- Professional-crypto U.S President Donald Trump might fan the bullish crypto flames as soon as in workplace

- Dogecoin can be extremely more likely to profit enormously and might be aided by Elon Musk

On the time of writing, Bitcoin [BTC] was buying and selling close to the $100k-mark after robust good points over the previous six weeks. This impulse transfer larger started after the U.S presidential elections outcomes had been known as on 5 November.

With regulatory readability already benefiting crypto, reminiscent of with Ripple’s stablecoin RLUSD, different crypto belongings are set to profit too. Which of them could be the most important winners from a Trump presidency?

Bitcoin strategic reserve for america?

On Thursday, President-elect Donald Trump responded to a query relating to a possible Bitcoin reserve. He stated to Jim Cramer, “We’re gonna do one thing nice with crypto,” talking from the New York Inventory Change.

Throughout his earlier presidency, Trump had pointed to rising inventory costs and asserted that the market was robust and America was turning into nice once more. Within the coming months and years, he would possibly use Bitcoin’s rising prices to make some extent, vindicating his election guarantees associated to crypto.

Considered one of them was a nationwide strategic Bitcoin reserve, with laws launched within the Texas Home of Representatives on 12 December to determine this.

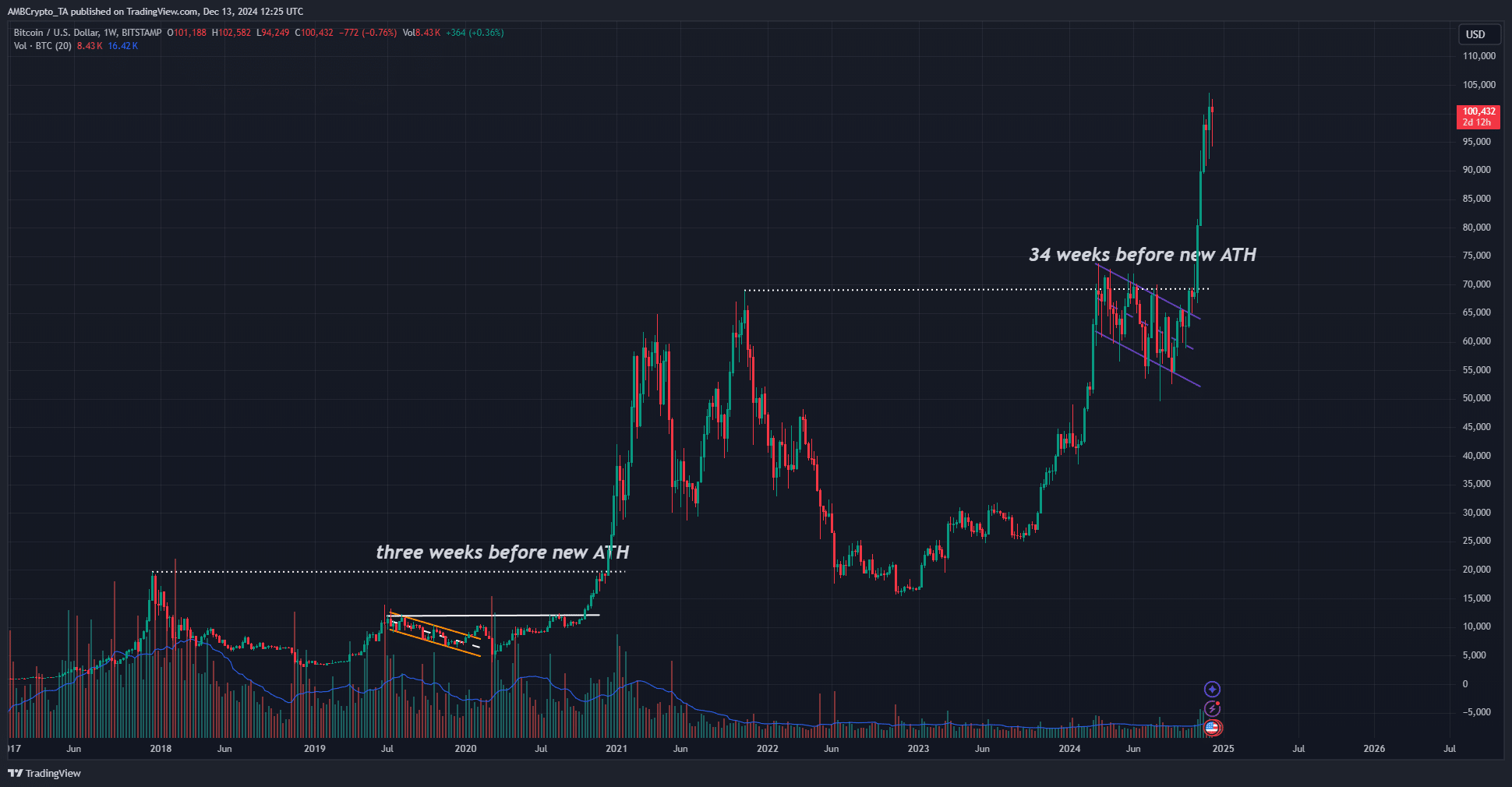

The variations between the earlier cycle’s value motion and this one’s are many. A 34-week consolidation after making a brand new excessive in opposition to USD got here earlier this 12 months, lasting from March to early November. In 2020, BTC confronted resistance at ATH, however blasted previous it in below three weeks.

Thereafter, it went on to make near 400% good points earlier than April 2021. An identical run would take BTC near $300k in April 2025, however we all know that successive cycles take extra time and produce much less share good points.

The earlier ATH being damaged earlier than the BTC halving date arrived has not but occurred. An eight-month consolidation below these highs in a halving 12 months can be a brand new phenomenon. This cycle could be pushed to the seemingly unimaginable $280k-$300k ranges with President Trump on the helm, heralding every new week’s ATH as his victory.

D.O.G.E. co-head Musk might drive the memecoin market

Different influential figures or KOLs might assist drive different sectors of the market larger. Just a few weeks in the past we noticed Murad Mahmudov emerge as a key memecoin KOL, however none would possibly beat the earlier cycle’s prime Dogecoin shill spot. Elon Musk, proprietor of X (previously Twitter) was one of many causes behind the rise of Dogecoin in the course of the earlier cycle.

His huge attain and public notion of technological genius meant individuals put a substantial amount of religion in his phrases. When he shared memes associated to DOGE or information of Tesla accepting Dogecoin as cost, these updates contributed to DOGE’s rise. And but, his affect waned because the cycle matured.

Learn Bitcoin’s [BTC] Price Prediction 2024-25

As co-lead of the Division of Authorities Effectivity or D.O.G.E., any official mentions of the division have the potential to result in Dogecoin pumping.

An instance of this was seen in mid-October– 4 days later, DOGE was up 26%. Though the tweet was not the one purpose (Bitcoin was additionally pumping at the moment), it did elevate the visibility of the preferred memecoin.

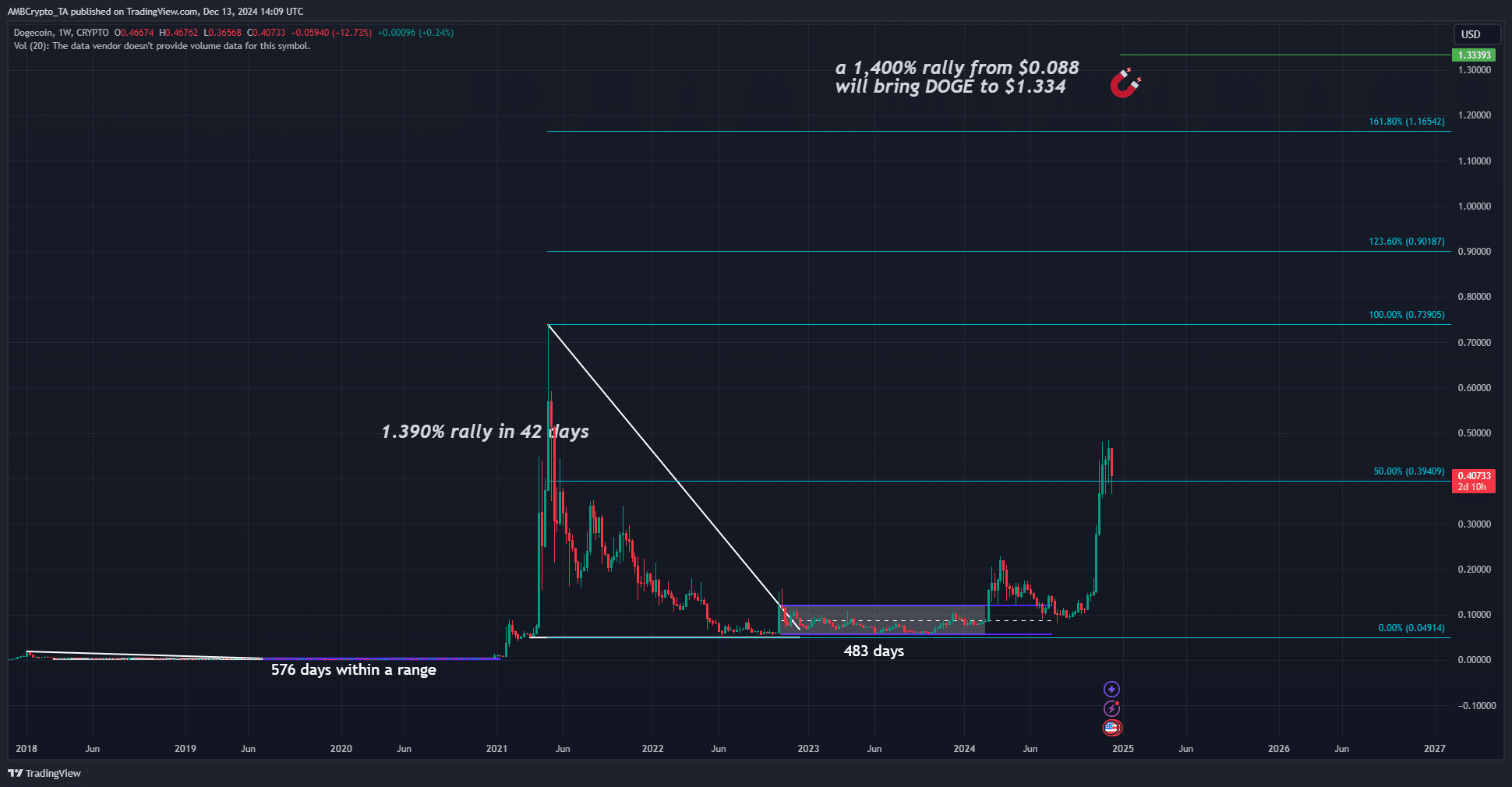

The vary formation after the rallies in the direction of the tip of the earlier cycles was highlighted on the chart, they usually had a comparatively comparable age. The breakout in early 2024 and retracement was a bit just like the February 2021 rally to $0.088. A subsequent 1,400% rally was seen in six weeks too.

Whereas that’s unlikely to repeat, an identical efficiency for Dogecoin within the coming months would take it to $1.334. A respectably bullish goal, however probably too conservative for this run. Musk’s tweets might be a recreation changer, as might the capital rotation from BTC to top-performing altcoins in the direction of the tip of the cycle.