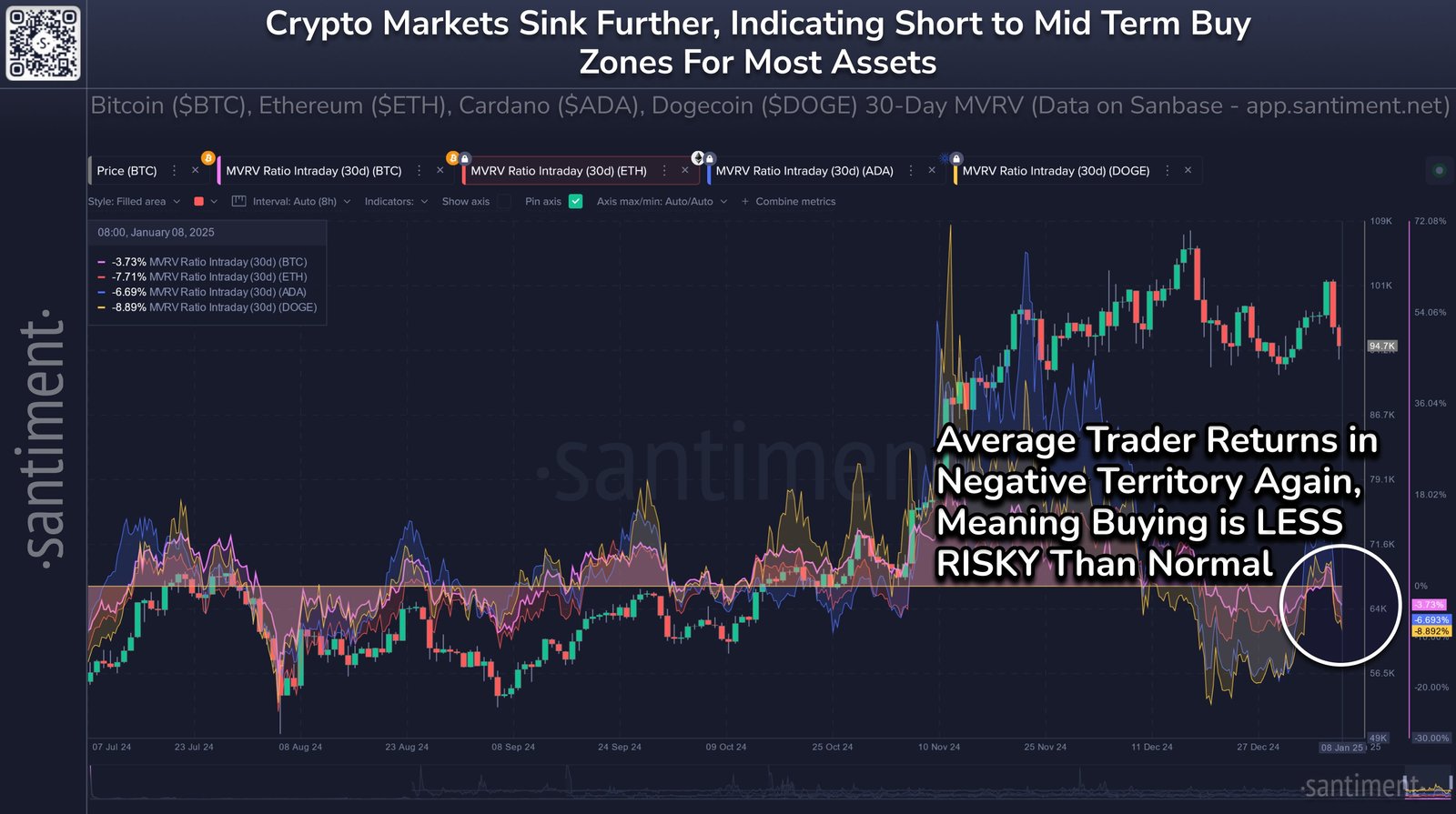

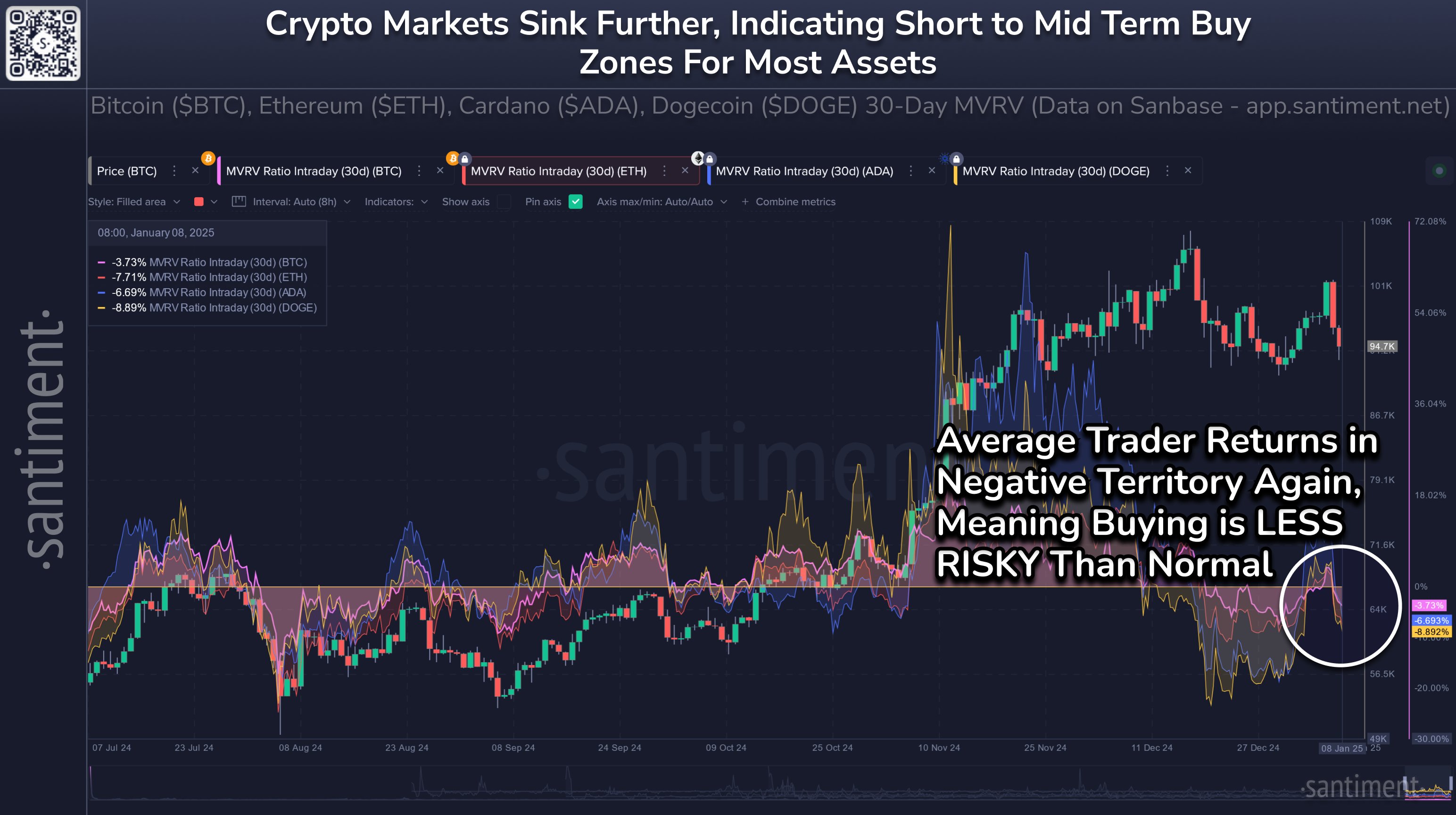

Dogecoin (DOGE) has once more discovered itself within the crosshairs of market watchers, with a “blood within the streets” second rising in accordance with information from on-chain analytics agency Santiment. The agency’s newest research, shared on January 8 by way of X, highlights a sequence of unfavourable MVRV (Market Worth to Realized Worth) ratios throughout the crypto panorama—encompassing Bitcoin (BTC), Ethereum (ETH), Cardano (ADA), and Dogecoin.

“Common buying and selling returns are an ideal illustration of whether or not ‘shopping for low’ or ‘promoting excessive’ is definitely the precise timing,” Santiment acknowledged, stressing that present on-chain metrics level towards an atmosphere the place many crypto property are sitting in oversold territory.

“When MVRV’s are unfavourable, this implies a purchase or addition to your holding is doing so whereas others are already at a loss. Traditionally, these ‘blood within the streets’ moments are when skilled merchants become profitable,” Samtiment writes.

The information Santiment printed contains the 30-day MVRV ratios for 4 main property as of January 8. Bitcoin’s MVRV ratio is at -3.73%, Ethereum’s at -7.71%, Cardano’s at -6.69% and Dogecoin’s at -8.89%.

In easy phrases, MVRV compares the full market capitalization of a cryptocurrency (its “Market Worth”) with the full price foundation of holders (its “Realized Worth”). A unfavourable MVRV usually signifies that the typical holder is presently underwater on their place.

Associated Studying

For Dogecoin, the -8.89% MVRV ratio means that—on common—buyers who acquired DOGE within the final 30 days are sitting on notable unrealized losses. This contrasts with BTC’s much less pronounced -3.73%, indicating that Dogecoin’s short-term holders are, on common, deeper within the crimson relative to Bitcoin’s. Ethereum (-7.71%) and Cardano (-6.69%) additionally face unfavourable territory, however their holders are faring barely higher than Dogecoin over the previous month.

As a result of DOGE’s MVRV is essentially the most unfavourable among the many 4 talked about, there may be potential for a stronger restoration bounce if market situations stabilize. Nevertheless, it additionally underscores greater danger if broader crypto sentiment stays fragile. As Santiment famous, merchants usually scan for unfavourable MVRV as a possible alternative to “purchase low,” however that is under no circumstances a assure of quick upside.

Purchase Or Promote Dogecoin Now?

Santiment’s evaluation additional emphasizes how macroeconomic forces have accelerated the crypto market’s latest sell-off. On Tuesday, January 7, US bond yields surged following unexpectedly strong financial indicators, with the 10-year Treasury rising to 4.67%.

A lot of the market anxiousness centered on the higher-than-expected ISM Costs Paid Index, a metric that may herald inflation, in addition to a shock uptick within the JOLTS job openings information. With indicators of labor market tightness and attainable inflation pressures, buyers pivoted to risk-off methods, hitting crypto property throughout the board.

Associated Studying

“Crypto markets sink additional, indicating quick to midterm purchase zones for many property,” reads Santiment’s printed chart. On this vein, Dogecoin’s present downturn traces up with the broader market narrative. If yields and inflation considerations proceed to dominate headlines, we will anticipate extra cautious capital flows into danger property. Conversely, any sign of cooling inflation or a much less restrictive Federal Reserve stance would possibly catalyze a rally—one which could possibly be amplified by unfavourable MVRV ratios throughout the board.

However, the contrasting indicators make for a difficult buying and selling atmosphere. On one hand, Santiment’s metrics level to advantageous historic situations for these seeking to accumulate, notably for DOGE at -8.89% MVRV. On the opposite, unsure macro information—starting from Treasury yields to inflation prints—might hamper any near-term restoration.

For now, Santiment’s outlook is measured: “Don’t assume these alternative zone indicators will result in a right away turnaround. However possibilities are pointing to at the very least a brief to mid time period turnaround for crypto shortly, assuming financial or geopolitical components don’t get in the way in which.”

At press time, DOGE traded at $0.33.

Featured picture created with DALL.E, chart from TradingView.com