- Bitcoin stays caught beneath $100K, regardless of 81% odds of reaching it.

- Bears have proven that hitting this milestone gained’t be straightforward—endurance might be examined.

Bitcoin [BTC] traders have endured a rollercoaster week, with excessive hopes for the cryptocurrency’s historic $100K milestone. Regardless of high analysts assigning an 81% likelihood of BTC reaching this goal, the weekend ended with out the anticipated breakthrough, maintaining the market on edge.

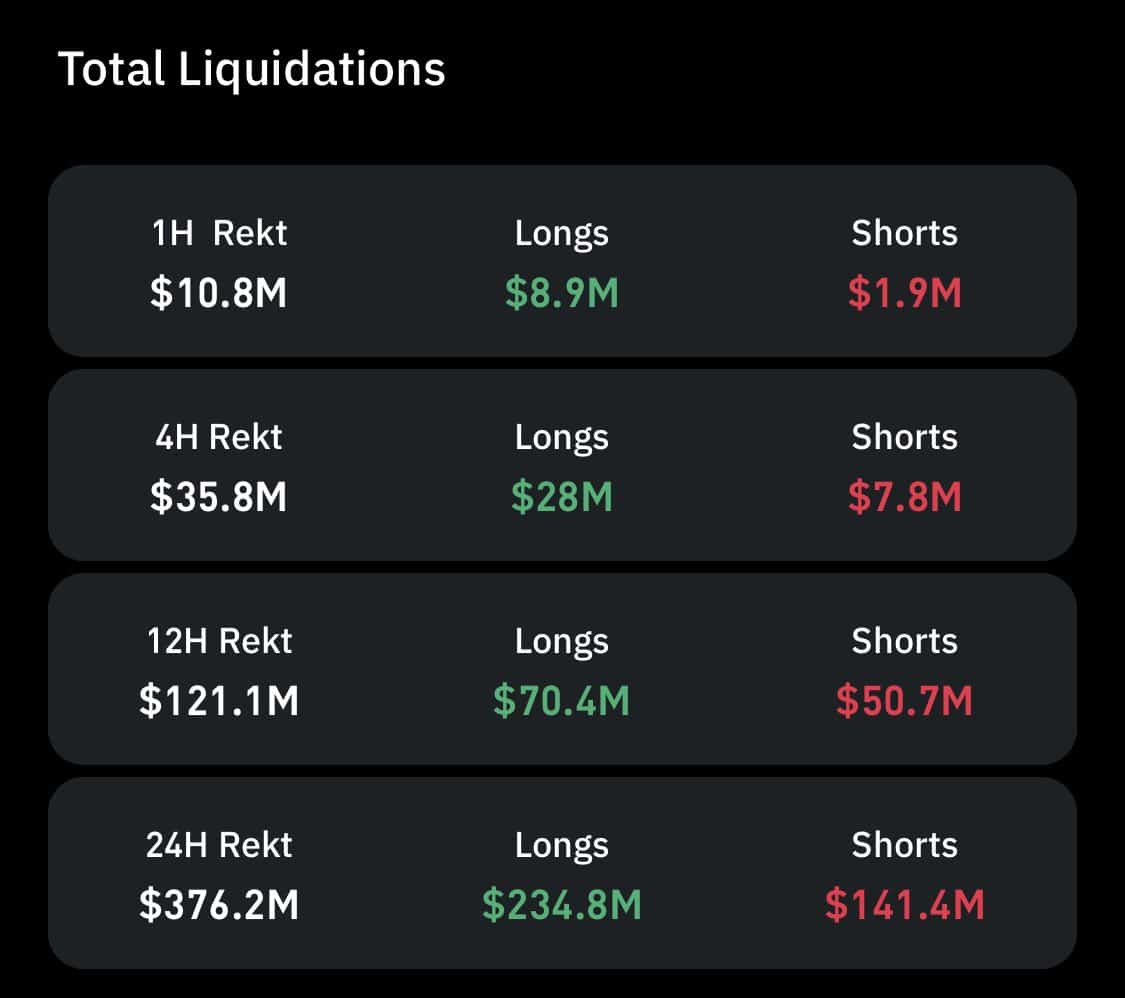

The final 24 hours have solely added to the drama. A staggering 160,527 merchants had been liquidated, amounting to $376.22 million in losses, as risky worth actions disrupted each lengthy and quick positions.

This surge in liquidations highlights the extreme volatility gripping the spinoff market. Is that this a warning signal of a bigger market shift on the horizon?

Lengthy-squeeze triggered as bears’ technique performs out

Present lengthy/quick ratios reveal a bearish tilt, with merchants closely shorting Bitcoin.

This imbalance comes with a warning: extreme leverage within the derivatives market may spark sudden corrections or perhaps a lengthy squeeze – a hidden catalyst which may be driving Bitcoin’s current reversal.

Prior to now 24 hours, over $234 million in lengthy positions had been liquidated – a staggering 65.96% improve in comparison with $141 million briefly liquidations.

This stark disparity underscores the volatility in play as “longs” (bets on worth will increase) had been pressured to shut positions following Bitcoin’s dip from its all-time excessive of $99,317 simply two days in the past.

In easy phrases, as Bitcoin skilled a minor downturn, merchants exited their positions to reduce losses – a rational transfer given the excessive stakes at present worth ranges. Bears seized this chance, seemingly triggering a cascade of lengthy liquidations.

This aligns with the present bull cycle, the place, regardless of fast good points, BTC has prevented overheating hypothesis because of the dominance of lengthy positions.

Nonetheless, even a minor deviation from the bullish path supplied a gap for bears to exert stress. The end result? An extended squeeze that pressured merchants to liquidate their positions, triggering a close to 2% slide in Bitcoin’s worth.

Whereas a breakthrough to $100K may nonetheless materialize, the volatility available in the market is turning into more and more evident.

As BTC nears a historic milestone, traders are adjusting their portfolios – both shifting consideration to different high-cap property or cashing out with spectacular good points.

If this pattern continues, each time BTC posts a brand new ATH, bears are prone to capitalize on the ensuing volatility, triggering lengthy squeezes. This might push BTC into a chronic loop except an exterior catalyst disrupts this sample and sparks a breakout.

The $100K dream might be on maintain for now

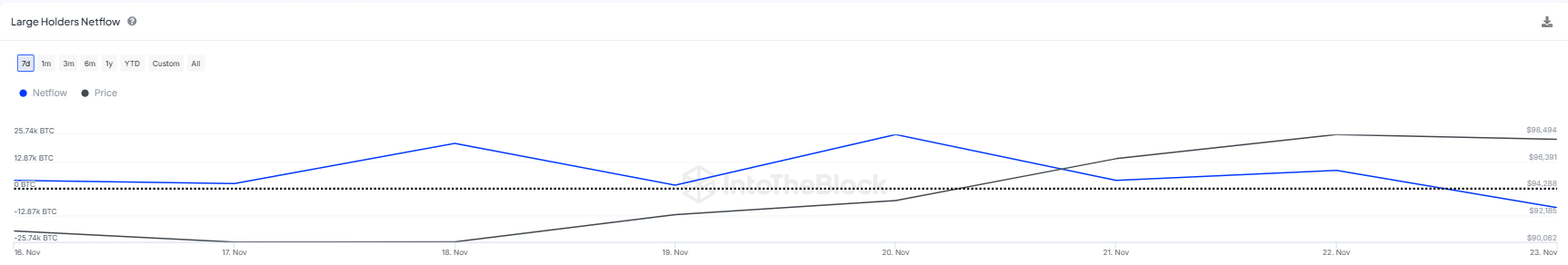

Curiously, prior to now two days, whales have deposited roughly 10K Bitcoins at a worth of $98,121, amounting to a big complete of round $981 million.

Extra notably, this reinforces AMBCrypto’s earlier evaluation, highlighting how bears capitalized on the seismic shift as whales offloaded their holdings.

The maneuver triggered a worth dip, which allowed short-sellers to grab management. This pressured lengthy positions to liquidate in an effort to reduce danger.

Learn Bitcoin’s [BTC] Price Prediction 2024-25

Thus, whereas anticipation for the $100K milestone is constructing, it gained’t be an easy journey.

Every time Bitcoin nears that worth goal, a wave of exits – from giant HODLers, swing merchants, or miners – creates the right atmosphere for bears to take cost. This cycle traps Bitcoin in an ongoing loop, stopping a clean ascent to its historic milestone.