- ARB may rally by 125% – 200% amid key bullish catalysts

- ETH’s worth may additional assist the token’s prospects from January 2025

In line with analysts, Arbitrum [ARB] could also be comparatively undervalued and will supply further 125% good points if it soars to its 2024 highs.

In a latest post, Andrew Kang of crypto VC Mechanism Capital famous that ARB has been ‘essentially’ undervalued in opposition to different altcoins.

“$ARB has had an awesome rally however continues to be essentially undervalued. Trades at a fraction of Sui, AVAX, Tron, and so on, however has them beat on quantity and TVL by multiples.”

ARB’s key catalysts

Kang added that the altcoin has seen huge institutional curiosity and Ethereum’s interoperability analysis. These, in response to him, have been bullish catalysts for the worth.

For his half, Blockworks Analysis’s Ryan Connor views Arbitrum’s Timeboost, a brand new precedence transaction ordering system, as one other key catalyst. The analysis agency said that Timeboost would drive extra exercise on Arbitrum, claiming that the market has been mis-pricing ARB.

So, how far can ARB’s worth go from right here?

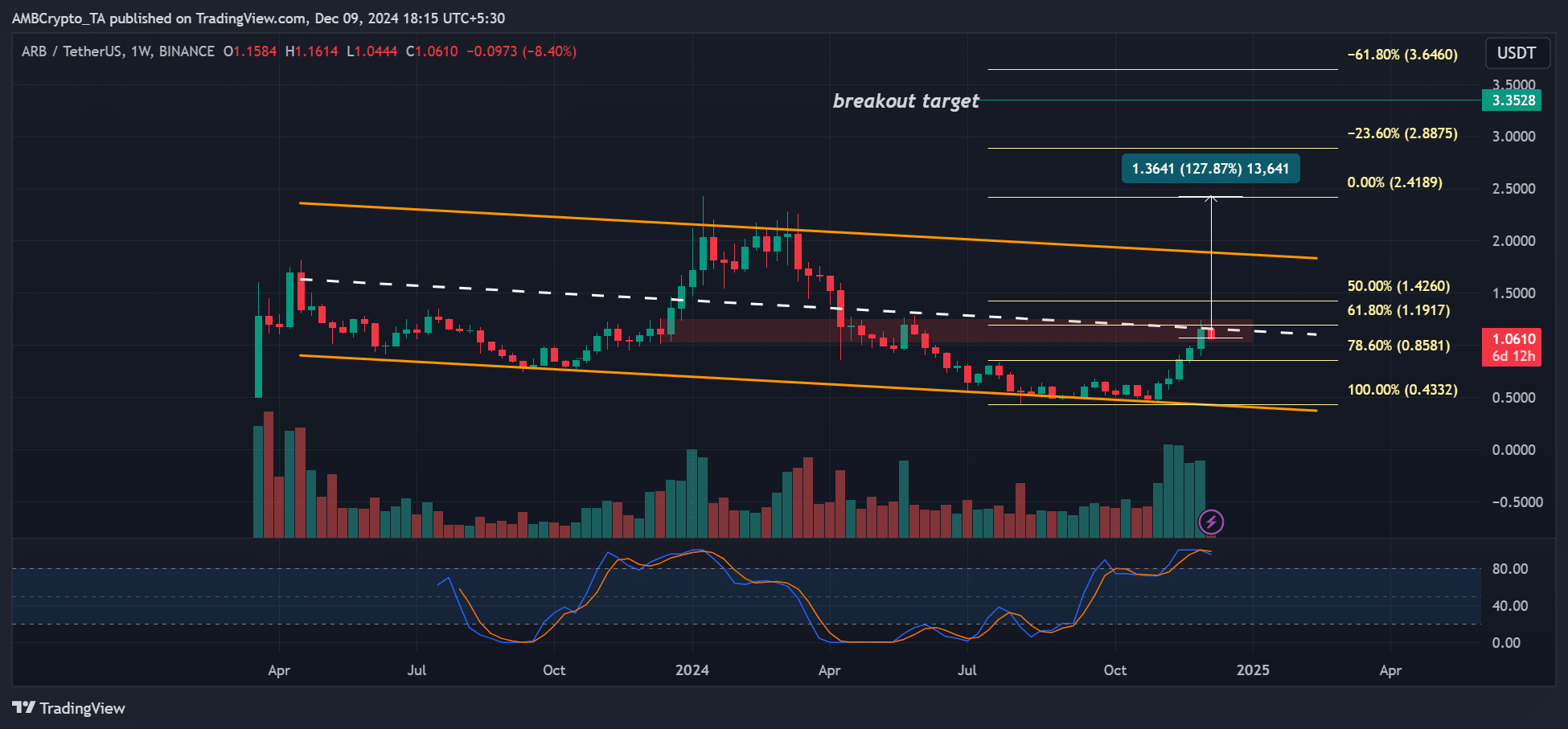

On the weekly charts, the medium-term goal could be the higher channel ($1.9) – An 80% potential acquire if hit. An extension to its 2024 excessive of $2.4 would increase the potential rally to 127%.

That’s a conservative worth goal. If the breakout from the descending channel follows textbook eventualities, the bullish goal could be $3.35. That’s a whopping 213% acquire from its present $1 worth – A possible 3x transfer.

On the time of writing, ARB was at a key roadblock on the channel’s median degree. A decisive transfer above $1.2 may speed up the chances of hitting the higher channel and a doable breakout.

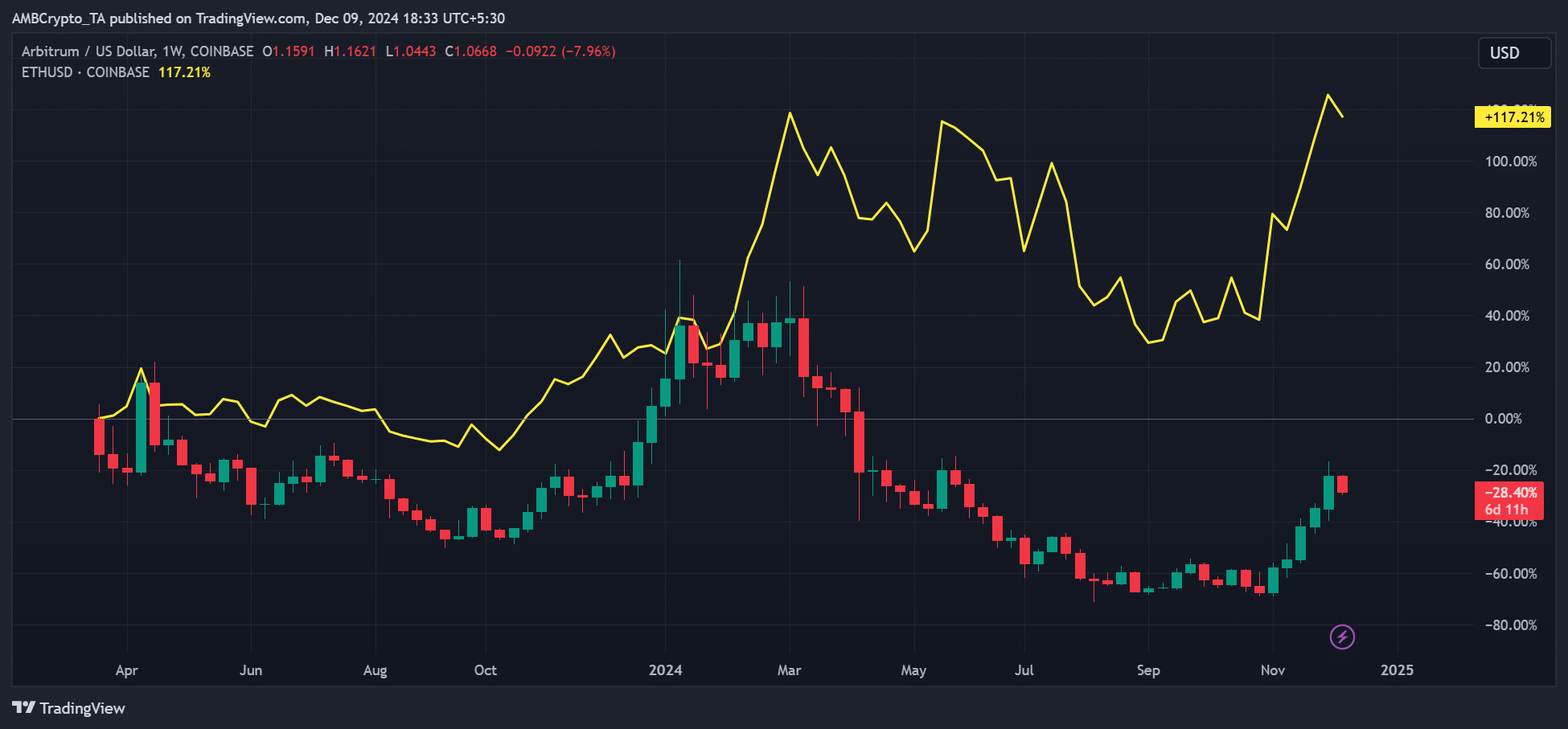

Maybe the long-term influence can be ETH’s worth route and regulatory shift. The ETH L2 phase lagged behind different sectors due to unclear DeFi regulation. This may be anticipated to alter underneath the Trump 2.0 administration.

Final week’s nomination of pro-crypto Paul Atkins as SEC Chair tipped ETH to faucet $4k. ARB additionally climbed increased, a optimistic correlation, underscoring ETH’s affect on ARB and your complete L2 phase.

So, how may ETH’s price outlook assist ARB? Most analysts foresee ETH hitting a brand new all-time excessive (ATH) by January 2025. In actual fact, in its newest market replace, QCP Capital famous,

“Traditionally, ETH doesn’t often put in a brand new all-time excessive till January of the post-halving 12 months. This sentiment can also be mirrored within the choices market, the place ETH threat reversals are skewed towards calls solely from January onwards.”

In brief, robust ETH momentum from January 2025 may raise ARB even increased.

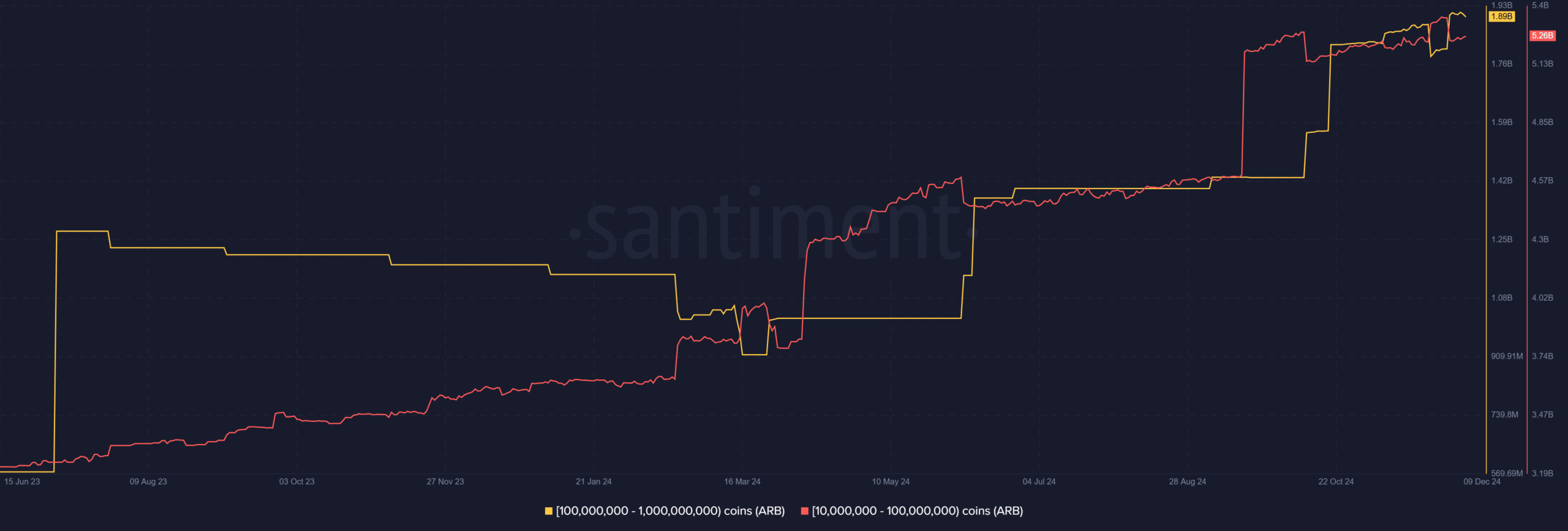

Apparently, the motion of high whale wallets additionally anticipated an additional rally for ARB. Since September, high whales have elevated ARB holdings from 6 billion to 7.15 billion tokens (value $7.15B).

The aforementioned observations, collectively, pointed in the direction of a bullish consequence for ARB with potential +200% good points from January 2025.

Nonetheless, ETH may decide the altcoin’s route. So, any weak sentiment on the king altcoin may have an effect on ARB’s bullish projections.

Disclaimer: The knowledge offered doesn’t represent monetary, funding, buying and selling, or different sorts of recommendation and is solely the author’s opinion