- Cumulative inflows into Ethereum ETFs turned optimistic for the primary time since July.

- Blackrock’s ETHA ranked as one of many prime ETF launches this yr.

On the twelfth of November, Ethereum [ETH] ETFs broke new floor, lastly tipping whole web flows into optimistic territory—for the primary time since their launch.

Data from SoSo Worth revealed a day by day web influx of $135.92 million, pushing cumulative inflows to $94.62 million.

Buying and selling exercise additionally ramped up, with a complete worth of $582.18 million traded and whole web belongings climbing to $9.67 billion.

Of the 9 ETFs, 5 noticed inflows. In the meantime, solely Grayscale Ethereum Belief [ETHE] recorded outflows, with the remaining funds displaying no new inflows.

Execs weigh in

The most recent growth caught the eye of business leaders on X (previously twitter).

Nate Geraci, President of the ETF Retailer, highlighted the online optimistic flows mark a major milestone for ETH ETFs given they’ve,

“Overcome $3.2bil in outflows from ETHE.”

Moreover, Geraci pointed out that 19 of the highest 50 ETF launches this yr are linked to Bitcoin [BTC], ETH, or MicroStrategy, with 12 among the many prime 18—a formidable work out of 610 whole launches.

Moreover, iShares’ Ethereum Belief [ETHA] ranked because the sixth prime ETF launch of 2024

Bankless co-founder Ryan Sean Adams additionally commented on the event. He famous that ETHE’s dominant outflows primarily offset any upward strain from ETFs.

Nonetheless, as inflows flip optimistic for the primary time, this may sign a shift.

Adams even forecasted that this shift is a

“Recipe for an ETH rocket to $10k.”

Ethereum ETFs hit file inflows

This newest milestone comes a day after the ETFs skilled a record-breaking day on eleventh November, registering $295 million in inflows.

This inflow, led by business giants like Constancy and BlackRock, marked practically triple the earlier peak of $106.6 million recorded on launch day.

Eric Balchunas, Bloomberg’s senior ETF analyst, noted on X that ETFs had been,

“Trending in proper path.”

The analyst additional anticipated a optimistic development for the ETFs, stating,

“Sunny days forward, though nonetheless a number of nation miles behind BTC ETFs.”

How are BTC ETFs doing?

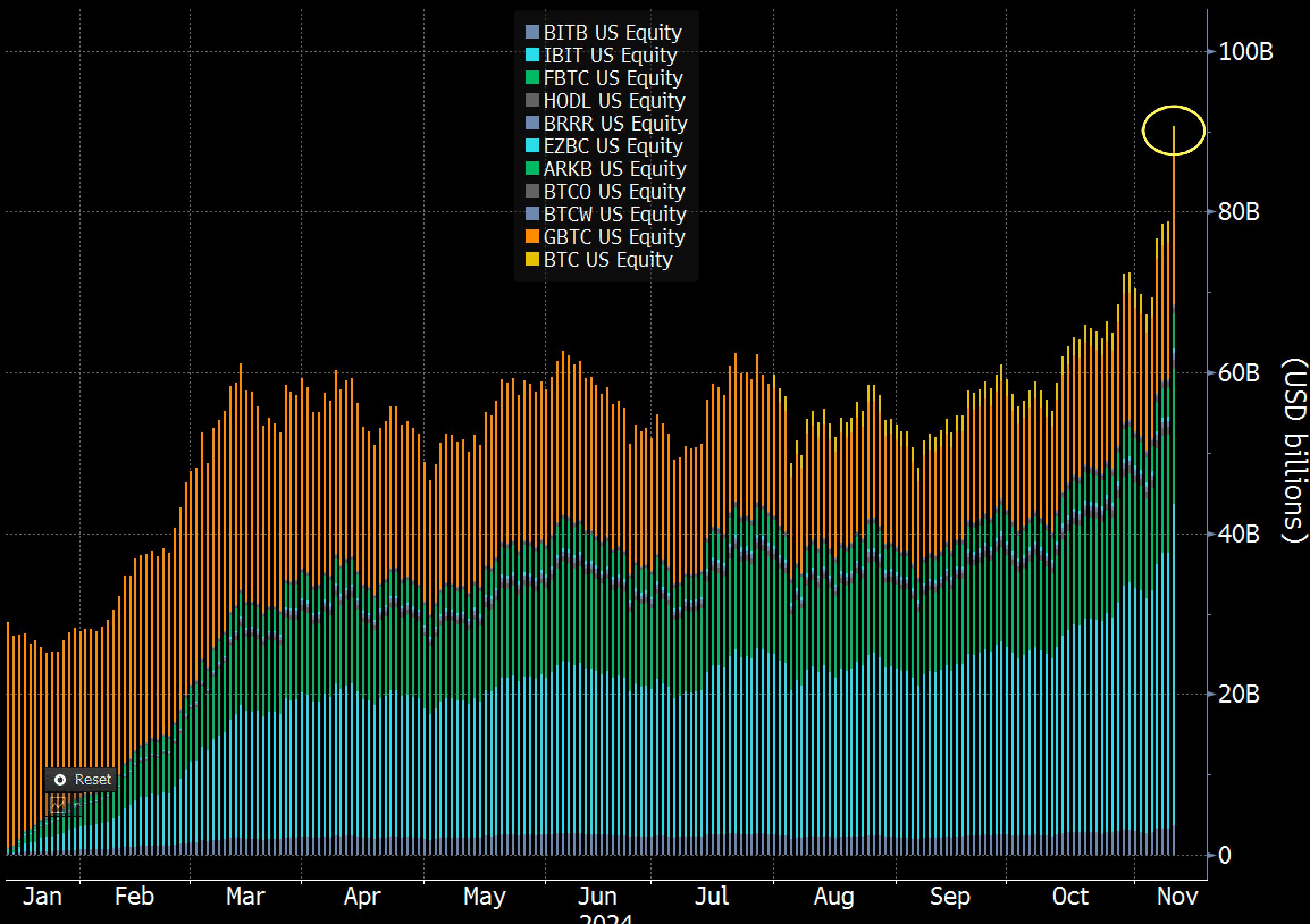

In the meantime, BTC ETFs additionally hit a file of their very own. Balchunas revealed on X that Bitcoin ETFs crossed the $90 billion mark in belongings beneath administration, following a considerable $6 billion enhance.

This comprised $1 billion in new inflows and $5 billion in market appreciation. This surge means that Bitcoin ETFs had been now 72% of the best way towards surpassing gold ETFs in whole belongings.

In an extra signal of demand, IBIT reached $1 billion in buying and selling quantity inside simply 25 minutes—sooner than the day gone by, when it went on to interrupt an all-time file.

Balchunas described the sustained curiosity in BTC ETFs as a “feeding frenzy” that reveals no indicators of slowing down.