- Ethereum’s promoting strain was dominating on Binance

- ETH has declined over the previous month by 18.61%.

Since hitting a latest excessive of $3746 every week in the past, Ethereum [ETH] has skilled sturdy downward strain.

Over this era, ETH declined to a neighborhood low of $3,157. Though the altcoin has made average good points, it’s nonetheless declining.

On the time of writing, Ethereum was buying and selling at $3,196, marking a 2.17% decline on day by day charts. ETH has additionally dropped by 12.67% on weekly charts and 18.61% on month-to-month charts.

This decline throughout ETH charts is essentially attributed to elevated promoting strain, in line with CryptoQuant.

Ethereum’s promoting strain dominates

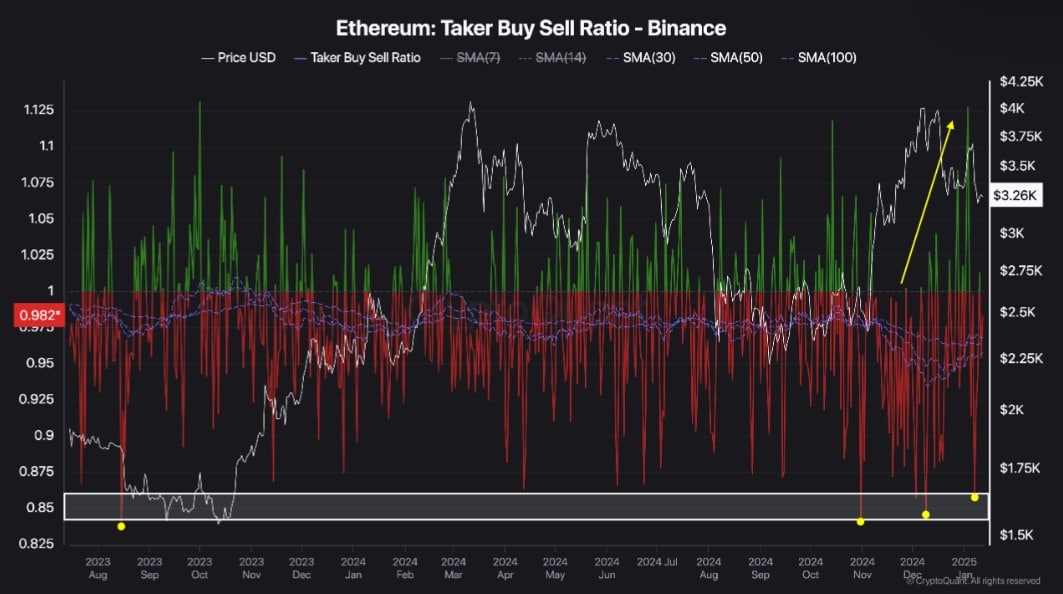

As per CryptoQuant evaluation, ETH is experiencing sturdy promoting strain on Binance. As such, since November 2024, Ethereum has seen appreciable promoting strain on the alternate.

The rising dominant promoting strain on Binance is evidenced by ETH’s Taker Purchase/Promote Ratio. This metric has remained adverse since November 2024, indicating the next quantity of promote orders in contrast to purchase orders.

Throughout this era, the Taker Purchase/Promote Ratio has dropped to ranges not seen since August 2023, reflecting the prevailing bearish sentiment.

Whereas consumers tried to take management in December, sellers rapidly regained the higher hand, reinforcing the downward momentum.

The sustained promoting strain over the previous months underscores a market that’s each bearish and cautious.

On the flip aspect, a rising promoting ratio presents a possible shopping for alternative for long-term holders.

Influence on ETH value charts?

As noticed above, Ethereum is experiencing sturdy promoting strain, which has negatively affected the altcoin’s value actions.

Supply: Tradingview

For starters, we will see greater promoting strain as ETH Chaikin Cash Circulate (CMF) has turned adverse. With CMF sitting at -0.08, it implies that sellers are dominating the market.

This market habits is confirmed by a declining Relative Power Index (RSI) which has dropped to virtually oversold territory to settle at 38. Such a dip implies sellers are in charge of the market.

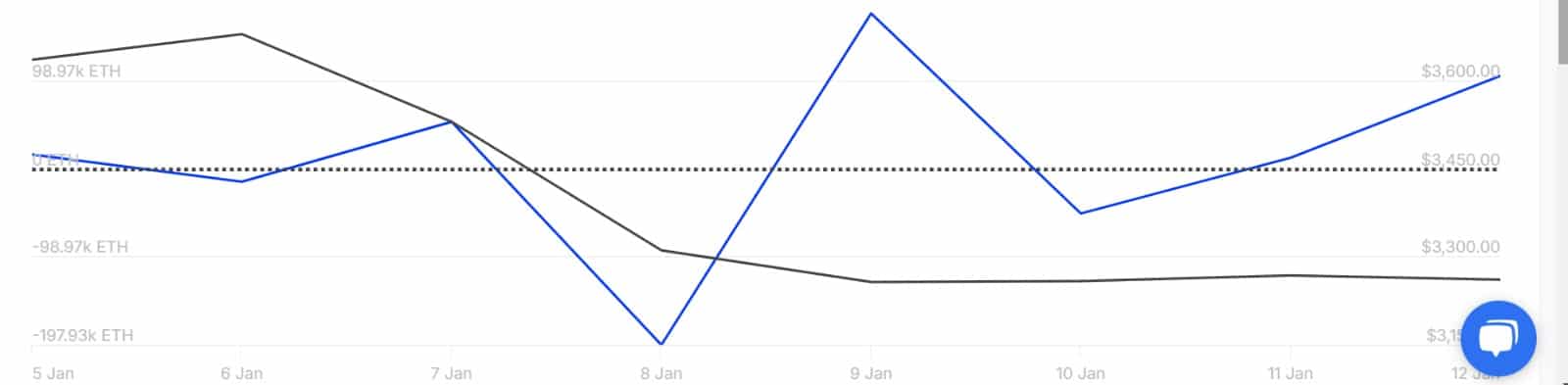

Trying additional, Ethereum’s influx into exchanges has spiked over the previous week. This has surged from -50.77k to 103.77k, which signifies that there’s extra ETH influx onto exchanges than outflow.

Normally, greater influx into exchanges precedes elevated promoting ppressure,as buyers are likely to promote after they make these transfers.

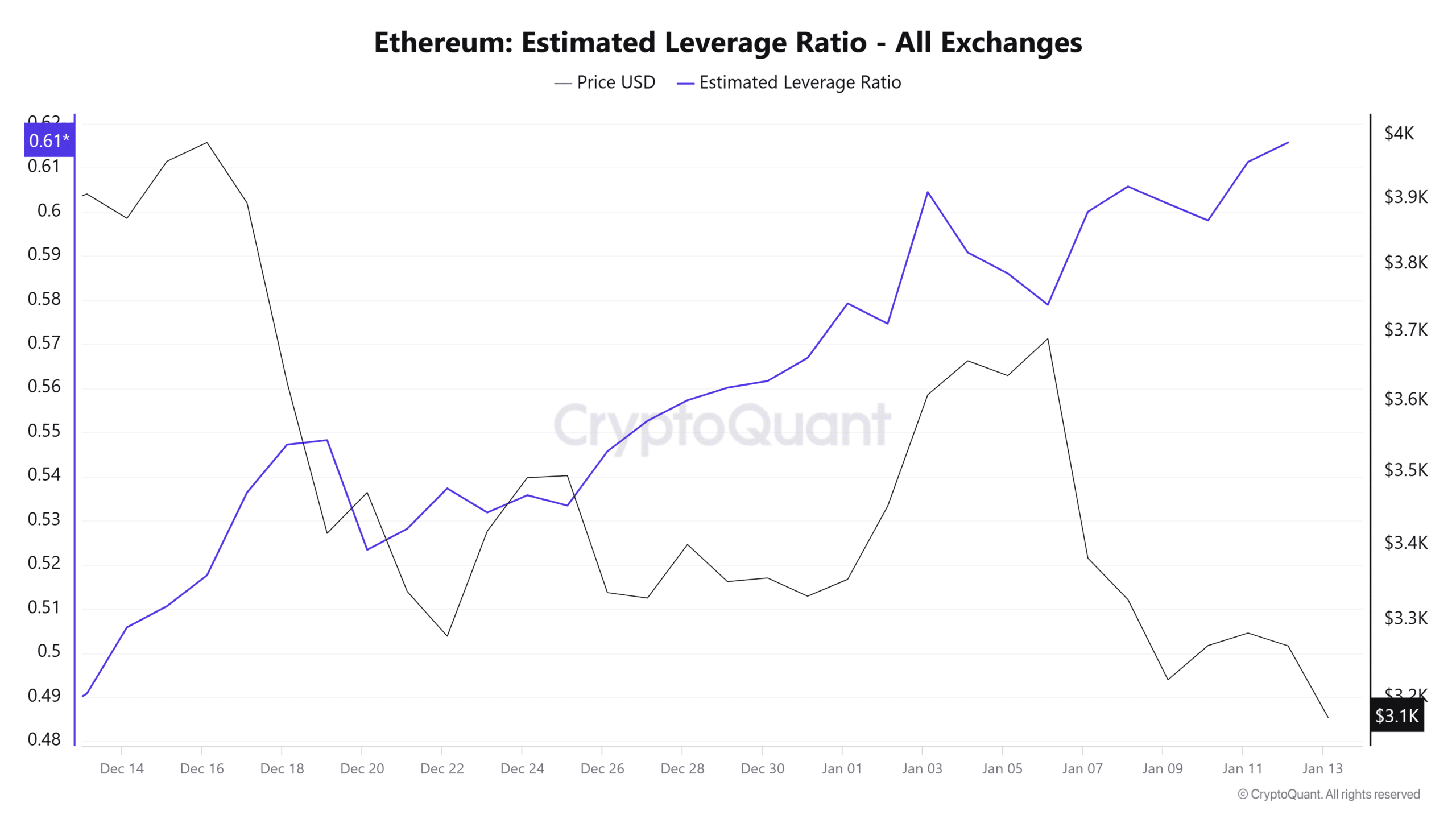

Ethereum’s Estimated Leverage Ratio (ELR) has skilled a sustained improve over the previous month. When ELR rises throughout a downtrend, it signifies a bearish sentiment, rising the danger of an extended squeeze.

If costs drop additional, lengthy positions might be liquidated, leading to an extended squeeze and additional value declines.

Learn Ethereum’s [ETH] Price Prediction 2025–2026

In conclusion, Ethereum is below sturdy promoting strain as bearish sentiments persist. If present market situations proceed, ETH might decline to $3,030 and probably drop beneath $3,000 to search out help round $2,810.

Nevertheless, if the downtrend exhausts and a reversal emerges, the altcoin might reclaim $3,300.