- World Liberty Finance and Grayscale, two main establishments, have transferred a considerable portion of their ETH holdings to exchanges, signaling the potential for a sell-off.

- Investor exercise in ETH has stalled, with the funding premium turning damaging as demand drops.

Ethereum [ETH] has underperformed in current weeks, dropping by 18.31% over the previous month. The bearish pattern continued within the final 24 hours, with a slight lack of 0.53%.

Current market tendencies recommend that Ethereum’s decline could intensify within the coming days, notably following the inauguration of the brand new U.S. president, Donald Trump.

Investor actions don’t favor ETH

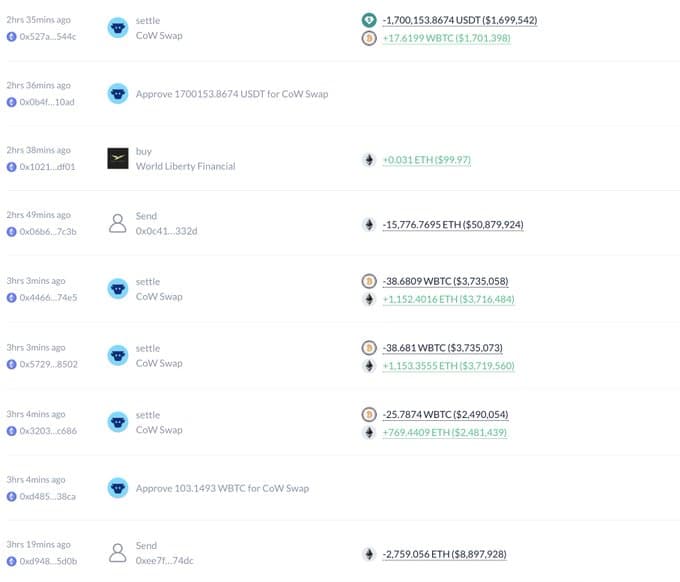

In a current transfer, World Liberty Finance, related to President-elect Donald Trump, elevated its ETH holdings by buying extra tokens, solely to dump.

This transaction concerned World Liberty swapping 103 WBTC, valued at $9.89 million on the time of the change, for 3,075 ETH.

After finishing the swap, they added 15,461 ETH to their holdings, bringing their complete to 18,536 ETH, which was then deposited on the cryptocurrency change Coinbase Prime.

Sometimes, when belongings transfer from personal wallets to exchanges, it indicators an impending sell-off. Nevertheless, on this case, the sell-off could not happen instantly.

World Liberty Finance could also be holding the belongings in anticipation of a value surge following the upcoming inauguration of President-elect Trump, as seen prior to now.

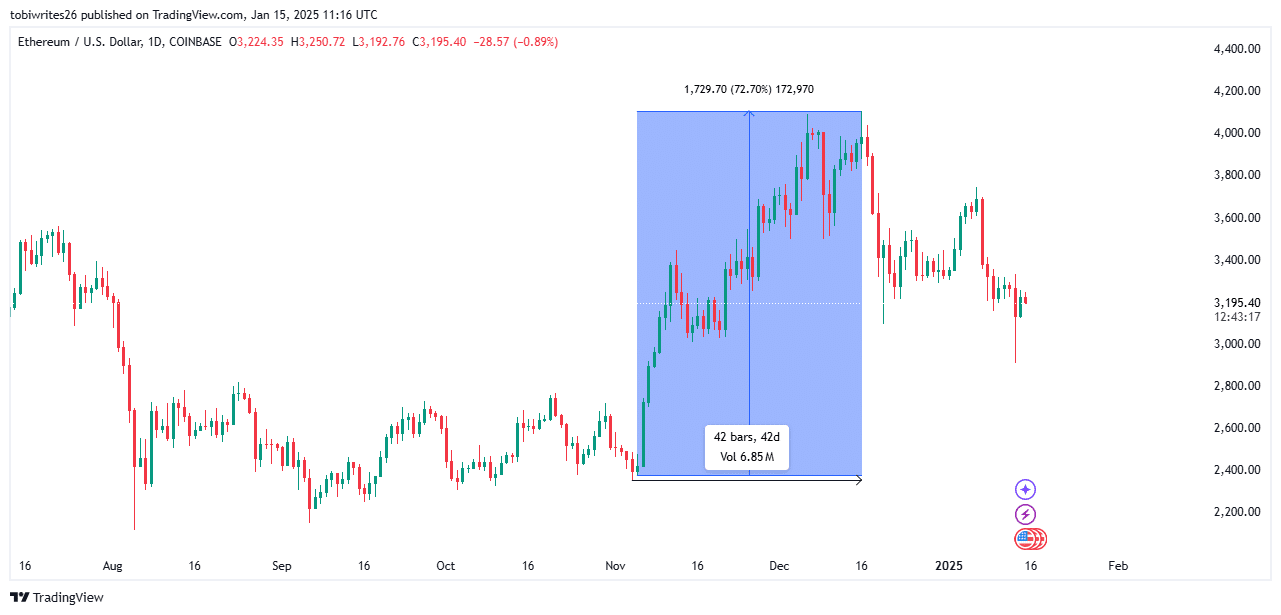

The potential for a big Ethereum rally with Trump assuming workplace might mirror the worth surge following his 2024 presidential win.

On the fifth of November 2024, ETH surged by 72.70%, rising from a low of $2,379.30 to a excessive of $4,109.00 on the sixteenth of December 2024—simply 42 days later.

If historical past repeats itself, World Liberty Finance could aggressively dump its ETH on Coinbase Prime after the anticipated value surge, doubtlessly driving ETH’s value down.

Extra information from Intel reveals that institutional investor Grayscale, identified for its massive ETH holdings, has adopted the same sample, transferring its belongings to Coinbase Prime.

Based on the information, three transactions noticed a complete of 16,941 ETH moved to Coinbase Prime, valued at $54.27 million on the time, signaling a bearish stance on the asset.

Demand has begun to say no

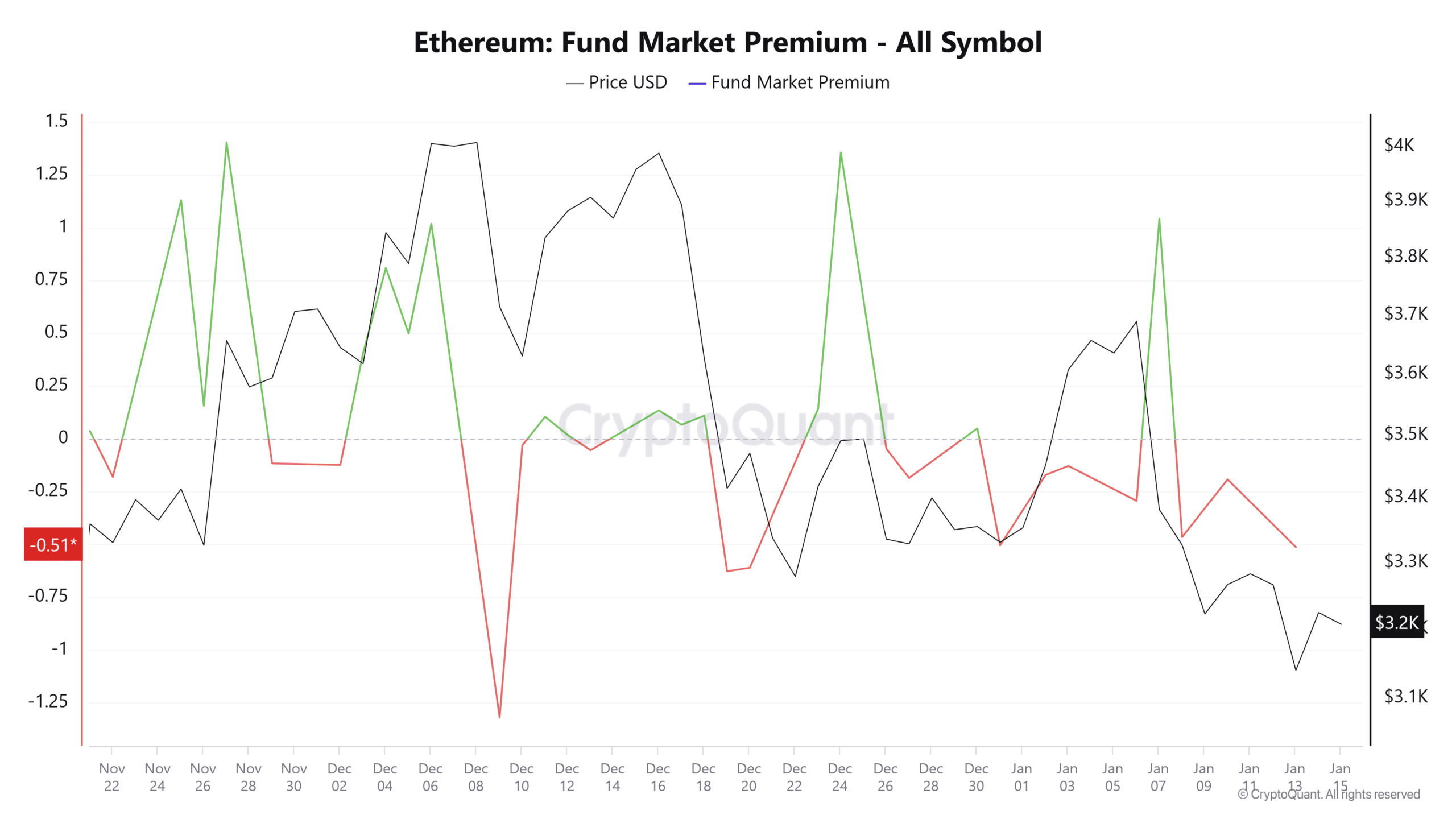

Based on CryptoQuant’s premium index, which measures institutional demand for an asset, there was a big drop in ETH’s fund premium. It now trades at a damaging 0.515, transferring additional away from its impartial zone.

A drop under the impartial zone (zero) signifies that institutional traders are much less keen to pay a premium for ETH, suggesting a decline in demand and a progressively bearish outlook.

Concurrently, spot merchants are displaying indicators of uncertainty. These merchants now desire to carry their belongings on exchanges, the place they will simply promote, somewhat than in personal wallets for long-term holding.

Learn Ethereum’s [ETH] Price Prediction 2025-26

This habits is mirrored within the change netflow, which shifted from a day by day netflow of damaging 39,270 ETH in early January to simply 6,093 ETH, on the time of writing.

This sentiment means that each institutional and retail traders are dropping curiosity, with some progressively promoting off their positions. Nevertheless, the general sentiment stays that ETH remains to be seen as a bullish asset.