- Ethereum has traditionally soared in Q1, with returns typically doubling

- Nonetheless, with progress slowing down, the stakes at the moment are increased

Keep in mind Election Evening final yr? Nicely, Ethereum recorded its longest inexperienced candlestick in three months on the time, hovering by 12% in a single day to shut at $2,721. Quick ahead to 19 January and now, it’s 20% off its $4,015 peak from that rally.

With a lot unfolding in the intervening time, the upcoming week will put ETH’s historical past of bullish Q1 to the check – Will it ship?

In crypto, historical past issues

Ethereum has traditionally thrived in Q1, with returns typically doubling and even tripling within the final 4 years. In 2023, ETH rose by 54%, hitting $1,800 by the top of the quarter. Nonetheless, 2021 stays the standout, with ETH surging by 160% to $1,920 in simply three months.

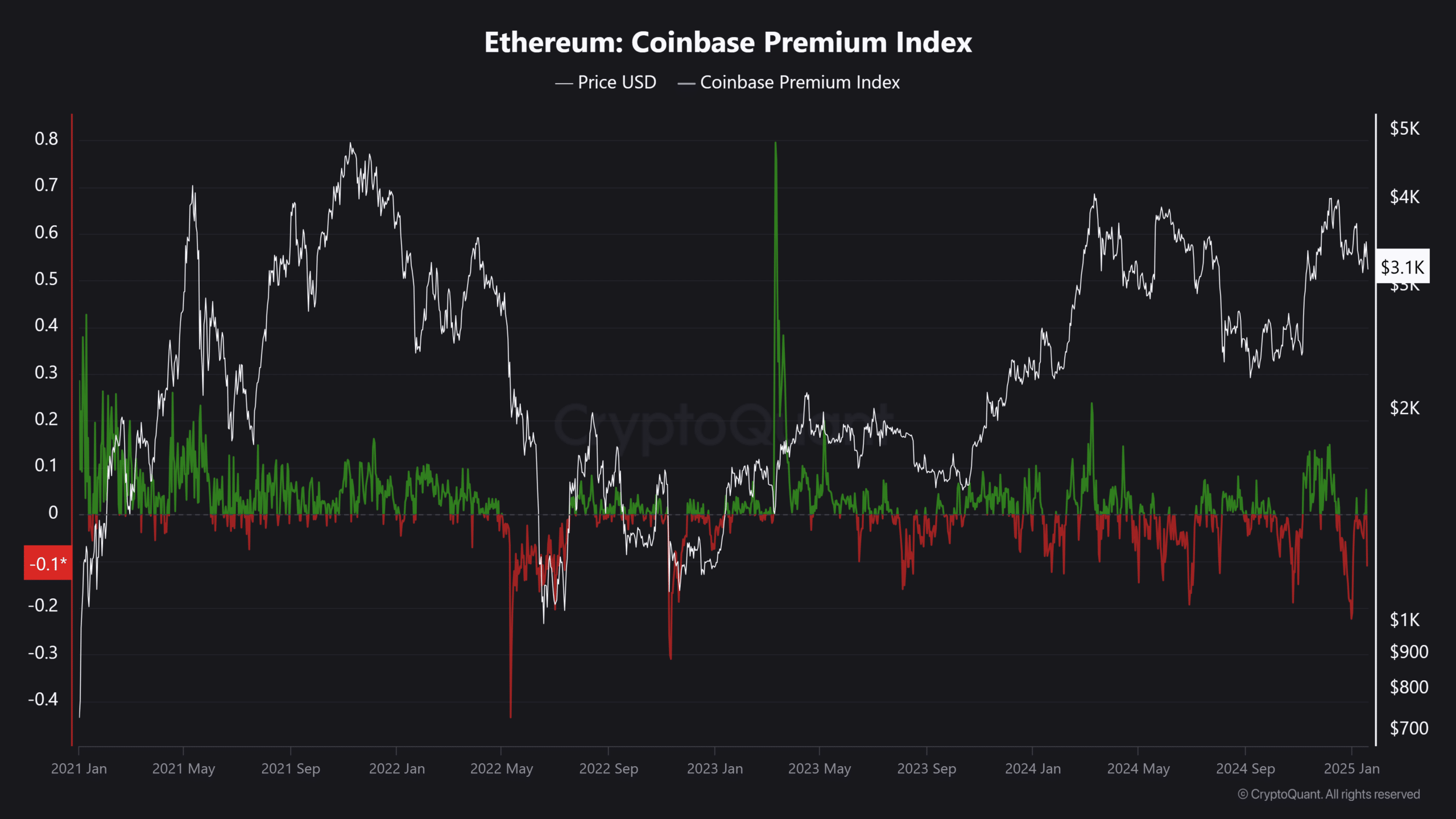

Clearly, progress has slowed since then, and year-on-year returns are really fizzling out too, making a dilemma for HODLers. This shift in sentiment is seen within the Coinbase Premium Index (CPI), which underlined a cool-off in shopping for momentum.

Even with the crypto market cap hitting an all-time excessive of $3.70 trillion throughout final yr’s post-election rally, ETH’s shopping for frenzy amongst U.S traders barely moved the CPI. This hinted at fading enthusiasm throughout the board.

The truth is, 4 years in the past, Ethereum’s market cap hit $500 billion, with its value hovering to $4.76k. Quick ahead to as we speak, and it’s down 22%, buying and selling at $3.2k at press time. With quarterly returns cooling off, HODLers’ endurance is now being examined as ETH struggles to interrupt previous its key psychological ranges.

Regardless of the market-wide rebound, ETH’s failure to breach $4k stands in sharp distinction to XRP, which has already surged by 53% in Q1. Traders are clearly searching for increased returns, and different high-caps are stepping as much as ship.

Ethereum liable to being left behind

Zooming in, XRP’s market cap has surged to a brand new all-time excessive of $180 billion, now half of Ethereum’s. In the meantime, ETH has slipped by 3% for the reason that begin of the yr. At this fee, XRP might quickly overtake Ethereum – quicker than anybody expects.

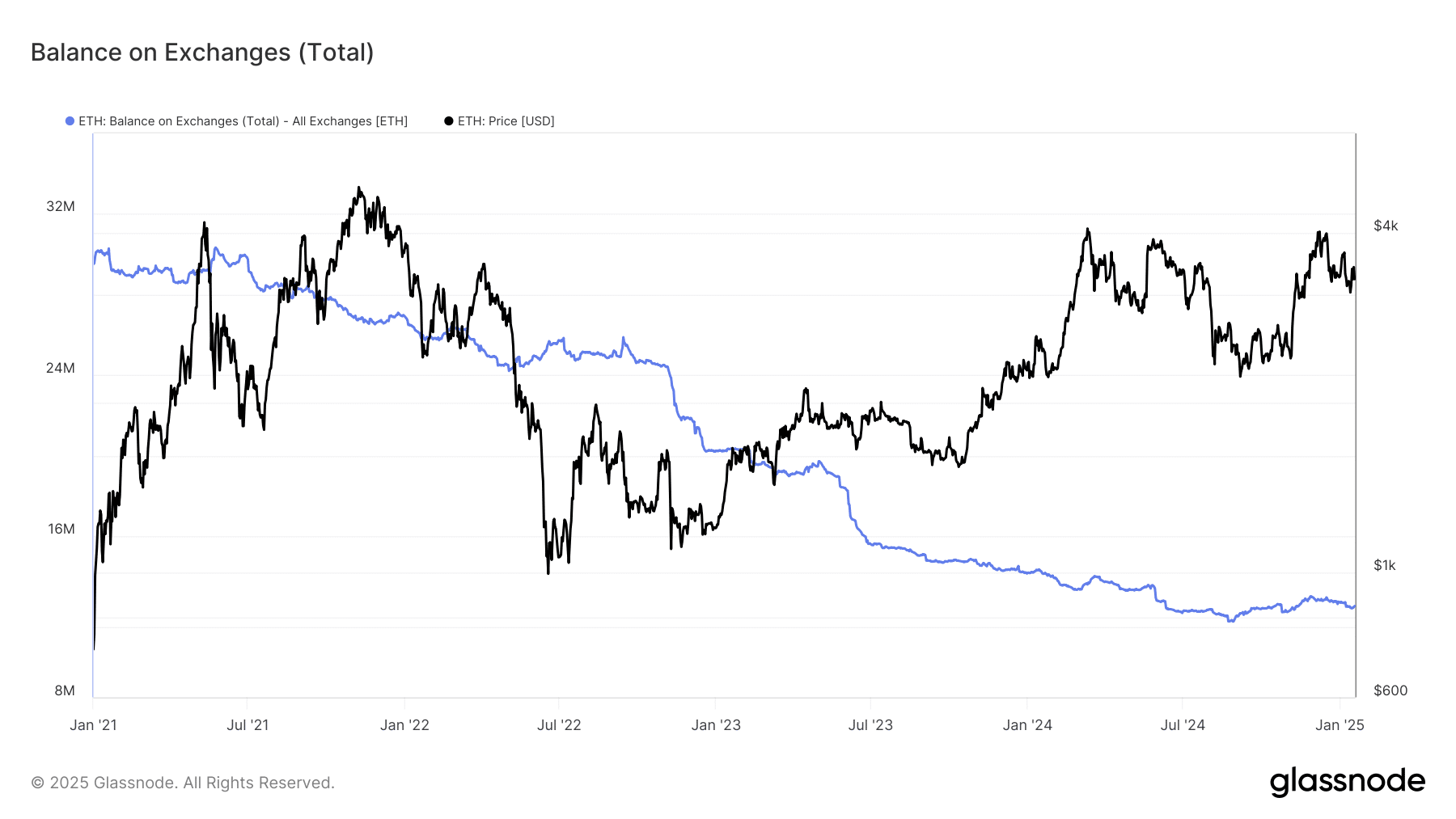

Regardless of 540k ETH being withdrawn and $1.84 billion in contemporary capital pouring into the market, Ethereum has nonetheless seen a 2% decline over the previous month. The truth is, the stability on exchanges hit a brand new all-time low too. Right here, the lack of bullish motion is evident too, placing Ethereum’s long-term outlook in danger.

Learn Ethereum’s [ETH] Price Prediction 2025–2026

What’s extra regarding? Lengthy-term holders (LTHs) have ramped up their positions by 75% over the previous yr.

Nonetheless, with returns falling quick, these LTHs might quickly exit, making the $4k-level a vital check for ETH within the days forward.