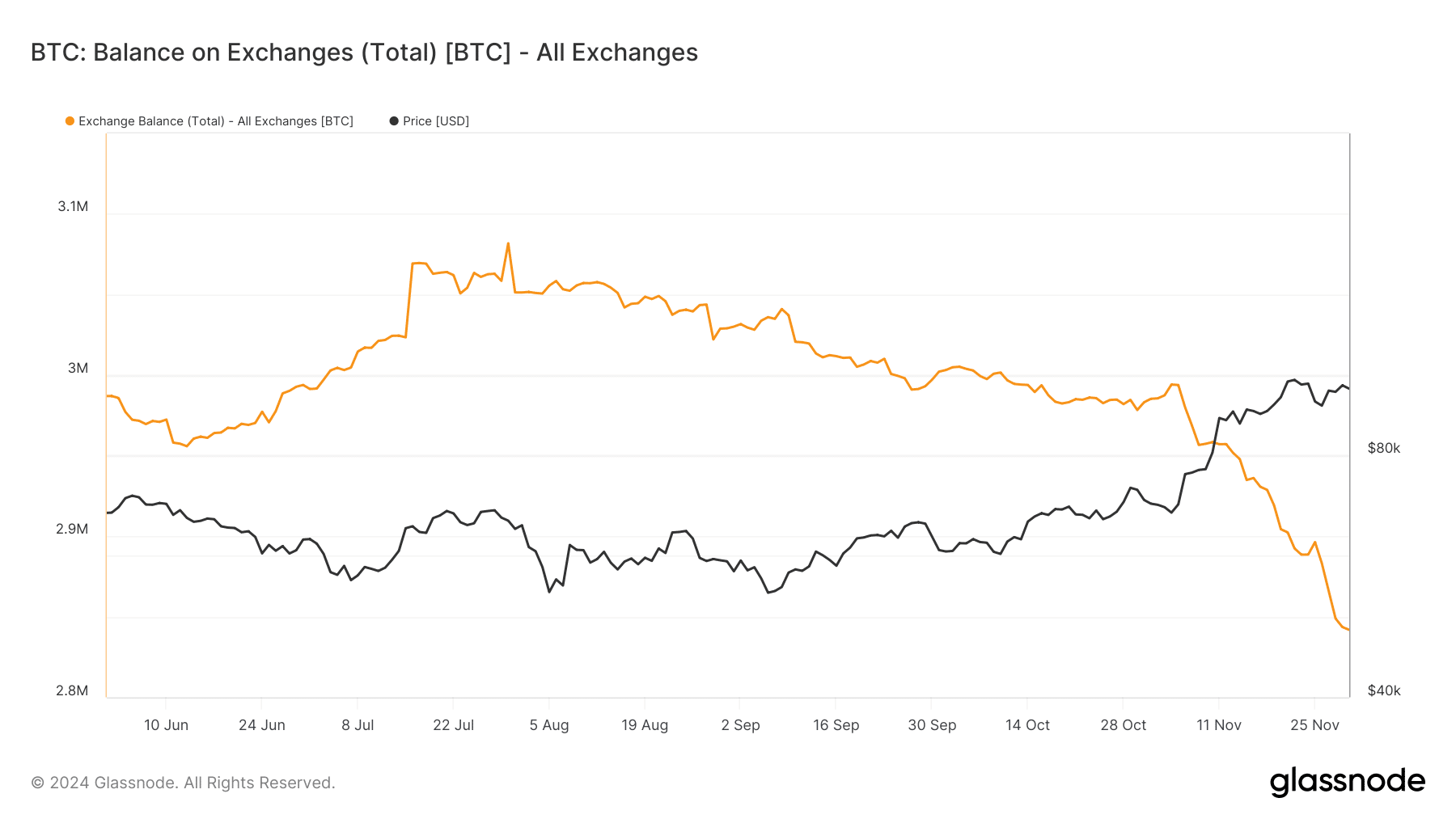

- Over 55,000 BTC have been withdrawn from exchanges in 72 hours, highlighting robust accumulation and demand.

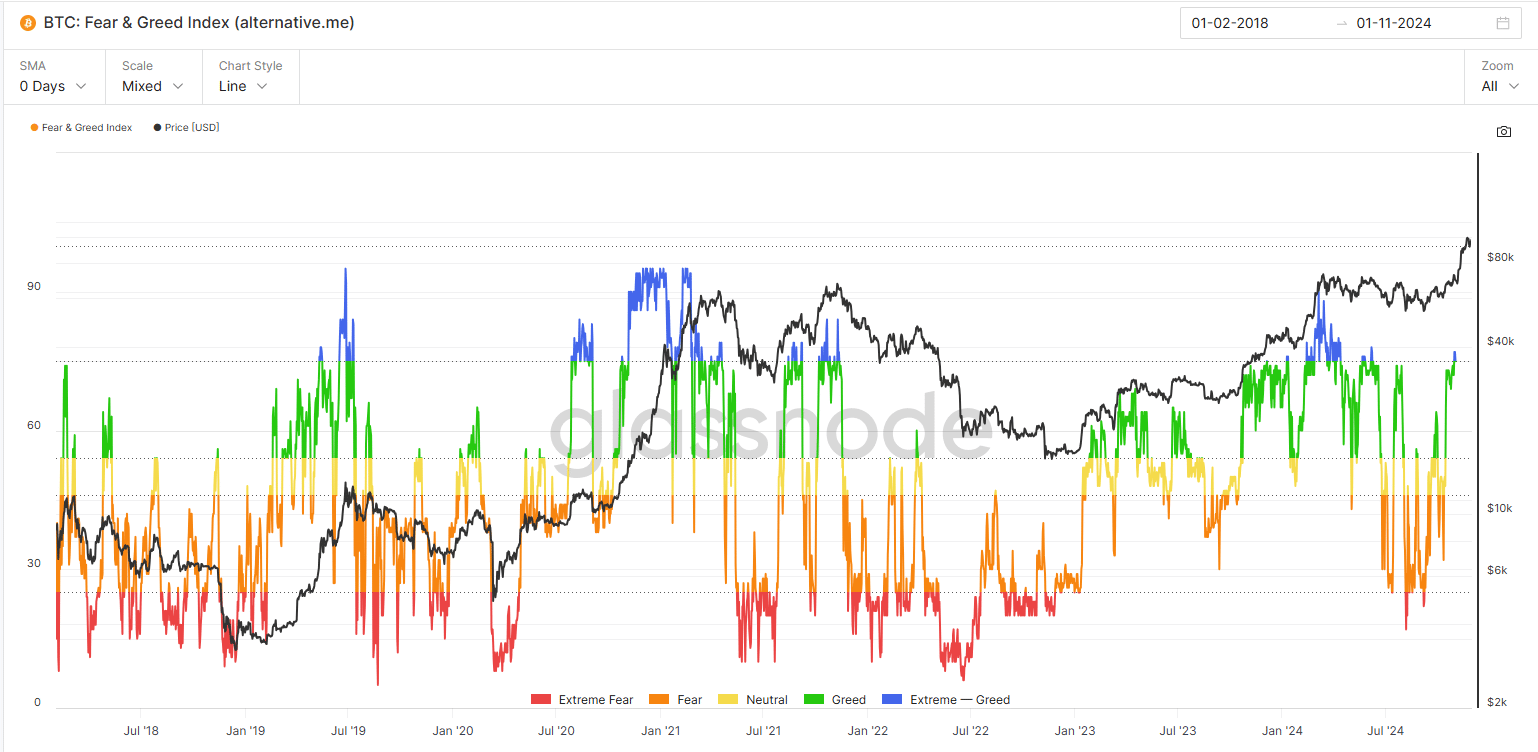

- Bitcoin’s “excessive greed” indicators warning, as historical past reveals excessive danger of market corrections

Bitcoin [BTC] has as soon as once more captured the market’s consideration with a colossal withdrawal of over 55,000 BTC from exchanges in simply 72 hours — a transfer valued at $5.34 billion.

This exodus, mixed with the Concern & Greed Index now registering “excessive greed,” has ignited hypothesis about its subsequent main transfer.

The sentiment mirrors circumstances seen throughout Bitcoin’s historic bull run, when euphoric optimism propelled the worth from $15,000 to $57,000 between 2020-21.

Because the market grapples with this unprecedented exercise, buyers are left to surprise: Are we on the point of one other explosive rally, or is a pointy correction looming?

The Bitcoin exodus

The sharp drop in Bitcoin’s alternate steadiness, now underneath 2.8M BTC for the primary time since 2018, displays strategic strikes by buyers.

This 55,000 BTC exodus aligns with heightened on-chain exercise, suggesting important accumulation. The motion coincides with elevated demand for self-custody as confidence in centralized platforms wanes.

Moreover, the rising value pattern highlights a possible provide squeeze. Traditionally, such withdrawals have preceded bull runs, lowering speedy promote stress on exchanges whereas signaling a long-term holding technique.

Driving the wave of “Excessive Greed”

The Bitcoin Fear & Greed Index has surged into “excessive greed” territory, reflecting heightened optimism amongst buyers.

Sitting above 80 at press time, a degree not seen for the reason that 2021 bull run, this sentiment suggests a possible rally but in addition indicators warning.

Traditionally, excessive greed has pushed parabolic value actions, such because the climb from $15,000 to $57,000 in 2020-21.

Nonetheless, these durations typically precede volatility, as exuberant sentiment will increase the chance of overleveraged positions and abrupt corrections.

With Bitcoin breaking previous $99,000 in November, the market is getting into uncharted territory. Trade reserves have plunged to multi-year lows, signaling a provide squeeze as long-term holders dominate.

Nonetheless, the mix of maximum sentiment and overheated circumstances warns of potential retracements — like the newest value correction within the final week.

Bitcoin’s milestone displays robust bullish momentum however underscores the delicate steadiness between euphoria and warning as buyers weigh earnings towards additional upside potential.

Catalysts, sustainability, and dangers

Bitcoin’s latest rally is a results of a trio of things: a tightening provide as alternate reserves fall beneath 2.8M BTC, elevated institutional participation, and macroeconomic uncertainty driving demand for digital property.

The continued provide squeeze, coupled with the surge in long-term holder exercise, gives a robust basis for sustained upward momentum.

Nonetheless, dangers loom massive. The “excessive greed” sentiment heightens the likelihood of leveraged liquidations, which might set off sharp corrections.

Learn Bitcoin’s [BTC] Price Prediction 2024–2025

Moreover, Bitcoin’s unprecedented progress amplifies speculative exercise, making it inclined to profit-taking.

Sustaining the rally is determined by continued institutional inflows, secure macro circumstances, and the flexibility to navigate risky sentiment shifts with out destabilizing the market.