’s [ETH] Price Prediction 2024–2025

ETH stays above key EMA strains, with $3,500 because the speedy resistance degree – breaking it may result in a transfer towards $3,700, with $4,000 as the subsequent goal.

Minor corrections mirror profit-taking, however ETH’s resilience and whale exercise recommend a possible push for a brand new ATH, supplied help holds above $3,000.