- ETH dropped under $3k amidst better outflows from ETFs

- Some analysts at the moment are predicting a drop under $2k for the altcoin

On the again of nice crypto volatility amid Bitcoin’s personal instability, altcoins are getting hit. In the midst of this downtrend, ETH has suffered probably the most over the past 7 days after dropping under $3k on the charts. As anticipated, this decline has fearful analysts in regards to the potential destructive affect of Spot ETFs on Ethereum since their launch two weeks in the past.

The sustained draw back has seen varied analysts predicting an extra decline. For starters, the founding father of Schiff Gold, Peter Schiff, believes that ETH will fall under $2k now. On his official X web page, he famous,

“Ethereum itself is now buying and selling under $3K. It gained’t be lengthy earlier than it breaks $2K. #Gold rose 2% this week.”

This pessimism arose after ETH reported a ten.74% decline over the previous few months. The timing right here is very essential since many locally welcomed Spot ETH ETFs positively. Nonetheless, they appear to have had little constructive affect on the crypto’s worth on the charts.

ETH ETFs’ excessive outflows

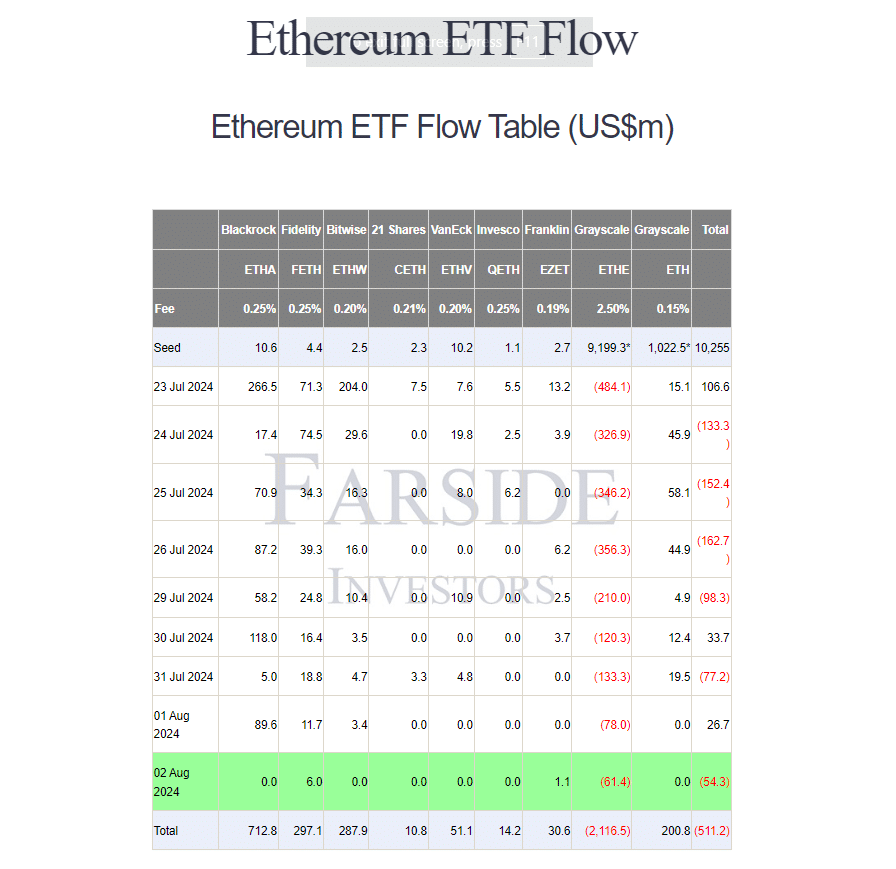

Notably, because the launch of Spot ETFs ETFs on 25 July, they’ve seen large outflows. Because the launch, ETHE has famous a document excessive of $2.1B in outflows.

Since 2 August alone, Ethereum spot ETFs recorded whole internet outflows of over $54.3 million. This concerned varied ETFs, together with ETHE with a single day outflow of $61.4M, Constancy with $6M inflows, and EZET with $1M inflows. Merely put, because the launch of those merchandise, outflows have constantly risen, facilitating investor warning and insecurity.

Peter Schiff, a recognized crypto-skeptic, was fast to level this out, including,

“Ethereum ETFs have been buying and selling for simply two weeks and are already down 15%. They closed the week on new lows#Bitcoin fell 10%.”

What do the value charts say?

At press time, ETH was buying and selling at $2985.86 after a 5.29% decline on the each day chart. The altcoin additionally registered a fall of 8.88% on a month-to-month foundation. Quite the opposite although, the crypto’s buying and selling quantity rose by 20.10% over the past 24 hours.

AMBCrypto’s evaluation revealed that ETH is now on the finish of a robust downtrend. At press time, the Chaikin Cash Circulation was under zero at -0.02 – An indication that ETH appeared to be closing within the decrease half of its vary on the each day charts. This, due to greater promoting strain than shopping for strain.

Moreover, the MACD was under zero at -62, indicating that the short-term EMA was under the long-term EMA.

Such findings recommend that the market could also be seeing sturdy downward momentum, with sellers dominating the market.

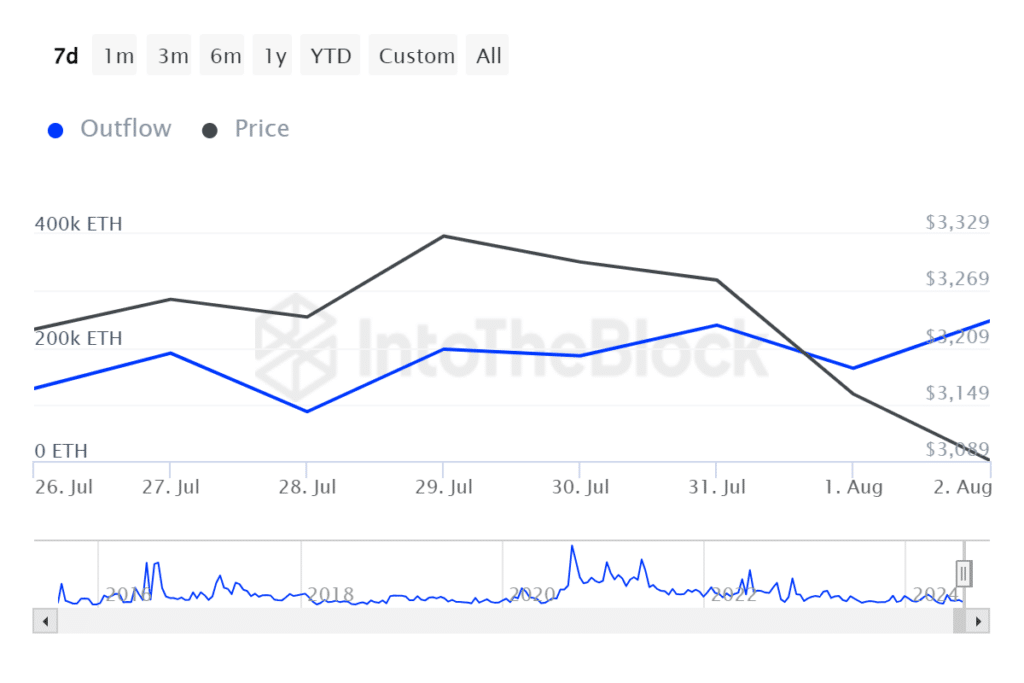

Wanting additional, information from IntoTheBlock highlighted that enormous holders’ outflows have elevated over the previous few days. The outflows spiked from a low of 127.79k to 246k.

Merely put, massive traders have been promoting their ETH tokens – Inflicting promoting strain whereas additional driving the value down.

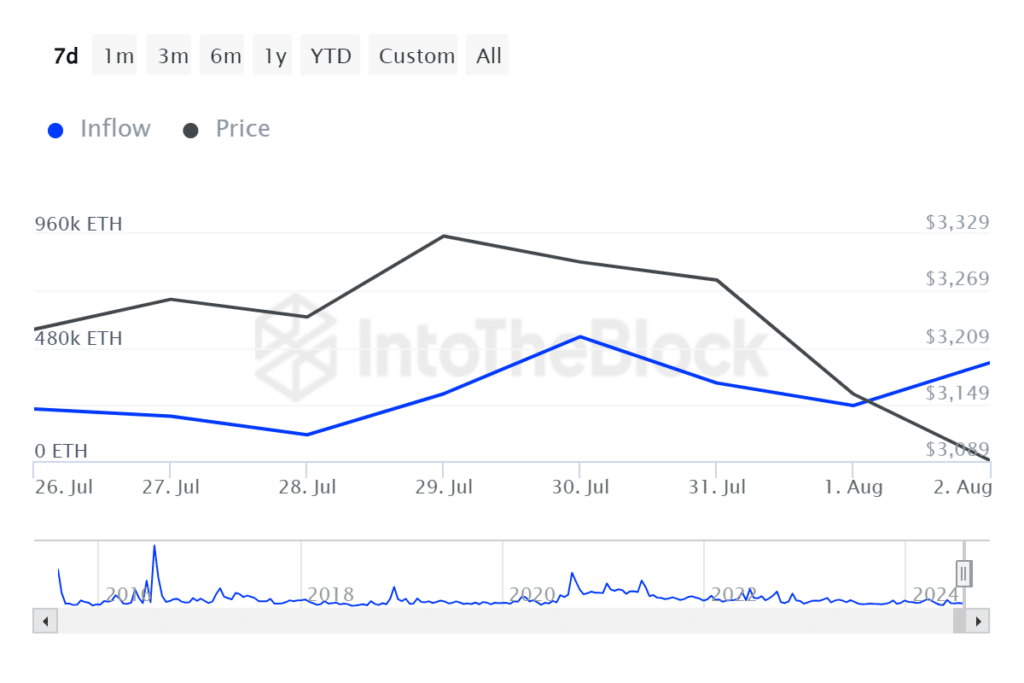

On the identical time, inflows fell from a excessive of 525.82k to a low of 234.62k. Lowered inflows indicate that sellers dominate the market – A bearish sign.

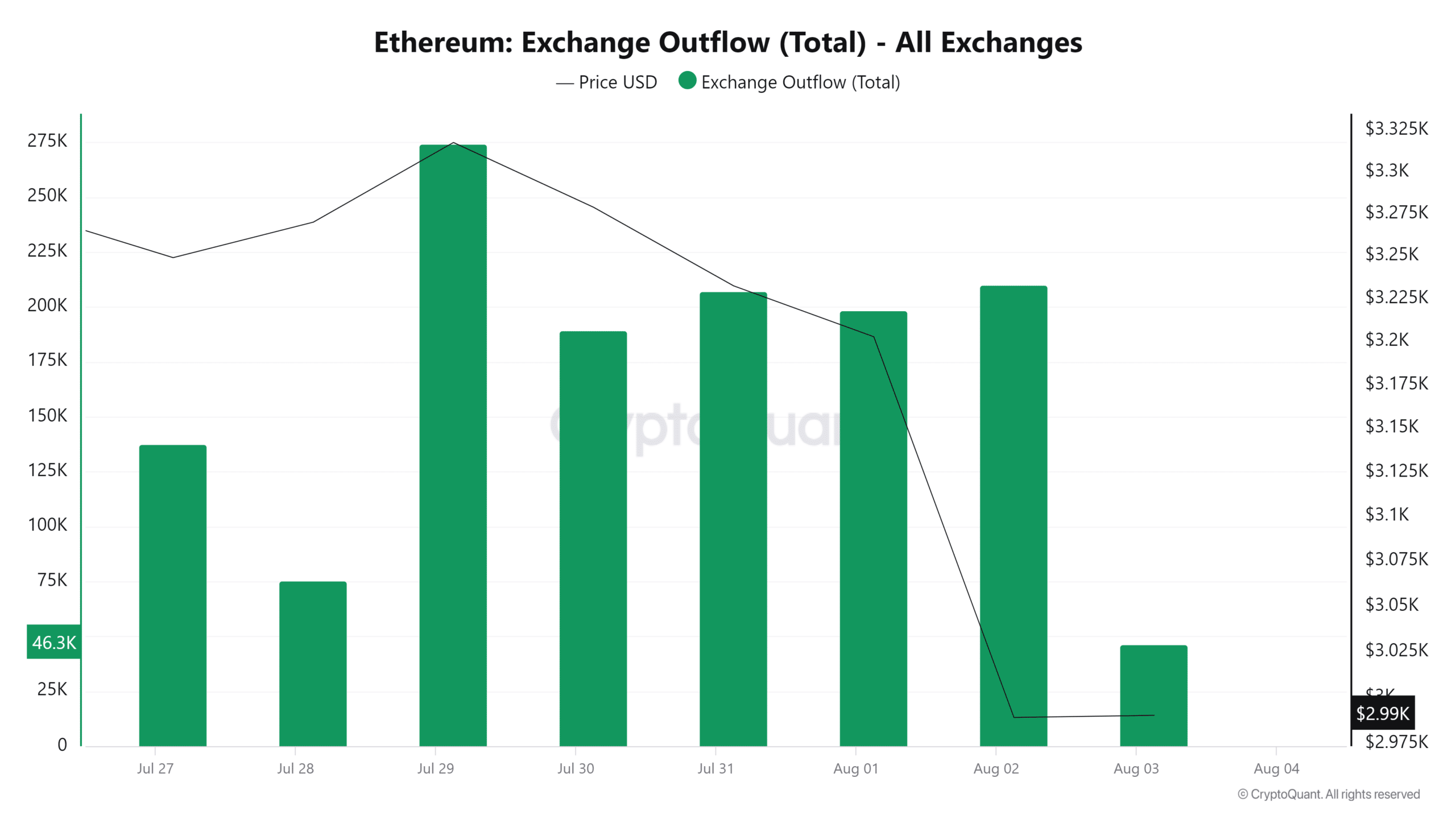

Lastly, the decline of ETH alternate outflows additional proves this because it exhibits an absence of investor confidence in potential worth hikes within the brief time period.

Due to this fact, if the continuing market sentiment and situations prevail, ETH will decline to the vital help degree of round $2810.87. A retest at this degree has traditionally pushed Ethereum’s worth to $3560.

Thus, simply as Bitcoin declined through the first few weeks of ETFs, ETH will probably replicate this sample and bounce again.