This guide provides a comprehensive overview of the process for converting Bitcoin (BTC) into a wrapped or tokenized form (cbBTC, wBTC and others) to be used as collateral for borrowing stablecoins like USDT and USDC. It explores several distinct pathways, detailing the associated platforms, benefits, and inherent risks of each approach. The information presented is based on research conducted in September 2025 and is intended for informational purposes only.

Note: Some of the strategies listed below are for intermediate and advanced users. If you are not sure how to approach this, take professional crypto advice.

Understanding Wrapped Bitcoin

Wrapped Bitcoin (wBTC) and its variants, such as Coinbase’s cbBTC, are tokens on other blockchains (primarily Ethereum) that represent Bitcoin. Each wrapped token is backed 1:1 by an equivalent amount of BTC held in custody. This process allows Bitcoin, which is native to its own blockchain, to be utilized within the decentralized finance (DeFi) ecosystem, enabling activities like lending, borrowing, and trading on platforms that support these tokens.

Option 1: Coinbase and Aave Protocol – BTC to cbBTC

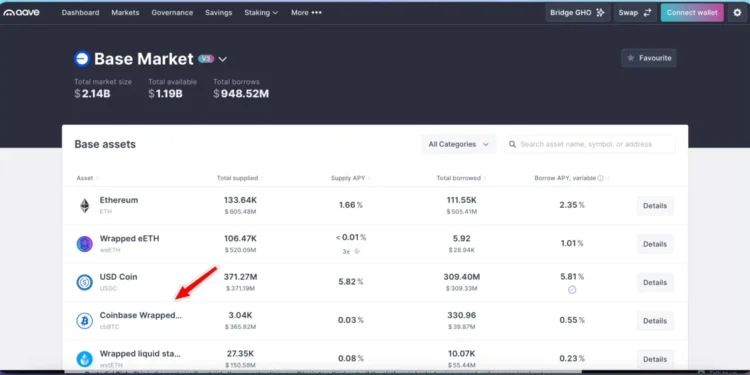

This route involves using Coinbase or Bybit to convert BTC to cbBTC and then supplying it as collateral on the Aave protocol, a leading decentralized lending platform.

Route:

1. Convert BTC to cbBTC: Within your Coinbase account, you can wrap your BTC into cbBTC. This is typically done by sending BTC from your main Coinbase account to a Base or Ethereum address, where it is automatically converted to cbBTC [1].

2. Convert BTC to cbBTC: You can also use Bybit crypto exchange to convert BTC to cbBTC. Bybit will also let you withdraw cbBTC on different chains, making it easier for you to take it to different blockchain.

2. Supply cbBTC to Aave: Connect a compatible web3 wallet (e.g., MetaMask, Coinbase Wallet, Ledger, ) to the Aave application. Transfer the cbBTC from your Coinbase account to this wallet.

3. Borrow USDT/USDC: On the Aave platform, supply your cbBTC to the lending pool. You can then borrow USDT or USDC against your supplied collateral, up to the specified collateralization ratio.

Benefits:

• Trust and Security: Coinbase is a well-established and regulated entity, providing a degree of trust in the custody of the underlying BTC that backs cbBTC.

• Deep Liquidity: Aave is one of the largest and most liquid DeFi lending protocols, offering substantial pools for borrowing and lending.

• Ecosystem Integration: cbBTC is designed for the Base ecosystem, which may offer lower transaction fees and faster speeds compared to the Ethereum mainnet.

| Platform | colleteral asset | Borrowable Stablecoins | Supply APY | Borrow APY (USDC) | Borrow APY (USDT) |

| AAVE | cbBTC | USDT/USDC | <0.01% | 5.82% | 6.85% |

| Kamino Finance (Solana) | cbBTC | USDT/USDC | 3.99% (Rewards) | – | – |

Note: The above data changes fast. Check official website to get the latest data

Risks:

• Centralization: The primary risk is the centralized nature of cbBTC. The underlying Bitcoin is held in custody by Coinbase, creating a single point of failure. If Coinbase were to face regulatory issues or insolvency, the value and redeemability of cbBTC could be compromised. However, Coinbase is a NASDAQ listed website and the trust on their products including cbBTC and BASE blockchain is rising.

• Smart Contract Vulnerabilities: Aave, like all DeFi protocols, is subject to smart contract risk. A bug or exploit in the Aave protocol could lead to a loss of funds.

• Liquidation Risk: If the price of BTC (and therefore cbBTC) drops significantly, your collateral may be liquidated to cover your loan. This is an automated process in DeFi protocols.Option 2: Using Wrapped Bitcoin (WBTC) for Stablecoins loans on DeFi Platforms

This option utilizes Wrapped Bitcoin (WBTC), the most widely adopted form of tokenized Bitcoin, on established DeFi lending platforms like Aave or Compound.

Route:

1. Convert BTC to WBTC: You can convert BTC to WBTC through various centralized exchanges (e.g., Kraken) or decentralized services that act as merchants in the WBTC minting process.

2. Supply WBTC to a Lending Platform: Similar to the cbBTC route, you would transfer your WBTC to a web3 wallet and supply it as collateral on a platform like Aave or Compound.

3. Borrow USDT/USDC: Borrow stablecoins against your WBTC collateral.| Platform | Collateral Asset | Borrowable Stablecoins | Supply APY | Borrow APY (USDC) | Borrow APY (USDT) |

| Aave Protocol | WBTC | USDC, USDT, etc. | <0.01% | 5.82% | 8.65% |

| Compound Finance | WBTC | USDC, USDT, etc. | Varies | Varies | Varies |

Benefits:

• Widespread Adoption: WBTC is the most recognized and integrated form of wrapped Bitcoin, supported by a vast array of DeFi applications and enjoying the highest liquidity.

• Decentralized Governance (Partial): While still reliant on custodians, the WBTC DAO (Decentralized Autonomous Organization) adds a layer of community governance to the process.

• Proven Track Record: WBTC has been in existence longer than many other wrapped Bitcoin variants and has a more established history.Risks:

• Custodian Risk: WBTC relies on a consortium of custodians to hold the underlying BTC. While this is more decentralized than a single custodian like Coinbase, it still presents counterparty risk.

• Smart Contract and Liquidation Risks: These are the same as with Option 1 and are inherent to using DeFi lending protocols.

• Wrapping/Unwrapping Fees: The process of minting and burning WBTC can involve fees that may not be present in the more streamlined Coinbase cbBTC process.Option 3: Fluid Protocol for Integrated Bitcoin Lending

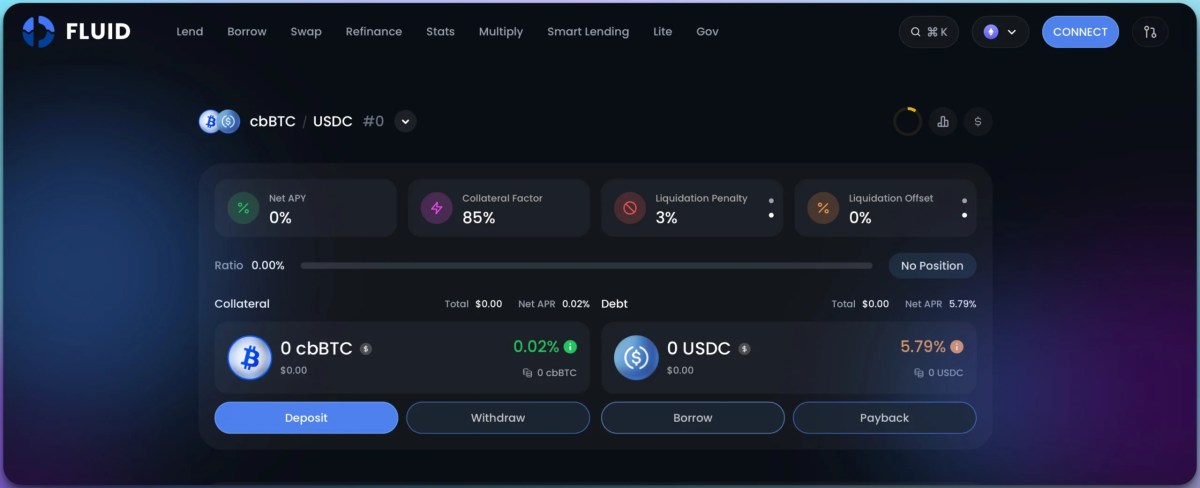

Fluid is a newer lending protocol that offers a more integrated experience, with specific vaults for lending and borrowing various assets, including cbBTC and WBTC.

Route:

1. Acquire cbBTC or WBTC: Follow the conversion steps outlined in Option 1 or 2.

2. Use Fluid Protocol Vaults: Connect your wallet to the Fluid application and select a vault that matches your desired collateral and debt asset (e.g., cbBTC/USDC, WBTC/USDT).

3. Create a Position: Supply your wrapped Bitcoin and borrow stablecoins directly within the selected vault.Benefits:

• Potentially Better Rates: As a newer protocol, Fluid may offer more competitive interest rates or incentives to attract users and liquidity.

• Specialized Vaults: The vault structure allows for more specific risk management and potentially more efficient use of capital.

• Growing Ecosystem: Engaging with newer protocols can provide opportunities to benefit from their growth and future token incentives.Risks:

• Newer Protocol Risk: Fluid has a shorter track record than Aave or Compound, which can imply higher smart contract risk and less certainty about its long-term stability.

• Lower Liquidity: While growing, Fluid’s liquidity pools are smaller than those of the major protocols, which could lead to higher slippage or difficulty entering/exiting large positions.

• Complexity: The variety of vaults and options may be more complex for users who are new to DeFi.Option 4: Centralized Bitcoin Lending Platforms

For those who prefer a simpler, non-DeFi approach, centralized lending platforms offer a straightforward way to borrow against your native Bitcoin without the need for wrapping. I have talked about one such platform called Nexo before, and shared my honest review on what I think. I do use Nexo for myself, but keep it small as their is counterparty risk with centralized lending platforms.

Route:

1. Create an Account: Sign up for an account on a platform like Nexo or YouHodler.

2. Deposit BTC: Transfer your native BTC directly to your account on the platform.

3. Borrow Stablecoins: Request a loan in USDT or USDC, using your deposited BTC as collateral.Benefits:

• Simplicity: This is the most straightforward option, with a user experience similar to a traditional financial service. There are no web3 wallets, gas fees, or complex protocol interactions.

• Customer Support: Centralized platforms typically offer dedicated customer support.

• Insurance: Many centralized platforms provide insurance on custodial assets, offering a degree of protection against hacks.Risks:

• Custodial Risk: This is the most significant risk. You are entrusting your Bitcoin to a third party. If the platform is hacked, mismanaged, or becomes insolvent, you could lose your funds entirely.

• Lack of Transparency: The internal workings, reserves, and lending activities of centralized platforms are often opaque compared to the public, on-chain nature of DeFi protocols.

• Terms and Conditions: The platform has full control over the terms of the loan and can change them. They can also freeze your account or assets if they deem it necessary.Summary and Recommendations: Get USDT, USDC Interest Loans with Bitcoin Collateral

Choosing the right Bitcoing lending option to borrow stable coin depends on your individual risk tolerance, technical expertise, and priorities. Here is a summary to help guide your decision:

| Feature | DeFi (Aave, Compound, Fluid) | Centralized (Nexo, YouHodler) |

| Control over Funds | High (Non-custodial, you hold your keys) | Low (Custodial, platform holds your assets) |

| Transparency | High (All transactions are on-chain and public) | Low (Operations are largely opaque) |

| Complexity | High (Requires web3 wallet, understanding of gas fees, etc.) | Low (Simple, web2-style user interface) |

| Risk Profile | Smart contract bugs, liquidation, wrapped asset risk | Custodial risk (platform failure/hack), lack of transparency |

| Potential Returns | Can be higher due to yield farming and token incentives | Generally fixed and may be lower than DeFi potential |

For user who prioritizes simplicity:

• Option 4 (Centralized Lending) is the most suitable. It avoids the complexities and smart contract risks of DeFi. Some of them like Nexo have no lock-in feature, though you may incurr withdrawal fees and the risk profile as stated above. For the user comfortable with DeFi who values trust in the custodian:

• Option 1 (Coinbase/Aave/Kamino) offers a good balance, combining the robust and battle-tested Aave protocol with the perceived security of Coinbase as the custodian for cbBTC.For the DeFi-native user seeking maximum decentralization and adoption:

• Option 2 (WBTC on Aave/Compound) is the standard choice. WBTC’s wider adoption and more decentralized (though still custodial) model make it a cornerstone of the DeFi ecosystem.Final words:

DeFi world is fast growing, and my suggestion would be monitor your favorite protocol for best yeild on a regular basis and do not shy away from moving funds from one to protocol (as moving cost is fraction) and returns are high. Though do not take unwanted risks by using less established defi platform for extra yield. You can also use an AI tool like Manus or something similar to regularly monitor the health of these deficiencies platrorms and find out which platform is offering best yeild.

Before proceeding with any of these options, it is crucial to conduct your own thorough research, understand the specific terms and conditions of each platform, and never invest more than you are willing to lose.

Help us improve. Was this helpful

A Guide to Using Bitcoin for Stablecoin Loans – Navigating Bitcoin-Backed Lending was published on CoinSutra – Bitcoin Community